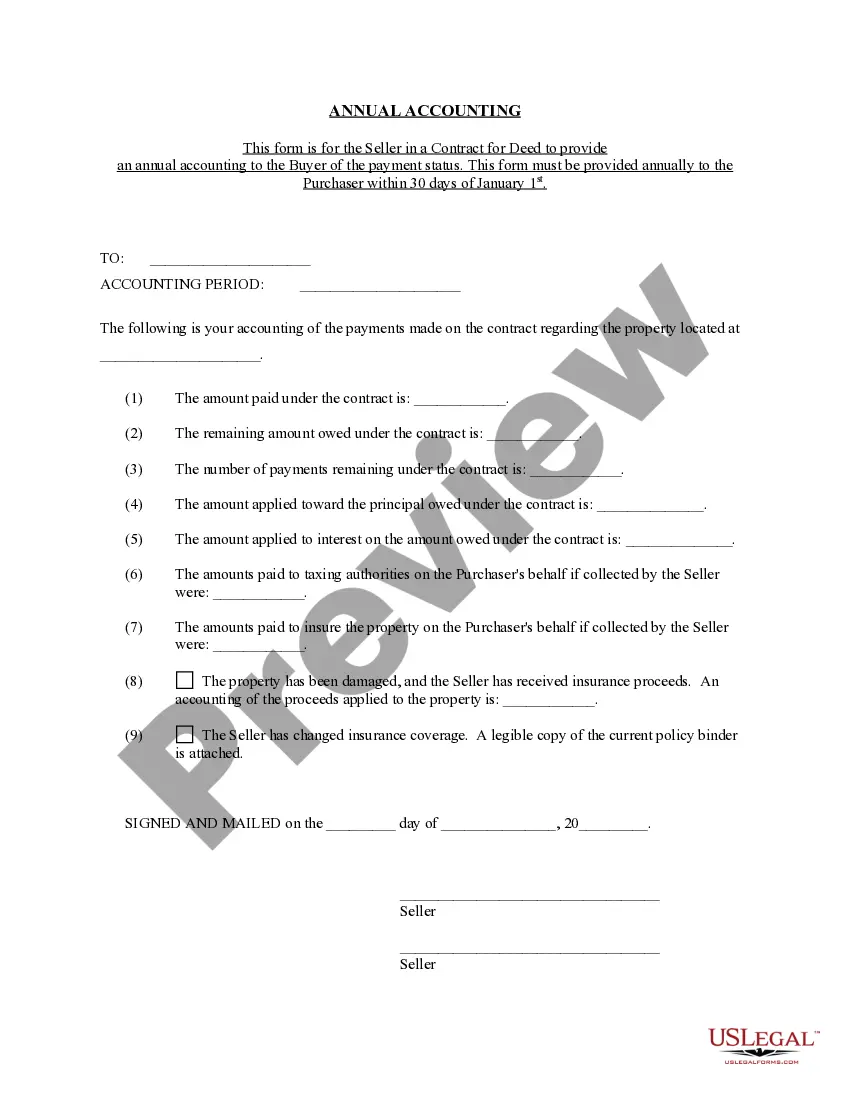

The Montgomery Maryland Contract for Deed Seller's Annual Accounting Statement is a legal document that outlines the financial information and transactions between the seller and buyer in a contract for deed agreement in Montgomery County, Maryland. This statement is typically prepared and provided by the seller on an annual basis to provide a comprehensive overview of the financial aspects of the agreement. The annual accounting statement is an essential component of the contract for deed as it ensures transparency and clarity regarding the financial obligations and rights of both parties involved. It helps in ensuring that the buyer and seller are aware of all the financial transactions and payments made throughout the year, including payments towards the purchase price, interest, taxes, insurance, and any other relevant expenses. The statement provides a detailed breakdown of the financial transactions made during the year, including the amount received from the buyer, any interest accrued, and expenses incurred by the seller. It also includes information on the outstanding balance, payment due dates, and any changes in the terms of the contract. Some key elements and relevant keywords associated with the Montgomery Maryland Contract for Deed Seller's Annual Accounting Statement include: 1. Financial transactions: Details of all payments received from the buyer, including principal and interest. 2. Interest accrued: Calculation and inclusion of interest accrued on the outstanding balance. 3. Expenses incurred: Recording and disclosure of expenses such as property taxes, insurance, and maintenance costs. 4. Payment due dates: Communication of payment due dates and any changes in the payment schedule. 5. Outstanding balance: The remaining balance owed by the buyer. 6. Changes in terms: Any modifications or amendments to the original contract. 7. Transparency: The statement promotes transparency and ensures both parties have a clear understanding of the financial matters involved. 8. Legal compliance: The statement helps ensure compliance with local laws and regulations regarding contract for deed agreements in Montgomery County, Maryland. Different types of Montgomery Maryland Contract for Deed Seller's Annual Accounting Statements may include variations based on specific terms and conditions outlined in the contract. These variations could include adjustments for additional charges, such as HOA fees, special assessments, or other costs agreed upon by the buyer and seller. It is important to review the specific terms of the contract to determine the exact content and structure of the annual accounting statement in each individual case.

Montgomery Maryland Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Montgomery Maryland Contract For Deed Seller's Annual Accounting Statement?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person without any legal background to draft this sort of papers from scratch, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform provides a massive collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI forms.

Whether you need the Montgomery Maryland Contract for Deed Seller's Annual Accounting Statement or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Montgomery Maryland Contract for Deed Seller's Annual Accounting Statement quickly using our reliable platform. In case you are already a subscriber, you can proceed to log in to your account to download the appropriate form.

However, in case you are unfamiliar with our library, ensure that you follow these steps prior to obtaining the Montgomery Maryland Contract for Deed Seller's Annual Accounting Statement:

- Be sure the template you have chosen is specific to your location because the regulations of one state or county do not work for another state or county.

- Preview the document and go through a short outline (if available) of scenarios the paper can be used for.

- If the one you chosen doesn’t meet your needs, you can start over and search for the suitable document.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment gateway and proceed to download the Montgomery Maryland Contract for Deed Seller's Annual Accounting Statement once the payment is through.

You’re good to go! Now you can proceed to print out the document or complete it online. Should you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.