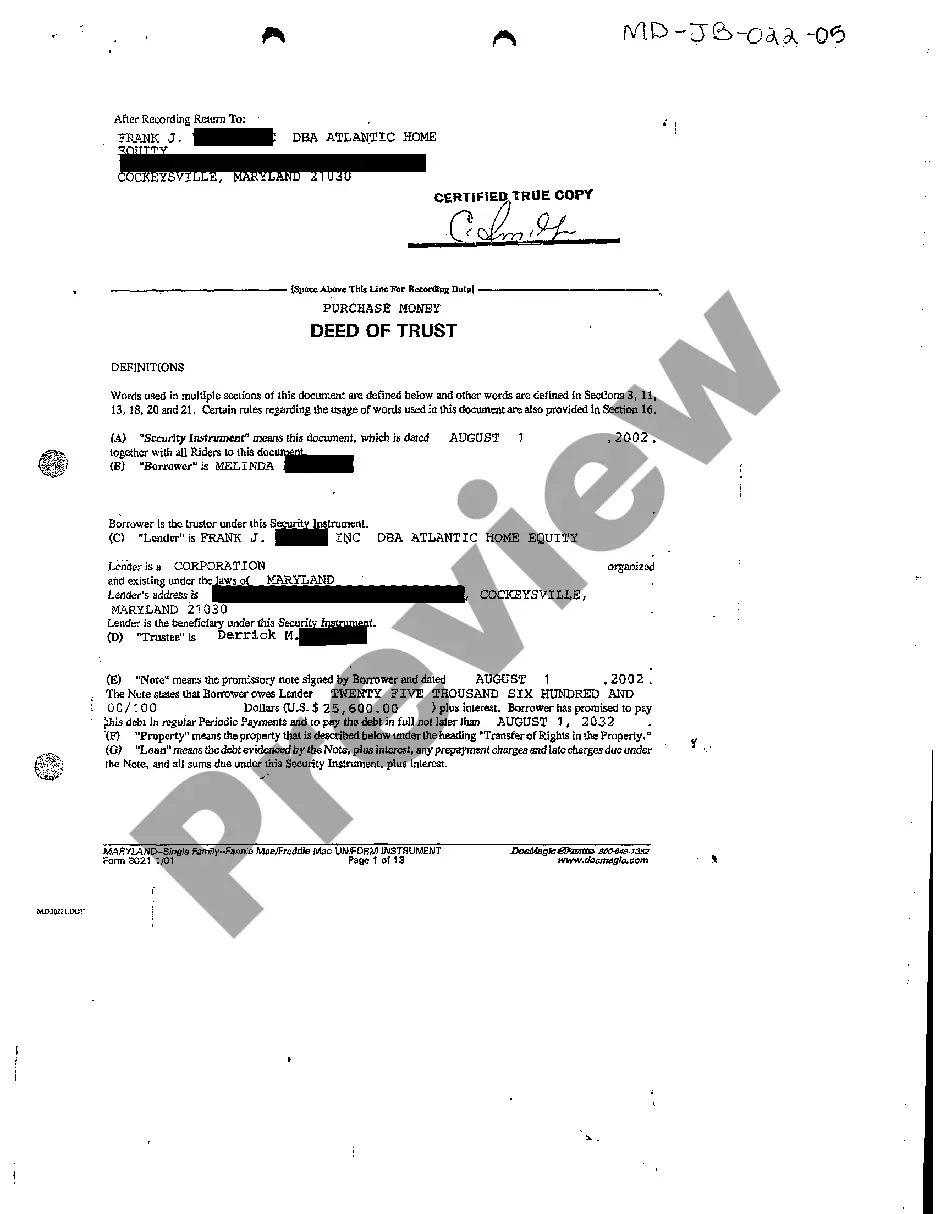

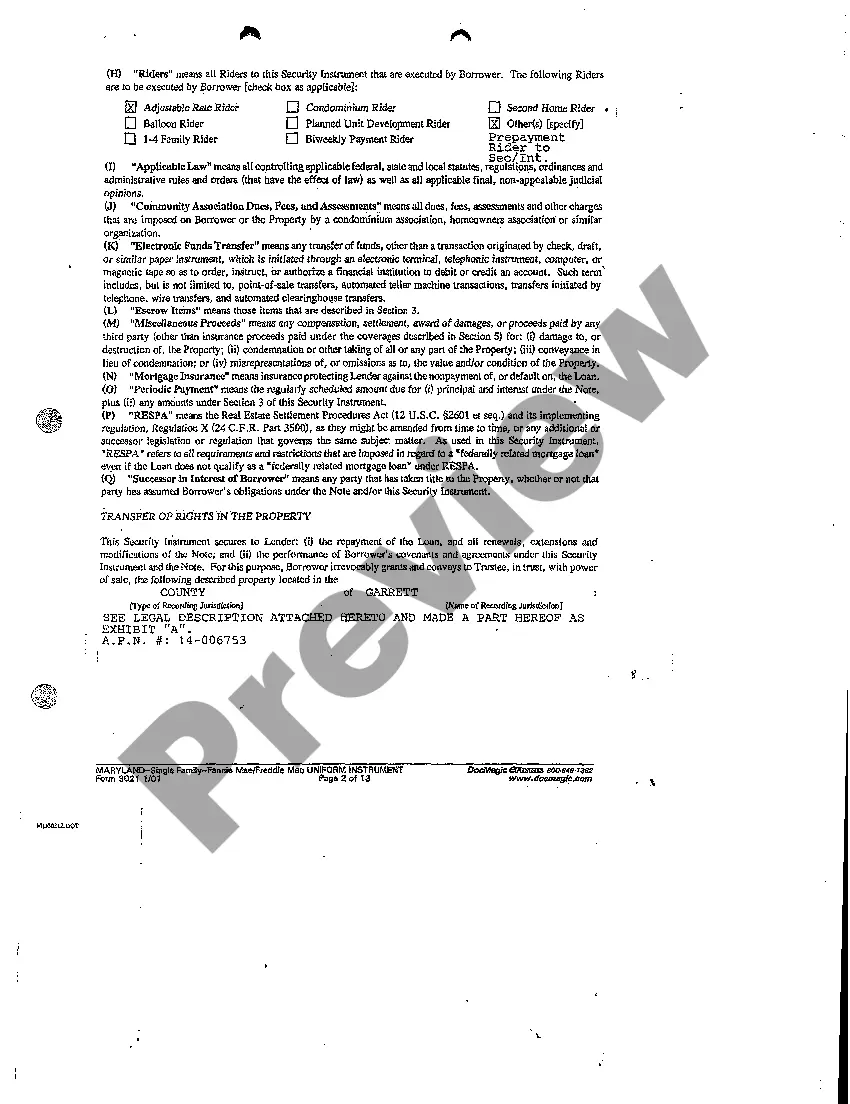

A detailed description of the Montgomery Maryland Deed of Trust: The Montgomery Maryland Deed of Trust is a legal document that serves as a security instrument in real estate transactions. It is commonly used when purchasing or refinancing a property in Montgomery County, Maryland. This document outlines the terms and conditions of the loan, ensuring the lender's interest is protected in the event of default. Keywords: Montgomery Maryland Deed of Trust, security instrument, real estate transactions, purchasing, refinancing, property, Montgomery County, Maryland, terms and conditions, loan, lender's interest, default. Different types of Montgomery Maryland Deed of Trust include: 1. Fixed-Rate Deed of Trust: This type of deed of trust offers a fixed interest rate for the entire term of the loan, which provides stability and predictability in mortgage payments for the borrower. 2. Adjustable Rate Deed of Trust: In contrast to the fixed-rate deed of trust, this type of deed of trust comes with an adjustable interest rate. The interest rate can fluctuate over time according to predefined market indexes, which could result in changes to the monthly mortgage payments. 3. Purchase Money Deed of Trust: This specific type of deed of trust is used when a buyer obtains financing from the seller or another private party, rather than a traditional lender. It secures the lender's interest in the property, serving as collateral for the loan. 4. Refinance Deed of Trust: When homeowners in Montgomery County, Maryland, choose to refinance their existing mortgage to take advantage of more favorable interest rates or change the terms of their loan, they may use a refinancing deed of trust. This document replaces the original mortgage and secures the new loan against the property. Keywords: Fixed-Rate Deed of Trust, Adjustable Rate Deed of Trust, Purchase Money Deed of Trust, Refinance Deed of Trust, buyer, financing, private party, lender, collateral, refinance, homeowners, interest rates, terms of loan.

Montgomery Maryland Deed of Trust

State:

Maryland

County:

Montgomery

Control #:

MD-JB-022-05

Format:

PDF

Instant download

This form is available by subscription

Description

A06 Deed of Trust

