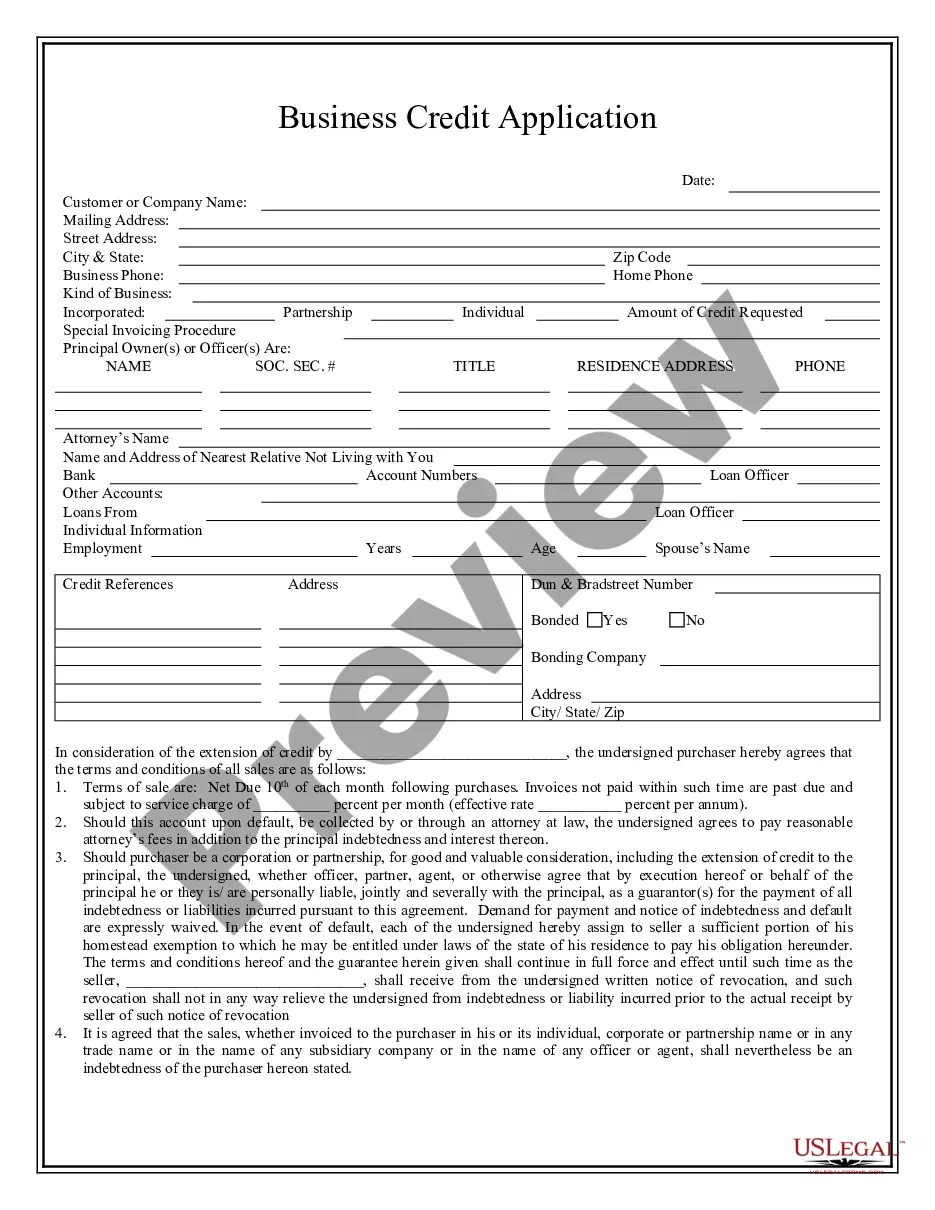

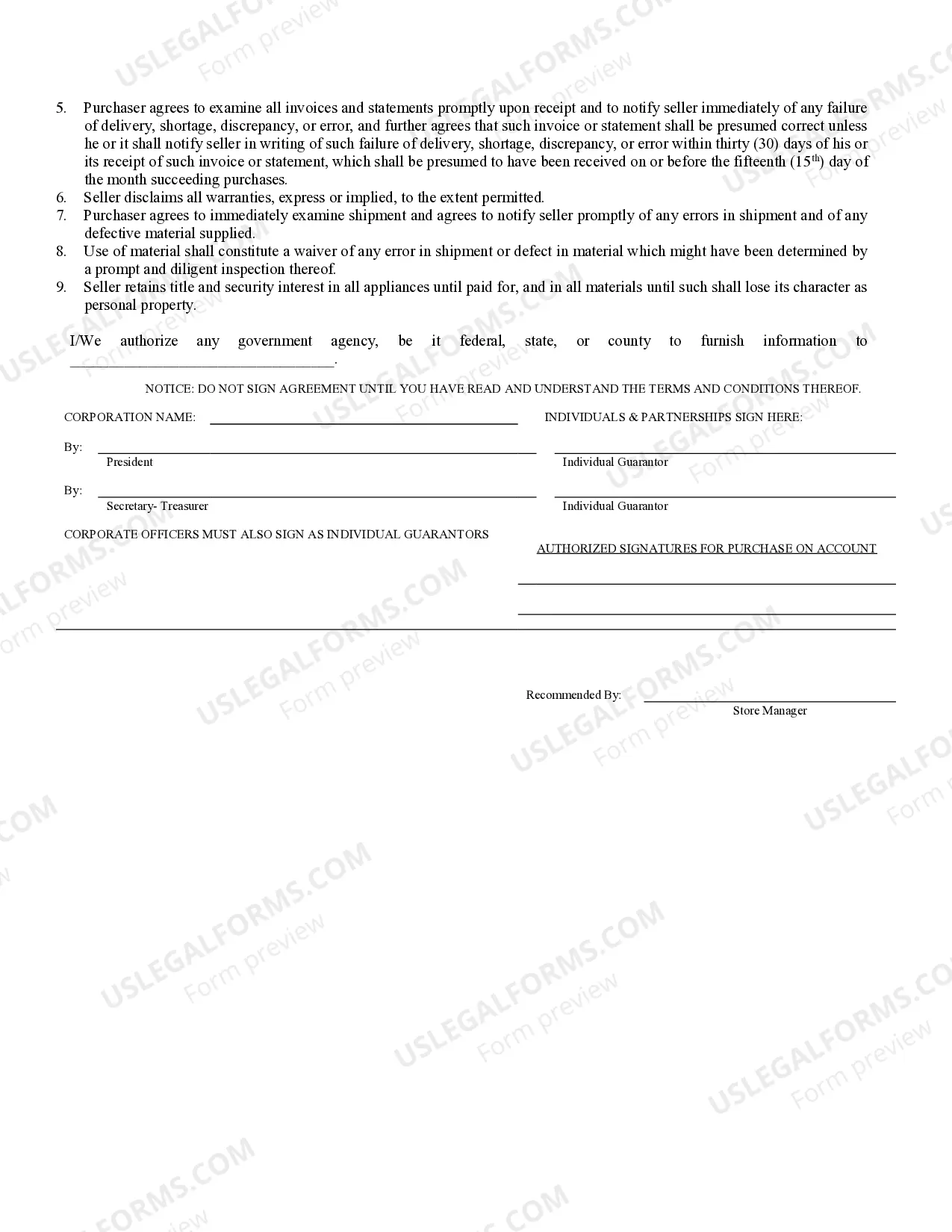

Montgomery Maryland Business Credit Application is a comprehensive tool designed to assist businesses in Montgomery County, Maryland, in securing credit for their operational needs. Whether you are a small startup or an established company, this application provides an opportunity to request credit from financial institutions, suppliers, or lenders. The Montgomery Maryland Business Credit Application gathers essential information about the business, its owners, and key financial details necessary for evaluating creditworthiness. It creates a formal document that serves as a professional representation of the business and aids in building trust with potential creditors or lenders. Key Information Included in the Montgomery Maryland Business Credit Application: 1. Business Details: The application requires details such as the legal name, trade name, business address, phone number, and email address. This information helps identify the business and establish contact. 2. Ownership Information: The application collects information about the business owners, including names, addresses, Social Security numbers, and ownership percentages. This helps determine the liability and accountability of the owners in credit-related matters. 3. Financial Information: Businesses need to disclose crucial financial data, such as annual revenues, net income, expenses, assets, and liabilities. Additionally, they may be required to provide financial statements, including balance sheets, income statements, and cash flow statements, to support their credit application. 4. Business History: This section covers the length of time the business has been operating, previous credit history, and any past bankruptcies or legal issues. This information assists creditors in assessing the business's stability and reliability to meet its financial obligations. 