Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Maryland Dissolution Package To Dissolve Limited Liability Company LLC?

If you are looking for an appropriate form, it’s tough to locate a more suitable service than the US Legal Forms website – one of the largest collections available online.

Here you can discover numerous form samples for business and personal reasons categorized by types and states, or keywords.

With the advanced search capability, locating the latest Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC is as simple as 1-2-3.

Complete the payment process. Utilize your credit card or PayPal account to finalize the registration procedure.

Acquire the template. Choose the format and save it to your device. Edit. Populate, modify, print, and sign the acquired Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC.

- Furthermore, the accuracy of each document is validated by a team of professional lawyers who consistently review the templates on our site and refresh them in accordance with the latest state and county laws.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC is to Log In to your user profile and click the Download option.

- For first-time users of US Legal Forms, simply adhere to the steps outlined below.

- Ensure you have selected the example you desire. Review its details and utilize the Preview feature to examine its content. If it does not fulfill your requirements, use the Search bar at the top of the page to find the suitable document.

- Confirm your selection. Click the Buy now button. Then, select your preferred payment plan and provide information to create an account.

Form popularity

FAQ

To fix a dissolved LLC, you generally need to file for reinstatement with the appropriate state authority. This process may involve paying any outstanding fees and submitting necessary paperwork. The Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC can provide guidance on the reinstatement requirements and help you navigate each step efficiently. Having a clear plan can significantly ease the reinstatement process.

