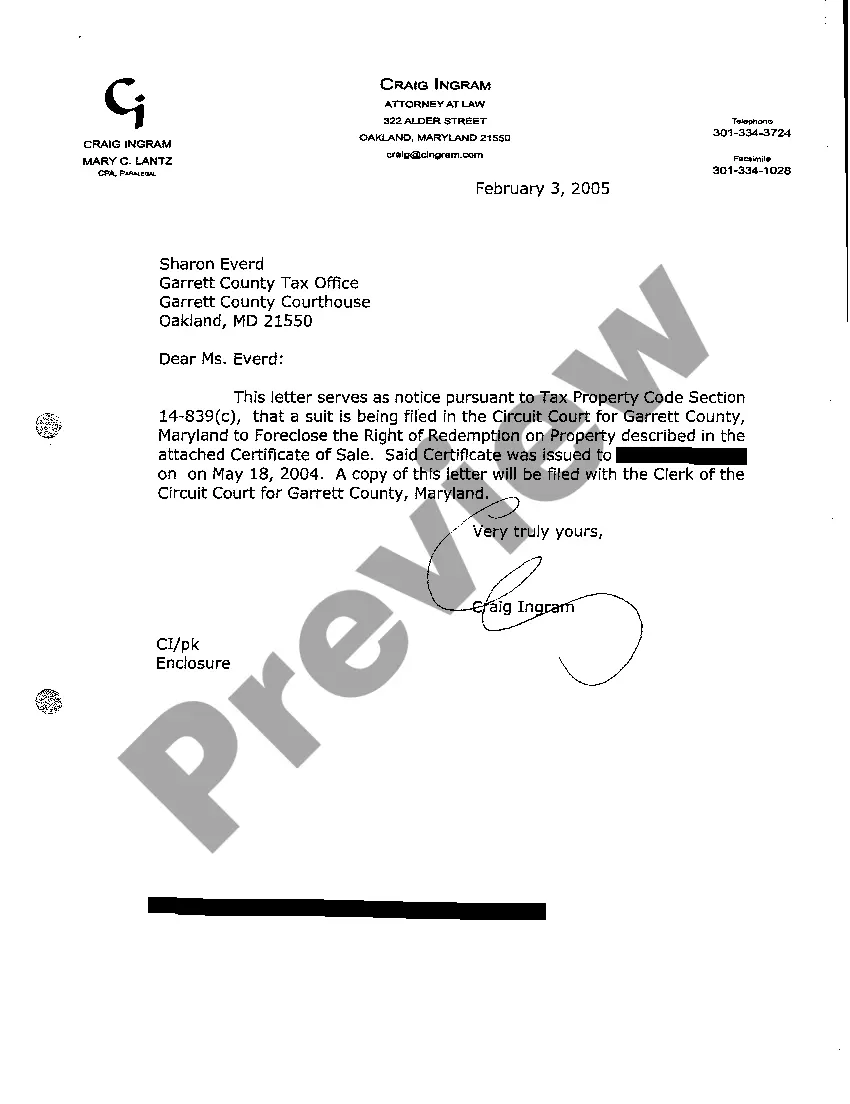

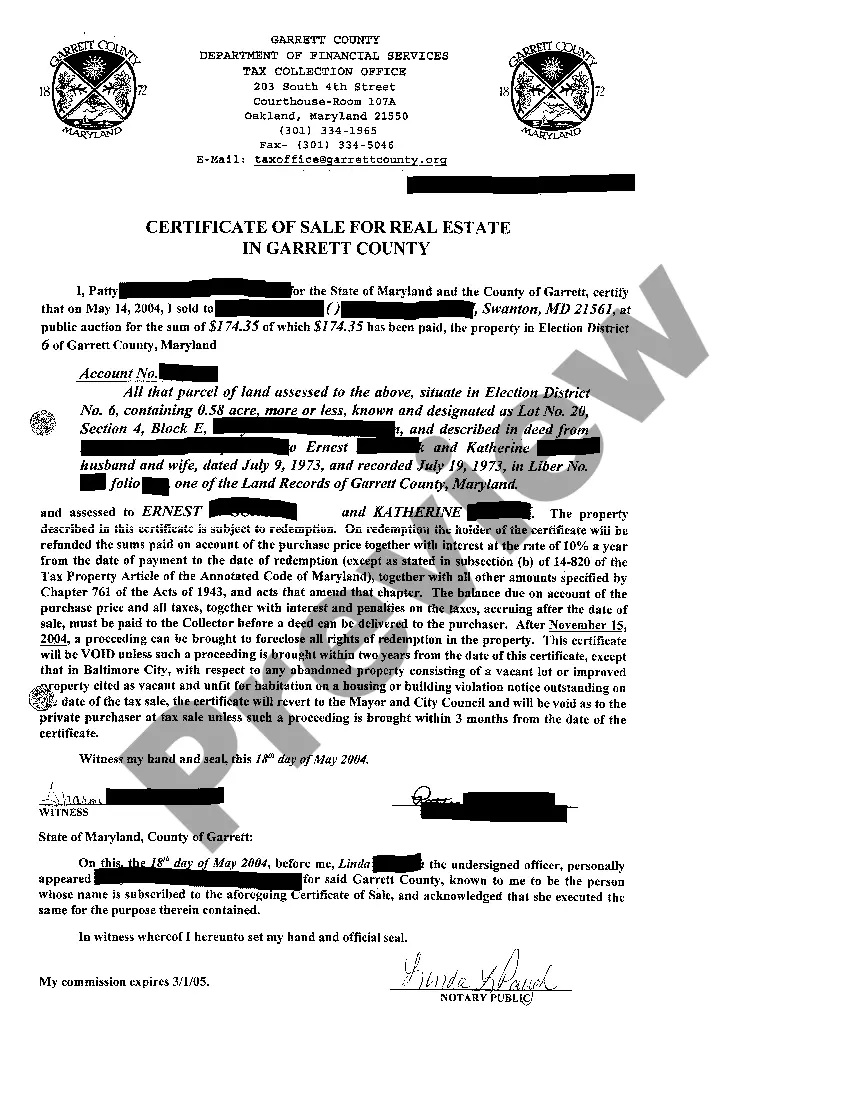

Title: Understanding the Montgomery Maryland Exhibit B Notice to Collector of Taxes Introduction: The Montgomery County Exhibit B Notice to Collector of Taxes is an essential document issued by the County's Department of Finance to inform property owners about their tax obligations and any potential tax assessments or adjustments. This article aims to provide a comprehensive overview of the Montgomery Maryland Exhibit B Notice to Collector of Taxes, its purpose, types, and other relevant information to help property owners navigate through the tax collection process successfully. 1. Purpose of the Montgomery Maryland Exhibit B Notice to Collector of Taxes: The primary purpose of the Exhibit B Notice to Collector of Taxes is to notify property owners of any changes or updates related to their property tax assessments. It aims to ensure transparency in the tax collection process and provides property owners with an opportunity to address any concerns or discrepancies. 2. Types of Montgomery Maryland Exhibit B Notice to Collector of Taxes: a. Annual Notice: The Annual Exhibit B Notice is typically issued to property owners on an annual basis. It contains detailed information regarding the assessed value of the property, any changes in tax rates, and the amount of taxes due. This notice enables property owners to plan and budget for their property tax payments accordingly. b. Special Assessments Notice: In certain situations, the county may impose special assessments on properties for purposes such as infrastructure improvements or community development. The Special Assessments Exhibit B Notice is sent to property owners to inform them about such additional tax obligations. c. Adjustments Notice: If there are any adjustments made to prior property tax assessments, such as corrections in property value, exemptions, or deductions, the Adjustments Exhibit B Notice is issued. This notice ensures accurate tax billing based on the most up-to-date information. 3. Key Information Included in a Montgomery Maryland Exhibit B Notice to Collector of Taxes: a. Property Details: The notice provides precise details about the property, such as the property's location, unique identifier, zoning classification, and other relevant information. b. Assessed Value: It presents the assessed value assigned to the property by the county's Department of Finance, which determines the basis for calculating the property tax amount. c. Tax Rates and Calculations: The notice outlines the current tax rates applicable to the property, including county, municipal, and other district taxes. It