Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

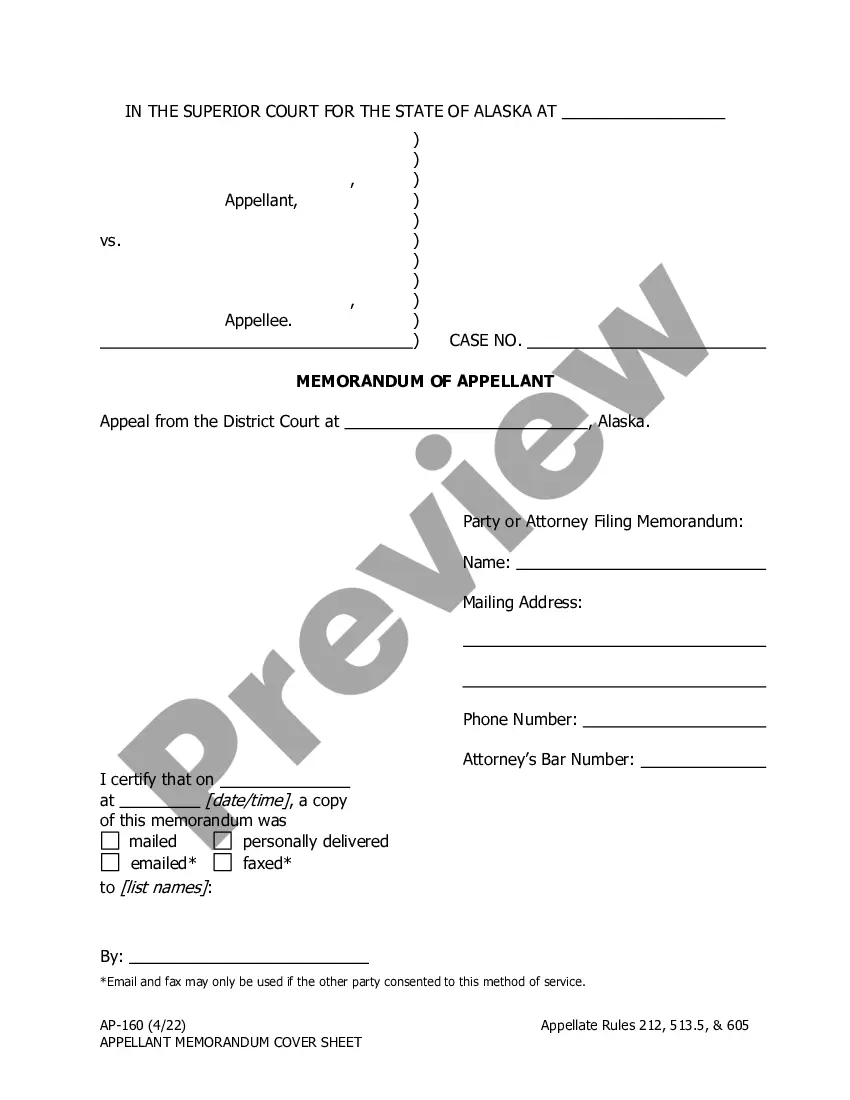

How to fill out Maryland Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

If you are looking for a legitimate form, it’s challenging to select a superior platform than the US Legal Forms site – likely the most extensive online collections.

Here you can obtain a vast array of document samples for professional and personal uses sorted by categories and regions, or key terms.

With the excellent search feature, finding the latest Montgomery Maryland Bill of Sale in Relation to Sale of Business by Individual or Corporate Seller is as simple as 1-2-3.

Complete the financial transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Select the format and download it to your device.

- Furthermore, the validity of each document is validated by a team of professional attorneys who routinely assess the templates on our site and refresh them to comply with the latest state and county regulations.

- If you are already familiar with our platform and have an account, all you need to do to obtain the Montgomery Maryland Bill of Sale in Relation to Sale of Business by Individual or Corporate Seller is to Log In to your user account and click the Download button.

- If this is your first time using US Legal Forms, simply adhere to the instructions outlined below.

- Ensure you have accessed the sample you need. Review its description and utilize the Preview option (if available) to inspect its content. If it doesn’t meet your requirements, use the Search option located at the top of the screen to find the suitable document.

- Confirm your choice. Click the Buy now button. After that, choose the desired subscription plan and provide details to register for an account.

Form popularity

FAQ

Reading a Maryland title involves understanding the key sections such as the title number, vehicle information, and buyer/seller details. Familiarize yourself with where to find information on the vehicle's make, model, and year, as well as identifying signs of a clear title. This knowledge is particularly useful when navigating the requirements associated with the Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

Yes, both parties are generally required to be present to transfer a title in Maryland. This helps ensure that the signing process is transparent, and both the seller and buyer confirm the transaction. Having both individuals present simplifies the process and adheres to the Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

When filling out a Maryland car title, start by entering the vehicle details, including the VIN and make. Then, provide your name and address as the seller and the buyer’s name and address. Finally, sign the title to officially transfer ownership while ensuring it aligns with the Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

Filling out a title in a private car sale involves entering the vehicle's information and providing your details as the seller along with the buyer's information. Document the sale date, sale amount, and both parties' signatures. This process is crucial for creating legitimacy and establishing a clear agreement, related to the Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

To transfer a car title in Maryland, both the buyer and seller must complete the title transfer section on the document. The seller should sign the title, and the buyer will need to provide their details as well. Once that’s done, visit the Maryland Vehicle Administration to finalize the transfer, ensuring compliance with the Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

Yes, Tennessee typically requires a bill of sale, especially for the transfer of vehicles and certain high-value items. Although requirements may vary depending on the item, a well-drafted bill of sale protects both parties. If you're dealing with a Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller and expand your business to TN, it's wise to check local regulations.

A bill of sale is verified through signatures and possibly notarization. This process confirms that both the buyer and seller agree to the terms of sale. For a valid Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, ensure each party signs and dates the document, which adds to its legal legitimacy.

No, a title is not considered a bill of sale. The title signifies ownership of an asset, while a bill of sale records the sale transaction itself. Using a Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller clearly delineates the sale from ownership transfer, providing clarity for all parties involved.

In most cases, you cannot transfer a title without a bill of sale. The bill serves as proof of the transaction, ensuring that the ownership transfer is legally recognized. When executing a Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, including a bill of sale is essential for a smooth transfer process.

A bill of sale and title are not the same, though they are related. A bill of sale serves as a legal document that records the sale of an item, whereas a title proves ownership. When dealing with a Montgomery Maryland Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, the bill documents the sale, and the title indicates ownership transfer.