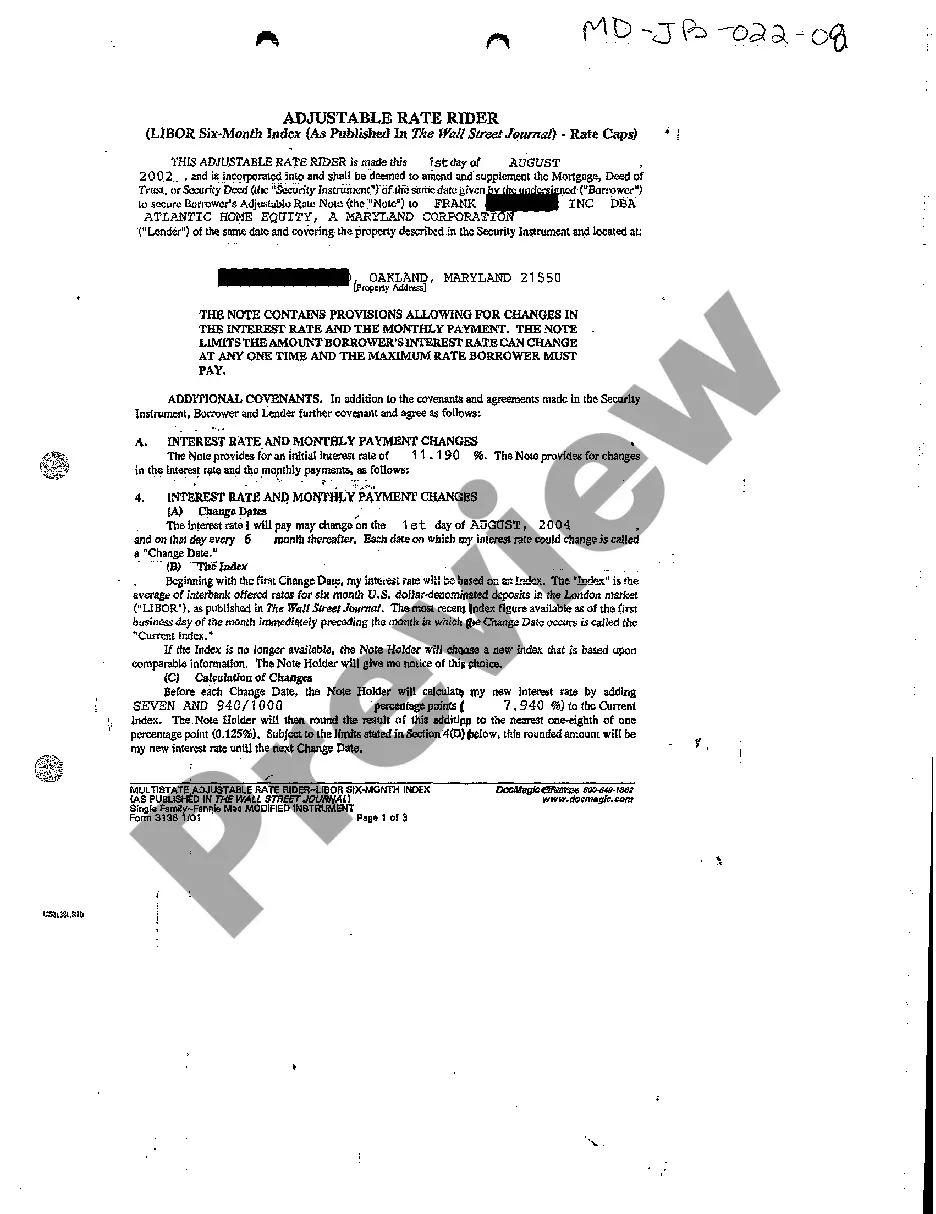

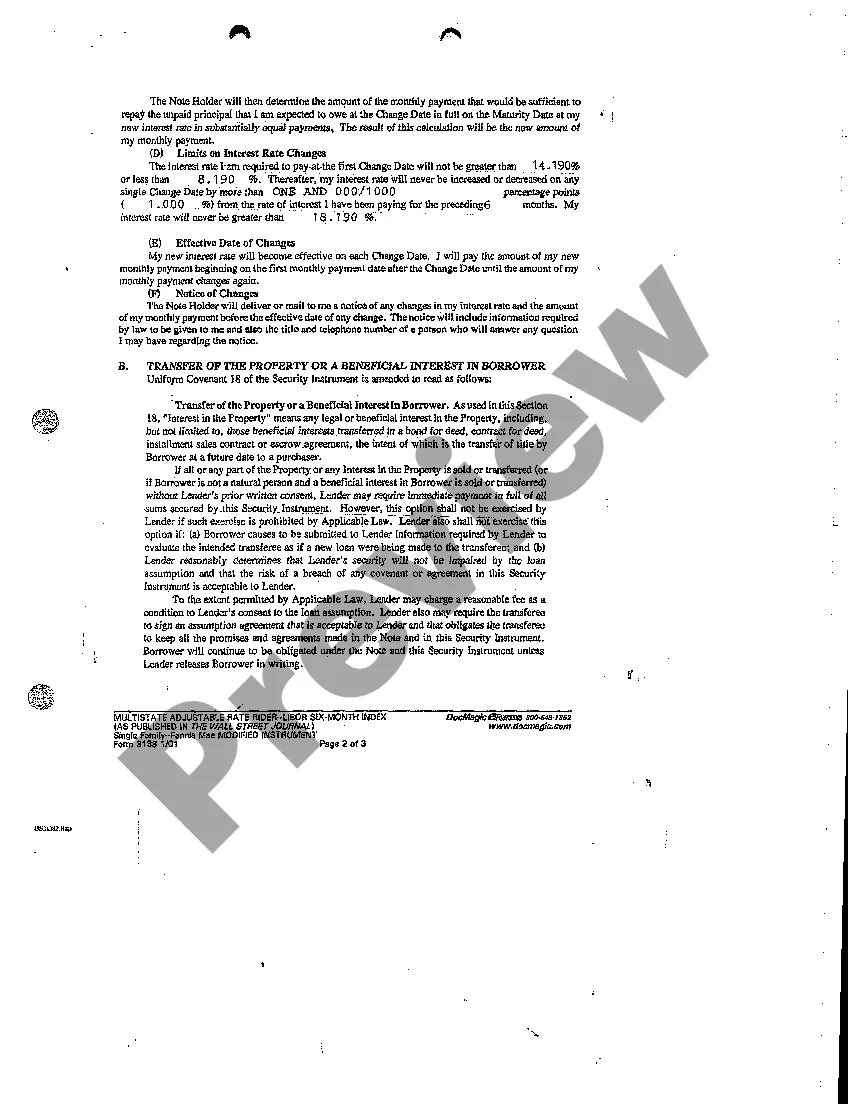

Montgomery Maryland Adjustable Rate Rider (ARM) is a lending instrument that is commonly used in mortgage loans in Montgomery County, Maryland. The ARM is designed to provide flexibility to borrowers by offering an adjustable interest rate rather than a fixed rate throughout the loan term. This allows borrowers to take advantage of fluctuating market conditions and potentially lower interest rates in the future. The Montgomery Maryland ARM typically starts with an initial fixed-rate period, also known as the introductory period, which can range from one to ten years. During this period, the interest rate remains unchanged, providing stability and predictable monthly payments to borrowers. After the initial period ends, the interest rate adjusts periodically based on a specific index, such as the London Interbank Offered Rate (LIBOR) or the Constant Maturity Treasury (CMT) rate, along with a predetermined margin set by the lender. There are different types of Montgomery Maryland Adjustable Rate Riders available, including: 1. Traditional ARM: This type of ARM has a fixed-rate period followed by periodic rate adjustments based on the market index and the margin. The adjustment frequency can be annual, semi-annual, or monthly, depending on the terms of the loan. 2. Hybrid ARM: This ARM offers a fixed-rate period, similar to the traditional ARM, but with a longer duration. For instance, a 5/1 ARM signifies a five-year fixed-rate period followed by annual adjustments for the remaining term. 3. Interest-only ARM: This ARM allows borrowers to make interest-only payments during the initial fixed-rate period, keeping their monthly payments relatively low. However, once the interest-only period ends, the remaining term will involve principal and interest payments that may increase. 4. Option ARM: This ARM provides borrowers with multiple payment options during the initial period, including fully amortizing payments, interest-only payments, or minimum payments. The minimum payment option can result in negative amortization, meaning the loan balance may increase over time. It is crucial for borrowers in Montgomery