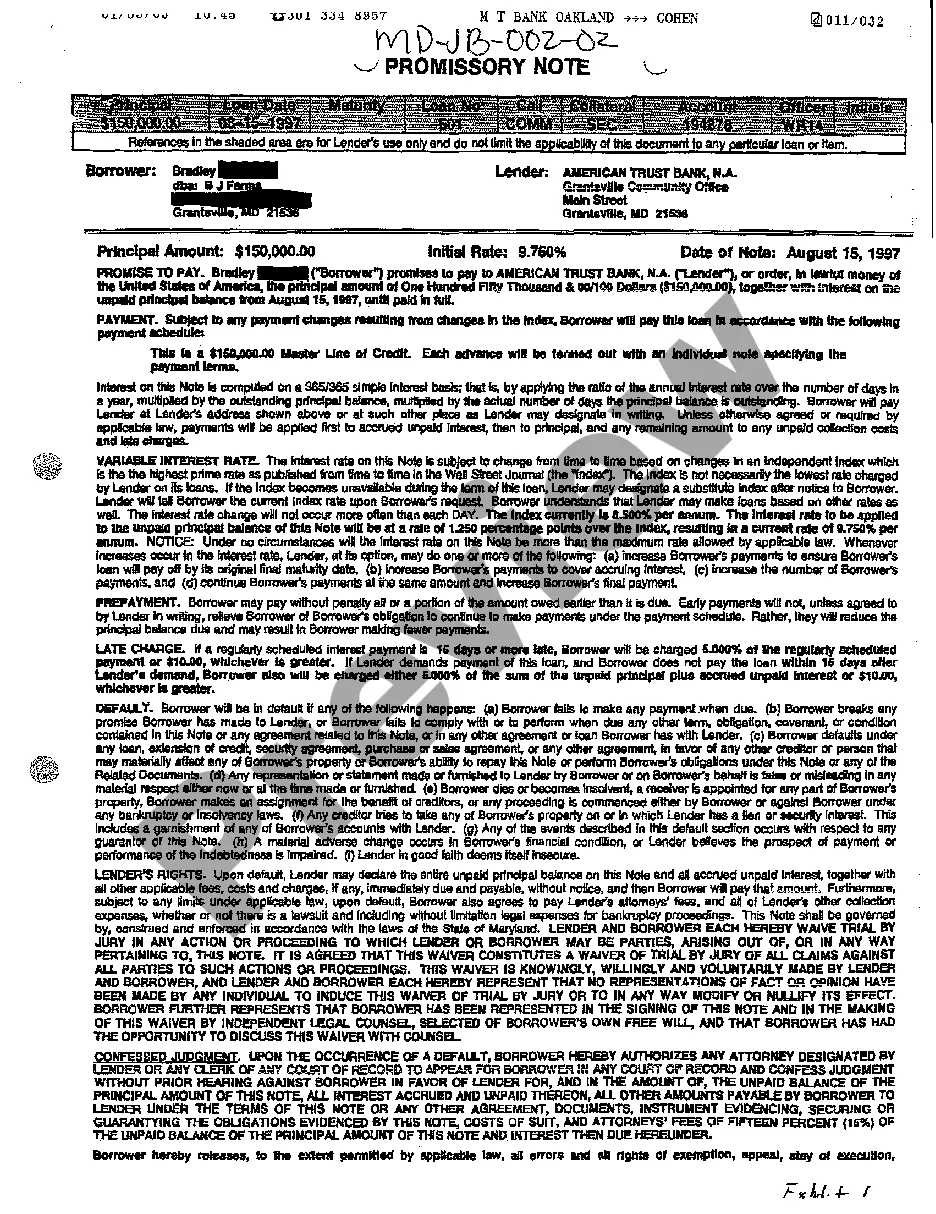

Montgomery, Maryland Exhibit 1 Promissory Note is a legal document that outlines the terms and conditions of a financial agreement between two parties. It serves as evidence of a loan or debt between a borrower and a lender. This note provides specific details regarding the loan amount, repayment terms, interest rate, and any additional terms agreed upon by the involved parties. The Montgomery, Maryland Exhibit 1 Promissory Note is often used for various purposes such as personal loans, business loans, real estate transactions, or even financing for investments. It is an essential document in ensuring that the lender is legally protected and that the borrower understands their obligations. The different types of Montgomery, Maryland Exhibit 1 Promissory Notes may include: 1. Personal Loan Promissory Note: This type of promissory note is used for loans between individuals, friends, or family members. It outlines the loan amount, repayment schedule, interest rate (if applicable), and any collateral involved. 2. Business Loan Promissory Note: This note is utilized in business transactions, where a company borrows money from a lender. It lays out the loan amount, repayment terms, interest rate, and any necessary provisions regarding collateral or guarantees. 3. Real Estate Promissory Note: This note is commonly used in real estate transactions. It details the loan amount provided by a lender for purchasing a property, the repayment plan, interest rate, and any specific conditions related to the property. 4. Student Loan Promissory Note: This type of promissory note is utilized when a student receives a loan to finance their education. It includes the loan amount, repayment terms, interest rate, and any deferment or forgiveness options available. 5. Convertible Promissory Note: This note is unique as it includes an option for the lender to convert the debt into equity under specific circumstances, usually related to investments in startups or early-stage companies. 6. Demand Promissory Note: This type of promissory note allows the lender to request repayment of the loan in full at any time, without adhering to a fixed repayment schedule. It is crucial for all parties involved to carefully review and understand the terms outlined in the Montgomery, Maryland Exhibit 1 Promissory Note to avoid any potential issues or disputes in the future. Consulting with a legal professional experienced in contract law is advisable to ensure all aspects of the note are legally binding and enforceable.

Montgomery Maryland Exhibit 1 Promissory Note

Description

How to fill out Montgomery Maryland Exhibit 1 Promissory Note?

Take advantage of the US Legal Forms and obtain instant access to any form sample you want. Our helpful platform with a huge number of templates allows you to find and obtain virtually any document sample you need. You are able to download, fill, and sign the Montgomery Maryland Exhibit 1 Promissory Note in a couple of minutes instead of browsing the web for several hours attempting to find the right template.

Utilizing our library is a great strategy to increase the safety of your form filing. Our professional legal professionals regularly check all the records to make sure that the templates are appropriate for a particular state and compliant with new laws and regulations.

How can you get the Montgomery Maryland Exhibit 1 Promissory Note? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Additionally, you can find all the previously saved files in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Open the page with the template you need. Ensure that it is the template you were seeking: examine its headline and description, and take take advantage of the Preview feature when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order using a credit card or PayPal.

- Download the document. Indicate the format to obtain the Montgomery Maryland Exhibit 1 Promissory Note and revise and fill, or sign it for your needs.

US Legal Forms is one of the most extensive and reliable template libraries on the web. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Montgomery Maryland Exhibit 1 Promissory Note.

Feel free to make the most of our platform and make your document experience as efficient as possible!