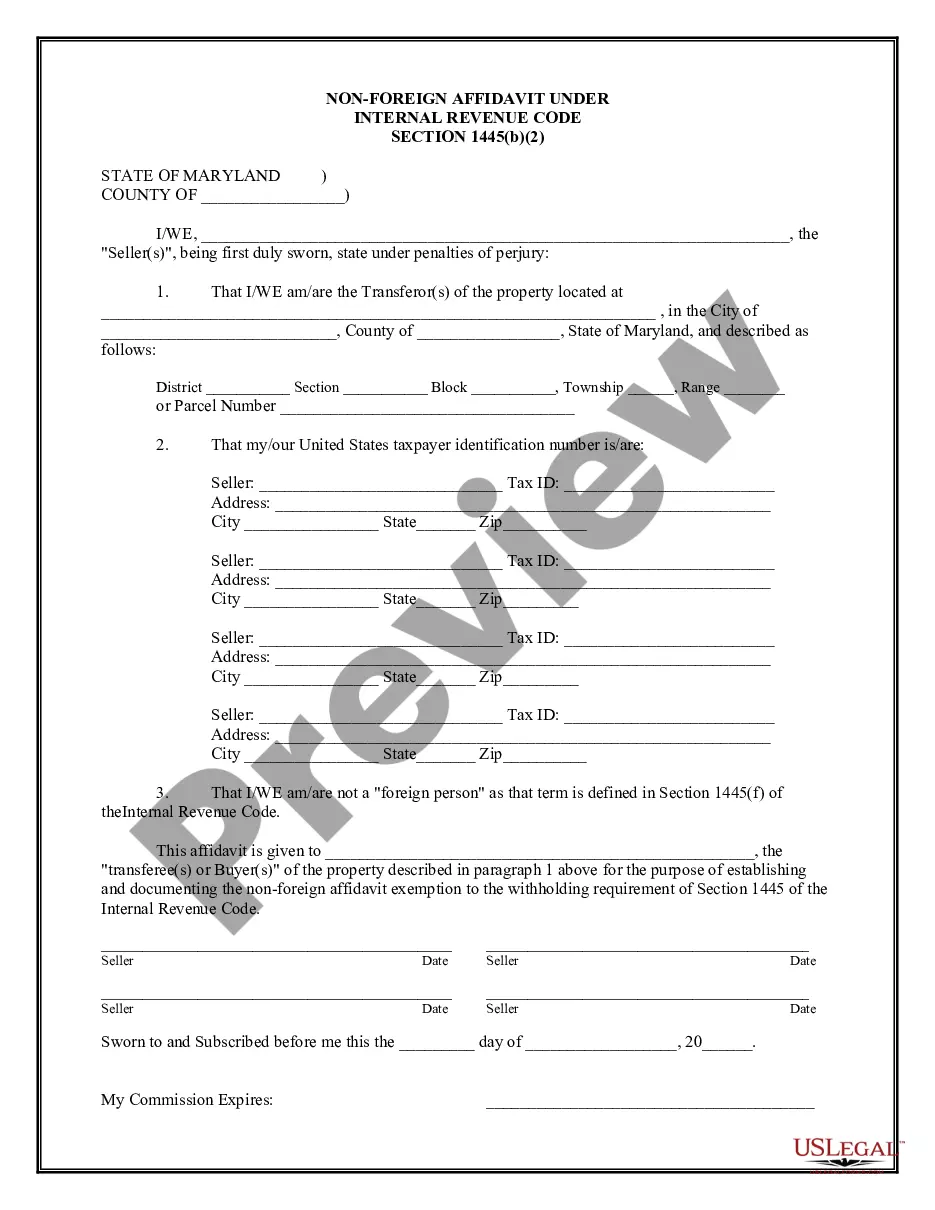

The Montgomery Maryland Non-Foreign Affidavit Under IRC 1445 is an important document that may be required in certain real estate transactions involving non-U.S. individuals or foreign corporations. This affidavit serves to certify that the seller of the property is not a foreign person as defined by the Internal Revenue Code (IRC) Section 1445. The purpose of this provision is to protect the interests of the U.S. government by ensuring that proper withholding taxes are withheld and paid when a non-U.S. person sells U.S. real property. The Montgomery Maryland Non-Foreign Affidavit Under IRC 1445 is a legal declaration made by the seller, stating that they qualify as a non-foreign person for tax purposes. This affidavit is typically submitted to the buyer, settlement agent, or the IRS for verification. It is important to note that there may be different types of Montgomery Maryland Non-Foreign Affidavits Under IRC 1445, based on the specific circumstances of the transaction. These types may include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual, who is a non-U.S. citizen or resident alien, is selling the property. The individual must provide their personal information, including name, address, and taxpayer identification number (TIN), along with supporting documentation such as a copy of their passport or visa. 2. Corporate Non-Foreign Affidavit: In cases where a foreign corporation is the seller, a corporate non-foreign affidavit is required. This affidavit includes information about the corporation, such as its legal name, address, and Employer Identification Number (EIN). The corporation may also need to provide additional supporting documents, such as articles of incorporation or a certificate of good standing. 3. Trust Non-Foreign Affidavit: If the property is held in a trust and being sold by a non-U.S. resident trustee, a trust non-foreign affidavit is necessary. This affidavit confirms that the trustee is not a foreign person and provides information about the trust, such as its name, date of establishment, and tax identification number. It is crucial to accurately complete and submit the Montgomery Maryland Non-Foreign Affidavit Under IRC 1445, as any errors or fraudulent statements may have legal and financial consequences. Seeking guidance from a qualified attorney or tax professional is recommended to ensure proper compliance with the applicable regulations and to avoid any potential penalties or misunderstandings in the transaction.

Montgomery Maryland Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Montgomery Maryland Non-Foreign Affidavit Under IRC 1445?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Montgomery Maryland Non-Foreign Affidavit Under IRC 1445 becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Montgomery Maryland Non-Foreign Affidavit Under IRC 1445 takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Montgomery Maryland Non-Foreign Affidavit Under IRC 1445. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!