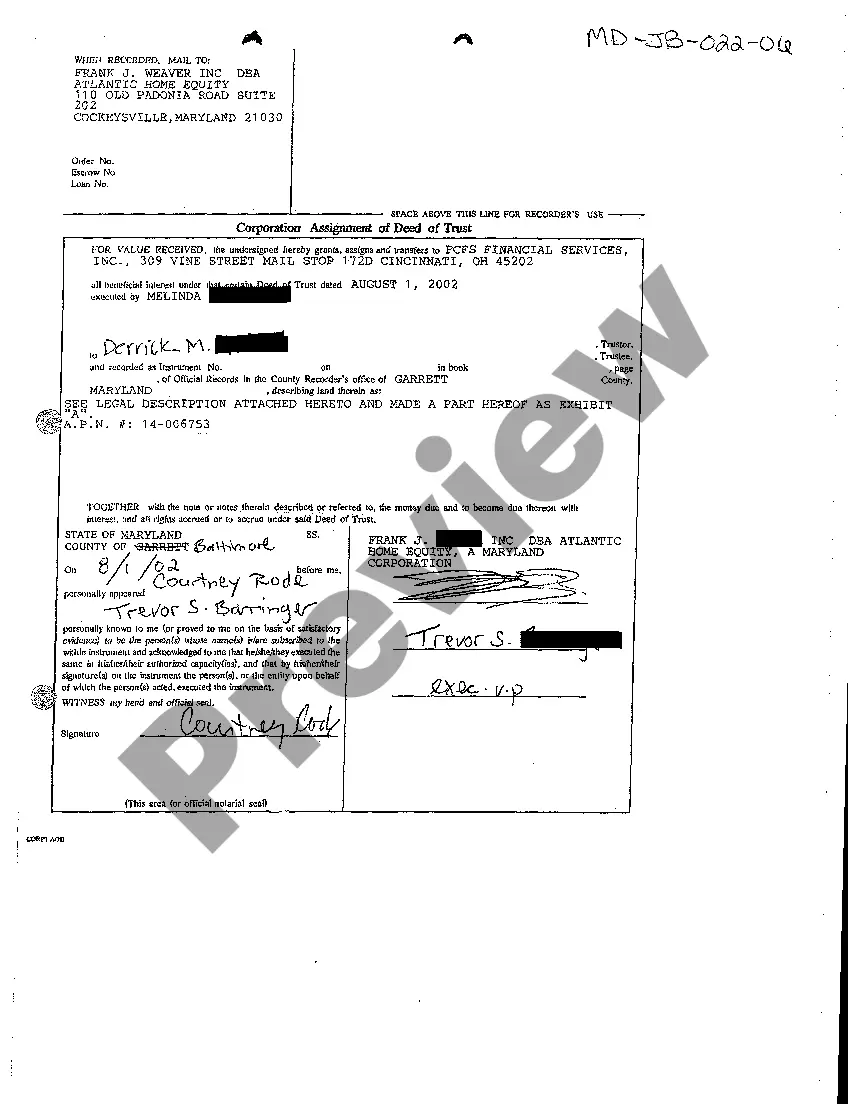

Montgomery Maryland Corporation Assignment of Deed of Trust refers to a legal document that allows the transfer of one's rights and interest in a property to another party as collateral for a loan or debt. It serves as a way for corporations or individuals to transfer their mortgage interests to a different entity. This type of assignment is commonly utilized in real estate transactions, where the borrower grants a lender a security interest in the property. In Montgomery County, Maryland, there are several types of Corporation Assignment of Deed of Trust that exist, depending on the specific circumstances and agreements involved: 1. Voluntary Assignment: This occurs when a corporation willingly transfers its interest in a property to another party, typically a lender, to secure a loan or satisfy a debt. It is a consensual transaction between the borrower and the assignee. 2. Involuntary Assignment: In some cases, a corporation may be forced to assign their deed of trust due to defaulting on loan repayments or breaching contractual obligations. This type of assignment may occur through legal actions, such as foreclosure, where the lender takes possession of the property to recover the loan amount. 3. Partial Assignment: This type of assignment involves transferring only a portion of the corporation's interest in the property to another party. It may occur when the borrower needs to secure additional financing or when a lender wants to share the loan risk with another entity. 4. Assignment of Trustee's Interest: Sometimes, the assignment involves the transfer of a trustee's interest in the deed of trust. The trustee is responsible for overseeing the terms of the loan and the transfer ensures that a new trustee takes on these responsibilities. It is essential to note that each Montgomery Maryland Corporation Assignment of Deed of Trust is a legally binding agreement that should be executed with the assistance of legal professionals. The document typically includes details such as the names of the parties involved, property address, loan amount, terms, and conditions of the assignment, and any specific provisions or contingencies agreed upon. Overall, Montgomery Maryland Corporation Assignment of Deed of Trust plays a crucial role in facilitating real estate transactions and securing loans through the transfer of property interests. Understanding the various types of assignments can help individuals and corporations navigate these transactions efficiently and protect their rights and interests.

Montgomery Maryland Corporation Assignment of Deed of Trust refers to a legal document that allows the transfer of one's rights and interest in a property to another party as collateral for a loan or debt. It serves as a way for corporations or individuals to transfer their mortgage interests to a different entity. This type of assignment is commonly utilized in real estate transactions, where the borrower grants a lender a security interest in the property. In Montgomery County, Maryland, there are several types of Corporation Assignment of Deed of Trust that exist, depending on the specific circumstances and agreements involved: 1. Voluntary Assignment: This occurs when a corporation willingly transfers its interest in a property to another party, typically a lender, to secure a loan or satisfy a debt. It is a consensual transaction between the borrower and the assignee. 2. Involuntary Assignment: In some cases, a corporation may be forced to assign their deed of trust due to defaulting on loan repayments or breaching contractual obligations. This type of assignment may occur through legal actions, such as foreclosure, where the lender takes possession of the property to recover the loan amount. 3. Partial Assignment: This type of assignment involves transferring only a portion of the corporation's interest in the property to another party. It may occur when the borrower needs to secure additional financing or when a lender wants to share the loan risk with another entity. 4. Assignment of Trustee's Interest: Sometimes, the assignment involves the transfer of a trustee's interest in the deed of trust. The trustee is responsible for overseeing the terms of the loan and the transfer ensures that a new trustee takes on these responsibilities. It is essential to note that each Montgomery Maryland Corporation Assignment of Deed of Trust is a legally binding agreement that should be executed with the assistance of legal professionals. The document typically includes details such as the names of the parties involved, property address, loan amount, terms, and conditions of the assignment, and any specific provisions or contingencies agreed upon. Overall, Montgomery Maryland Corporation Assignment of Deed of Trust plays a crucial role in facilitating real estate transactions and securing loans through the transfer of property interests. Understanding the various types of assignments can help individuals and corporations navigate these transactions efficiently and protect their rights and interests.