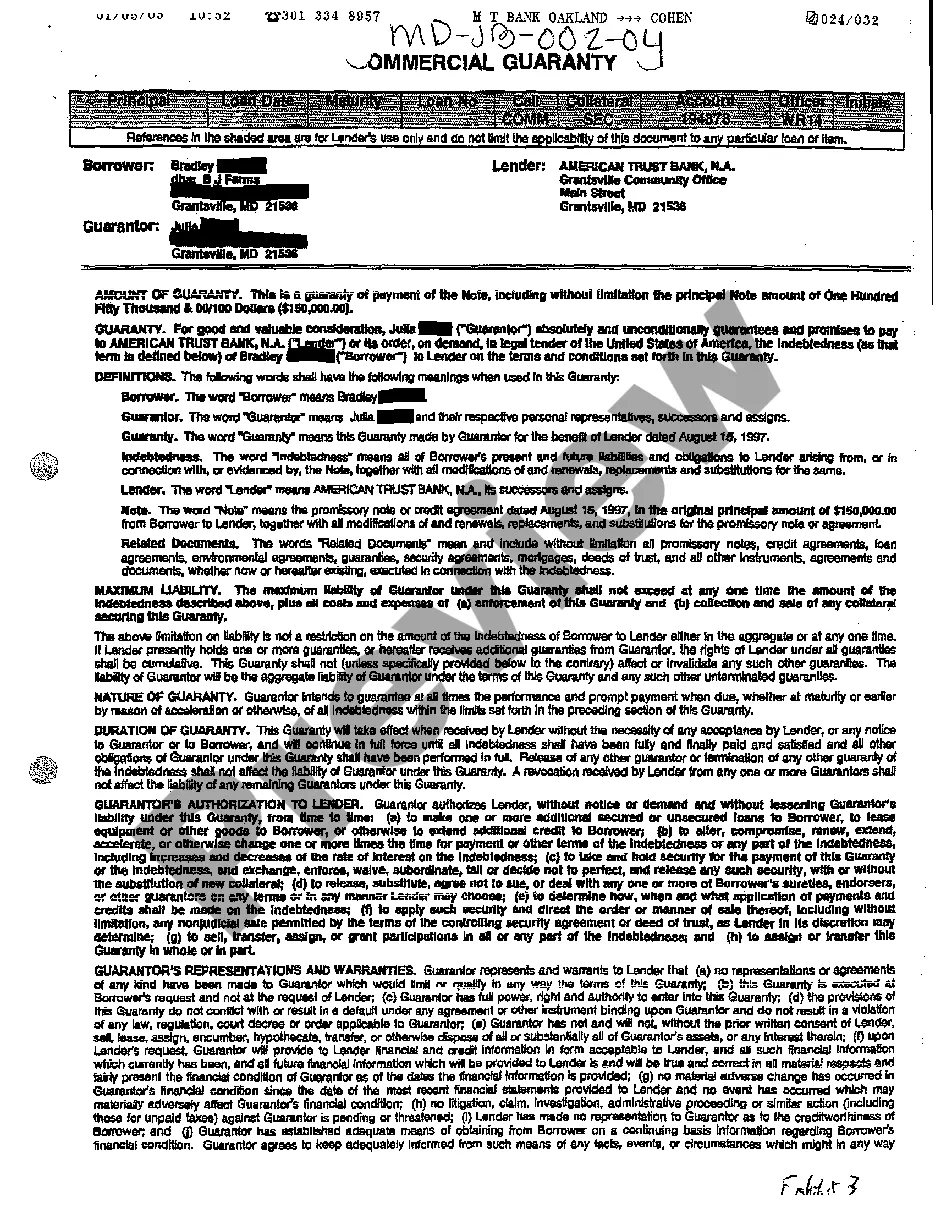

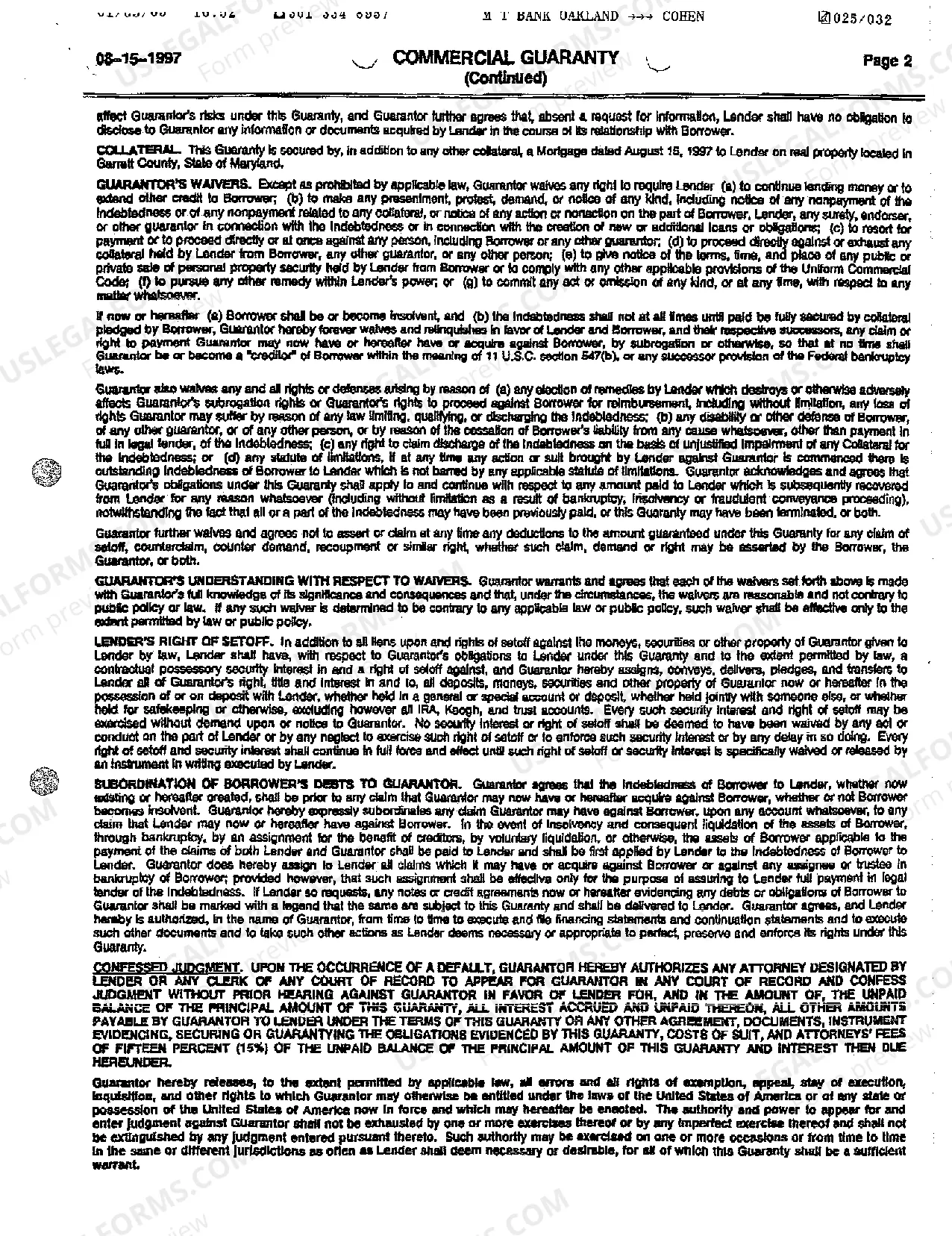

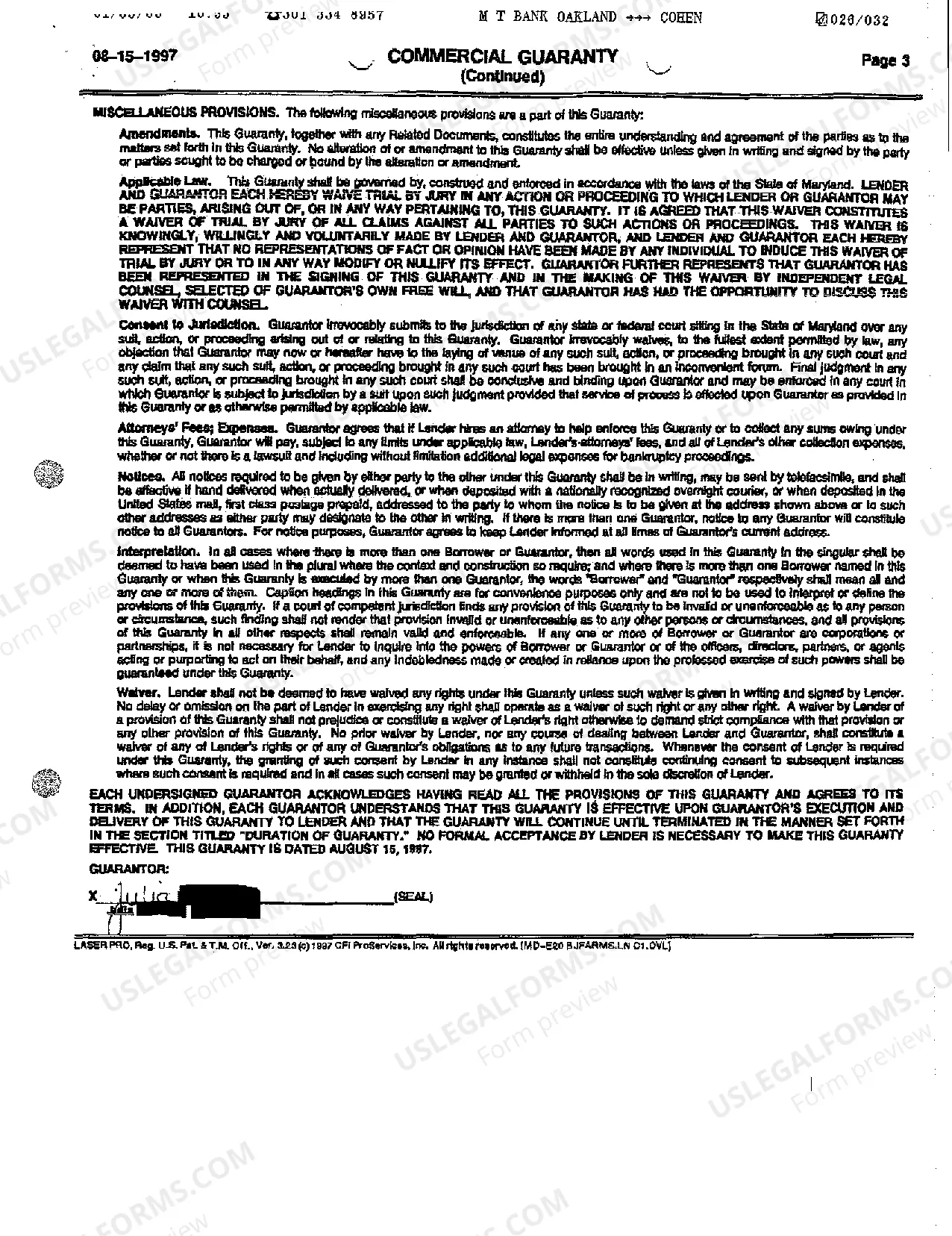

Montgomery Maryland Exhibit 3 Commercial Guaranty is a legally binding document used in commercial transactions to provide an additional layer of security for a loan or lease agreement. This guaranty assures the lender or lessor that if the borrower or lessee fails to fulfill their financial obligations, the guarantor will step in and fulfill those obligations instead. The purpose of the Montgomery Maryland Exhibit 3 Commercial Guaranty is to mitigate the lender's risk and increase the likelihood of loan repayment or lease compliance. It typically outlines the terms and conditions under which the guarantor becomes responsible, ensuring that the guarantor's obligations are clearly defined. There can be variations of Montgomery Maryland Exhibit 3 Commercial Guaranty, depending on the specific circumstances and requirements of the parties involved. Some common types include: 1. Limited Guarantee: This type of guaranty places certain limits or restrictions on the guarantor's liability. It may specify a maximum amount or a specific time frame within which the guarantor will be responsible for the borrower's or lessee's obligations. 2. Continuing Guaranty: This guaranty remains in effect until a specific event or condition occurs, such as the repayment of the loan or the termination of the lease agreement. It ensures ongoing protection for the lender or lessor throughout the duration of the commercial transaction. 