Title: Understanding the Montgomery Maryland Notice of Default Order: Types and Implications Introduction: The Montgomery Maryland Notice of Default Order is a legal document that signifies a homeowner's failure to meet their mortgage payment obligations. This comprehensive guide will delve into the various types of notices, their significance in foreclosure proceedings, and the potential consequences for homeowners. 1. Montgomery Maryland Notice of Default Order Overview: The Montgomery Maryland Notice of Default Order is issued when a homeowner defaults on their mortgage payment, failing to honor the agreed-upon terms of the loan agreement. This notice serves as a crucial step toward initiating foreclosure proceedings. 2. Types of Montgomery Maryland Notice of Default Order: a. Advisement of Rights Notice: This is the initial notice that homeowners receive, typically governed by the Code of Maryland Regulations (COMA). It informs homeowners of their rights, initiates the foreclosure process, and provides crucial details such as the amount owed, loan reinstatement options, and the deadline to respond. b. Notice of Intent to Foreclose: If the homeowner fails to rectify the default within the specified timeframe provided in the Advisement of Rights Notice, a Notice of Intent to Foreclose is served. This notice outlines the lender's intent to initiate foreclosure proceedings if the default is not resolved promptly. c. Notice of Default: Issued following the Notice of Intent to Foreclose, this notice formally declares the homeowner in default and serves as a precursor to the scheduling of a foreclosure sale. d. Final Notice Before Foreclosure: Given under the Maryland Foreclosure Procedure Act, this notice informs homeowners of an impending foreclosure sale if the default is not promptly addressed. 3. Implications and Consequences: a. Foreclosure Proceedings: The Montgomery Maryland Notice of Default Order marks the beginning of the foreclosure process, allowing lenders to take steps to reclaim the property and sell it to recover the outstanding mortgage debt. b. Damage to Credit Score: Facing a foreclosure and receiving a Notice of Default Order can significantly damage a homeowner's credit score, making it challenging to secure future loans or credit. c. Potential Loss of Homeownership: Failure to resolve the default may result in the loss of the homeowner's property through foreclosure, leading to eviction and potential financial distress. d. Legal Remedies and Alternatives: Homeowners served with a Notice of Default Order should consult legal counsel to explore possible remedies such as loan modification, refinancing, or seeking assistance from government programs designed to prevent foreclosure. In conclusion, the Montgomery Maryland Notice of Default Order is a critical legal document that initiates foreclosure proceedings following a homeowner's mortgage payment default. Understanding the various types of these notices and the potential consequences is essential for homeowners who find themselves in this challenging situation. Seeking professional advice promptly can help homeowners explore alternatives and protect their interests.

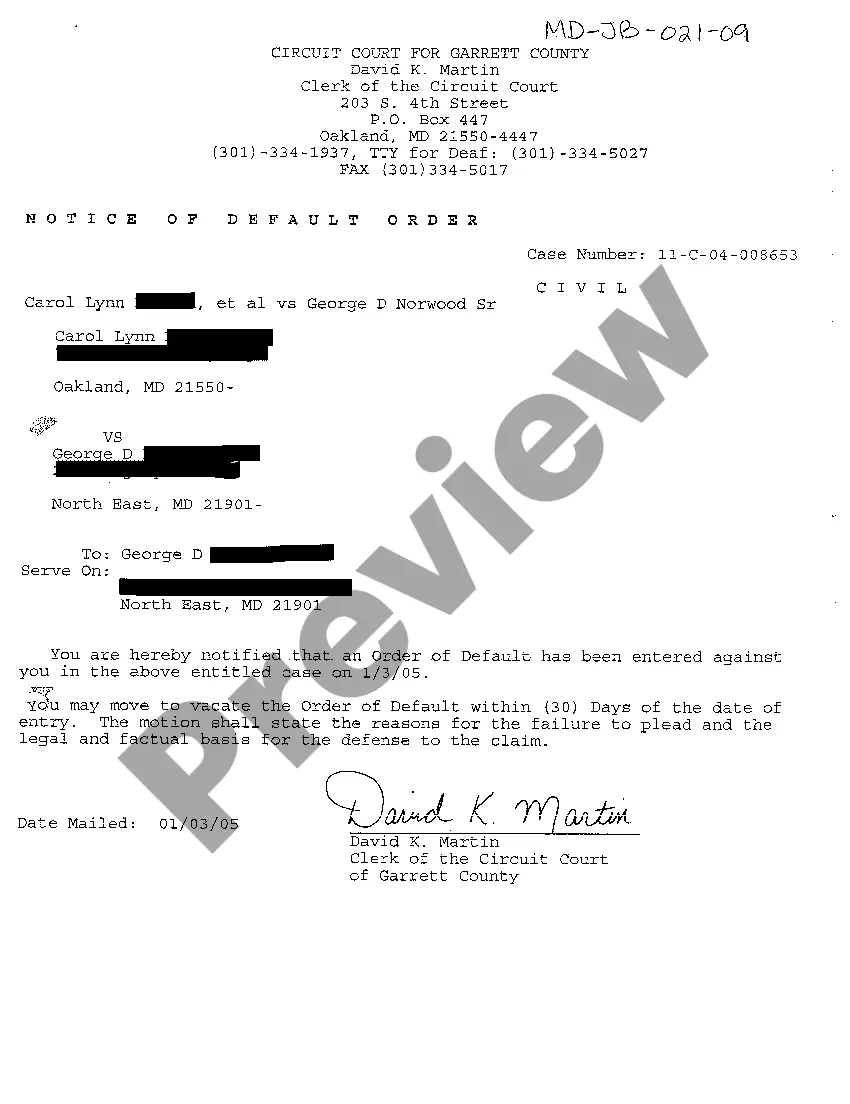

Montgomery Maryland Notice of Default Order

Description

How to fill out Montgomery Maryland Notice Of Default Order?

Benefit from the US Legal Forms and obtain immediate access to any form you require. Our helpful platform with thousands of documents makes it simple to find and obtain almost any document sample you want. You are able to export, fill, and sign the Montgomery Maryland Notice of Default Order in just a matter of minutes instead of surfing the Net for hours attempting to find the right template.

Using our library is a superb way to improve the safety of your form filing. Our professional lawyers regularly check all the records to make sure that the forms are relevant for a particular region and compliant with new acts and polices.

How do you get the Montgomery Maryland Notice of Default Order? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Furthermore, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, follow the tips listed below:

- Find the form you require. Make certain that it is the form you were hoping to find: examine its headline and description, and use the Preview option if it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving procedure. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Download the document. Select the format to obtain the Montgomery Maryland Notice of Default Order and revise and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and reliable form libraries on the web. We are always ready to help you in any legal procedure, even if it is just downloading the Montgomery Maryland Notice of Default Order.

Feel free to take advantage of our service and make your document experience as efficient as possible!