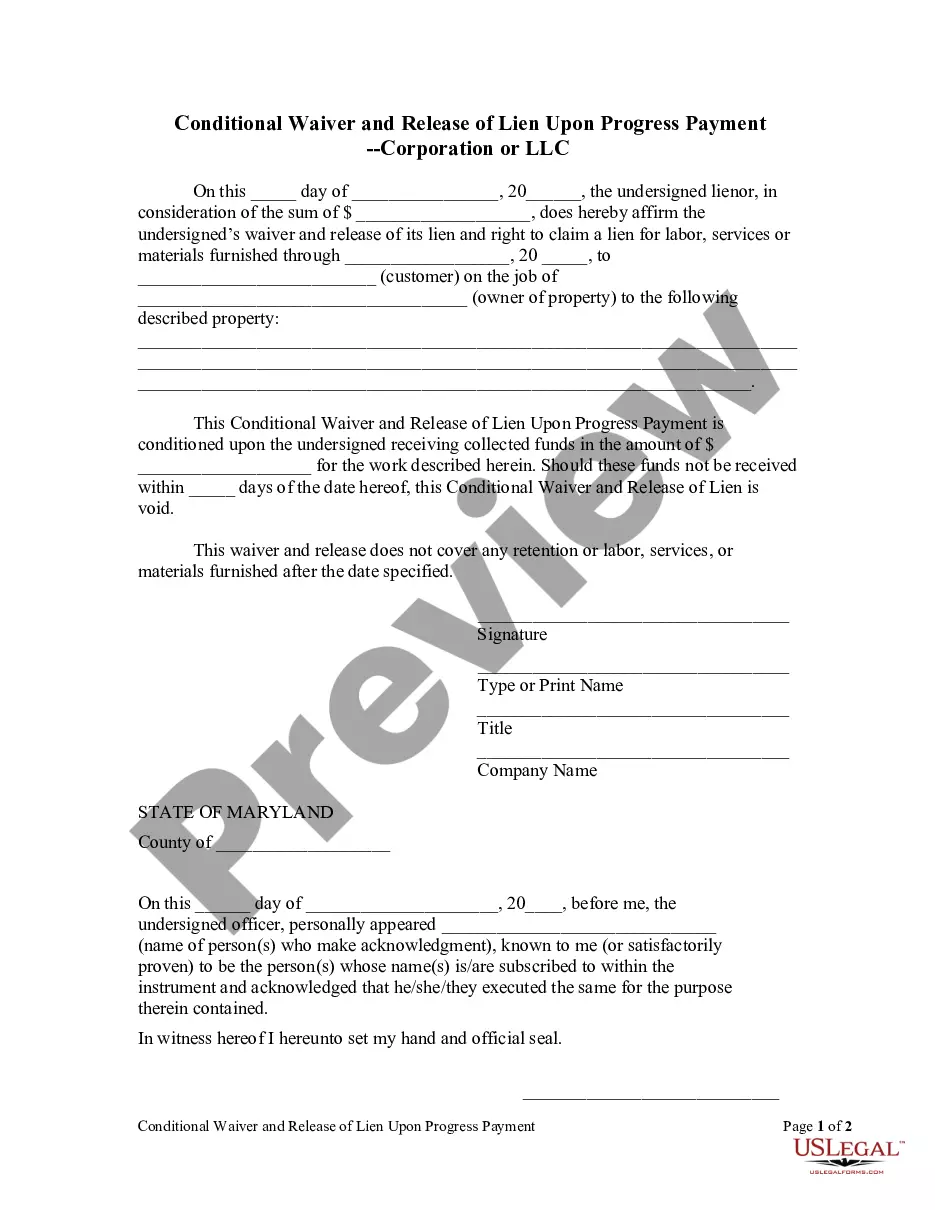

This Conditional Waiver and Release Upon Progress Payment form is for use by a corporate or LLC lienor, in consideration of a certain sum of money to affirm the waiver and release of its lien and right to claim a lien for labor, services or materials furnished on a particular job of the owner of property. This Conditional Waiver and Release of Lien Upon Progress Payment is conditioned upon the lienor receiving collected funds in a certain amount for the work, and will be considered void if the funds are not received within a certain number of days of the date of the waiver.

