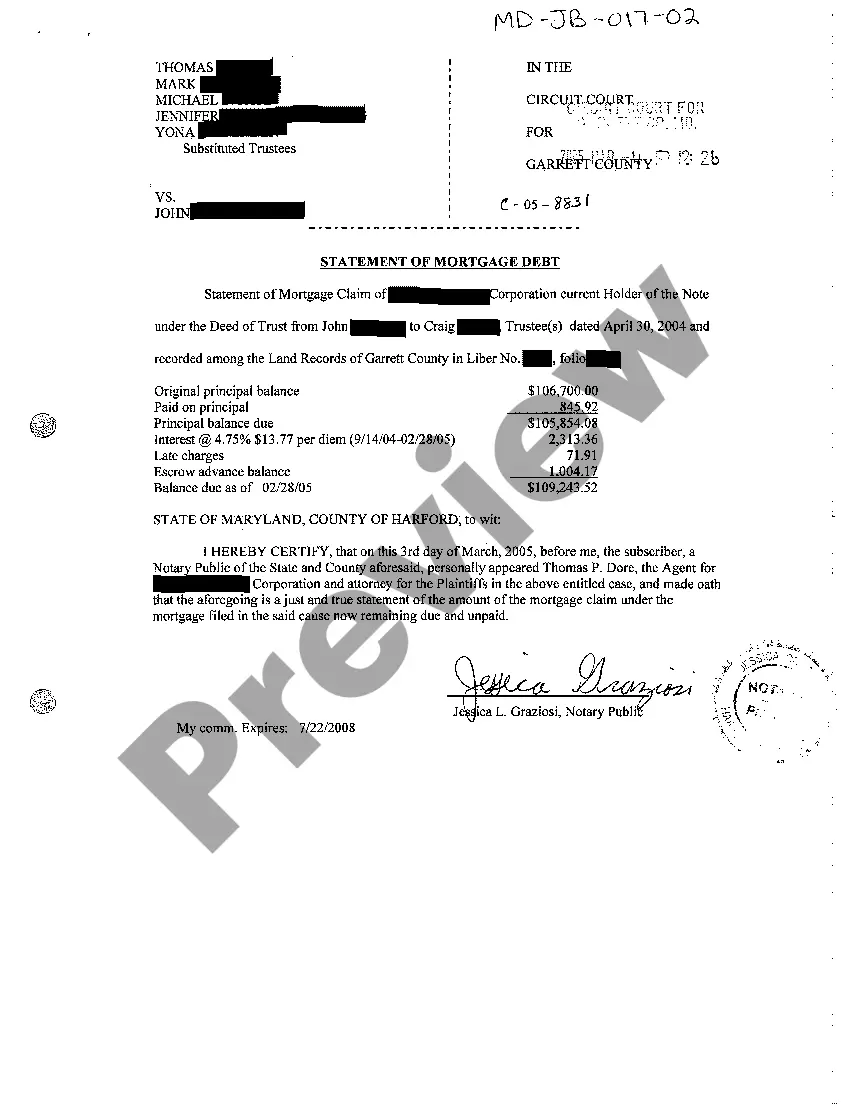

The Montgomery Maryland Statement of Mortgage Debt is a legal document that encompasses the detailed information regarding an individual's mortgage debt in Montgomery County, Maryland. It is extensively used in real estate transactions, refinancing, and in cases of foreclosure. This statement contains crucial keywords such as "Montgomery Maryland," "statement," "mortgage debt," and "legal document." It plays a significant role in providing transparency and clarity between the borrower and the lender, as it outlines the terms and conditions associated with the mortgage. Montgomery County, Maryland is a key location identified in the statement due to its specific jurisdictional requirements for mortgage-related matters. As such, it is essential to mention this location to highlight the geographical context and recognize the local laws and regulations that govern mortgage debt in the county. The statement includes comprehensive information, such as the borrower's name, address, and contact details, as well as the lender's information. It also outlines the exact loan amount, interest rate, repayment terms, and any additional charges or fees associated with the mortgage. Additionally, the Statement of Mortgage Debt may encompass different types, depending on the specific circumstances, including: 1. Initial Mortgage Statement: This type of statement is prepared when an individual initially applies for a mortgage loan. It provides a detailed breakdown of the loan amount, interest rate, repayment schedule, and relevant terms and conditions. 2. Refinance Mortgage Statement: A refinancing mortgage statement is created when a borrower decides to refinance their existing mortgage. It outlines the new loan amount, adjusted interest rate, and any modifications made to the terms and conditions. 3. Foreclosure Mortgage Statement: In the unfortunate event of foreclosure, a foreclosure mortgage statement is generated, providing an overview of the outstanding balance, any penalties incurred, and the legal actions taken towards reclaiming the property. In conclusion, the Montgomery Maryland Statement of Mortgage Debt is a vital document when dealing with mortgage-related matters in Montgomery County. It ensures transparency and clarity between the borrower and lender, outlining all pertinent information related to the mortgage loan. Understanding the different types of statements, such as initial mortgage statements, refinance mortgage statements, and foreclosure mortgage statements, enhances one's awareness of the range of scenarios that may require the creation of such documents.

Montgomery Maryland Statement of Mortgage Debt

Description

How to fill out Montgomery Maryland Statement Of Mortgage Debt?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Montgomery Maryland Statement of Mortgage Debt gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Montgomery Maryland Statement of Mortgage Debt takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Montgomery Maryland Statement of Mortgage Debt. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!