also explains the methodology used to calculate the property tax based on the assessed value. d. Payment Deadlines: The notice specifies the due date and payment deadlines for property taxes to avoid penalties or interest charges. It may also provide information about payment options, alternative methods, and available exemptions or deductions. e. Contact Information: The notice includes relevant contact details, such as the Department of Finance's contact information or the assigned tax collector, to address any inquiries or concerns regarding the tax notice or payment process. Conclusion: The Montgomery Maryland Exhibit B Notice to Collector of Taxes plays a vital role in maintaining transparency in the tax collection process and ensuring property owners are well-informed about their tax obligations. By understanding the purpose, types, and key elements of this notice, property owners can proactively manage their tax payments and address any issues promptly. It is crucial for property owners in Montgomery County, Maryland, to carefully review and respond to these notices to avoid unnecessary penalties and maintain compliance with the tax laws.

Montgomery Maryland Exhibit B Notice to Collector of Taxes

Description

How to fill out Montgomery Maryland Exhibit B Notice To Collector Of Taxes?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone without any legal education to draft this sort of paperwork from scratch, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you require the Montgomery Maryland Exhibit B Notice to Collector of Taxes or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Montgomery Maryland Exhibit B Notice to Collector of Taxes quickly employing our trustworthy platform. In case you are already an existing customer, you can go ahead and log in to your account to get the needed form.

However, if you are a novice to our platform, make sure to follow these steps prior to downloading the Montgomery Maryland Exhibit B Notice to Collector of Taxes:

- Be sure the form you have found is specific to your location considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a quick outline (if provided) of scenarios the paper can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start over and search for the needed form.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your credentials or register for one from scratch.

- Select the payment method and proceed to download the Montgomery Maryland Exhibit B Notice to Collector of Taxes as soon as the payment is completed.

You’re good to go! Now you can go ahead and print out the form or fill it out online. Should you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.