County, Maryland, to thoroughly understand the terms and risks associated with an Adjustable Rate Rider. They should carefully consider their financial situation, long-term goals, and market conditions to determine if an ARM is the right choice for their mortgage needs. Consulting with a reputable mortgage lender or financial advisor is highly recommended ensuring a well-informed decision.

Montgomery Maryland Adjustable Rate Rider

Description

How to fill out Montgomery Maryland Adjustable Rate Rider?

Take advantage of the US Legal Forms and have instant access to any form sample you want. Our beneficial website with thousands of templates makes it easy to find and obtain virtually any document sample you need. You can download, fill, and sign the Montgomery Maryland Adjustable Rate Rider in just a few minutes instead of browsing the web for hours looking for the right template.

Utilizing our collection is a superb way to increase the safety of your record submissions. Our professional legal professionals on a regular basis check all the records to make sure that the forms are appropriate for a particular region and compliant with new acts and regulations.

How can you get the Montgomery Maryland Adjustable Rate Rider? If you have a subscription, just log in to the account. The Download option will appear on all the documents you look at. Furthermore, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips listed below:

- Open the page with the form you require. Ensure that it is the template you were seeking: examine its title and description, and take take advantage of the Preview option when it is available. Otherwise, use the Search field to find the needed one.

- Launch the saving procedure. Click Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the file. Choose the format to obtain the Montgomery Maryland Adjustable Rate Rider and edit and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy template libraries on the web. We are always ready to help you in virtually any legal case, even if it is just downloading the Montgomery Maryland Adjustable Rate Rider.

Feel free to take full advantage of our service and make your document experience as straightforward as possible!