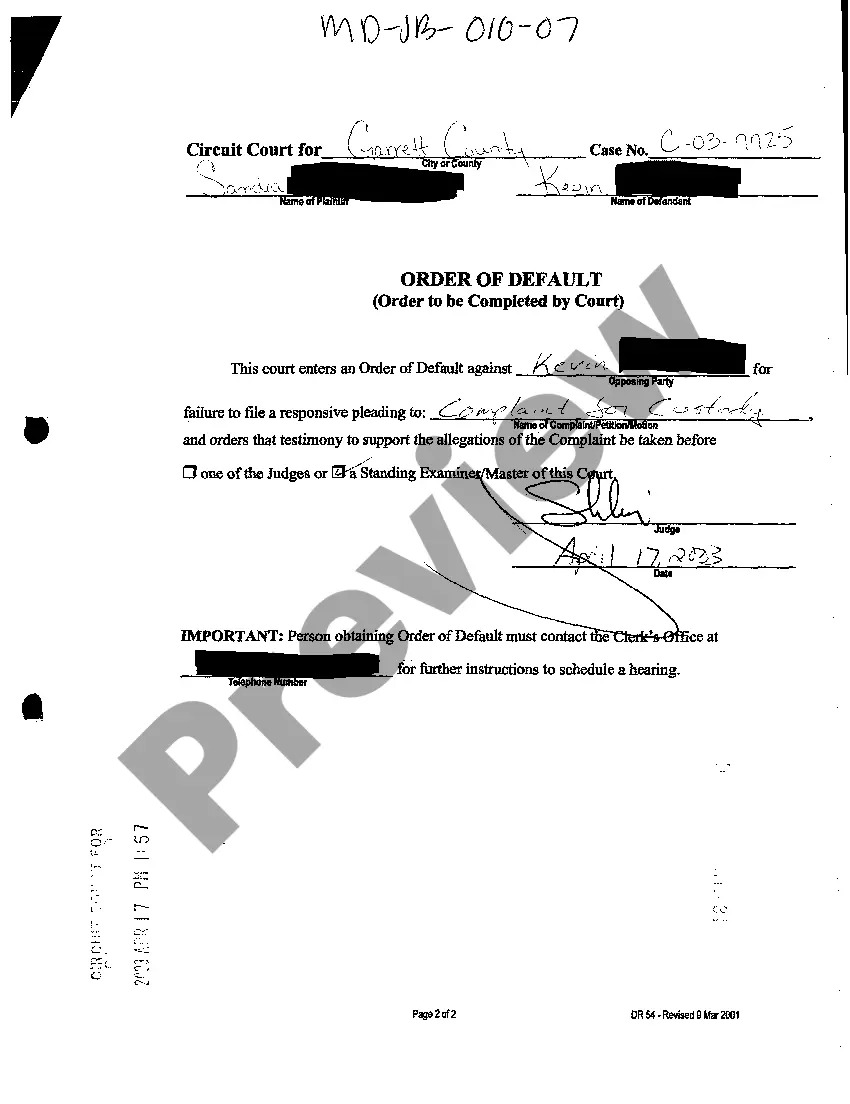

Montgomery Maryland Order of Default is a legal proceeding initiated by a creditor against a borrower who has failed to meet the financial obligations agreed upon in a loan or credit agreement. This legal action is typically taken when a borrower fails to make regular payments towards the debt and defaults on the agreed-upon terms. The Montgomery Maryland Order of Default follows a specific legal process to ensure that the creditor can take appropriate actions to recover the outstanding debt. Once the creditor files a lawsuit with the court, the borrower is notified and given an opportunity to respond. If the borrower fails to respond or contest the lawsuit within the specified timeframe, a default judgment may be entered against them. The default judgment grants the creditor the authority to collect the outstanding debt through various means, including wage garnishment, bank account levies, or property liens. These actions are taken to satisfy the debt owed by the borrower. It is important to note that there are different types of Montgomery Maryland Orders of Default, each serving a unique purpose based on the specific circumstances of the default. Some common types include: 1. Default Judgment: When the borrower fails to respond to the lawsuit within the provided timeframe, the court may enter a default judgment in favor of the creditor, granting them the right to collect the debt. 2. Montgomery Maryland Foreclosure: If the default is related to a mortgage loan, the creditor may initiate foreclosure proceedings to recover the outstanding debt by repossessing and selling the property securing the loan. 3. Wage Garnishment: In cases where the borrower is employed, a creditor can seek a wage garnishment order to deduct a portion of the borrower's wages until the debt is fully repaid. The employer is legally obliged to comply with the garnishment order. 4. Bank Account Levy: A bank account levy enables the creditor to freeze and withdraw funds from the borrower's bank account to fulfill the debt owed. 5. Property Lien: The creditor may place a lien on the borrower's property, which allows them to claim a portion of the proceeds from the sale of the property until the debt is satisfied. In summary, Montgomery Maryland Order of Default is a legal action taken by a creditor when a borrower fails to honor their financial obligations. Different types of orders may include default judgment, foreclosure, wage garnishment, bank account levy, or property lien, depending on the nature of the default and the debt involved.

Montgomery Maryland Order Of Default

Description

How to fill out Montgomery Maryland Order Of Default?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Montgomery Maryland Order Of Default? US Legal Forms is your go-to solution.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and area.

To download the document, you need to log in account, locate the required template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Montgomery Maryland Order Of Default conforms to the regulations of your state and local area.

- Read the form’s description (if available) to find out who and what the document is good for.

- Start the search over if the template isn’t suitable for your legal scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Montgomery Maryland Order Of Default in any available file format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time researching legal papers online for good.