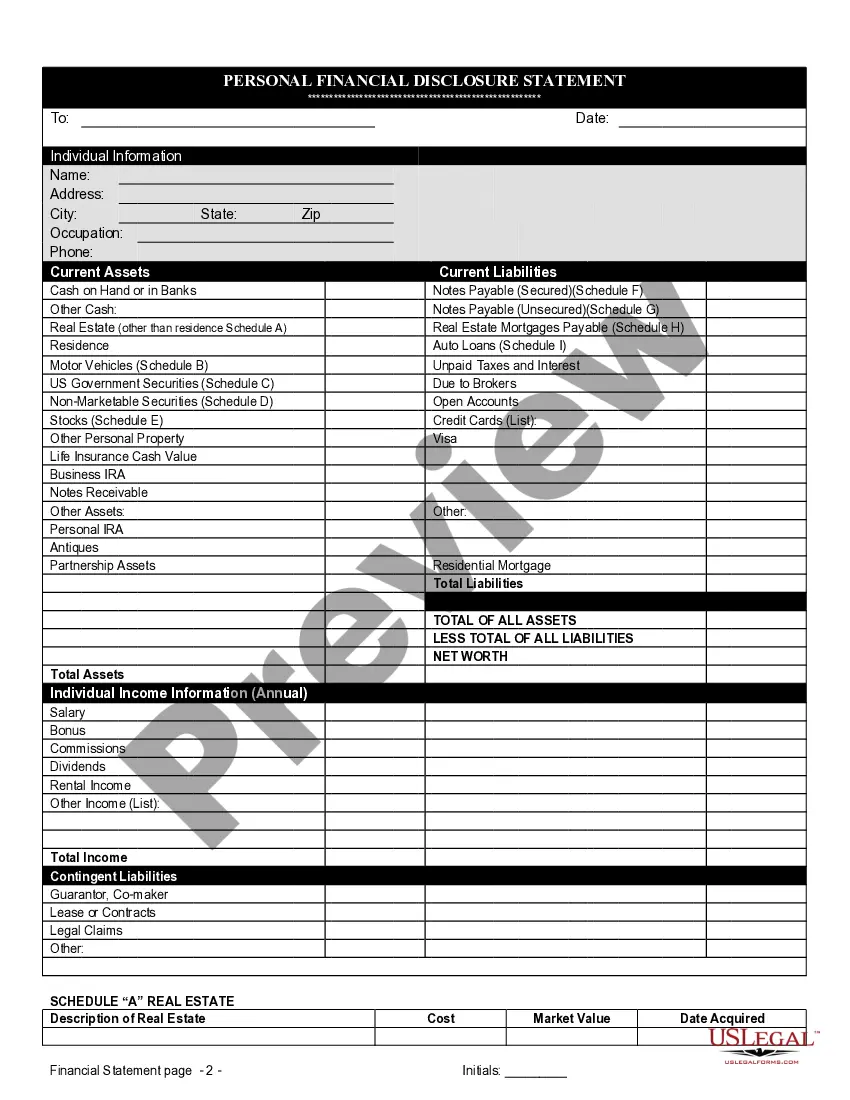

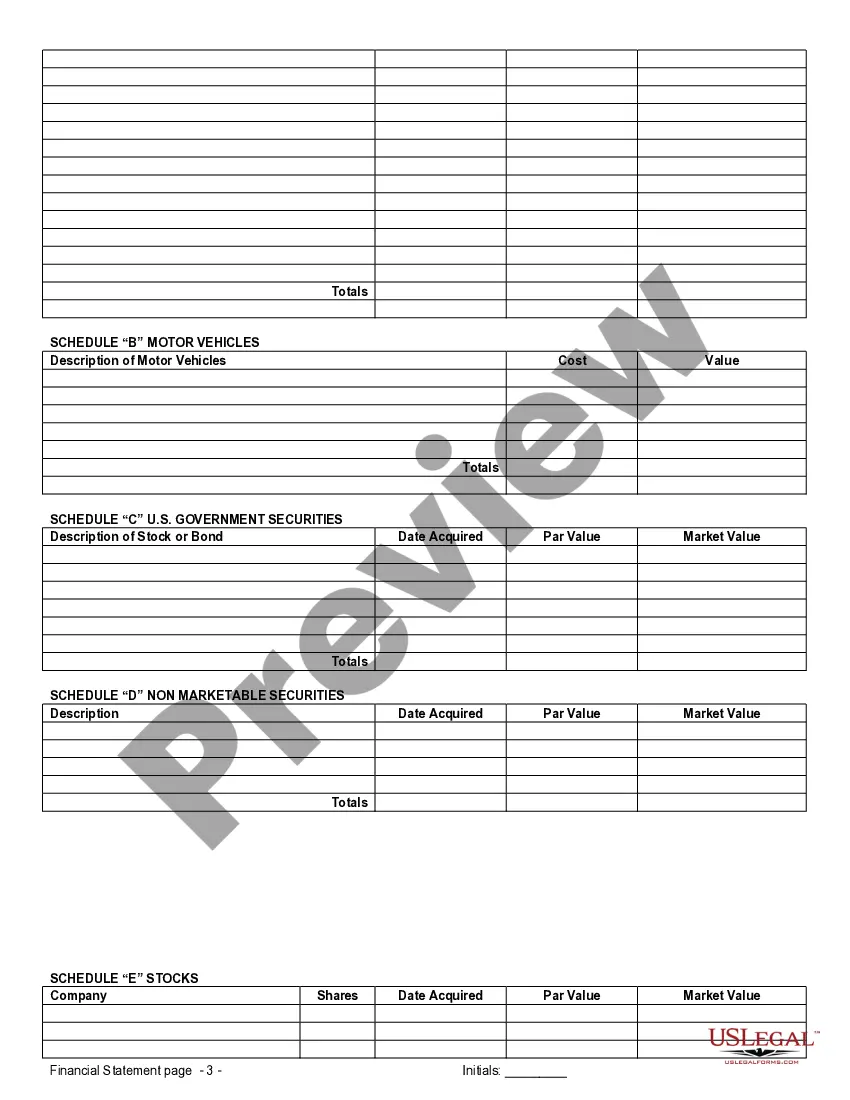

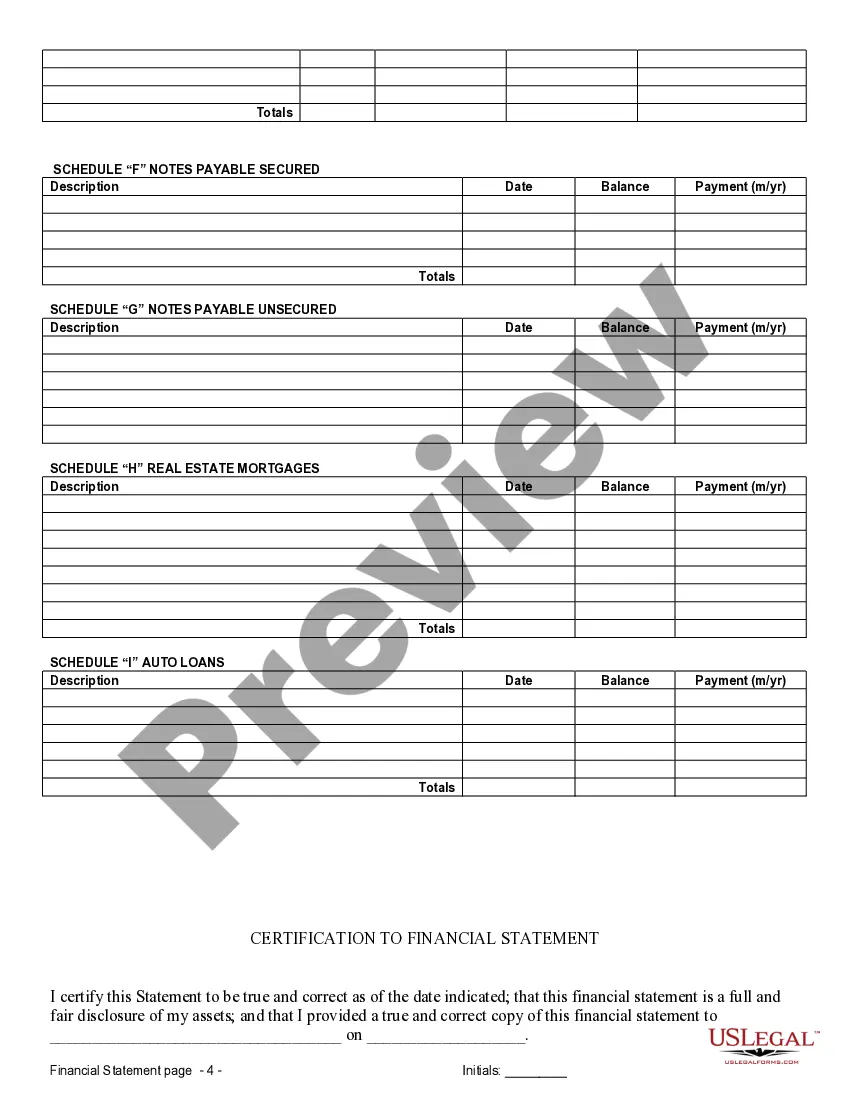

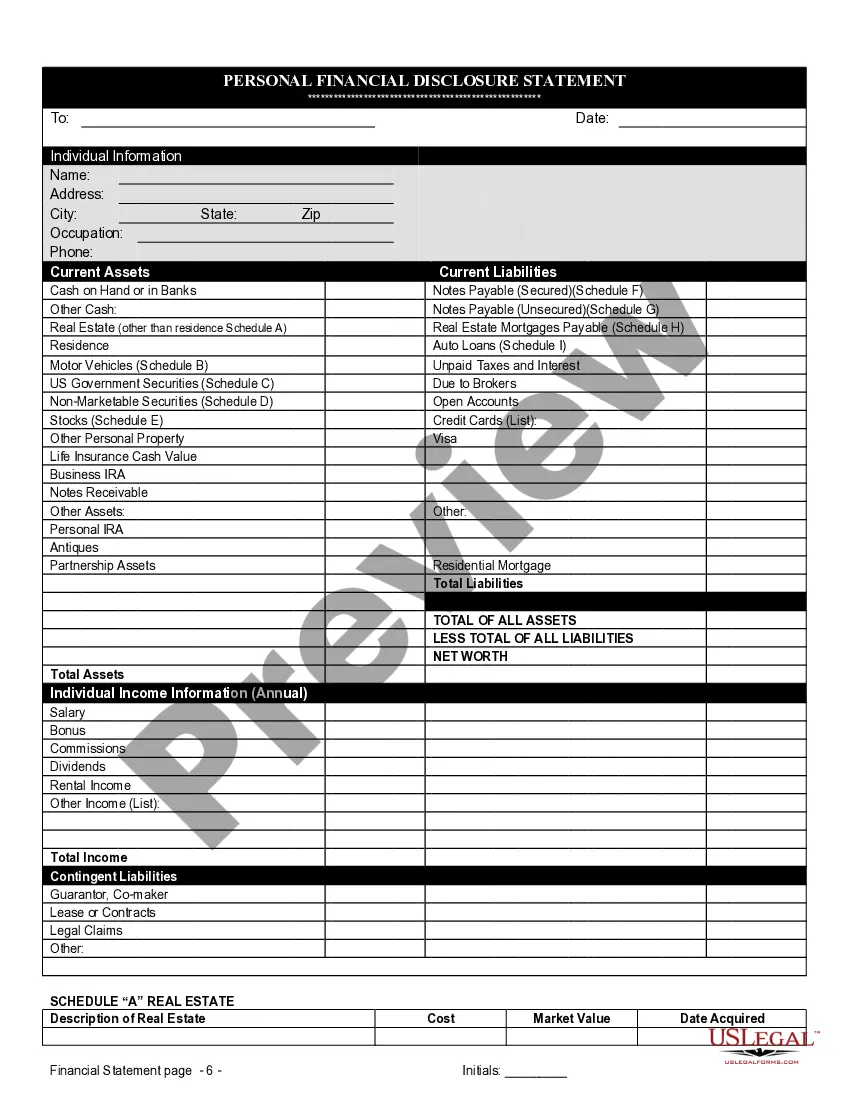

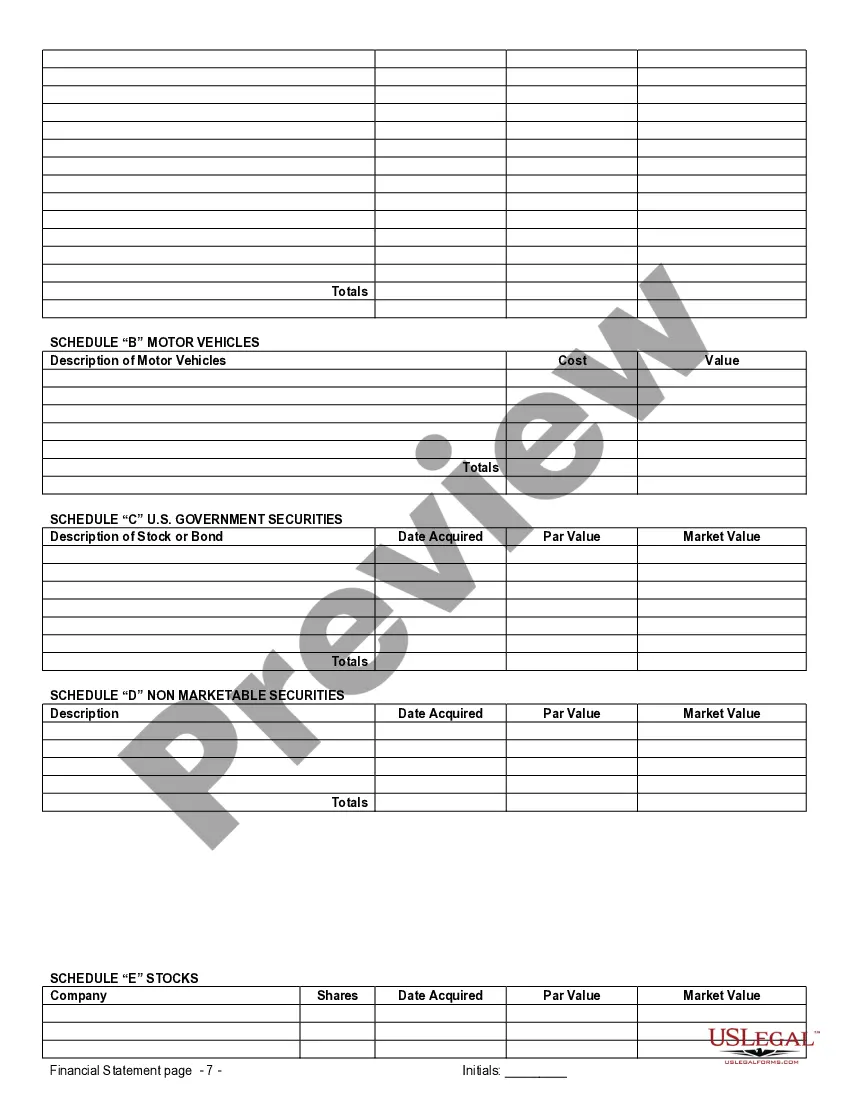

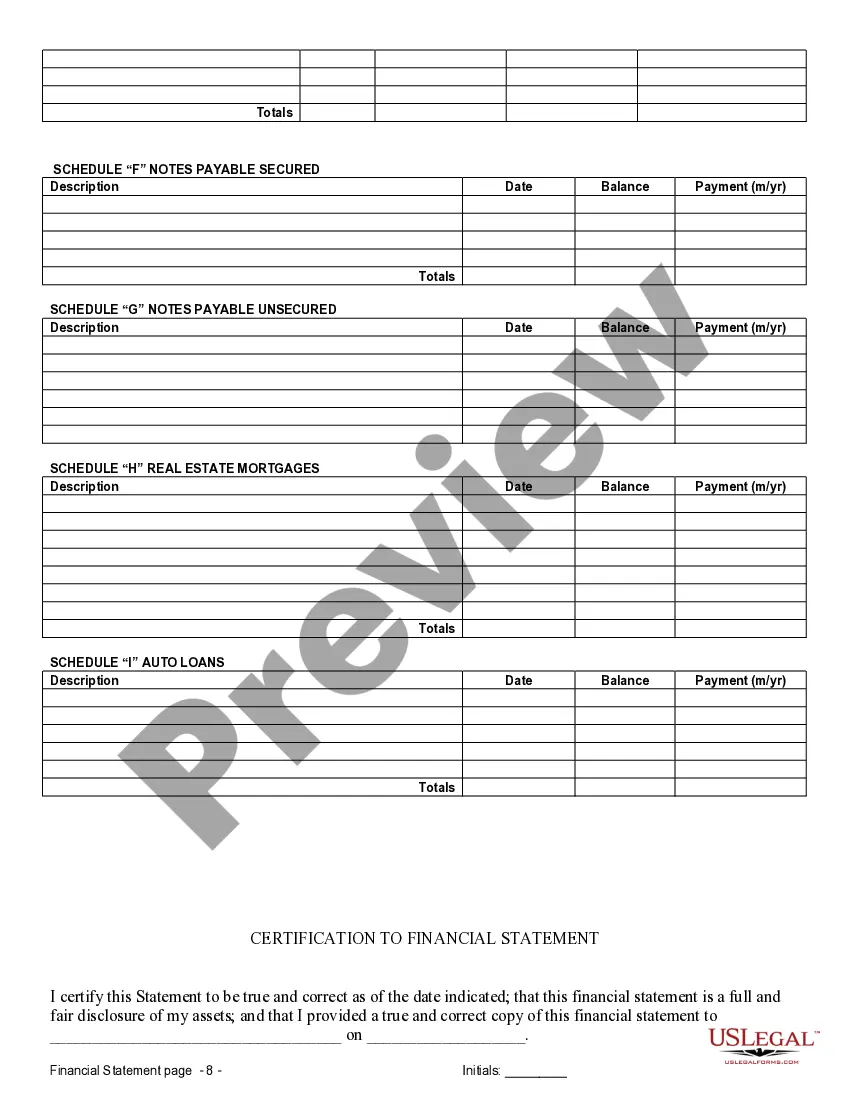

Montgomery Maryland Financial Statements in Connection with Prenuptial Premarital Agreement, also known as prenuptial financial statements, are comprehensive documents that provide a detailed overview of an individual's or couple's financial status. These statements serve as a crucial component within a prenuptial agreement, allowing both parties to fully understand each other's financial standing prior to entering into a marriage contract. Montgomery Maryland Financial Statements are typically prepared by both prospective spouses with