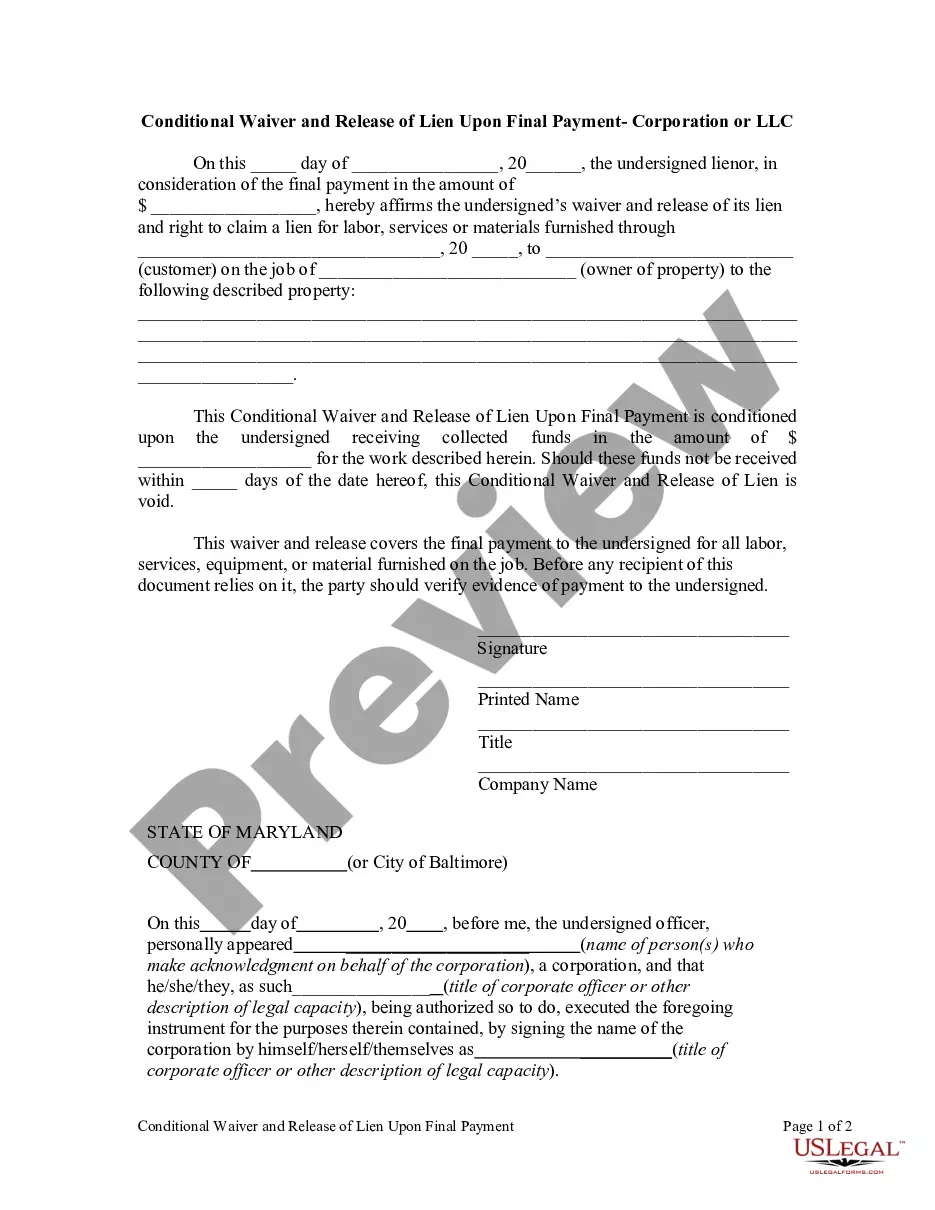

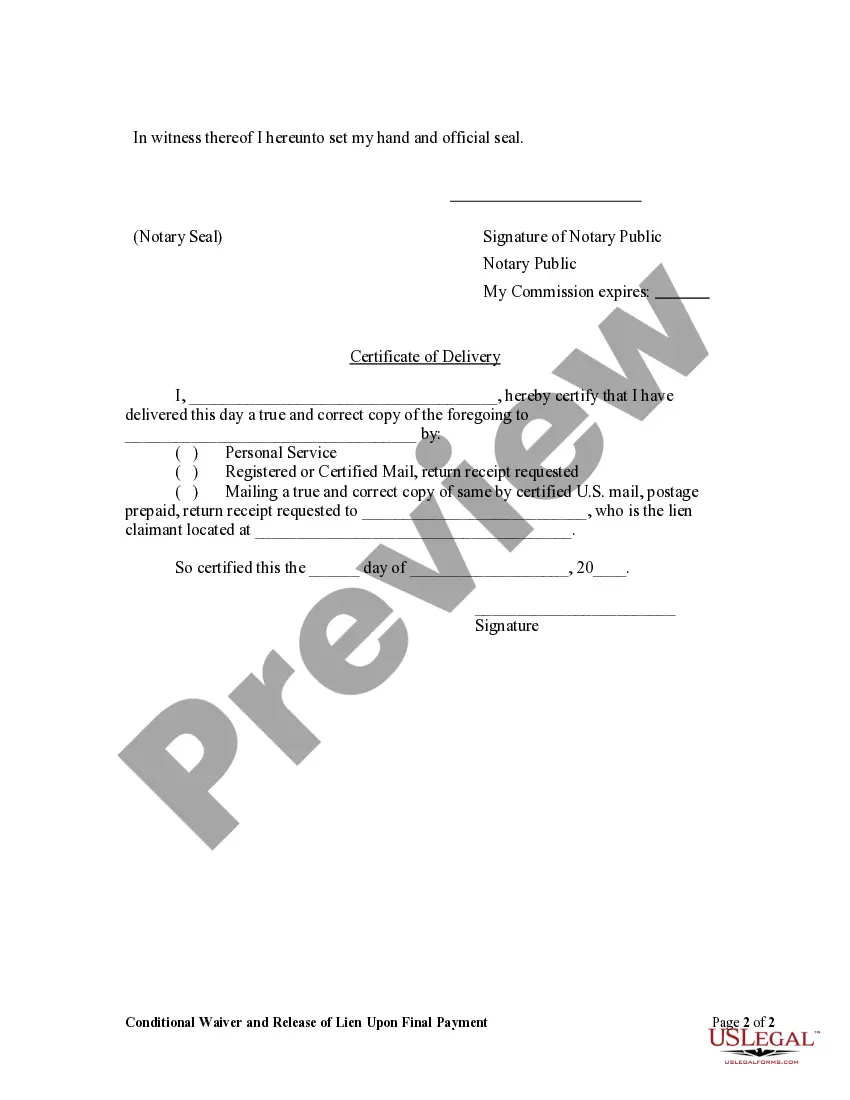

This Conditional Waiver and Release Upon Final Payment is for use by a corporate lienor, in consideration of final payment to affirm its waiver and release of lien and right to claim a lien for labor, services or materials furnished through a certain date to a customer on the job of an owner of property. This Conditional Waiver and Release of Lien Upon Final Payment is conditioned upon the lienor receiving collected funds in a certain amount for the work, and will be considered void if such funds are not received within a certain number of days of the date of the waiver.

The Montgomery Maryland Conditional Waiver and Release Upon Final Payment — Corporation or LLC is a legal document used in the state of Maryland for construction projects involving a corporation or limited liability company (LLC). This waiver and release form is crucial for protecting contractors, subcontractors, suppliers, and other construction professionals from any future claims or liabilities related to unpaid bills or disputes. In essence, the conditional waiver and release serve as a confirmation that the contractor or supplier has received the final payment for their services or materials. By signing this document, the corporation or LLC agrees to release the claimant from any further obligations or liabilities associated with the project. Several types of Montgomery Maryland Conditional Waiver and Release Upon Final Payment — Corporation or LLC can be categorized based on the nature and purpose of the document. Some commonly known types include: 1. Partial Conditional Waiver and Release Upon Final Payment — Corporation or LLC: This waiver and release form is issued when only a portion of the total payment has been received. It confirms that the claimant has been compensated partially and relinquishes their right to claim the remaining amount upon completion of the project. 2. Unconditional Waiver and Release Upon Final Payment — Corporation or LLC: Unlike the conditional waiver and release, this type is issued without any conditions attached. It indicates that the claimant has received the full and final payment, and they waive any future claims against the corporation or LLC. 3. Conditional Waiver and Release for Progress Payment — Corporation or LLC: This waiver and release form are used when a progress payment is made during the ongoing construction project. It confirms the receipt of partial payment for the completed work but allows the claimant to safeguard their rights to claim additional amounts until a final payment is received. Each of these Montgomery Maryland Conditional Waiver and Release Upon Final Payment — Corporation or LLC forms is crucial for maintaining transparency and trust in construction projects. Project stakeholders are required to carefully review and understand the specific type of waiver and release that aligns with their payment status to ensure correct documentation and full compliance with Maryland's legal requirements.

