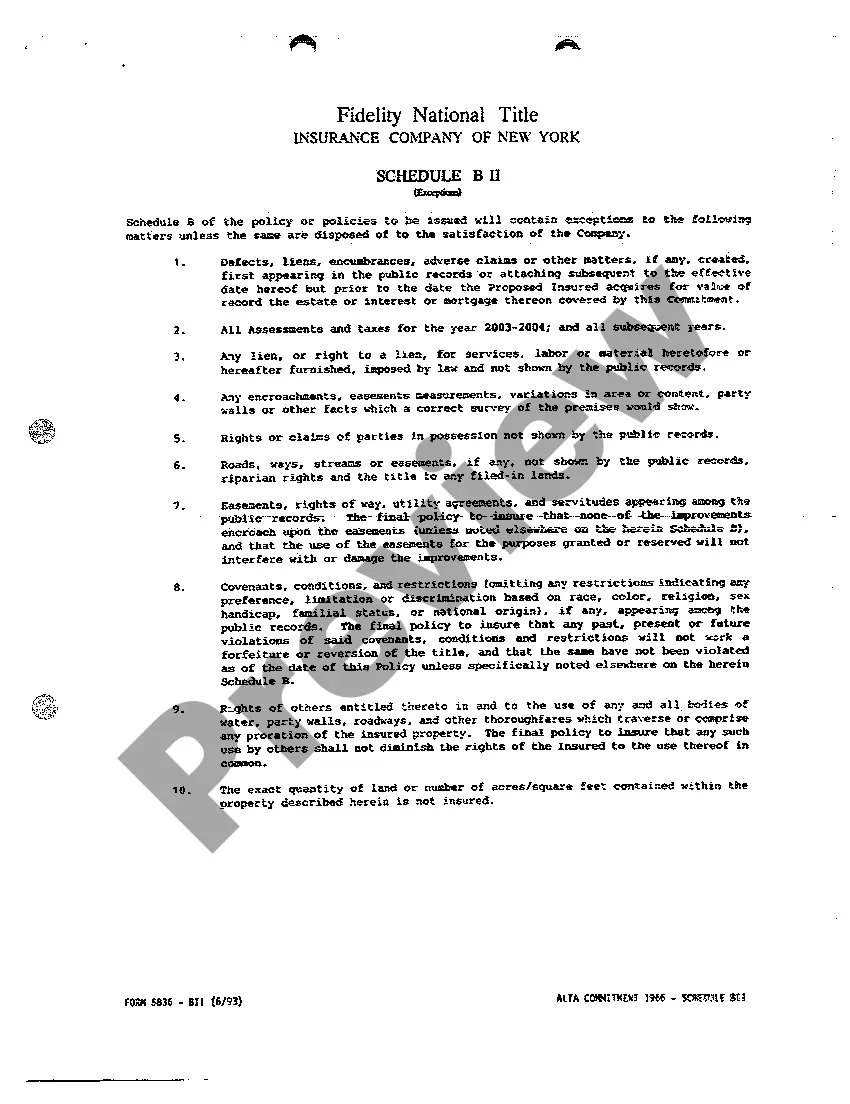

Montgomery Maryland Commitment for Title Insurance is a crucial step in the real estate transaction process, ensuring the buyer's property rights are protected. This commitment is a binding agreement between the insured party, typically the buyer, and the title insurance company, providing assurance of a clear and marketable title. A Montgomery Maryland Commitment for Title Insurance typically includes an extensive examination of public records to determine the property's ownership history, any liens, encumbrances, or claims that may impact the title's validity. This examination is performed by a licensed title examiner or attorney specializing in real estate law. There are several types of Montgomery Maryland Commitment for Title Insurance that serve different purposes, such as: 1. Owner's Policy Commitment: This type of commitment is issued to the buyer and protects their ownership rights against any future claims or defects in the title. It provides coverage up to the property's purchase price, safeguarding the owner's equity and financial investment. 2. Lender's Policy Commitment: Also referred to as a Loan Policy Commitment, this commitment is issued to the buyer's lender and protects their interest in the property. It ensures that the lender's mortgage lien is valid and enforceable, giving them additional security if the borrower defaults on the loan. 3. Leasehold Policy Commitment: In cases where the property is being sold on a leasehold basis, typically in a condominium or cooperative setting, a Leasehold Policy Commitment is issued. This commitment protects the buyer's leasehold interest and guarantees the validity of the lease. During the examination process, any defects or issues discovered are documented in a Schedule B-I Exceptions section. This section outlines the specific title concerns that must be addressed or resolved before the insurance is issued. Common issues that may arise include unpaid taxes, outstanding mortgages, easements, restrictive covenants, or pending lawsuits affecting the property. Once the commitment is issued, the buyer has an opportunity to review the document thoroughly and seek legal advice if needed. If the buyer is satisfied with the commitment's terms, they can proceed with the closing process, resolving any outstanding title issues listed on the Schedule B-I Exceptions. In conclusion, the Montgomery Maryland Commitment for Title Insurance is an essential component of a real estate transaction, providing peace of mind and financial protection to buyers and lenders. It ensures that the property's title is clear and marketable, protecting the buyer's investment and minimizing the risk of future unforeseen legal issues.

Montgomery Maryland Commitment for Title Insurance

Description

How to fill out Montgomery Maryland Commitment For Title Insurance?

Take advantage of the US Legal Forms and have instant access to any form you need. Our useful platform with a huge number of document templates makes it simple to find and get virtually any document sample you will need. You are able to download, fill, and sign the Montgomery Maryland Commitment for Title Insurance in a couple of minutes instead of surfing the Net for hours searching for an appropriate template.

Using our library is a wonderful way to improve the safety of your record submissions. Our experienced legal professionals regularly check all the records to make certain that the templates are relevant for a particular region and compliant with new laws and polices.

How do you obtain the Montgomery Maryland Commitment for Title Insurance? If you already have a profile, just log in to the account. The Download button will be enabled on all the samples you view. Moreover, you can get all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, follow the tips listed below:

- Open the page with the form you need. Ensure that it is the template you were seeking: check its title and description, and take take advantage of the Preview function if it is available. Otherwise, use the Search field to find the needed one.

- Start the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the file. Choose the format to get the Montgomery Maryland Commitment for Title Insurance and modify and fill, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy template libraries on the web. Our company is always ready to assist you in any legal case, even if it is just downloading the Montgomery Maryland Commitment for Title Insurance.

Feel free to benefit from our service and make your document experience as convenient as possible!