5. Trade References: Businesses are typically asked to provide references from suppliers or vendors with whom they have established credit relationships. These references serve as testimonials on the applicant's payment history and trade credibility. Types of Montgomery Maryland Business Credit Applications: 1. Commercial Credit Application: Designed for businesses seeking credit from suppliers or vendors for purchasing goods and services necessary for their operations. This application focuses on establishing trade credit relationships. 2. Bank Loan Application: Aimed at businesses seeking financing from banks or financial institutions for various purposes, such as business expansion, equipment purchase, or working capital. Bank loan applications require more extensive financial documentation and may involve a more rigorous evaluation process. 3. SBA Loan Application: Specifically for businesses interested in obtaining loans guaranteed by the Small Business Administration (SBA). SBA loans often have favorable terms and conditions, making them a sought-after financing option for small businesses. 4. Credit Card Application: Geared towards businesses applying for credit cards specifically designed for business use. These cards offer perks and rewards tailored to business needs while allowing for flexibility in managing expenses. In summary, the Montgomery Maryland Business Credit Application is a crucial tool for businesses in Montgomery County, Maryland, seeking credit from various sources. Whether it's trade credit, bank loans, SBA loans, or credit cards, a well-prepared and detailed application facilitates the process of securing the necessary financial resources for continued growth and success.

Montgomery Maryland Business Credit Application

Description

How to fill out Montgomery Maryland Business Credit Application?

We always want to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney solutions that, usually, are very costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to an attorney. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Montgomery Maryland Business Credit Application or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Montgomery Maryland Business Credit Application adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Montgomery Maryland Business Credit Application is suitable for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!