This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Boston Massachusetts Last Will and Testament for Divorced Person Not Remarried with Adult and Minor Children

Description

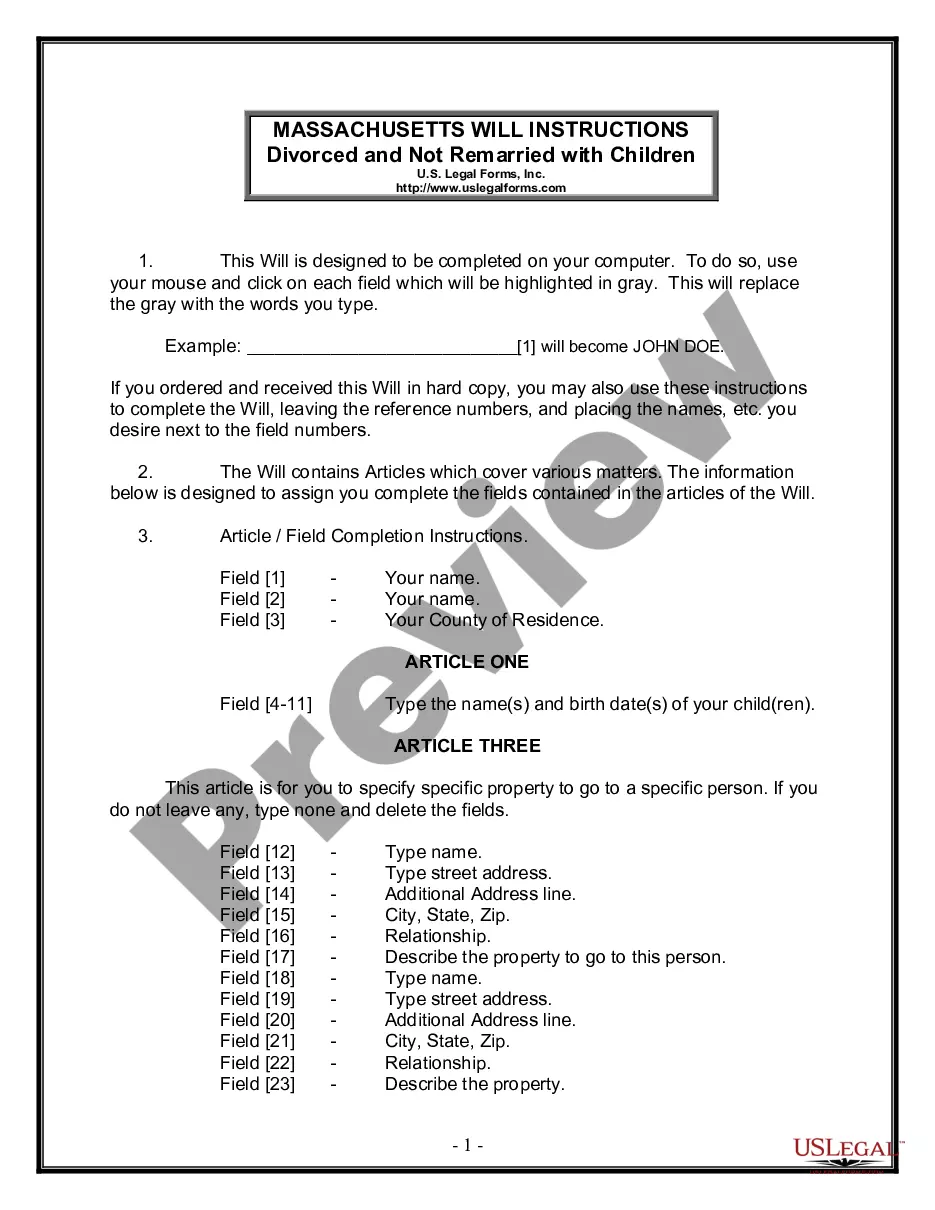

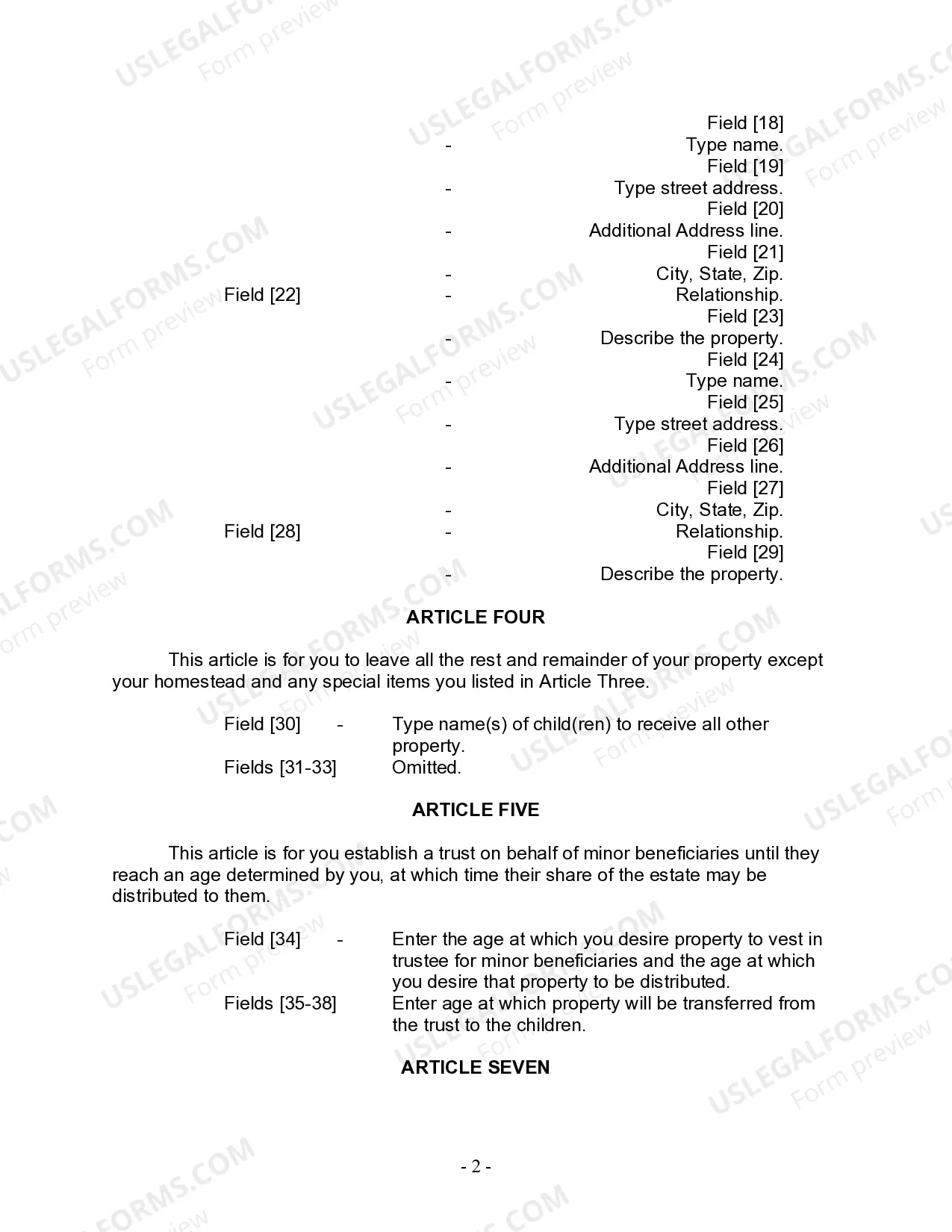

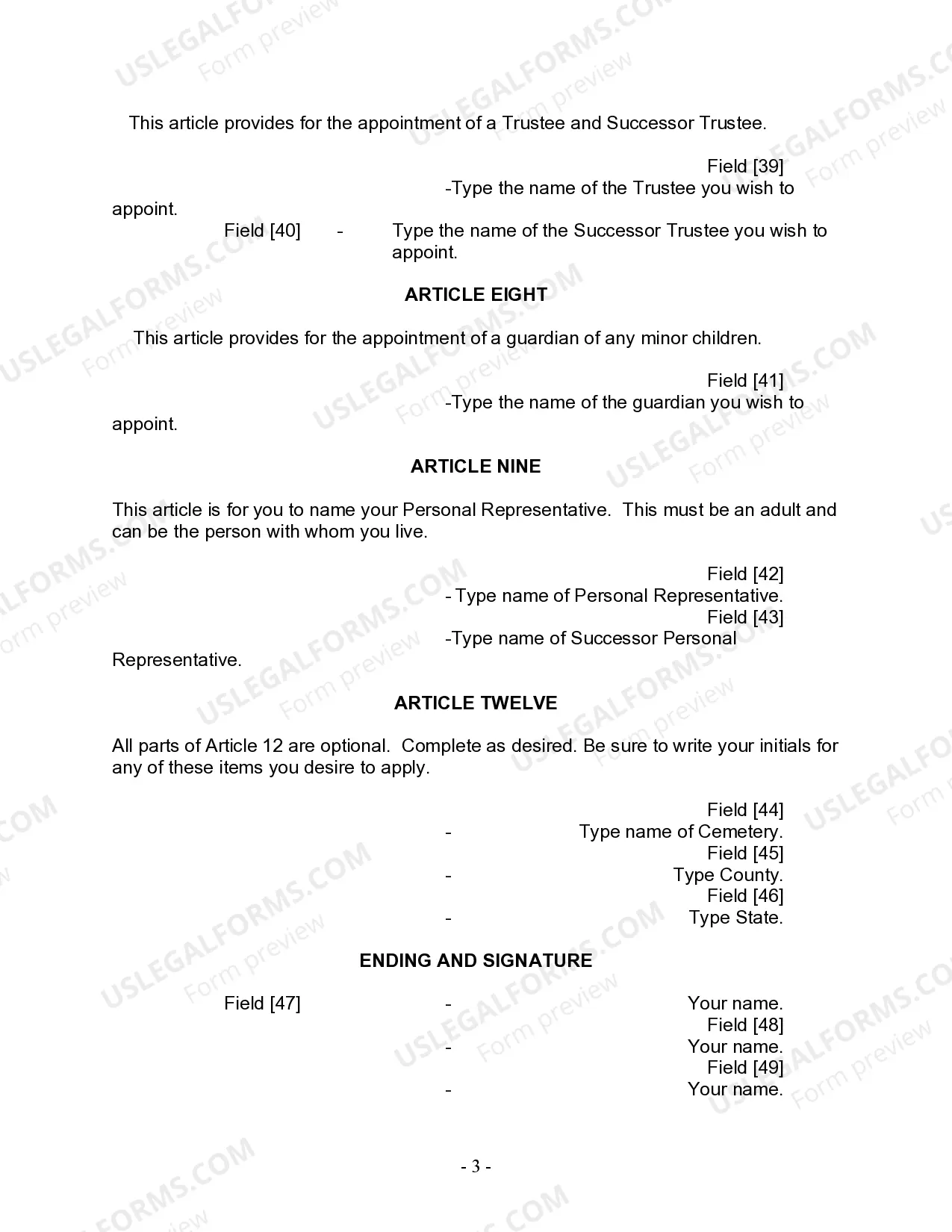

How to fill out Massachusetts Last Will And Testament For Divorced Person Not Remarried With Adult And Minor Children?

Finding authenticated templates tailored to your local laws can be difficult unless you access the US Legal Forms library.

This is an online repository comprising over 85,000 legal documents for personal and business requirements as well as various real-life scenarios.

All files are systematically organized by usage area and jurisdiction, making it straightforward to locate the Boston Massachusetts Legal Last Will and Testament Form for Divorced Individuals Not Remarried with Adult and Minor Children in a breeze.

Keeping documents organized and compliant with legal regulations is critically important. Leverage the US Legal Forms library to consistently have crucial document templates for any requirements right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve selected the right one that satisfies your needs and aligns with your local jurisdiction prerequisites.

- Search for an alternative template, if necessary.

- If you discover any discrepancies, utilize the Search tab above to find the correct one. If it fits your criteria, proceed to the next step.

- Complete the transaction.

Form popularity

FAQ

Massachusetts probate records include, but are not limited to, wills, estate administrations, and legal name changes.

Your will doesn't have to be registered to be legal. However, registration ensures your will can be found in the National Will Register. This will make managing your estate easier after you have died. Probate can be delayed by lost wills, so it is wise to register your will.