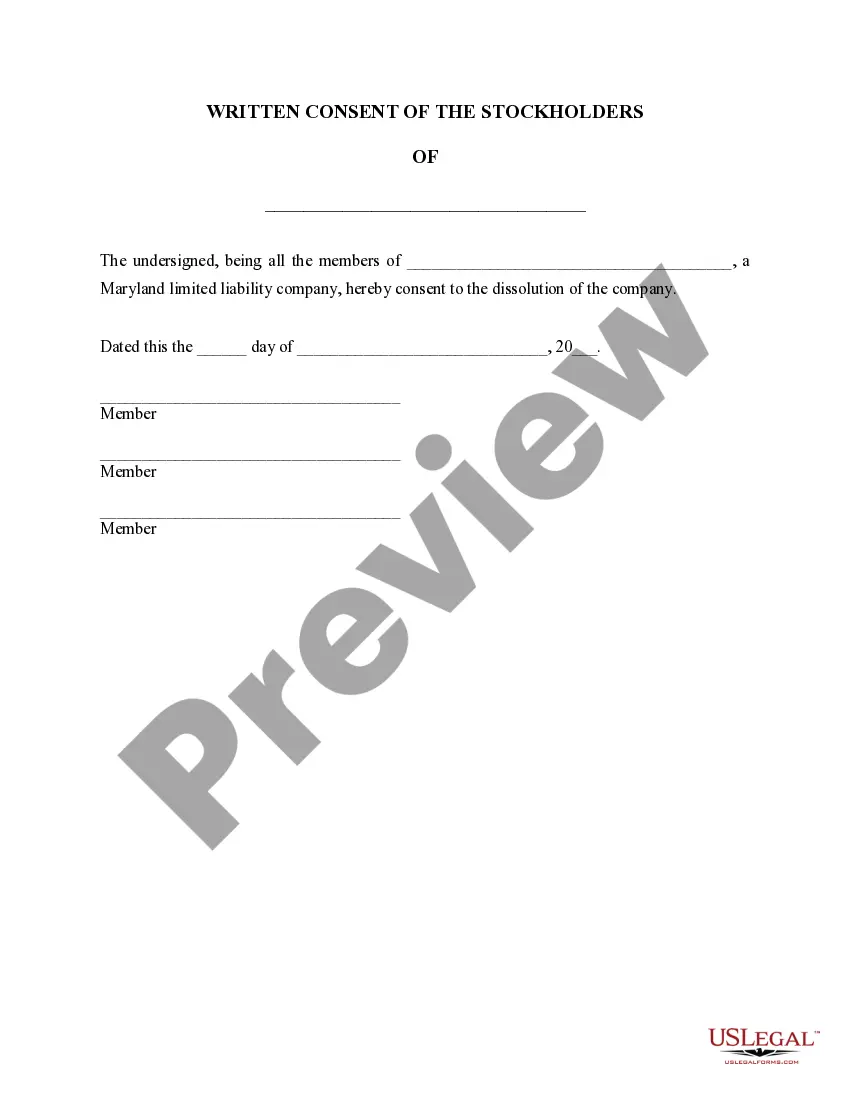

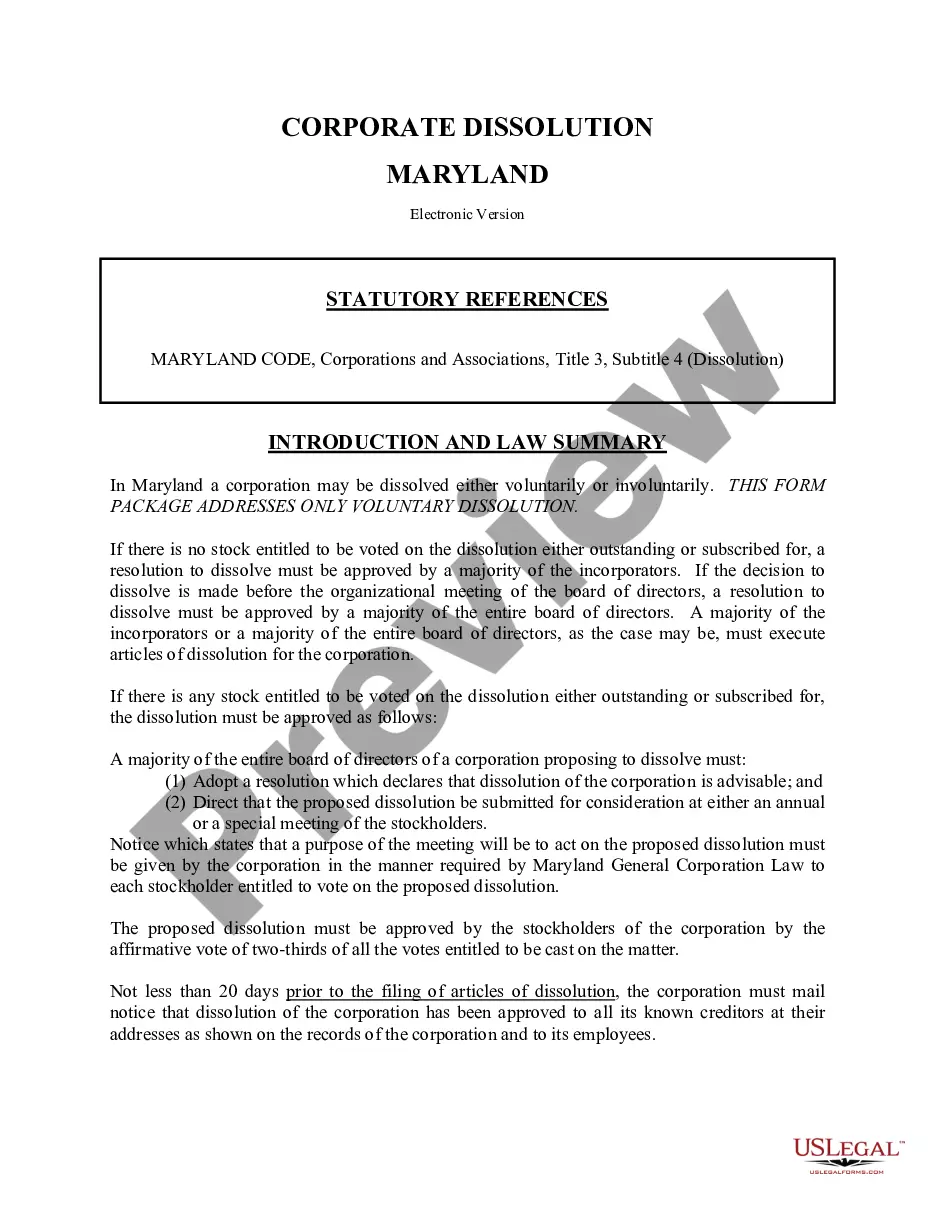

Voluntary dissolution of an LLC occurs when the members decide to close the business intentionally. This process involves filing necessary documents and resolving debts and obligations. Using the Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC can help streamline this process, ensuring all steps are followed properly. It's important to ensure that all members are in agreement when proceeding with voluntary dissolution.

