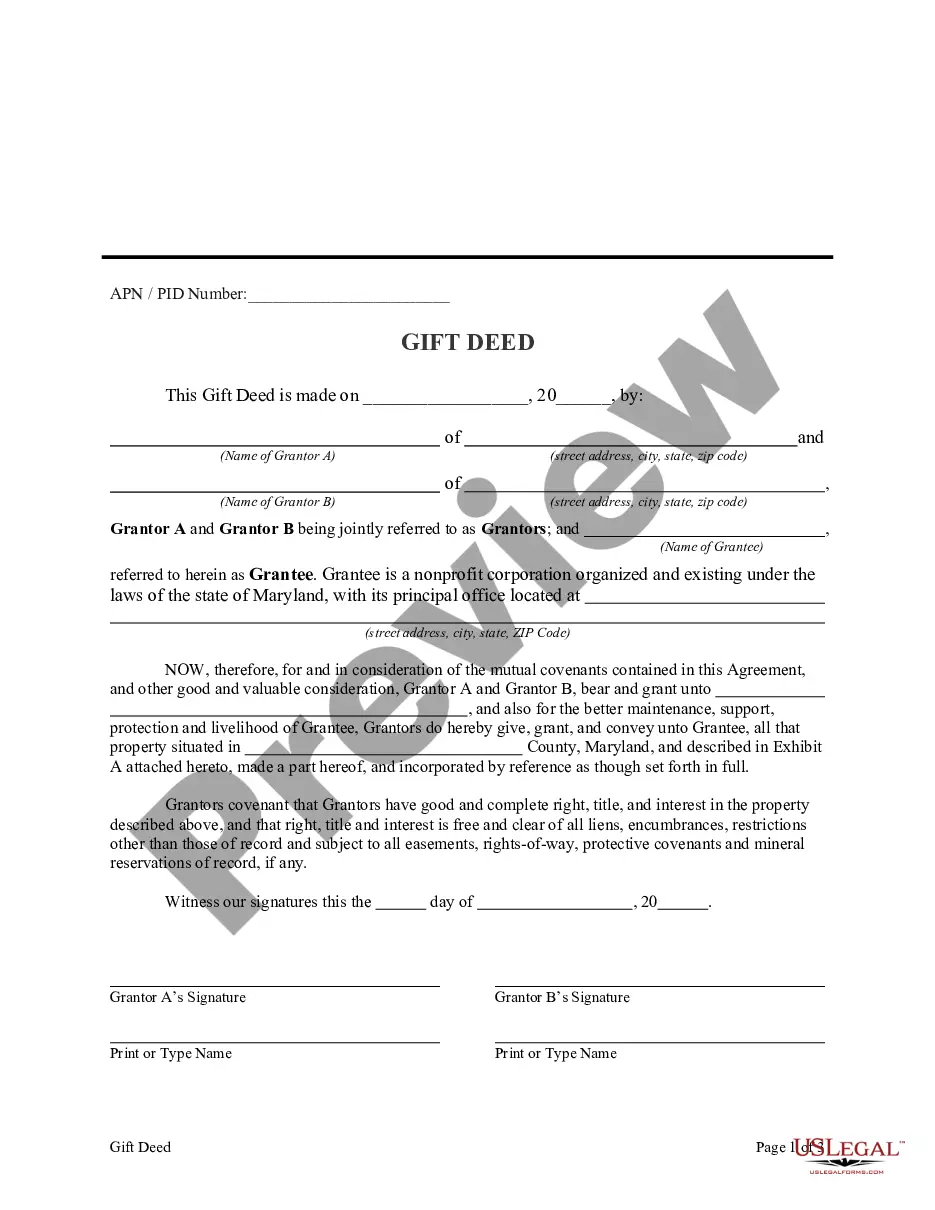

This form is a Gift Deed where the Grantors are two individuals and the Grantee is a non-profit corporation. Grantors convey the described property to the Grantee as a gift without monetary consideration. This deed complies with all state statutory laws.