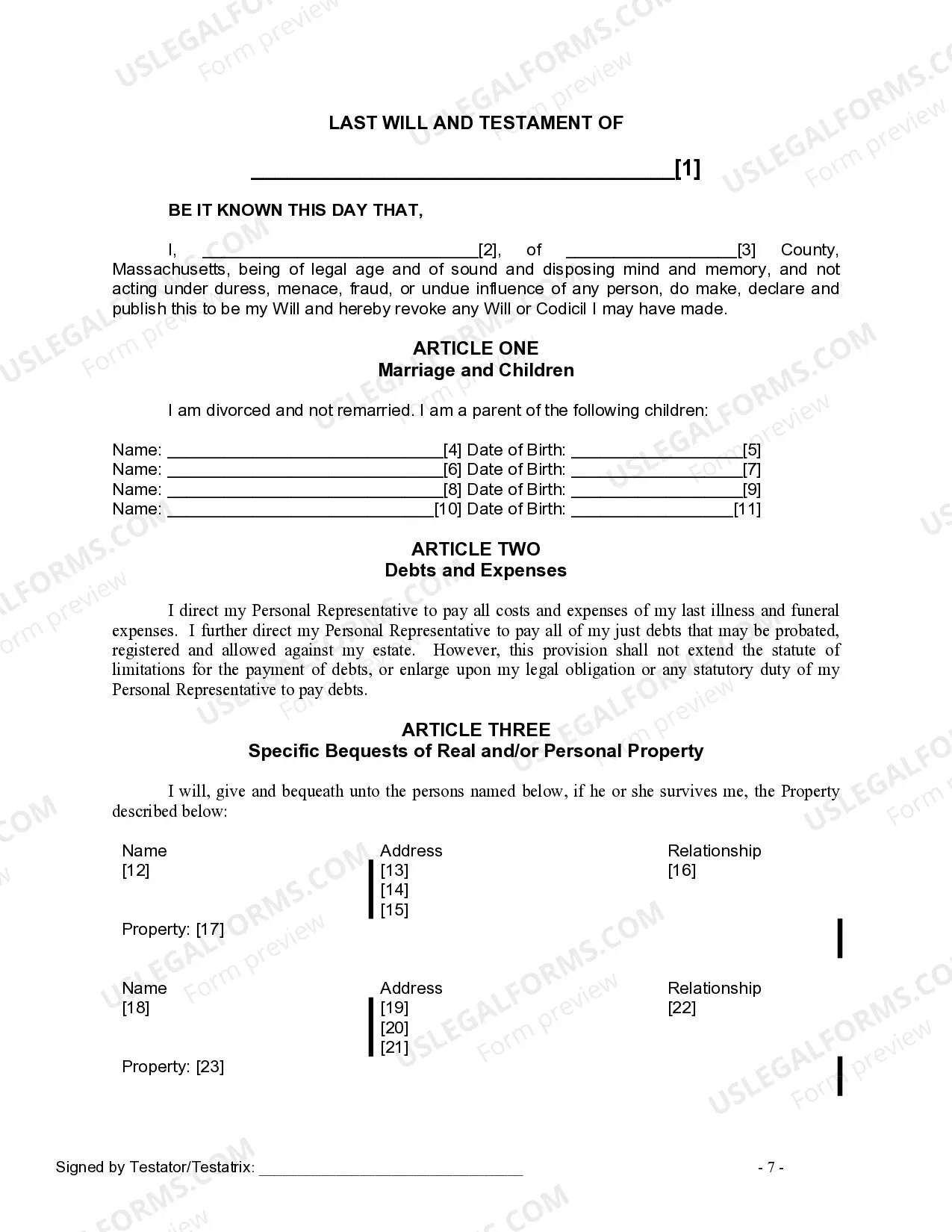

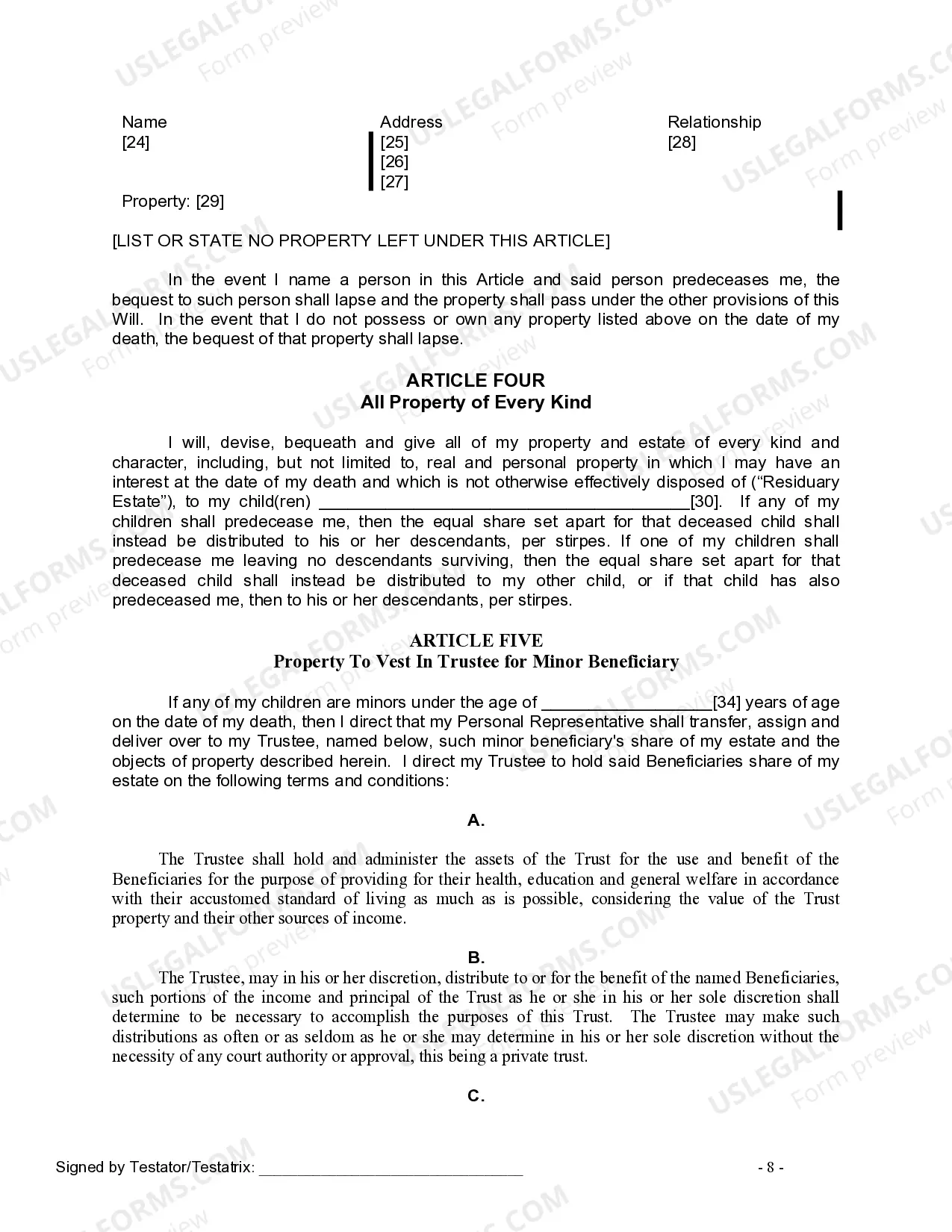

What Are the Three Conditions to Make a Will Valid? The testator, or person making the will, must be at least 18 years old and of sound mind. The will must be in writing, signed by the testator or by someone else at the testator's direction and in their presence.The will must be notarized.

The will must be filed in the county where the decedent last resided with the Probate and Family Court Department so the personal representative may be granted ?Letters? and proceed with the administration of the estate. Someone who dies without a will is called ?intestate,? which invokes the strict laws of intestacy.

In order for the will to be valid, it must either be signed by the testator or signed by someone else in the testator's presence and at the direction of the testator (if the testator is not able to sign the will themselves).

THE VALIDITY OF A WILL It must be made voluntarily. It must be in writing (either typed or hand written) It must be signed by the testator. The signature of the testator must be acknowledged by at least 2 witnesses (it is advised that a beneficiary to a will must not act as a witness to the will).

According to the Commonwealth of Massachusetts, ?an estate must be probated within three years of the decedent's death.?

The will must have been executed with testamentary intent; The testator must have had testamentary capacity: The will must have been executed free of fraud, duress, undue influence or mistake; and. The will must have been duly executed through a proper ceremony.

Yes, a will must be filed with the court in the county where the decedent lived. The court will establish the validity of the will and ensure that all provisions in the will are upheld.

In order for the will to be valid, it must either be signed by the testator or signed by someone else in the testator's presence and at the direction of the testator (if the testator is not able to sign the will themselves).