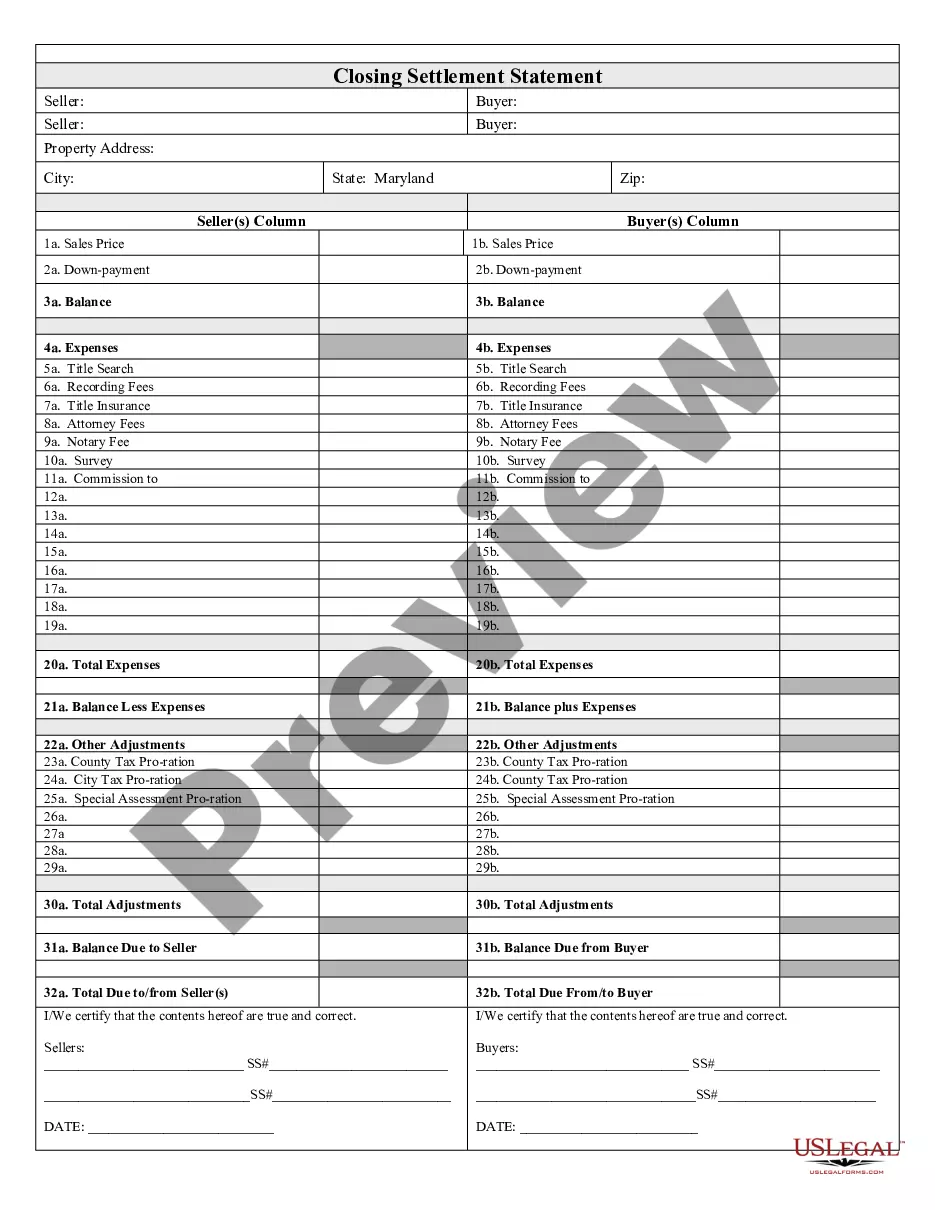

A Montgomery Maryland closing statement, also known as a settlement statement, is a legal document that outlines the final financial transactions and details involved in the sale or purchase of a property in Montgomery County, Maryland. It serves as a comprehensive summary of the financial aspects of the real estate transaction, ensuring that both the buyer and seller fully understand and agree upon the financial obligations and allocations. The Montgomery Maryland closing statement typically includes various sections and details such as the purchase price, closing costs, prorated taxes, loan details, and any additional expenses or credits related to the property transfer. It is prepared by a settlement agent, usually an attorney or a title company, and must be reviewed and signed by all parties involved. The closing statement is crucial as it provides an accurate breakdown of the funds involved in the transaction, ensuring transparency and preventing any misunderstandings or disputes. It serves as a final record of the financial agreement between the buyer and seller, ensuring that all terms are properly documented and accounted for. Different types of Montgomery Maryland closing statements may vary depending on the specific type of real estate transaction. For instance, if the property is financed through a mortgage, a closing statement will include details about the lender, the loan amount, interest rate, and any applicable fees. On the other hand, a cash transaction may have different sections, outlining the total purchase price and any additional costs associated with the sale. Keywords: Montgomery Maryland closing statement, settlement statement, final financial transactions, sale or purchase of a property, Montgomery County, Maryland, comprehensive summary, real estate transaction, buyer and seller, financial obligations, financial aspects, purchase price, closing costs, prorated taxes, loan details, additional expenses, credits, property transfer, settlement agent, attorney, title company, reviewed, signed, funds, transparency, misunderstandings, disputes, record, specific type, real estate transaction, financed, mortgage, interest rate, cash transaction, costs, sale.

A Montgomery Maryland closing statement, also known as a settlement statement, is a legal document that outlines the final financial transactions and details involved in the sale or purchase of a property in Montgomery County, Maryland. It serves as a comprehensive summary of the financial aspects of the real estate transaction, ensuring that both the buyer and seller fully understand and agree upon the financial obligations and allocations. The Montgomery Maryland closing statement typically includes various sections and details such as the purchase price, closing costs, prorated taxes, loan details, and any additional expenses or credits related to the property transfer. It is prepared by a settlement agent, usually an attorney or a title company, and must be reviewed and signed by all parties involved. The closing statement is crucial as it provides an accurate breakdown of the funds involved in the transaction, ensuring transparency and preventing any misunderstandings or disputes. It serves as a final record of the financial agreement between the buyer and seller, ensuring that all terms are properly documented and accounted for. Different types of Montgomery Maryland closing statements may vary depending on the specific type of real estate transaction. For instance, if the property is financed through a mortgage, a closing statement will include details about the lender, the loan amount, interest rate, and any applicable fees. On the other hand, a cash transaction may have different sections, outlining the total purchase price and any additional costs associated with the sale. Keywords: Montgomery Maryland closing statement, settlement statement, final financial transactions, sale or purchase of a property, Montgomery County, Maryland, comprehensive summary, real estate transaction, buyer and seller, financial obligations, financial aspects, purchase price, closing costs, prorated taxes, loan details, additional expenses, credits, property transfer, settlement agent, attorney, title company, reviewed, signed, funds, transparency, misunderstandings, disputes, record, specific type, real estate transaction, financed, mortgage, interest rate, cash transaction, costs, sale.