The Montgomery Maryland Living Trust for Husband and Wife with No Children is a legal document that allows a married couple without children to protect their assets, control their affairs, and provide for their needs during their lifetime, as well as ensure a smooth transfer of their estate upon death. This type of living trust is designed specifically for couples in Montgomery County, Maryland, and can be tailored to meet their unique circumstances and objectives. In a Montgomery Maryland Living Trust for Husband and Wife with No Children, the couple acts as the granters, creating the trust, and appoints themselves as trustees, maintaining control over their assets. They also designate successor trustees who will manage the trust in the event of their incapacity or death. The primary purpose of this living trust is to avoid probate, ensuring a faster and more private distribution of the couple's assets. By placing their assets into the trust during their lifetime, the couple transfers legal ownership to the trust, but maintains full control and use of those assets. This arrangement not only streamlines the transfer process but also eliminates the need for court supervision, saving time and expenses. Another critical aspect of the Montgomery Maryland Living Trust for Husband and Wife with No Children is its flexibility. The couple can use the trust to provide for their own needs and care during their lifetime. For example, if one spouse becomes incapacitated, the other can manage the trust assets without involving third parties or guardianship proceedings. They can also outline specific instructions for the management and distribution of their assets in the event of their death. Additionally, this living trust can incorporate various estate planning tools, such as a pour-over will, which ensures any assets unintentionally left outside the trust are transferred to it upon death. Advanced healthcare directives and durable powers of attorney can also be included to address medical decisions and financial matters when one or both spouses become unable to handle them. While there may not be different types of Montgomery Maryland Living Trusts for Husband and Wife with No Children, variations can occur based on the specific goals and needs of each couple. Some may prioritizes charitable giving, while others may focus on tax planning strategies. Working with an experienced estate planning attorney in Montgomery County, Maryland, is crucial to tailoring the trust to the couple's unique circumstances and goals. In conclusion, the Montgomery Maryland Living Trust for Husband and Wife with No Children offers married couples without children the opportunity to protect their assets, control their affairs, and ensure a smooth transition of their estate. By avoiding probate and providing flexibility, this living trust enables couples to achieve their estate planning objectives and secure their financial future.

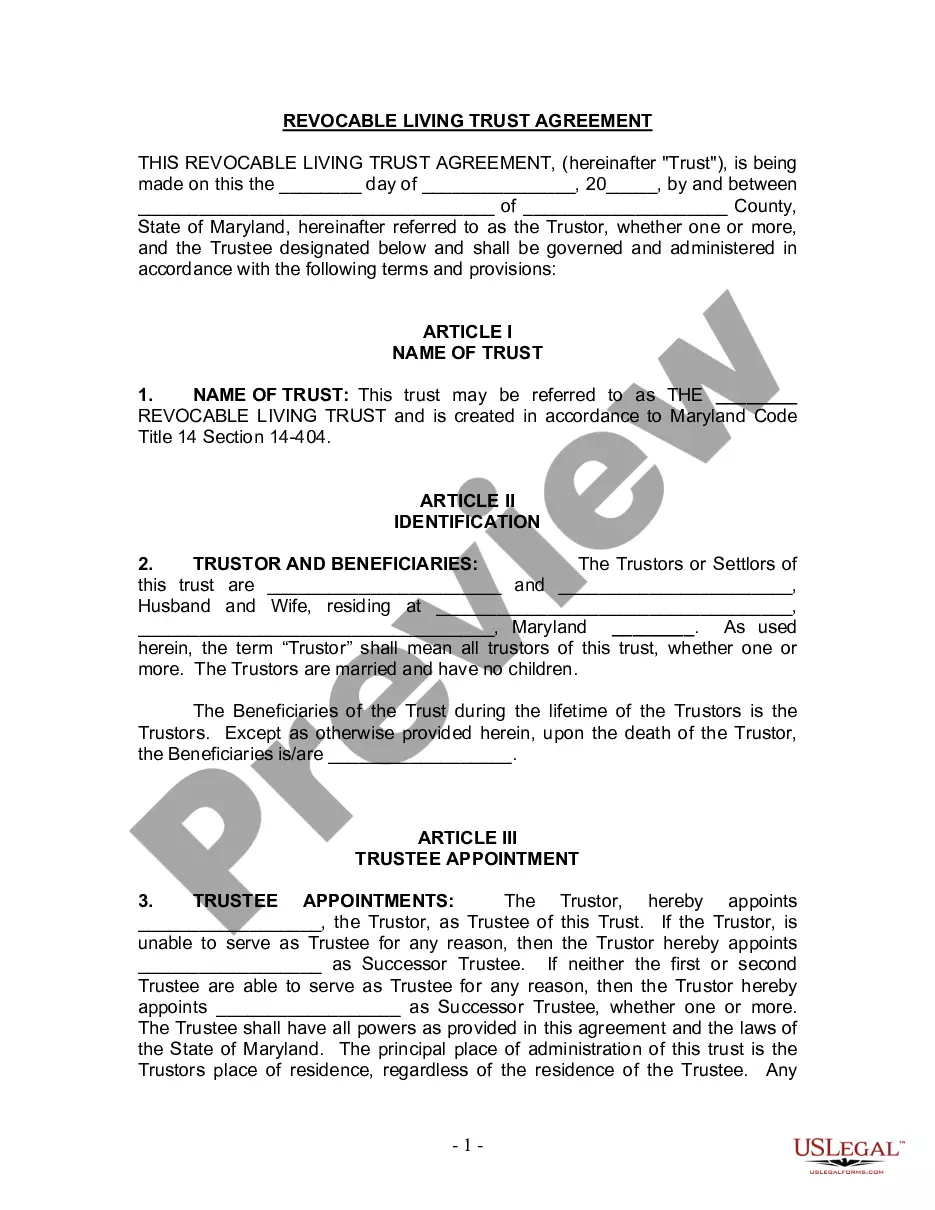

Montgomery Maryland Living Trust for Husband and Wife with No Children

Description

How to fill out Montgomery Maryland Living Trust For Husband And Wife With No Children?

Do you need a reliable and inexpensive legal forms supplier to buy the Montgomery Maryland Living Trust for Husband and Wife with No Children? US Legal Forms is your go-to option.

Whether you require a basic arrangement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of particular state and county.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Montgomery Maryland Living Trust for Husband and Wife with No Children conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to find out who and what the form is good for.

- Start the search over in case the template isn’t suitable for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Montgomery Maryland Living Trust for Husband and Wife with No Children in any provided file format. You can get back to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting hours learning about legal paperwork online for good.