The Montgomery Maryland Amendment to Living Trust is a legal document used to modify or update certain aspects of an existing living trust in Montgomery County, Maryland. This amendment is a crucial tool for individuals who wish to make changes to their trust without having to create an entirely new one. There are several types of Montgomery Maryland Amendments to Living Trust, catering to various situations and intentions. These include: 1. Beneficiary Amendment: This type of amendment allows the trust creator, also known as the granter, to add or remove beneficiaries from the living trust. It provides flexibility in adjusting who will receive assets or property upon the granter's passing. 2. Asset Amendment: Sometimes, the granter may want to alter the assets included in the trust. With an Asset Amendment, they can modify or revise the list of properties, investments, or any other assets assigned to the trust. This helps ensure that the trust accurately reflects the granter's current assets and intentions. 3. Successor Trustee Amendment: A Successor Trustee Amendment allows the granter to make changes to the individuals or entities designated to manage and distribute the trust's assets after their death or incapacitation. This amendment is particularly useful if the granter wishes to replace the current successor trustee with a new one. 4. Administrative Amendment: An Administrative Amendment is used when alterations need to be made to administrative or operational aspects of the trust. This can include changing the name of the trust, updating contact information, or modifying any specific provisions related to how the trust is managed. 5. Revocation Amendment: In some cases, the granter may decide to revoke the entire living trust. A Revocation Amendment is used to nullify the existing trust and all its provisions. This type of amendment is often chosen when the granter wants to create a new living trust or execute different estate planning strategies. The Montgomery Maryland Amendment to Living Trust provides individuals with the flexibility and control to make changes to the trust to align with their evolving financial and personal situations. It is always advisable to consult with an experienced estate planning attorney to ensure that the amendment is executed correctly and in compliance with Maryland laws. Keywords: Montgomery Maryland, Amendment to Living Trust, living trust, granter, beneficiaries, assets, successor trustee, administrative, revocation, estate planning, Montgomery County.

Montgomery Maryland Amendment to Living Trust

Description

How to fill out Montgomery Maryland Amendment To Living Trust?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone with no legal education to create this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes in handy. Our platform provides a huge library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you need the Montgomery Maryland Amendment to Living Trust or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Montgomery Maryland Amendment to Living Trust quickly employing our trusted platform. In case you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Montgomery Maryland Amendment to Living Trust:

- Ensure the form you have chosen is suitable for your area considering that the regulations of one state or area do not work for another state or area.

