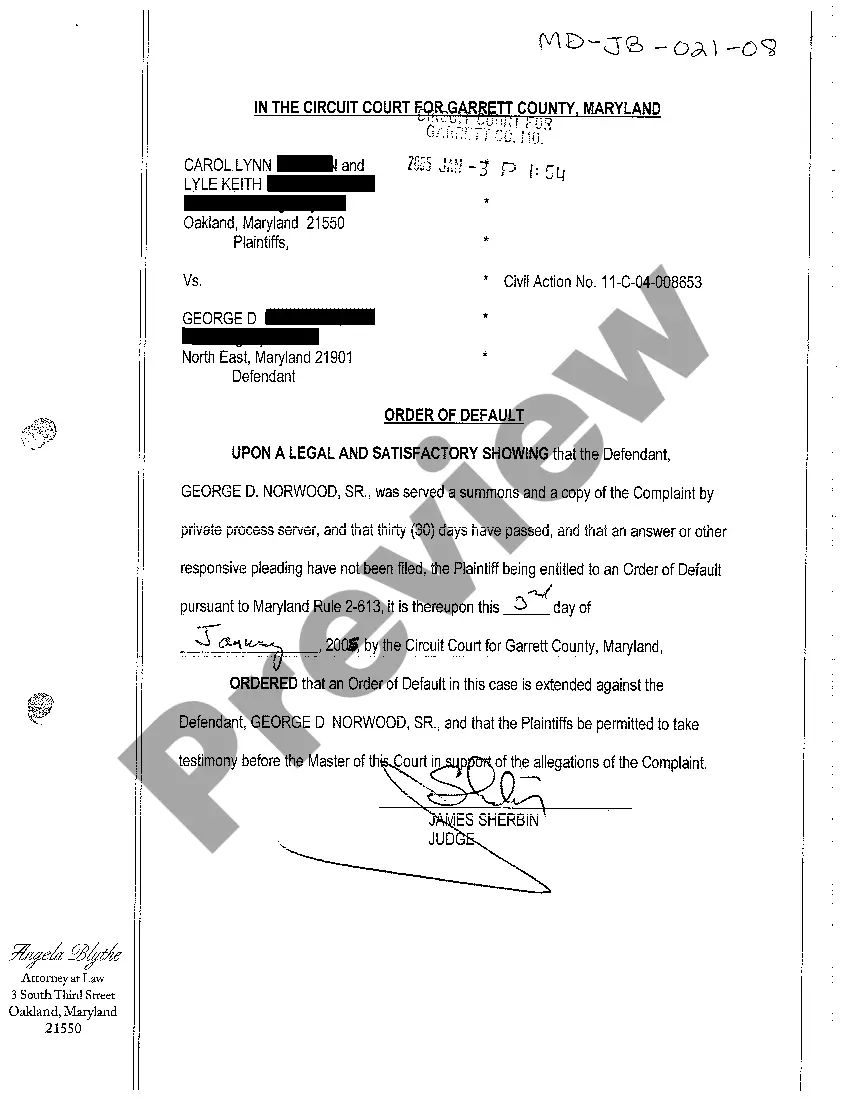

The Montgomery Maryland Order of Default is a legal process that occurs when a borrower fails to make timely mortgage payments, resulting in a breach of the loan agreement. In this specific jurisdiction, the order is enacted by the Montgomery Circuit Court to protect the interests of the lender and ensure payment for the outstanding debt. One type of Montgomery Maryland Order of Default is the judicial process, which involves the lender filing a lawsuit against the borrower in the Montgomery Circuit Court. The court then reviews the evidence and, if satisfied, issues an order declaring the default. This order allows the lender to proceed with foreclosure proceedings. Another type is the non-judicial process, also known as a power of sale foreclosure. This type does not involve the court system and is carried out through a trustee. The lender, through the trustee, issues a Notice of Default, giving the borrower a specified period to rectify the overdue payments. If the borrower fails to remedy the default within the given time frame, the trustee may proceed with a public auction of the property. Montgomery Maryland Order of Default keywords: 1. Montgomery Maryland 2. Order of Default 3. Mortgage default 4. Breach of loan agreement 5. Montgomery Circuit Court 6. Lender 7. Borrower 8. Mortgage payments 9. Foreclosure proceedings 10. Judicial process 11. Lawsuit 12. Non-judicial process 13. Power of sale foreclosure 14. Trustee 15. Notice of Default 16. Overdue payments 17. Rectify default 18. Public auction 19. Property seizure 20. Loan agreement breach consequences.

Montgomery Maryland Order of Default

Description

How to fill out Montgomery Maryland Order Of Default?

If you are searching for a valid form, it’s difficult to choose a better service than the US Legal Forms site – probably the most comprehensive online libraries. Here you can get thousands of templates for business and personal purposes by categories and regions, or keywords. With our advanced search function, getting the newest Montgomery Maryland Order of Default is as easy as 1-2-3. Moreover, the relevance of each document is verified by a team of expert lawyers that regularly check the templates on our platform and update them according to the most recent state and county requirements.

If you already know about our system and have a registered account, all you need to receive the Montgomery Maryland Order of Default is to log in to your profile and click the Download option.

If you use US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have opened the sample you require. Read its information and utilize the Preview function to check its content. If it doesn’t meet your needs, use the Search field at the top of the screen to get the appropriate file.

- Confirm your selection. Click the Buy now option. After that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Choose the format and download it to your system.

- Make adjustments. Fill out, edit, print, and sign the obtained Montgomery Maryland Order of Default.

Every single form you add to your profile has no expiration date and is yours forever. You can easily access them via the My Forms menu, so if you want to receive an extra version for editing or creating a hard copy, you may come back and export it once more whenever you want.

Take advantage of the US Legal Forms extensive collection to get access to the Montgomery Maryland Order of Default you were looking for and thousands of other professional and state-specific templates in one place!