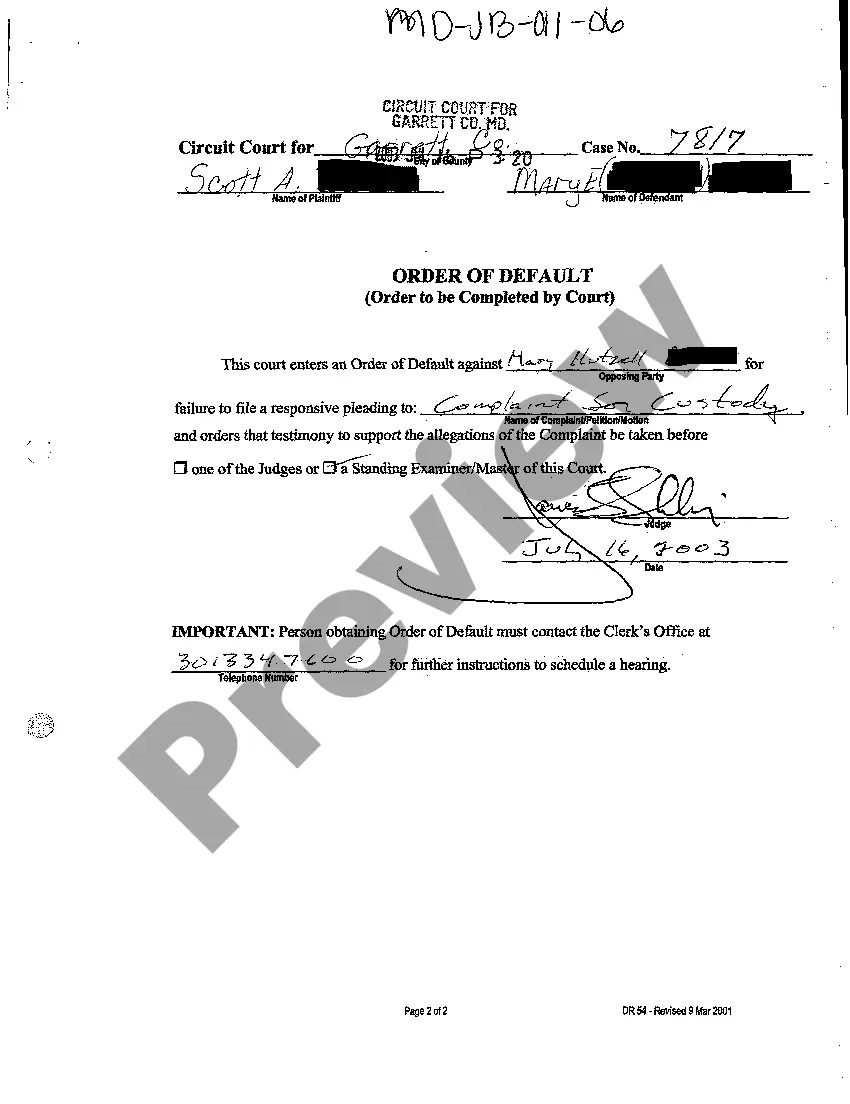

The Montgomery Maryland Order of Default refers to a legal process that occurs when a borrower fails to make timely payments on a loan or mortgage. It is crucial to understand the intricacies of this order to navigate through a potential default in Montgomery County, Maryland. Here is an insightful description of what Montgomery Maryland Order of Default entails, including its various types and key concepts. Montgomery Maryland Order of Default is a legal procedure initiated by a lender or mortgage holder when a borrower defaults on their loan obligations. Default occurs when the borrower fails to make regular payments or breaches other agreed-upon terms of the loan contract. This order outlines the actions the lender can take to recover the owed funds or reclaim the collateral. There are different types of Montgomery Maryland Orders of Default, each with its own implications and procedures: 1. Mortgage Default: This type of default specifically pertains to home loans or mortgages. If a homeowner fails to make mortgage payments for a certain period, typically 90 days, the lender can initiate foreclosure proceedings, leading to the eventual sale of the property to recoup the outstanding debt. 2. Loan Default: Loan defaults cover various types of loans, including personal, auto, or business loans. In case a borrower fails to make the agreed-upon payments consistently, the lender can declare a default and employ legal measures to recover the amount due. 3. Deed of Trust Default: In Montgomery County, Maryland, some mortgages involve a deed of trust, which is a legally binding agreement between the lender, borrower, and a trustee. If the borrower defaults on the loan, the trustee can initiate foreclosure proceedings to sell the property and satisfy the outstanding debt. 4. Notice of Default: Before initiating any legal action, lenders usually send a Notice of Default to the borrower. This notice informs the borrower about the default status, the amount owed, and provides a specified timeframe to cure the default by paying the overdue amount. When a Montgomery Maryland Order of Default is initiated, the lender may pursue several options, including: a) Foreclosure: If efforts to resolve the default fail, the lender can foreclose on the property, triggering a public auction or trustee's sale to recover their losses. b) Repossession: In cases where the default involves an auto loan or another secured asset, the lender may repossess the property to offset the unpaid balance. c) Debt Collection: Lenders can also pursue debt collection efforts to recover losses, such as hiring collections agencies or filing a lawsuit to obtain a judgment against the borrower. d) Loan Modification or Refinancing: In certain instances, lenders may consider modifying the loan terms or refinancing the debt to assist the borrower in resolving the default and avoiding the foreclosure process. In summary, the Montgomery Maryland Order of Default involves a legal procedure initiated by lenders or mortgage holders when borrowers fail to fulfill their loan obligations. This order encompasses various types of defaults, including mortgage, loan, and deed of trust defaults. Lenders have several options when dealing with default, ranging from foreclosure and repossession to debt collection and loan modifications. Understanding the implications and potential consequences of this order is essential for both borrowers and lenders in Montgomery County, Maryland.

Montgomery Maryland Order Of Default

Description

How to fill out Montgomery Maryland Order Of Default?

If you are searching for a relevant form template, it’s impossible to choose a more convenient service than the US Legal Forms site – probably the most comprehensive libraries on the internet. Here you can find a large number of document samples for organization and personal purposes by types and states, or keywords. With our high-quality search option, finding the most up-to-date Montgomery Maryland Order Of Default is as easy as 1-2-3. Additionally, the relevance of every file is confirmed by a group of professional lawyers that on a regular basis review the templates on our platform and revise them based on the newest state and county requirements.

If you already know about our system and have a registered account, all you need to receive the Montgomery Maryland Order Of Default is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have discovered the sample you need. Look at its explanation and utilize the Preview option (if available) to see its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to get the needed file.

- Affirm your decision. Click the Buy now option. Next, choose your preferred pricing plan and provide credentials to register an account.

- Make the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Get the form. Choose the format and download it to your system.

- Make adjustments. Fill out, edit, print, and sign the acquired Montgomery Maryland Order Of Default.

Every single form you add to your user profile has no expiration date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you want to get an additional copy for editing or printing, feel free to return and download it once again at any time.

Take advantage of the US Legal Forms professional library to get access to the Montgomery Maryland Order Of Default you were seeking and a large number of other professional and state-specific samples in a single place!