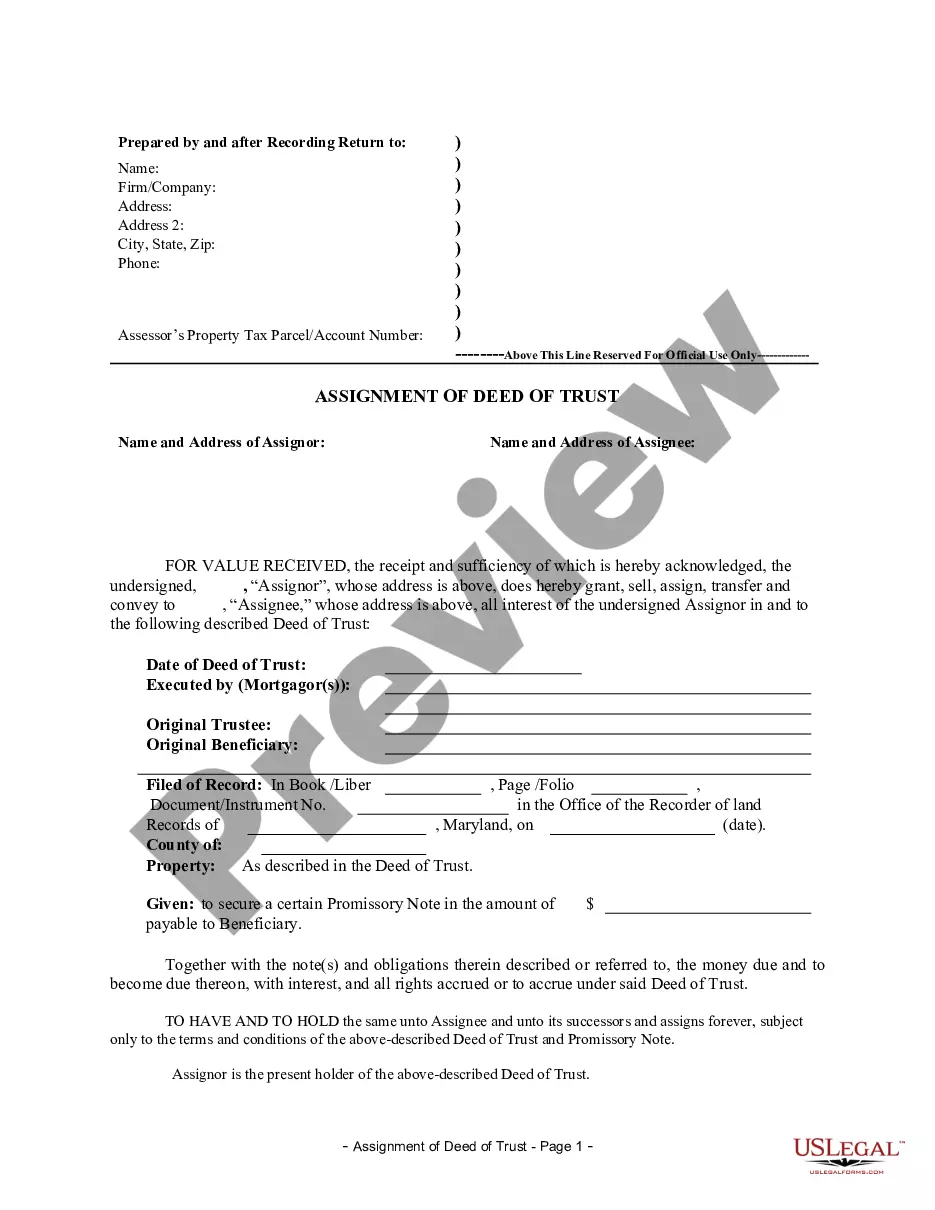

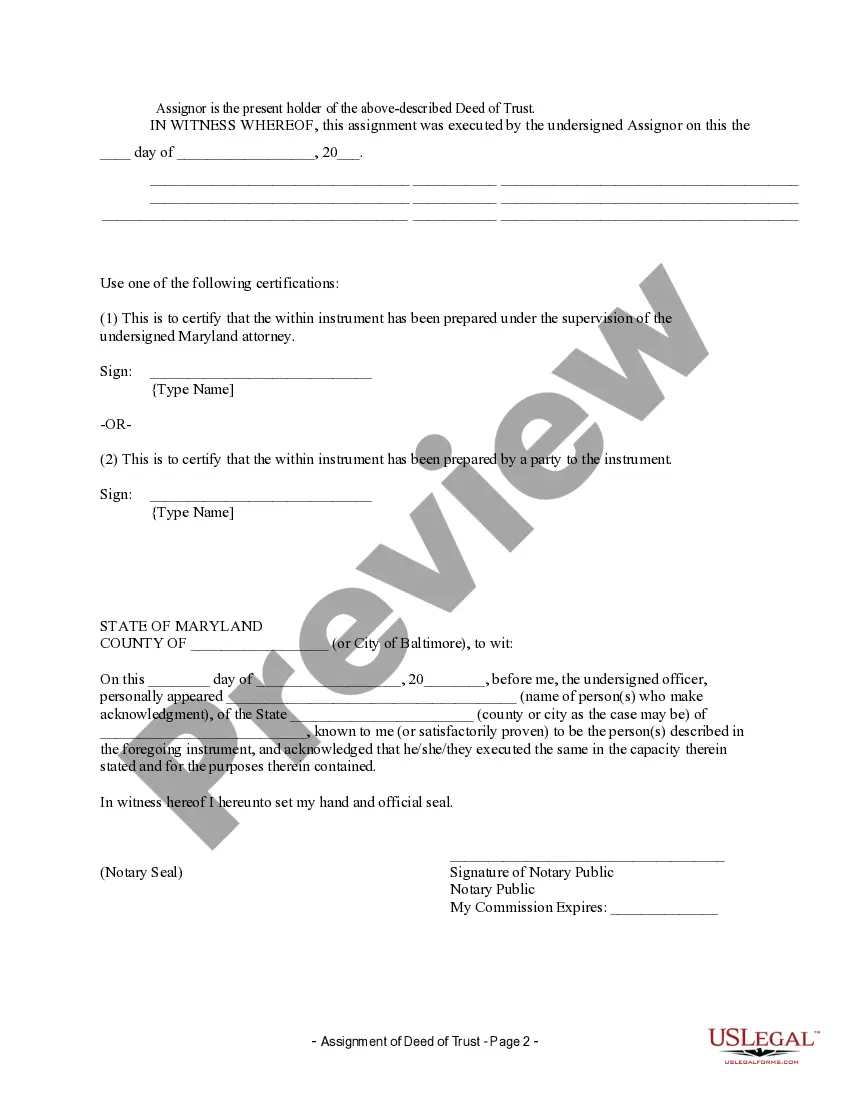

Assignment of Deed of Trust by Individual Mortgage Holder

Assignments Generally: Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rules

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Maryland Law

Assignment: An assignment must be in writing

and recorded.

Demand to Satisfy: Mortgagee must record

satisfaction and provide written evidence of same to mortgagor within 30

days of written demand.

Recording Satisfaction: A release may be

endorsed on the original mortgage or deed of trust by the mortgagee or

his assignee, the trustee or his successor under a deed of trust, or by

the holder of the debt or obligation secured by the deed of trust. The

mortgage or the deed of trust, with the endorsed release, then shall be

filed in the office in which the mortgage or deed of trust is recorded.

Marginal Satisfaction: Allowed, either

on the original mortgage document, or on the record of same at the recording

office.

Penalty: If mortgagee fails to satisfy

mortgage of record and provide mortgagee written evidence thereof within

30 days of written demand, mortgagee is liable for the delivery of the

release and for all costs and expenses in connection with the bringing

of the action, including reasonable attorney fees.

Acknowledgment: An assignment or satisfaction

must contain a proper Maryland acknowledgment, or other acknowledgment

approved by Statute.

Maryland Statutes

Article - Real Property § 3-105.

(a) A mortgage or deed of trust may

be released validly by any procedure enumerated in this section.