The Montgomery Maryland Conditional Waiver and Release Upon Final Payment — Corporation or LLC is a legal document used in the state of Maryland for construction projects involving a corporation or limited liability company (LLC). This waiver and release form is crucial for protecting contractors, subcontractors, suppliers, and other construction professionals from any future claims or liabilities related to unpaid bills or disputes. In essence, the conditional waiver and release serve as a confirmation that the contractor or supplier has received the final payment for their services or materials. By signing this document, the corporation or LLC agrees to release the claimant from any further obligations or liabilities associated with the project. Several types of Montgomery Maryland Conditional Waiver and Release Upon Final Payment — Corporation or LLC can be categorized based on the nature and purpose of the document. Some commonly known types include: 1. Partial Conditional Waiver and Release Upon Final Payment — Corporation or LLC: This waiver and release form is issued when only a portion of the total payment has been received. It confirms that the claimant has been compensated partially and relinquishes their right to claim the remaining amount upon completion of the project. 2. Unconditional Waiver and Release Upon Final Payment — Corporation or LLC: Unlike the conditional waiver and release, this type is issued without any conditions attached. It indicates that the claimant has received the full and final payment, and they waive any future claims against the corporation or LLC. 3. Conditional Waiver and Release for Progress Payment — Corporation or LLC: This waiver and release form are used when a progress payment is made during the ongoing construction project. It confirms the receipt of partial payment for the completed work but allows the claimant to safeguard their rights to claim additional amounts until a final payment is received. Each of these Montgomery Maryland Conditional Waiver and Release Upon Final Payment — Corporation or LLC forms is crucial for maintaining transparency and trust in construction projects. Project stakeholders are required to carefully review and understand the specific type of waiver and release that aligns with their payment status to ensure correct documentation and full compliance with Maryland's legal requirements.