A detailed description of the Montgomery Maryland Deed of Trust: The Montgomery Maryland Deed of Trust is a legal document that serves as a security instrument in real estate transactions. It is commonly used when purchasing or refinancing a property in Montgomery County, Maryland. This document outlines the terms and conditions of the loan, ensuring the lender's interest is protected in the event of default. Keywords: Montgomery Maryland Deed of Trust, security instrument, real estate transactions, purchasing, refinancing, property, Montgomery County, Maryland, terms and conditions, loan, lender's interest, default. Different types of Montgomery Maryland Deed of Trust include: 1. Fixed-Rate Deed of Trust: This type of deed of trust offers a fixed interest rate for the entire term of the loan, which provides stability and predictability in mortgage payments for the borrower. 2. Adjustable Rate Deed of Trust: In contrast to the fixed-rate deed of trust, this type of deed of trust comes with an adjustable interest rate. The interest rate can fluctuate over time according to predefined market indexes, which could result in changes to the monthly mortgage payments. 3. Purchase Money Deed of Trust: This specific type of deed of trust is used when a buyer obtains financing from the seller or another private party, rather than a traditional lender. It secures the lender's interest in the property, serving as collateral for the loan. 4. Refinance Deed of Trust: When homeowners in Montgomery County, Maryland, choose to refinance their existing mortgage to take advantage of more favorable interest rates or change the terms of their loan, they may use a refinancing deed of trust. This document replaces the original mortgage and secures the new loan against the property. Keywords: Fixed-Rate Deed of Trust, Adjustable Rate Deed of Trust, Purchase Money Deed of Trust, Refinance Deed of Trust, buyer, financing, private party, lender, collateral, refinance, homeowners, interest rates, terms of loan.

Free preview

How to fill out Montgomery Maryland Deed Of Trust?

If you’ve already utilized our service before, log in to your account and save the Montgomery Maryland Deed of Trust on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Montgomery Maryland Deed of Trust. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!