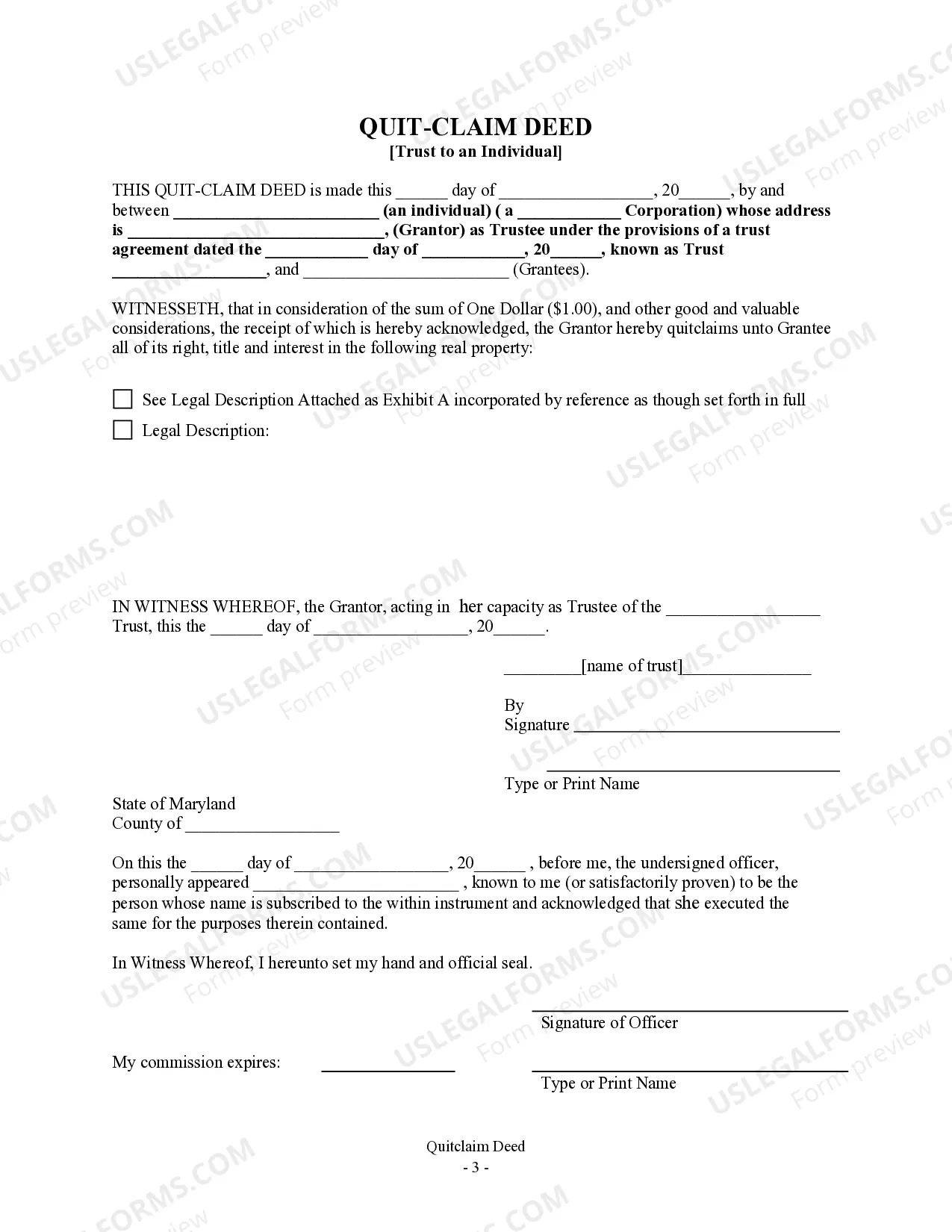

This form is a Quitclaim Deed where the grantor is a Trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Montgomery Maryland Quitclaim Deed from a Trust to an Individual is a legal document that transfers ownership of real estate property located in Montgomery County, Maryland, from a trust to an individual. This type of deed is commonly used when a property is held in a trust and the trustee wishes to transfer the property to a specific individual. The Montgomery Maryland Quitclaim Deed from a Trust to an Individual ensures a smooth transfer of property ownership by stating the granter (trustee) is relinquishing any claims or interest in the property to the grantee (individual), without providing any warranties or guarantees on the property's condition or title. This means that the grantee accepts the property "as is," assuming any existing liens, encumbrances, or title issues. There are different types of Montgomery Maryland Quitclaim Deeds from a Trust to an Individual, each suited for specific situations: 1. Inter vivos trust to individual: This type of quitclaim deed transfers property from a living trust to an individual while the granter is still alive. It is commonly used for estate planning purposes or when the granter wishes to distribute assets from the trust. 2. Testamentary trust to individual: This quitclaim deed transfers property held in a testamentary trust to an individual beneficiary after the granter's death, following the instructions outlined in their will. 3. Revocable trust to individual: A revocable trust is one that can be altered or revoked by the granter. This type of quitclaim deed transfers property from a revocable living trust to an individual, often used to remove a property from the trust or for estate planning purposes. 4. Irrevocable trust to individual: Unlike a revocable trust, an irrevocable trust cannot be changed or revoked by the granter after it is created. This quitclaim deed transfers property from an irrevocable trust to an individual, typically used for asset protection or Medicaid planning. When executing a Montgomery Maryland Quitclaim Deed from a Trust to an Individual, it is crucial to consult with an experienced attorney to ensure compliance with state laws and to safeguard the interests of all parties involved.