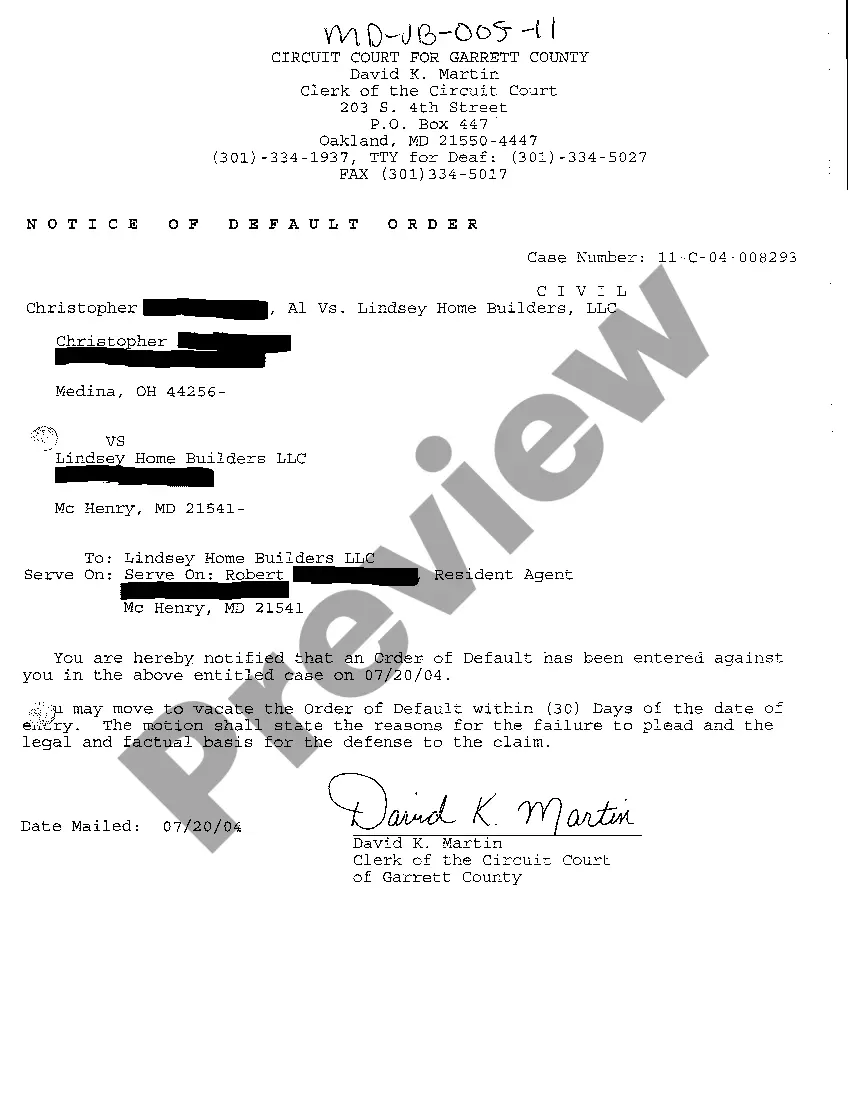

Montgomery County, Maryland Notice of Default Order is a legal document issued by the court system to inform individuals or entities about the initiation of a foreclosure process on a property due to non-payment or violation of terms in a loan agreement. This notice serves as a formal notification of the intent to foreclose and highlights the rights and options available to the homeowner to avoid foreclosure. The Montgomery County, Maryland Notice of Default Order is typically initiated by a lender or a mortgage holder when the borrower fails to make their mortgage payments within a specified period. The purpose of this notice is to officially declare the borrower's breach of contract and provide them an opportunity to rectify the situation or face the consequences of foreclosure. In Montgomery County, Maryland, there are different types of Notice of Default Orders, each serving a specific purpose: 1. Pre-Foreclosure Notice: This notice is sent by the lender to the borrower as a warning about the potential foreclosure proceedings. It provides details about the amount owed, the delinquent payments, and a timeline within which the borrower is required to bring their mortgage payments up to date. 2. Notice of Intent to Foreclose: If the borrower fails to rectify the delinquent payments within the pre-determined timeframe, the lender will issue a Notice of Intent to Foreclose. This legally informs the borrower of the lender's intention to initiate foreclosure proceedings if the outstanding amount is not paid promptly. 3. Notice of Default Order: When the borrower continues to default on their mortgage payments and fails to respond or resolve the situation, the lender obtains a Notice of Default Order from the appropriate court in Montgomery County, Maryland. This notifies the borrower that legal action has been initiated and sets forth a specific period, typically 45 days, within which the borrower must cure the default or risk losing the property through foreclosure. In summary, the Montgomery County, Maryland Notice of Default Order is a crucial step in the foreclosure process which informs borrowers of their legal obligations, offers an opportunity to resolve the default, and outlines the timeline and possible consequences if the situation remains unresolved. It is imperative for borrowers facing such notices to seek legal and financial advice promptly to explore available options, such as loan workout programs, refinancing, or sale of the property to avoid foreclosure.

Montgomery County, Maryland Notice of Default Order is a legal document issued by the court system to inform individuals or entities about the initiation of a foreclosure process on a property due to non-payment or violation of terms in a loan agreement. This notice serves as a formal notification of the intent to foreclose and highlights the rights and options available to the homeowner to avoid foreclosure. The Montgomery County, Maryland Notice of Default Order is typically initiated by a lender or a mortgage holder when the borrower fails to make their mortgage payments within a specified period. The purpose of this notice is to officially declare the borrower's breach of contract and provide them an opportunity to rectify the situation or face the consequences of foreclosure. In Montgomery County, Maryland, there are different types of Notice of Default Orders, each serving a specific purpose: 1. Pre-Foreclosure Notice: This notice is sent by the lender to the borrower as a warning about the potential foreclosure proceedings. It provides details about the amount owed, the delinquent payments, and a timeline within which the borrower is required to bring their mortgage payments up to date. 2. Notice of Intent to Foreclose: If the borrower fails to rectify the delinquent payments within the pre-determined timeframe, the lender will issue a Notice of Intent to Foreclose. This legally informs the borrower of the lender's intention to initiate foreclosure proceedings if the outstanding amount is not paid promptly. 3. Notice of Default Order: When the borrower continues to default on their mortgage payments and fails to respond or resolve the situation, the lender obtains a Notice of Default Order from the appropriate court in Montgomery County, Maryland. This notifies the borrower that legal action has been initiated and sets forth a specific period, typically 45 days, within which the borrower must cure the default or risk losing the property through foreclosure. In summary, the Montgomery County, Maryland Notice of Default Order is a crucial step in the foreclosure process which informs borrowers of their legal obligations, offers an opportunity to resolve the default, and outlines the timeline and possible consequences if the situation remains unresolved. It is imperative for borrowers facing such notices to seek legal and financial advice promptly to explore available options, such as loan workout programs, refinancing, or sale of the property to avoid foreclosure.