(b) A release may be endorsed on the

original mortgage or deed of trust by the mortgagee or his assignee, the

trustee or his successor under a deed of trust, or by the holder of the

debt or obligation secured by the deed of trust. The mortgage or the deed

of trust, with the endorsed release, then shall be filed in the office

in which the mortgage or deed of trust is recorded. The clerk shall record

the release photographically, with an attachment or rider affixed to it

containing the names of the parties as they appear on the original mortgage

or deed of trust, together with a reference to the book and page number

where the mortgage or deed of trust is recorded. When the mortgage or deed

of trust, with the attached release, is filed for the purpose of recording

the release, the clerk shall retain the mortgage or deed of trust in his

office and not permit it to be withdrawn for 25 years, after which time

he may destroy it. If, however, the clerk preserves a photographic copy

of the release, he may permit the original mortgage or deed of trust with

the release to be withdrawn.

(c) At the option of the clerk of

the court in whose office the book form of recording is used, the release

may be written by the mortgagee, or his assignee, or the trustee, or his

successor under a deed of trust, on the record in the office where the

mortgage or deed of trust is recorded and attested by the clerk of the

court. At the time of recording any mortgage or deed of trust, the clerk

of the court in whose office the book form of recording is used shall leave

a blank space at the foot of the mortgage or deed of trust for the purpose

of entering such release.

(d)

(1) When the debt secured by a deed

of trust is paid fully or satisfied, and any bond, note, or other evidence

of the total indebtedness is marked "paid" or "cancelled" by the holder

or his agent, it may be received by the clerk and indexed and recorded

as any other instrument in the nature of a release. The marked note has

the same effect as a release of the property for which it is the security,

as if a release were executed by the named trustees, if there is attached

to or endorsed on the note an affidavit of the holder, the party making

satisfaction, or an agent of either of them, that it has been paid or satisfied,

and specifically setting forth the land record reference where the original

deed of trust is recorded.

(2) When the debt secured by a mortgage

is paid fully or satisfied, and the original mortgage is marked "paid"

or "cancelled" by the mortgagee or his agent, it may be received by the

clerk and indexed and recorded as any other instrument in the nature of

a release. The marked mortgage has the same effect as a release of the

property for which it is the security, as if a release were executed by

the mortgagee, if there is attached to or endorsed on the mortgage an affidavit

of the mortgagee, the mortgagor, the party making satisfaction, or the

agent of any of them, that it has been paid or satisfied, and specifically

setting forth the land record reference where the mortgage is recorded.

(3) When the debt secured by a mortgage

or deed of trust is paid fully or satisfied, and the canceled check evidencing

final payment or, if the canceled check is unavailable, a copy of the canceled

check accompanied by a certificate from the institution on which the check

was drawn stating that the copy is a true and genuine image of the original

check is presented, it may be received by the clerk and indexed and recorded

as any other instrument in the nature of a release. The canceled check

or copy accompanied by the certificate has the same effect as a release

of the property for which the mortgage or deed of trust is the security,

as if a release were executed by the mortgagee or named trustees, if:

(i) The party making satisfaction

of the mortgage or deed of trust has:

1. Allowed at least a 60-day waiting

period, from the date the mortgage or deed of trust is paid fully or is

satisfied, for the party satisfied to provide a release suitable for recording;

2. Sent the party satisfied a copy

of this section and a notice that, unless a release is provided within

30 days, the party making satisfaction will obtain a release by utilizing

the provisions of this paragraph; and

3. Following the mailing of the notice

required under sub-subparagraph 2 of this subparagraph, allowed

an additional waiting period of at least 30 days for the party satisfied

to provide a release suitable for recording; and

(ii) The canceled check or copy accompanied

by the certificate contains the name of the party whose debt is being satisfied,

the debt account number, if any, and words indicating that the check is

intended as payment in full of the debt being satisfied; and

(iii) There is attached to the canceled

check or copy accompanied by the certificate an affidavit made by a member

of the Maryland Bar that the mortgage or deed of trust has been satisfied,

that the notice required under subparagraph (i) of this paragraph has been

sent, and specifically setting forth the land record reference where the

original mortgage or deed of trust is recorded.

