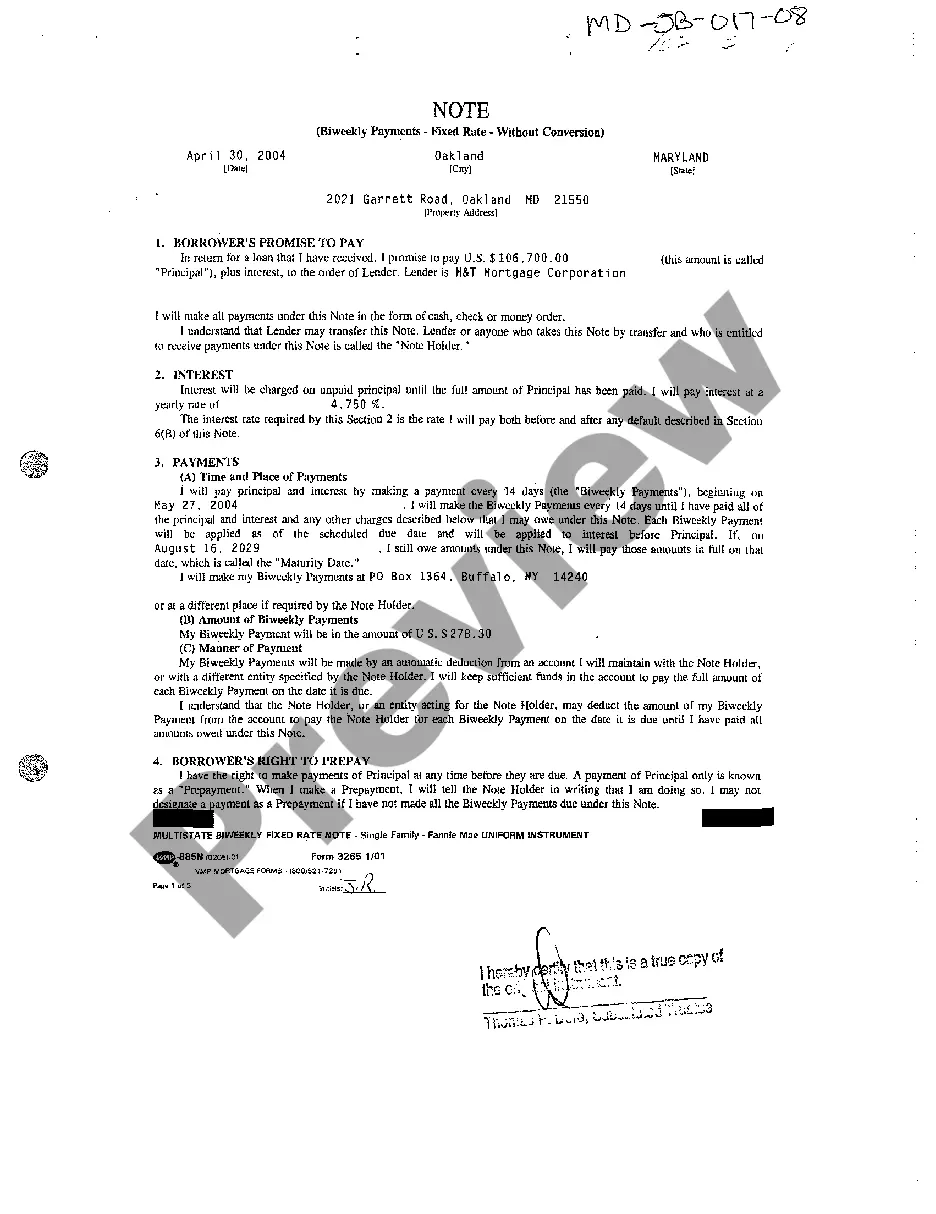

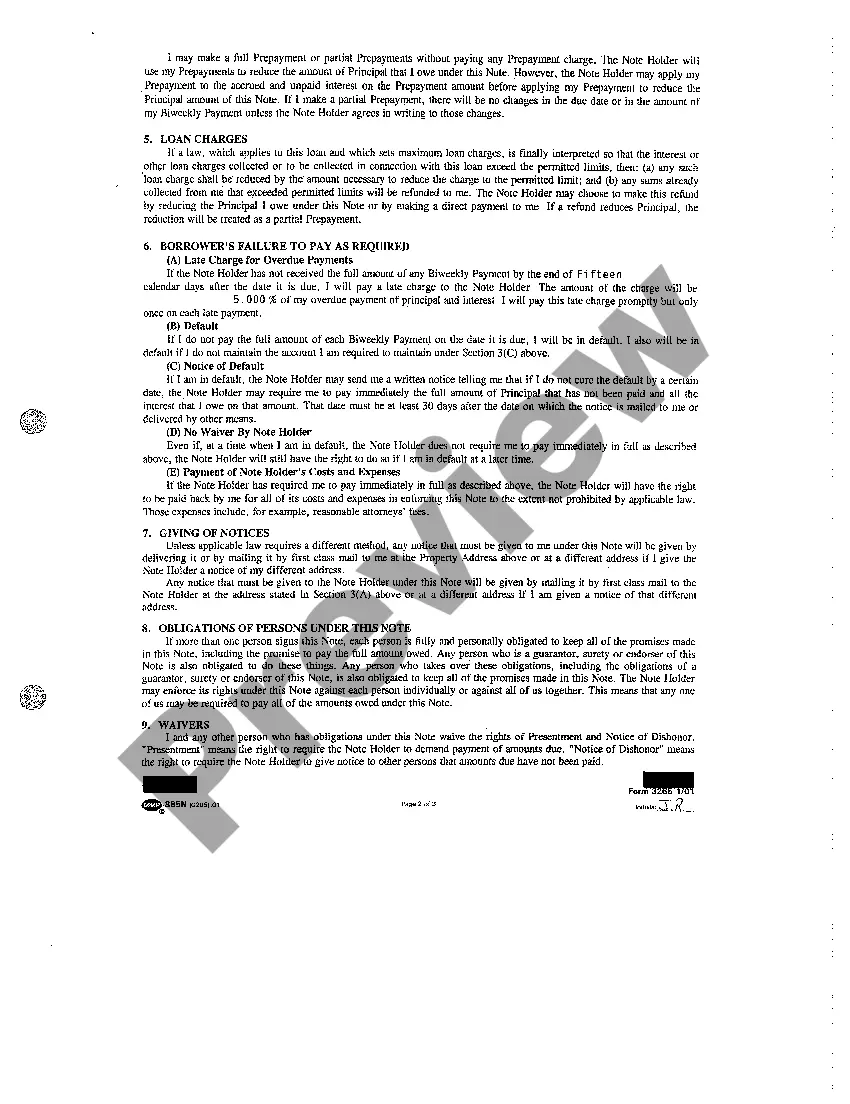

A Montgomery Maryland promissory note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender within a specified time frame. It serves as evidence of a loan agreement between the two parties and ensures that both parties understand the terms and conditions of the loan. One type of promissory note in Montgomery Maryland is the secured promissory note. This note requires the borrower to provide collateral, such as real estate or personal property, to secure the loan. If the borrower fails to repay the loan as agreed, the lender has the right to seize and sell the collateral to recoup their losses. Another type is an unsecured promissory note, which does not involve any collateral. In this case, the borrower relies solely on their creditworthiness and trustworthiness to obtain the loan. However, because there is no collateral involved, these notes often have higher interest rates to compensate for the increased risk perceived by the lender. Furthermore, Montgomery Maryland offers a demand promissory note, which allows the lender to request repayment of the loan at any time, often after a specified notice period. This type of note provides flexibility to the lender, allowing them to call in the debt earlier if necessary. A fixed-term promissory note is also common in Montgomery Maryland. This note specifies a specific repayment schedule with predetermined installments and interest rates. Both the lender and borrower are bound by the agreed-upon terms for the duration of the loan until it is fully repaid. In Montgomery Maryland, promissory notes are legally enforceable contracts, and if either party breaches the terms, legal action can be taken to seek repayment or damages. Given their legal significance, it is advised to consult with a knowledgeable attorney to ensure the promissory note complies with all relevant laws and regulations, providing protection for both the lender and borrower.

Montgomery Maryland Promissory Note

Description

How to fill out Montgomery Maryland Promissory Note?

Do you need a reliable and affordable legal forms supplier to get the Montgomery Maryland Promissory Note? US Legal Forms is your go-to solution.

Whether you require a basic arrangement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and county.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Montgomery Maryland Promissory Note conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is good for.

- Restart the search in case the form isn’t good for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Montgomery Maryland Promissory Note in any available format. You can get back to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time researching legal papers online for good.