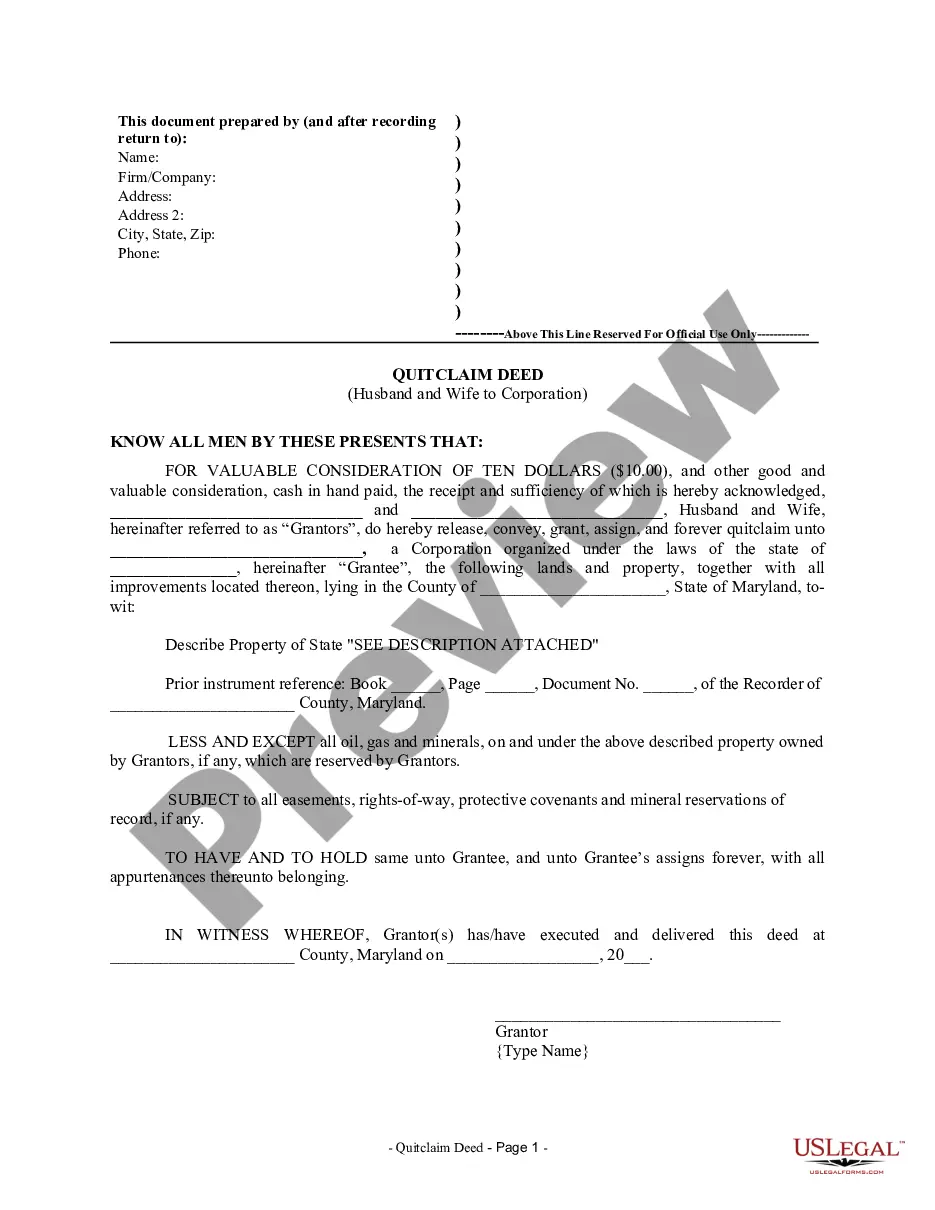

A Montgomery Maryland Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership interest of a property from a married couple to a corporation using a quitclaim deed. This type of deed is commonly used when a property is jointly owned by a husband and wife, and they wish to transfer the ownership to a corporation, typically for business or asset protection purposes. The main purpose of executing a Montgomery Maryland Quitclaim Deed from Husband and Wife to Corporation is to ensure a smooth transfer of ownership without warranty or guarantee of title. This means that the husband and wife are not guaranteeing that they have clear and marketable title to the property, nor are they responsible for any potential liens, encumbrances, or claims against the property. This type of deed is often used when the husband and wife have a certain level of trust in the corporation and the circumstances of the transfer. There are a few different types of Montgomery Maryland Quitclaim Deeds from Husband and Wife to Corporation that may be mentioned: 1. Montgomery Maryland Quitclaim Deed from Husband and Wife to Corporation for Business Purposes: This type of deed is used when the purpose of the transfer is to place the property under the ownership of a corporation for business-related reasons. This could include establishing it as a corporate asset, protecting personal assets, or taking advantage of tax benefits available to corporations. 2. Montgomery Maryland Quitclaim Deed from Husband and Wife to Corporation for Estate Planning: In some cases, a married couple may decide to transfer their property to a corporation as part of their estate planning strategy. This type of deed allows them to transfer ownership to the corporation, potentially minimizing estate taxes and simplifying the transfer of assets to heirs in the future. 3. Montgomery Maryland Quitclaim Deed from Husband and Wife to Corporation for Liability Protection: Transferring property to a corporation can help shield the individuals from personal liability associated with the property. This can be particularly useful in situations where the property carries a higher potential for liability, such as rental properties or commercial buildings. It is important to consult a qualified attorney or real estate professional knowledgeable in Montgomery Maryland real estate laws when considering executing a Quitclaim Deed from Husband and Wife to Corporation. They can provide guidance and ensure that the transfer is conducted properly and in compliance with all legal requirements.

Montgomery Maryland Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Montgomery Maryland Quitclaim Deed From Husband And Wife To Corporation?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for legal solutions that, usually, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Montgomery Maryland Quitclaim Deed from Husband and Wife to Corporation or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Montgomery Maryland Quitclaim Deed from Husband and Wife to Corporation adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Montgomery Maryland Quitclaim Deed from Husband and Wife to Corporation is suitable for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!