(4) When the debt secured by a mortgage

or deed of trust is fully paid or satisfied and the holder or the agent

of the holder of the mortgage or deed of trust note or other obligation

secured by the deed of trust, or the trustee or successor trustee under

the deed of trust, executes and acknowledges a certificate of satisfaction

substantially in the form specified under § 4-203(d) of this article,

containing the name of the debtor, holder, the authorized agent of the

holder, or the trustee or successor trustee under the deed of trust, the

date, and the land record recording reference of the instrument to be released,

it may be received by the clerk and indexed and recorded as any other instrument

in the nature of a release. The certificate of satisfaction shall have

the same effect as a release executed by the holder of a mortgage or the

named trustee under a deed of trust.

(5) When the holder of a mortgage

or deed of trust note or other obligation secured by the deed of trust

has agreed to release certain property from the lien of the mortgage or

deed of trust and the holder or the agent of the holder of the mortgage

or deed of trust note or other obligation secured by the deed of trust,

or the trustee or successor trustee under the deed of trust executes and

acknowledges a certificate of partial satisfaction or partial release substantially

in the form specified under § 4-203(e) of this article, containing

the name of the debtor, holder, the authorized agent of the holder, or

the trustee or successor trustee under the deed of trust, the date, the

land record recording reference of the instrument to be partially released,

and a description of the real property being released, it may be received

by the clerk and indexed and recorded as any other instrument in the nature

of a partial release. The certificate of partial satisfaction or partial

release shall have the same effect as a partial release executed by the

holder of a mortgage, the holder of the debt secured by a deed of trust,

or the named trustee under a deed of trust.

(e) A release of a mortgage or deed

of trust may be made on a separate instrument if it states that the mortgagee,

holder of the debt or obligation secured by the deed of trust, trustee,

or assignee releases the mortgage or deed of trust and states the names

of the parties to the mortgage or deed of trust and the date and recording

reference of the mortgage or deed of trust to be released. In addition,

any form of release that satisfies the requirements of a deed and is recorded

as required by this article is sufficient.

(f)

(1) A holder of a debt secured by

a mortgage or deed of trust, or a successor of a holder, may release part

of the collateral securing the mortgage or deed of trust by executing and

acknowledging a partial release on an instrument separate from the mortgage

or deed of trust.

(2) A partial release shall:

(i) Be executed and acknowledged;

(ii) Contain the names of the parties

to the mortgage or deed of trust, the date, and the land record recording

reference of the instrument subject to the partial release; and

(iii) Otherwise satisfy the requirements

of a valid deed.

(3) The clerk of the court shall accept,

index, and record, as a partial release, an nstrument that complies with

and is filed under this section.

(4) Unless otherwise stated in an

instrument recorded among the land records, a trustee under a deed of trust

may execute, acknowledge, and deliver partial releases.

(g) If a full or partial release of

a mortgage or deed of trust is recorded other than at the foot of the recorded

mortgage or deed of trust, the clerk shall place a reference to the book

and page number or other place where the release is recorded on the recorded

mortgage or deed of trust.

(h) Unless otherwise expressly provided

in the release, a full or partial release that is recorded for a mortgage

or deed of trust that is re-recorded, amended, modified, or otherwise altered

or affected by a supplemental instrument and which cites the released mortgage

or deed of trust by reference to only the original recorded mortgage, deed

of trust, or supplemental instrument to the original mortgage or deed of

trust, shall be effective as a full or partial release of the original

mortgage or deed of trust and all supplemental instruments to the original

mortgage or deed of trust.

(i) Unless otherwise expressly provided

in the release, a full or partial release that is recorded for a mortgage

or deed of trust, or for any re-recording, amendment, modification, or

supplemental instrument to the mortgage or deed of trust shall terminate

or partially release any related financial statements, but only to the

extent that the financing statements describe fixtures that are part of

the collateral described in the full or partial release.

§ 7-106 REAL PROP. Provisions for releases; ...

(a) Prohibition against release fee not specified in instrument.

- No trustee of a deed of trust may charge, demand, or receive any money

or any other item of value exceeding $15 for the partial or complete release

of the deed of trust unless the fee is specified in the instrument. Any

person who violates this section is guilty of a misdemeanor and on conviction

is subject to a fine not exceeding $100.