the assistance of a financial advisor or attorney. These statements include various relevant keywords such as: 1. Income: The financial statements include detailed information about the income sources for each individual. This may include employment income, business profits, investments/dividends, rental income, and any other sources of income. 2. Assets: All significant assets such as real estate properties, vehicles, bank accounts, investment portfolios, retirement accounts, and other valuable possessions are mentioned in the statements. Each asset is described with specific details, including current market value, ownership status, and any outstanding loans or mortgages against the asset. 3. Liabilities: These statements also outline all debts and liabilities owed by each spouse, such as mortgages, auto loans, student loans, credit card debts, outstanding taxes, or any other financial obligations. 4. Expenses: A detailed breakdown of monthly expenses is provided in the statements. This includes regular living expenses, insurance premiums, transportation costs, utilities, food, healthcare, education, and any other pertinent expenses. 5. Financial History: The statements often include a summary of each individual's financial history, including credit scores, bankruptcy filings, foreclosures, or any other financially significant events. This information helps in assessing the potential financial risks and obligations associated with the marriage. 6. Retirement Plans: Details of retirement plans or pension accounts, including contributions, vesting periods, and expected benefits in the future, are included to provide a comprehensive view of future financial security. 7. Business Ownership: If one or both individuals own a business, the statements will include relevant information, such as business valuation, ownership shares, profits, losses, and any associated liabilities. It's important to note that while these keywords are relevant, the specific content of Montgomery Maryland Financial Statements may vary depending on individual circumstances and the template or format used. It is therefore advisable to consult with a legal and financial professional who can provide tailored guidance and ensure all necessary components are included within the prenuptial financial statements.

Montgomery Prenuptial Agreement

Description

How to fill out Montgomery Maryland Financial Statements Only In Connection With Prenuptial Premarital Agreement?

If you are looking for a relevant form template, it’s impossible to choose a better service than the US Legal Forms website – one of the most considerable online libraries. With this library, you can get thousands of templates for company and personal purposes by types and regions, or keywords. With our advanced search option, discovering the newest Montgomery Maryland Financial Statements only in Connection with Prenuptial Premarital Agreement is as easy as 1-2-3. Furthermore, the relevance of each file is verified by a group of professional attorneys that on a regular basis review the templates on our platform and update them in accordance with the newest state and county laws.

