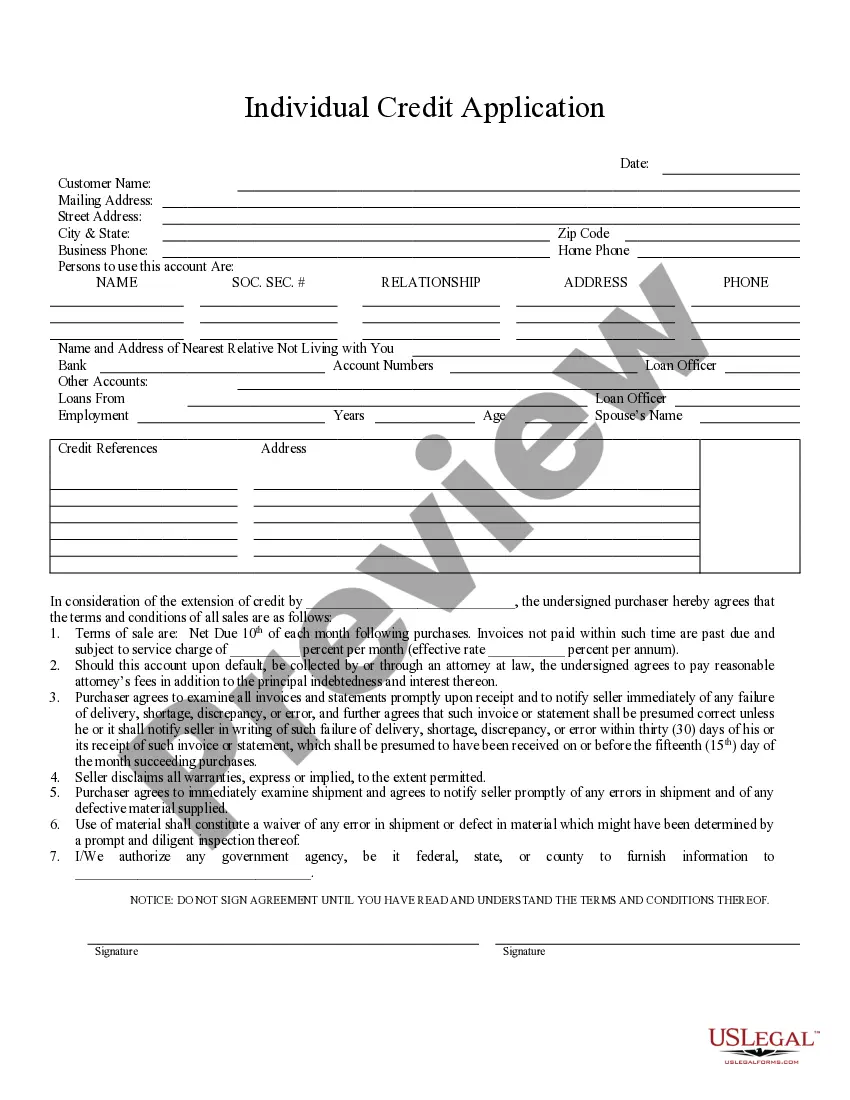

Montgomery Maryland Individual Credit Application is a document that individuals residing in Montgomery County, Maryland, are required to fill out when applying for credit from a financial institution. This application serves as a formal request for credit, allowing the lender to assess the applicant's creditworthiness and determine their eligibility to receive credit. The Montgomery Maryland Individual Credit Application typically asks for personal information, such as the applicant's full name, residential address, social security number, and contact details. It may also inquire about the applicant's employment history, income, and other sources of income, to evaluate their ability to repay the debt. This information helps the lender assess the applicant's financial stability and make an informed decision regarding the credit application. Additionally, the application may require the applicant to provide details about any existing debts or liabilities, including loans, mortgages, or credit card balances. This enables the lender to gauge the applicant's overall debt burden and determine their ability to manage additional credit responsibly. There are different types of Montgomery Maryland Individual Credit Applications based on the type of credit being sought. These may include: 1. Mortgage Credit Application: This type of credit application is used specifically for individuals who are applying for a mortgage loan to purchase or refinance a property in Montgomery County, Maryland. It may include additional questions related to the property being financed. 2. Auto Loan Credit Application: This variant of the individual credit application is designed for individuals seeking to finance the purchase of a vehicle. It may require details about the vehicle being purchased, such as make, model, and year. 3. Personal Loan Credit Application: Individuals who require a personal loan for various purposes, such as debt consolidation, home improvements, or educational expenses, would complete this version of the Montgomery Maryland Individual Credit Application. 4. Credit Card Application: This type of credit application is specific to individuals applying for a credit card from a financial institution. It may include questions to determine the desired credit limit and include clauses specific to credit card agreements. Regardless of the type, the Montgomery Maryland Individual Credit Application serves as a comprehensive tool for lenders to evaluate an individual's creditworthiness and make informed decisions regarding credit approvals. It is essential for applicants to provide accurate and detailed information to increase their chances of securing credit.

Montgomery Maryland Individual Credit Application

Description

How to fill out Montgomery Maryland Individual Credit Application?

Do you need a reliable and affordable legal forms provider to buy the Montgomery Maryland Individual Credit Application? US Legal Forms is your go-to option.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and area.

To download the form, you need to log in account, locate the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Montgomery Maryland Individual Credit Application conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to find out who and what the form is intended for.

- Restart the search in case the form isn’t suitable for your specific situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Montgomery Maryland Individual Credit Application in any provided format. You can get back to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal paperwork online for good.