3. Absolute Guaranty: In this type of guaranty, the guarantor assumes full responsibility for the borrower's or lessee's obligations without any limitations or conditions. The guarantor is obligated to fulfill the financial obligations regardless of the circumstances or default by the borrower or lessee. 4. Conditional Guaranty: This guaranty is contingent upon certain conditions being met. It may require the guarantor to guarantee repayment only if specific events or triggers occur, such as the borrower's or lessee's bankruptcy, insolvency, or default. The Montgomery Maryland Exhibit 3 Commercial Guaranty is a vital legal instrument in commercial transactions, protecting lenders and lessors from potential financial losses. It helps ensure that borrowers or lessees fulfill their obligations and provides a safety net to promote confidence and trust among parties involved in the transaction. It is important for all parties to carefully review and understand the terms and conditions outlined in the guaranty before signing.

Montgomery Maryland Exhibit 3 Commercial Guaranty

State:

Maryland

County:

Montgomery

Control #:

MD-JB-002-04

Format:

PDF

Instant download

This form is available by subscription

Description

A05 Exhibit 3 Commercial Guaranty

Montgomery Maryland Exhibit 3 Commercial Guaranty is a legally binding document used in commercial transactions to provide an additional layer of security for a loan or lease agreement. This guaranty assures the lender or lessor that if the borrower or lessee fails to fulfill their financial obligations, the guarantor will step in and fulfill those obligations instead. The purpose of the Montgomery Maryland Exhibit 3 Commercial Guaranty is to mitigate the lender's risk and increase the likelihood of loan repayment or lease compliance. It typically outlines the terms and conditions under which the guarantor becomes responsible, ensuring that the guarantor's obligations are clearly defined. There can be variations of Montgomery Maryland Exhibit 3 Commercial Guaranty, depending on the specific circumstances and requirements of the parties involved. Some common types include: 1. Limited Guarantee: This type of guaranty places certain limits or restrictions on the guarantor's liability. It may specify a maximum amount or a specific time frame within which the guarantor will be responsible for the borrower's or lessee's obligations. 2. Continuing Guaranty: This guaranty remains in effect until a specific event or condition occurs, such as the repayment of the loan or the termination of the lease agreement. It ensures ongoing protection for the lender or lessor throughout the duration of the commercial transaction. 3. Absolute Guaranty: In this type of guaranty, the guarantor assumes full responsibility for the borrower's or lessee's obligations without any limitations or conditions. The guarantor is obligated to fulfill the financial obligations regardless of the circumstances or default by the borrower or lessee. 4. Conditional Guaranty: This guaranty is contingent upon certain conditions being met. It may require the guarantor to guarantee repayment only if specific events or triggers occur, such as the borrower's or lessee's bankruptcy, insolvency, or default. The Montgomery Maryland Exhibit 3 Commercial Guaranty is a vital legal instrument in commercial transactions, protecting lenders and lessors from potential financial losses. It helps ensure that borrowers or lessees fulfill their obligations and provides a safety net to promote confidence and trust among parties involved in the transaction. It is important for all parties to carefully review and understand the terms and conditions outlined in the guaranty before signing.

Free preview

How to fill out Montgomery Maryland Exhibit 3 Commercial Guaranty?

If you’ve already used our service before, log in to your account and download the Montgomery Maryland Exhibit 3 Commercial Guaranty on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Montgomery Maryland Exhibit 3 Commercial Guaranty. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!