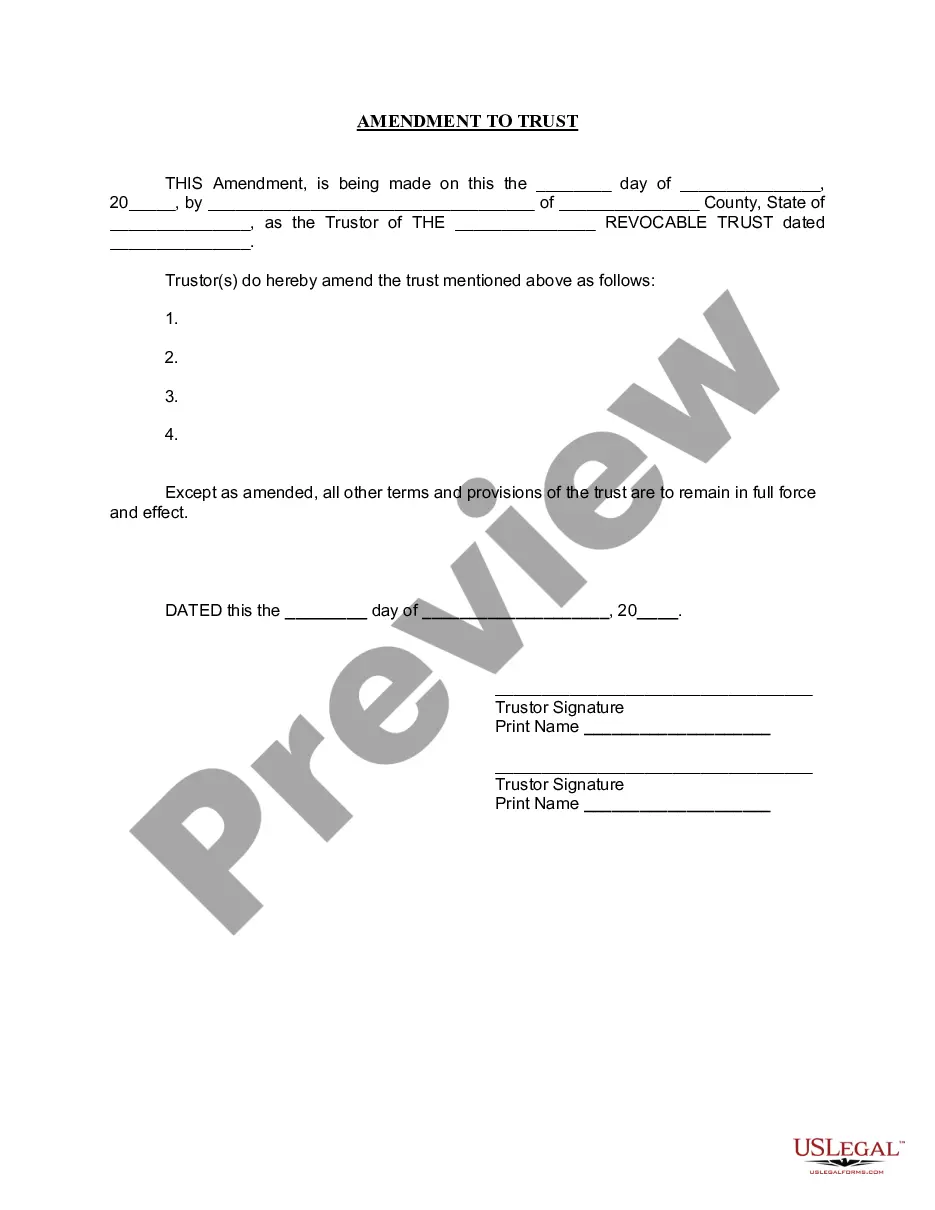

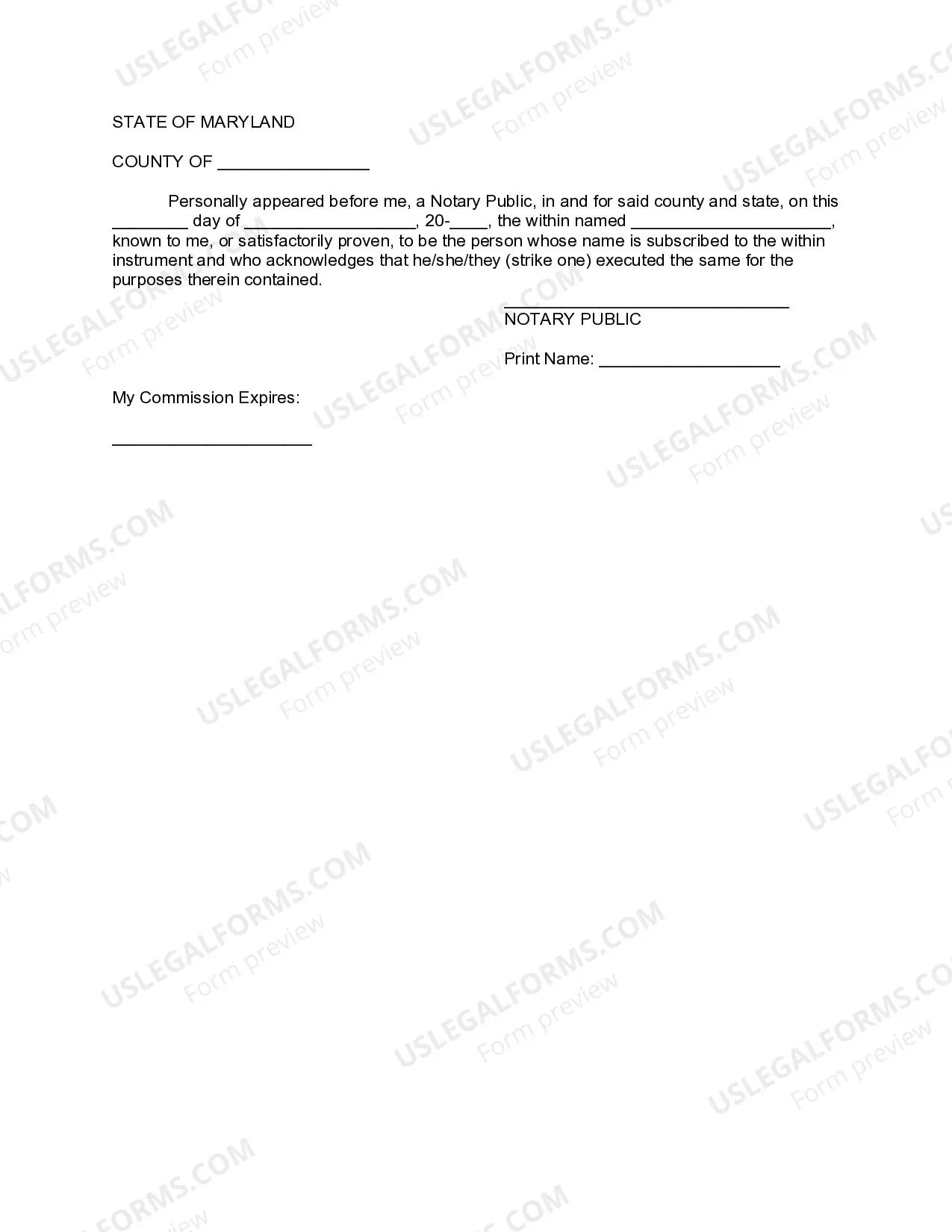

- Preview the document and read a brief description (if provided) of cases the paper can be used for.

- If the one you chosen doesn’t meet your requirements, you can start again and look for the needed form.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Montgomery Maryland Amendment to Living Trust once the payment is through.

You’re good to go! Now you can proceed to print the document or complete it online. If you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.