If you already know about our system and have a registered account, all you should do to get the Montgomery Maryland Financial Statements only in Connection with Prenuptial Premarital Agreement is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions below:

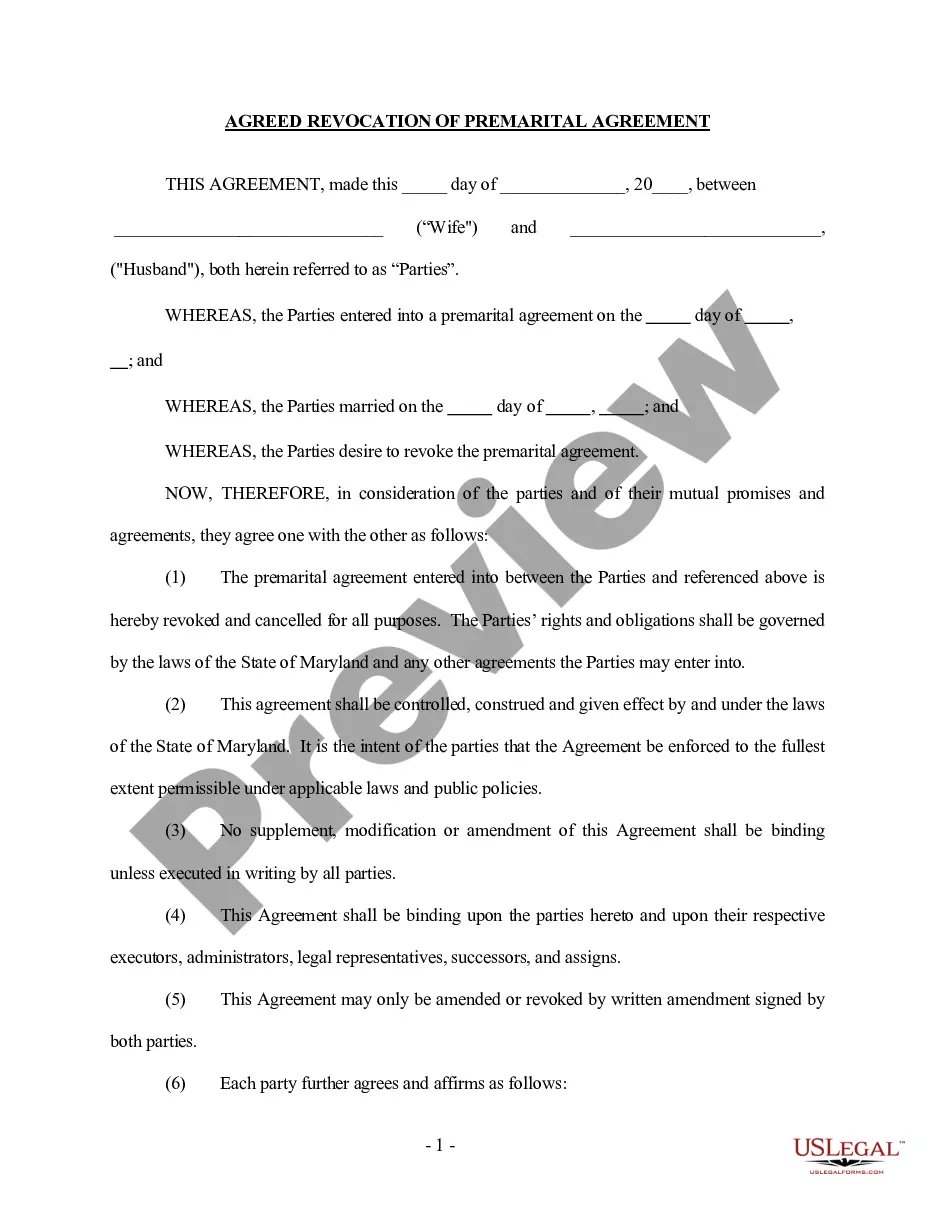

- Make sure you have discovered the sample you need. Read its information and make use of the Preview option (if available) to explore its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to discover the proper document.

- Confirm your selection. Select the Buy now option. Next, pick the preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Receive the template. Indicate the format and download it on your device.

- Make adjustments. Fill out, revise, print, and sign the received Montgomery Maryland Financial Statements only in Connection with Prenuptial Premarital Agreement.

Each template you save in your user profile has no expiration date and is yours permanently. You can easily access them via the My Forms menu, so if you want to have an additional copy for editing or creating a hard copy, you can come back and export it once again whenever you want.

Make use of the US Legal Forms extensive collection to gain access to the Montgomery Maryland Financial Statements only in Connection with Prenuptial Premarital Agreement you were looking for and thousands of other professional and state-specific samples in one place!