Montgomery Maryland Financial Account Transfer to Living Trust In Montgomery, Maryland, residents have the opportunity to transfer their financial accounts to a living trust. This legal process allows individuals to protect their assets and ensure a smoother transfer of funds to their intended beneficiaries after their passing. A living trust, commonly referred to as a revocable trust, is a document that provides instructions on how a person's assets and financial accounts should be managed during their lifetime and distributed after their death. Montgomery's residents have various types of financial account transfers available when creating a living trust. 1. Montgomery Maryland Bank Account Transfer to Living Trust: This type of financial account transfer includes checking accounts, savings accounts, certificates of deposit, and money market accounts. By transferring these accounts into a living trust, individuals ensure that the funds are managed according to their wishes without the need for probate court involvement. 2. Montgomery Maryland Investment Account Transfer to Living Trust: Many residents in Montgomery have investment accounts such as stocks, bonds, mutual funds, and real estate investments. By transferring these accounts to a living trust, individuals can maintain control over their investment decisions during their lifetime and have a clear plan for their distribution upon their death. 3. Montgomery Maryland Retirement Account Transfer to Living Trust: Retirement accounts, including 401(k)s, IRAs, and pensions, can also be transferred into a living trust. This transfer allows individuals to designate specific beneficiaries and outline their desired distribution plan to ensure their retirement funds are passed on efficiently. 4. Montgomery Maryland Estate Account Transfer to Living Trust: Individuals with substantial estates or inheritances can transfer these assets into a living trust to avoid the lengthy and costly probate process. This includes properties, vehicles, valuable possessions, and business assets. When engaging in a Montgomery Maryland Financial Account Transfer to Living Trust, it is essential to consult with a qualified attorney who specializes in estate planning and trust administration. They will guide individuals through the process, ensuring that all necessary legal documents are prepared accurately and according to Maryland state laws. The benefits of a living trust go beyond the efficient transfer of assets. It also provides privacy, as living trusts are kept confidential and not made public like a will filed in probate court. Moreover, a living trust can provide incapacity planning, ensuring that a designated trustee can manage an individual's financial accounts if they become unable to do so themselves. In conclusion, a Montgomery Maryland Financial Account Transfer to Living Trust offers residents a comprehensive and efficient way to protect their assets, manage their financial accounts, and ensure a smooth transfer of funds to their beneficiaries after their passing.

Montgomery Maryland Financial Account Transfer to Living Trust

Description

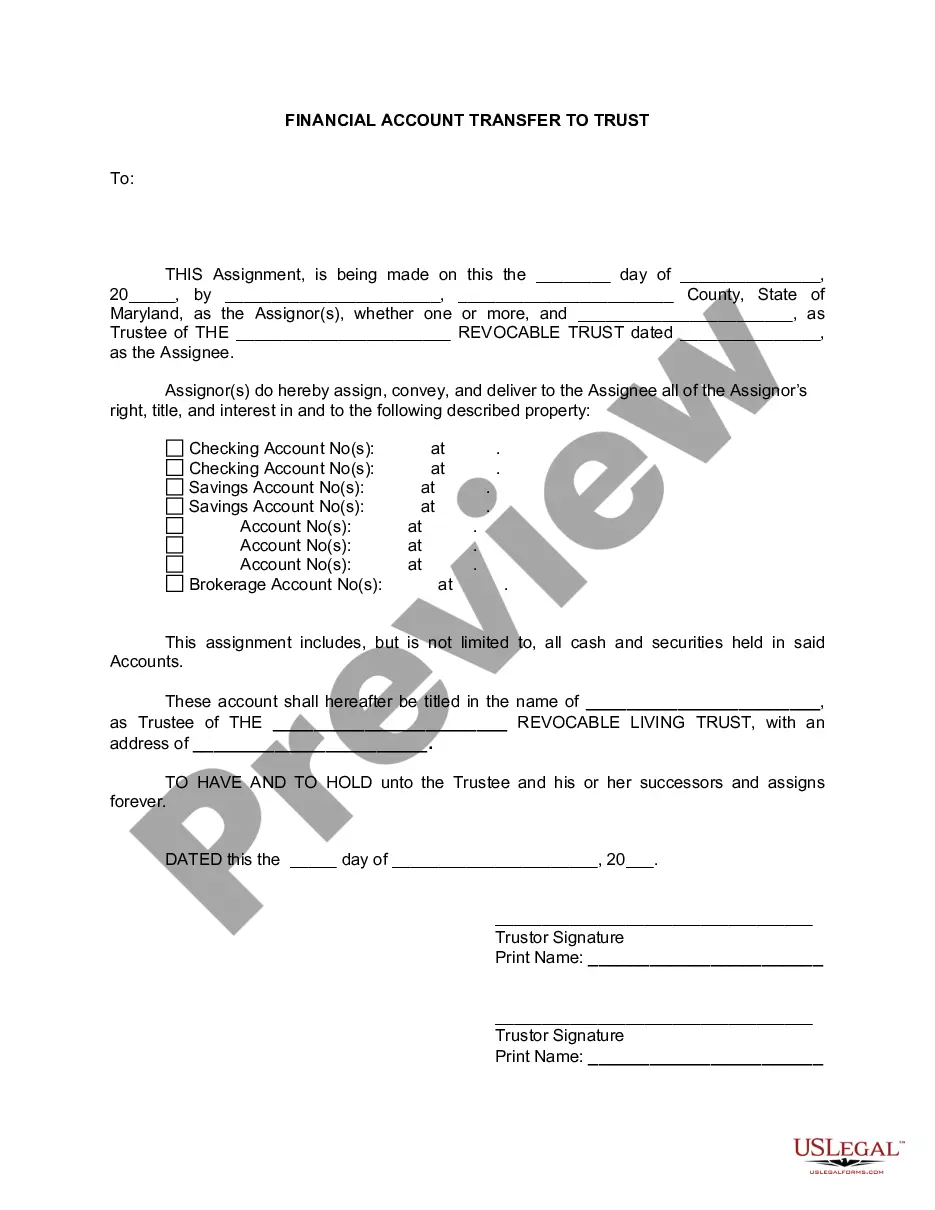

How to fill out Montgomery Maryland Financial Account Transfer To Living Trust?

Benefit from the US Legal Forms and have instant access to any form template you need. Our useful website with a huge number of document templates allows you to find and get virtually any document sample you will need. You can export, complete, and sign the Montgomery Maryland Financial Account Transfer to Living Trust in a couple of minutes instead of surfing the Net for several hours attempting to find a proper template.

Utilizing our library is a superb strategy to raise the safety of your document submissions. Our experienced legal professionals on a regular basis check all the documents to make certain that the forms are appropriate for a particular region and compliant with new laws and regulations.

How do you get the Montgomery Maryland Financial Account Transfer to Living Trust? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Additionally, you can get all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instruction below:

- Open the page with the template you require. Make certain that it is the template you were seeking: check its name and description, and make use of the Preview feature if it is available. Otherwise, utilize the Search field to find the needed one.

- Start the saving process. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order with a credit card or PayPal.

- Export the file. Indicate the format to get the Montgomery Maryland Financial Account Transfer to Living Trust and edit and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and trustworthy template libraries on the internet. Our company is always happy to help you in any legal procedure, even if it is just downloading the Montgomery Maryland Financial Account Transfer to Living Trust.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!