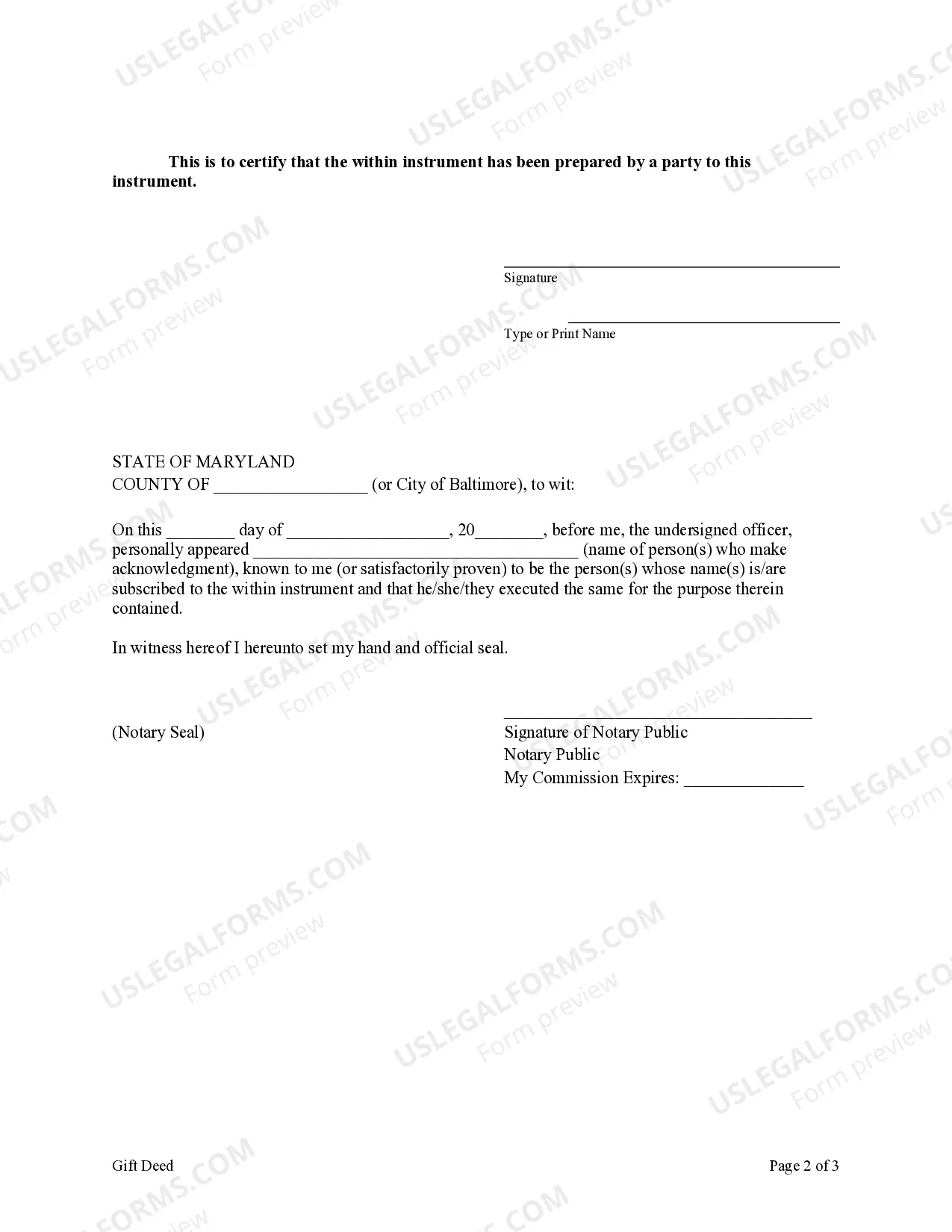

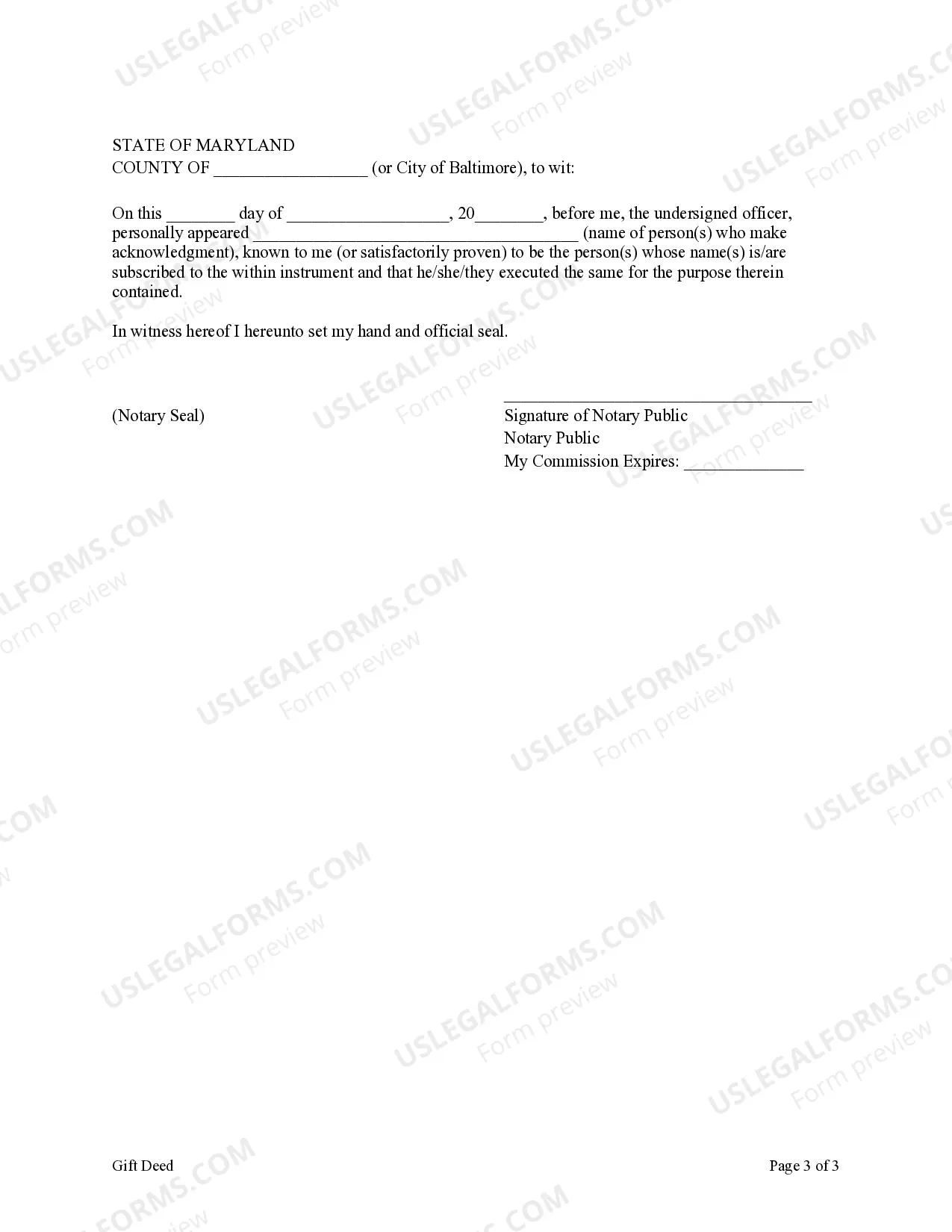

A Montgomery Maryland Gift Deed from Two Granters to a Non-Profit Corporation as Grantee is a legal document used to transfer ownership of real estate from two individuals, referred to as the granters, to a non-profit corporation, known as the grantee. This type of deed allows the granters to gift the property to the non-profit corporation without compensation in return. The Montgomery Maryland Gift Deed typically includes important details regarding the property being gifted, such as the physical address, legal description, and any existing liens or encumbrances. It also outlines the names and contact information of the granters and the non-profit corporation, establishing their roles in the transaction. There are different types of Montgomery Maryland Gift Deeds that can be used based on the specific circumstances: 1. General Montgomery Maryland Gift Deed: This is the most common type of gift deed used when the granters want to transfer the property to a non-profit corporation without any conditions attached. 2. Conditional Montgomery Maryland Gift Deed: In some cases, the granters may impose specific conditions on the gift, such as requiring the non-profit corporation to use the property for a certain purpose or maintain it in a particular condition. 3. Revocable Montgomery Maryland Gift Deed: This type of gift deed allows the granters to retain the right to revoke or cancel the gift during their lifetime. 4. Irrevocable Montgomery Maryland Gift Deed: In contrast to the revocable gift deed, the irrevocable gift deed cannot be reversed or cancelled once it has been executed. It offers a higher level of assurance to the non-profit corporation that the property will remain under their ownership. When executing a Montgomery Maryland Gift Deed, it is advisable for the granters to consult with an attorney specializing in real estate law to ensure that all legal requirements and formalities are met. The completed gift deed must be properly notarized and submitted to the relevant county or city office for recording in the public land records, establishing the non-profit corporation's legal ownership of the property. Remember, this content aims to provide a general overview. It is crucial to consult a qualified professional for precise advice