Walking away from an LLC typically requires formal dissolution to avoid future liabilities. This process includes filing the necessary paperwork and ensuring all obligations are met. For an organized approach, consider the Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC, which helps streamline your exit from the business responsibly.

The difficulty of dissolving an LLC varies depending on your situation and experience. While the process requires attention to detail, especially with compliance, it becomes manageable with the right resources. The Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC is designed to help you navigate this process smoothly, ensuring that you do not overlook critical steps.

Dissolving an LLC can be straightforward if you correctly follow the required steps. However, it may involve complex decisions, especially regarding liability and asset distribution. By choosing the Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC, you gain access to a structured approach that eases any challenges in dissolving your business.

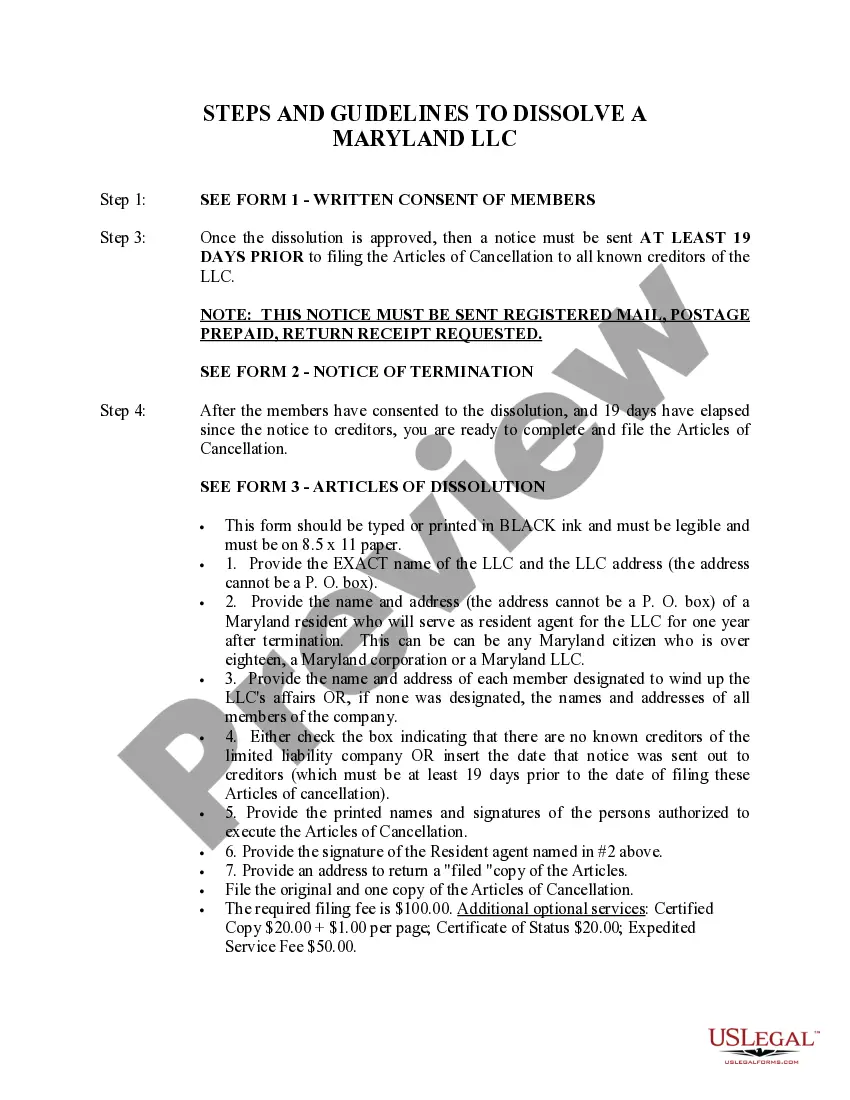

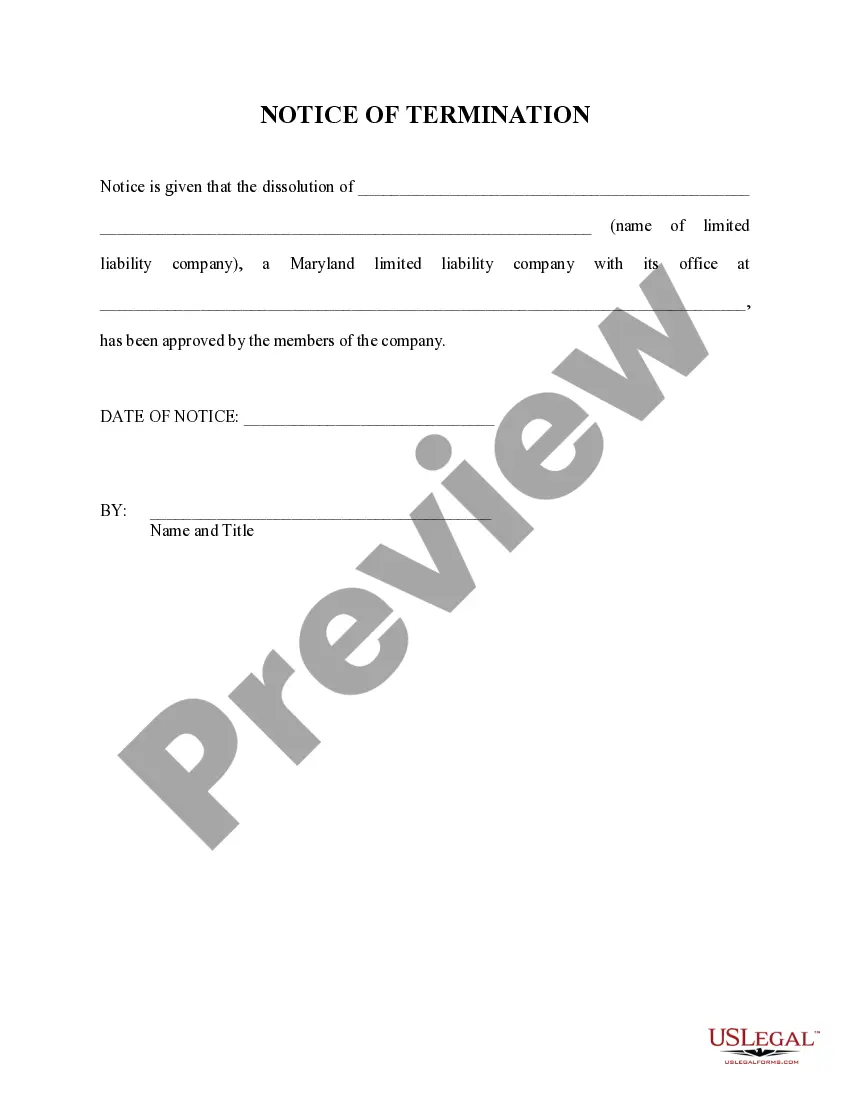

To dissolve your business in Maryland, you must file Articles of Dissolution with the state. This process typically involves completing forms and addressing any outstanding debts. Utilizing the Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC can simplify this process by guiding you through each necessary step.

When you dissolve your LLC, the business formally ceases to exist. This process includes settling debts, distributing any remaining assets, and fulfilling any state obligations. By using the Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC, you can ensure that all legal requirements are met efficiently, preventing any future liabilities.

After dissolving your LLC, you must wind up operations, settle any debts, and distribute any remaining assets to members. It is important to remember that you will no longer be able to conduct business under that name. The Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC provides guidance during this phase, ensuring all necessary steps are completed correctly.

Dissolving an LLC can mean losing certain business protections and benefits. Once dissolved, you cannot legally operate under that LLC name, and you could lose personal liability protection. However, the Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC can help you understand the implications, guiding you through the closure while ensuring compliance.

To dissolve your LLC in Maryland, you typically need to file a formal dissolution document with the Maryland State Department of Assessments and Taxation. The Montgomery Maryland Dissolution Package to Dissolve Limited Liability Company LLC offers a comprehensive solution, making it easy to gather the necessary documents and complete the process without hassle.