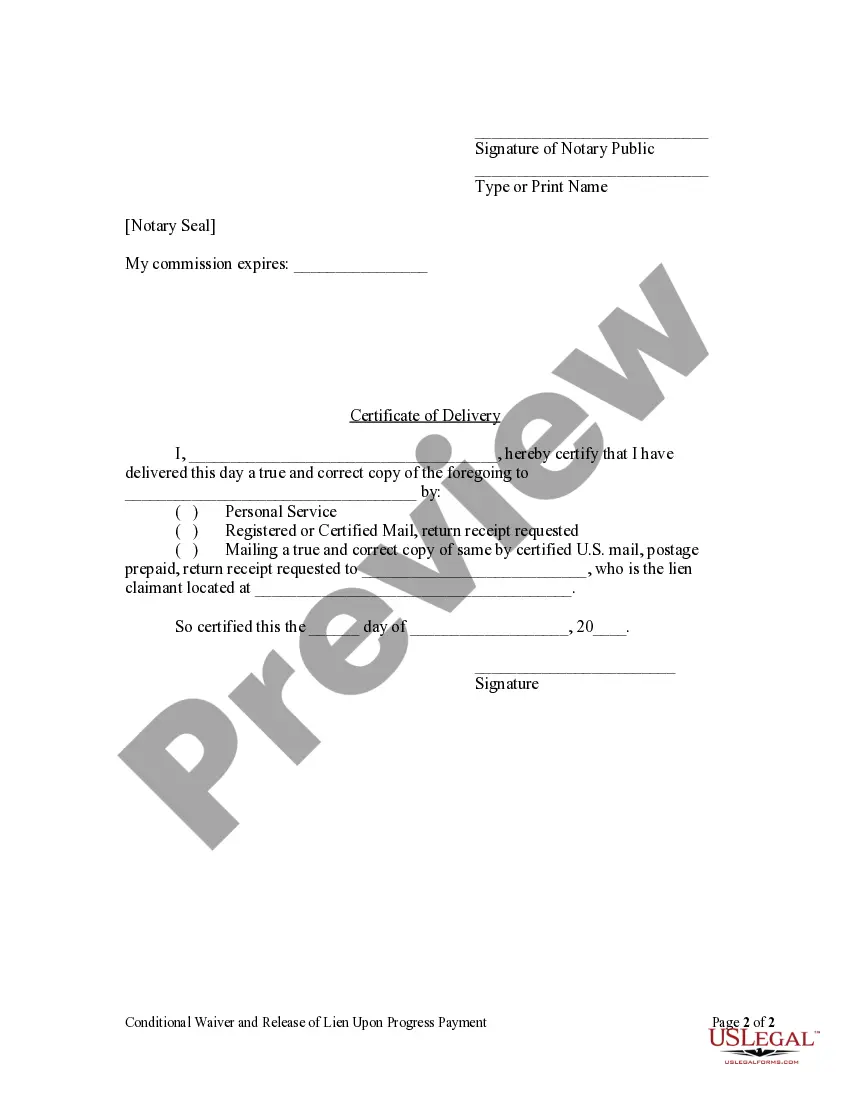

Montgomery Maryland Conditional Waiver and Release Upon Progress Payment — Corporation or LLC is a legal document used in the construction industry to release a portion of the lien rights when progress payment is made by the project owner or general contractor to a corporation or limited liability company (LLC). This waiver acts as a receipt of payment and creates a legal agreement between the contractor and the mayor, stating that the payment received confirms the releasing of the lien rights up to the date of the payment. By signing this waiver, the corporation or LLC acknowledges that they have received a partial payment for the work completed and grants a conditional release of their rights to file a lien against the property. There are different types of Montgomery Maryland Conditional Waiver and Release Upon Progress Payment — Corporation or LLC, depending on the specific situation and requirements of the project. Some of these variations include: 1. Conditional Waiver and Release upon Progress Payment: This type is commonly used when the contractor desires to release their lien rights for a partial payment made on a project. It ensures that the contractor or subcontractor receives payment while still maintaining rights to any unpaid balance. 2. Unconditional Waiver and Release upon Progress Payment: This type is used when the contractor wants to release their lien rights in full upon receiving a progress payment. It implies that the contractor has been paid the entire amount owed for the work completed and relinquishes any further claim to the payment. 3. Partial Conditional Waiver and Release upon Progress Payment: This type of waiver is utilized when the contractor receives partial payment for their work and wants to release their lien rights up to the amount received. It allows the contractor to maintain rights to any remaining unpaid balance. It is important to note that these variations can have further specifications and may require additional information, such as the project's name, property description, contractor's information, and the payment amount, among others. Overall, the Montgomery Maryland Conditional Waiver and Release Upon Progress Payment — Corporation or LLC is a vital document that ensures fair payment practices in the construction industry and protects both parties involved in the transaction.