(b) Mailing or delivering evidence of recorded release of

mortgage or deed of trust. - (1) Subject to the provisions of paragraph

(5) of this subsection a person who has undertaken responsibility for the

disbursement of funds in connection with the grant of title to property,

shall mail or deliver to the vendor and purchaser in the transaction, the

original or a photographic, photostatic, or similarly reproduced copy of

the recorded release of any mortgage or deed of trust which the person

was obliged to obtain and record with all or part of the funds to be disbursed.

If the original or copy of a recorded release is not readily obtainable

at the time of recording, the person may mail or deliver to the purchaser

or vendor the original or a copy of the court's recordation receipt for

the release, or any other certified court document clearly evidencing the

recordation of the release.

(2) The required evidence of a recorded release

shall be mailed or delivered to the vendor and purchaser within 30 days

from the delivery of the deed granting title to the property. However,

if the recording of the release is delayed beyond the 30-day period for

causes not attributable to the neglect, omission, or malfeasance of the

person responsible for the disbursement of funds, a letter explaining the

delay shall be mailed or delivered to the vendor and purchaser within the

30-day period, and the person shall mail or deliver to the vendor and purchaser

the required evidence of the recorded release at the earliest opportunity.

The person shall follow the procedure of mailing or delivering a letter

of explanation every 30 days until the required evidence of a recorded

release is mailed or delivered to the purchaser and vendor.

(3) If the person responsible for the disbursement

of funds does not comply with the provisions of paragraphs (1) and (2),

the vendor, purchaser, or a duly organized bar association of the State

may petition a court of equity to order an audit of the accounts maintained

by the person for funds received in connection with closing transactions

in the State. The petition shall state concisely the facts showing noncompliance

and shall be verified. On receipt of the petition, the court shall issue

an order to the person to show cause within ten days why the audit should

not be conducted. If cause is not shown, the court may order the audit

to be conducted. The court may order other relief as it deems appropriate

under the circumstances of the case.

(4) Prior to delivery of the deed granting title

to the property, the person responsible for the disbursement of funds shall

inform the vendor and purchaser in writing of the provisions of this section.

(5) Unless specifically requested to do so by

either the purchaser or the vendor, a person responsible for the disbursement

of funds in a closing transaction is not required to provide the purchaser

or vendor with the required evidence of a recorded release if the person

properly disburses all funds entrusted to him in the course of the closing

transaction within five days from the date of the delivery of any deed

granting title to the property.

(6) The vendor shall bear the cost of reproducing

and mailing a recorded release under this section unless the parties otherwise

agree.

...

(d) Furnishing original copy of executed release. - Any person

who has a lien on real property in this State, or the agent of the lienholder,

on payment in satisfaction of the lien, on written request, shall furnish

to the person responsible for the disbursement of funds in connection with

the grant of title to that property the original copy of the executed release

of that lien. If the lien instrument is a deed of trust the original promissory

note marked "paid" or "cancelled" in accordance with § 3-105 REAL

PROP. (d) (1) of this article constitutes an executed release. If the lien

instrument is a mortgage, the original mortgage marked "paid" or "cancelled"

in accordance with § 3-105 REAL PROP. (d) (2) of this article constitutes

an executed release. This release shall be mailed or otherwise delivered

to the person responsible for the disbursement of funds:

(1) Within seven days of the receipt, by the

holder of the lien, of currency, a certified or cashier's check, or money

order in satisfaction of the debt, including all amounts due under the

lien instruments and under instruments secured by the lien; or

(2) Within seven days after the clearance of

normal commercial channels of any type of commercial paper, other than

those specified in paragraph (1), received by the holder of the lien in

satisfaction of the outstanding debt, including all amounts due under the

lien instruments and under the instruments secured by the lien.

(e) Enforcement. - If the holder of a lien on real property

or his agent fails to provide the release within 30 days, the person

responsible for the disbursement of funds in connection with the grant

of title to the property, after having made demand therefor, may

bring an action to enforce the provisions of this section in the circuit

court for the county in which the property is located. In the action

the lienholder, or his agent, or both, shall be liable for the delivery

of the release and for all costs and expenses in connection with the bringing

of the action,

including reasonable attorney fees.