tailored to your specific circumstances.A Montgomery Maryland Gift Deed from Two Granters to a Non-Profit Corporation as Grantee is a legal document used to transfer ownership of real estate from two individuals, referred to as the granters, to a non-profit corporation, known as the grantee. This type of deed allows the granters to gift the property to the non-profit corporation without compensation in return. The Montgomery Maryland Gift Deed typically includes important details regarding the property being gifted, such as the physical address, legal description, and any existing liens or encumbrances. It also outlines the names and contact information of the granters and the non-profit corporation, establishing their roles in the transaction. There are different types of Montgomery Maryland Gift Deeds that can be used based on the specific circumstances: 1. General Montgomery Maryland Gift Deed: This is the most common type of gift deed used when the granters want to transfer the property to a non-profit corporation without any conditions attached. 2. Conditional Montgomery Maryland Gift Deed: In some cases, the granters may impose specific conditions on the gift, such as requiring the non-profit corporation to use the property for a certain purpose or maintain it in a particular condition. 3. Revocable Montgomery Maryland Gift Deed: This type of gift deed allows the granters to retain the right to revoke or cancel the gift during their lifetime. 4. Irrevocable Montgomery Maryland Gift Deed: In contrast to the revocable gift deed, the irrevocable gift deed cannot be reversed or cancelled once it has been executed. It offers a higher level of assurance to the non-profit corporation that the property will remain under their ownership. When executing a Montgomery Maryland Gift Deed, it is advisable for the granters to consult with an attorney specializing in real estate law to ensure that all legal requirements and formalities are met. The completed gift deed must be properly notarized and submitted to the relevant county or city office for recording in the public land records, establishing the non-profit corporation's legal ownership of the property. Remember, this content aims to provide a general overview. It is crucial to consult a qualified professional for precise advice tailored to your specific circumstances.