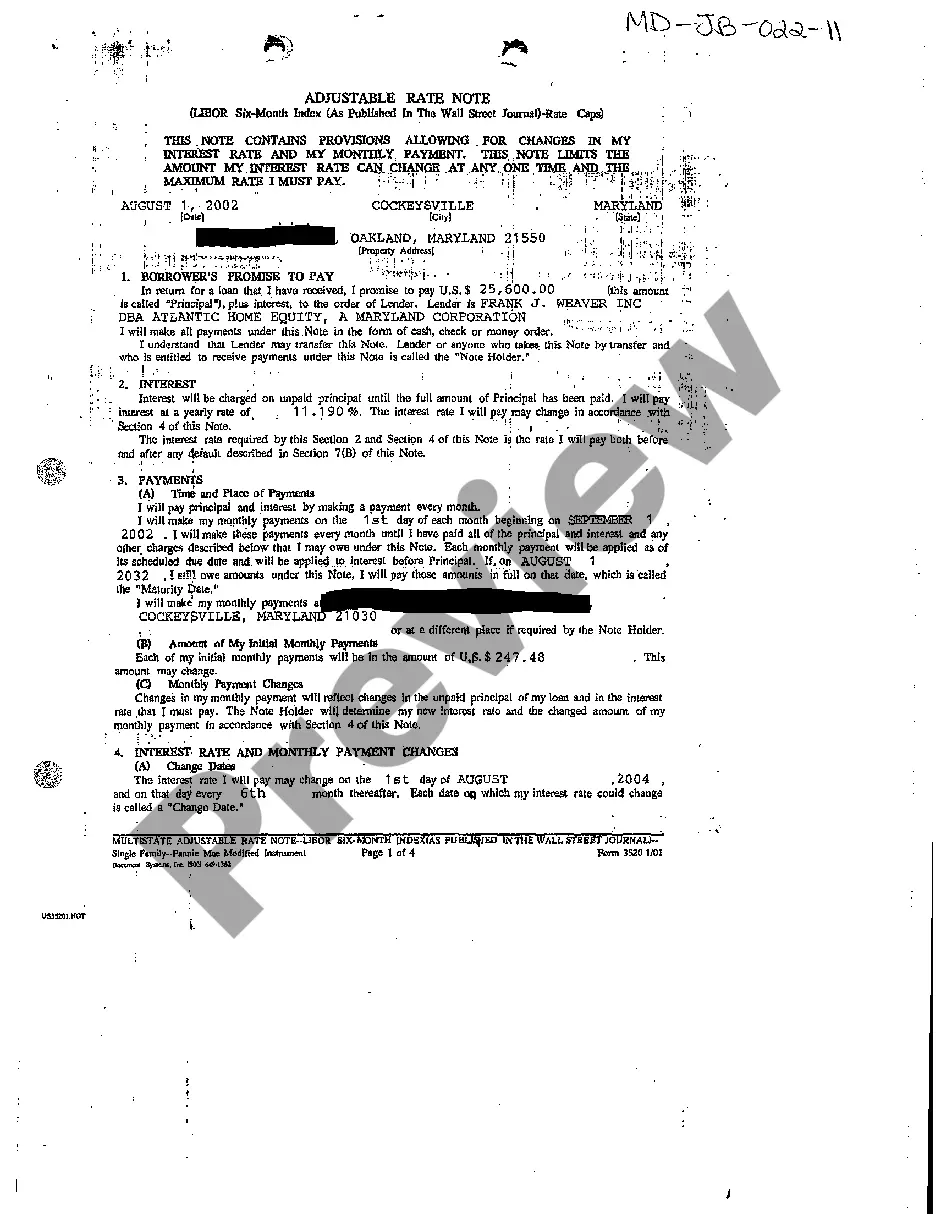

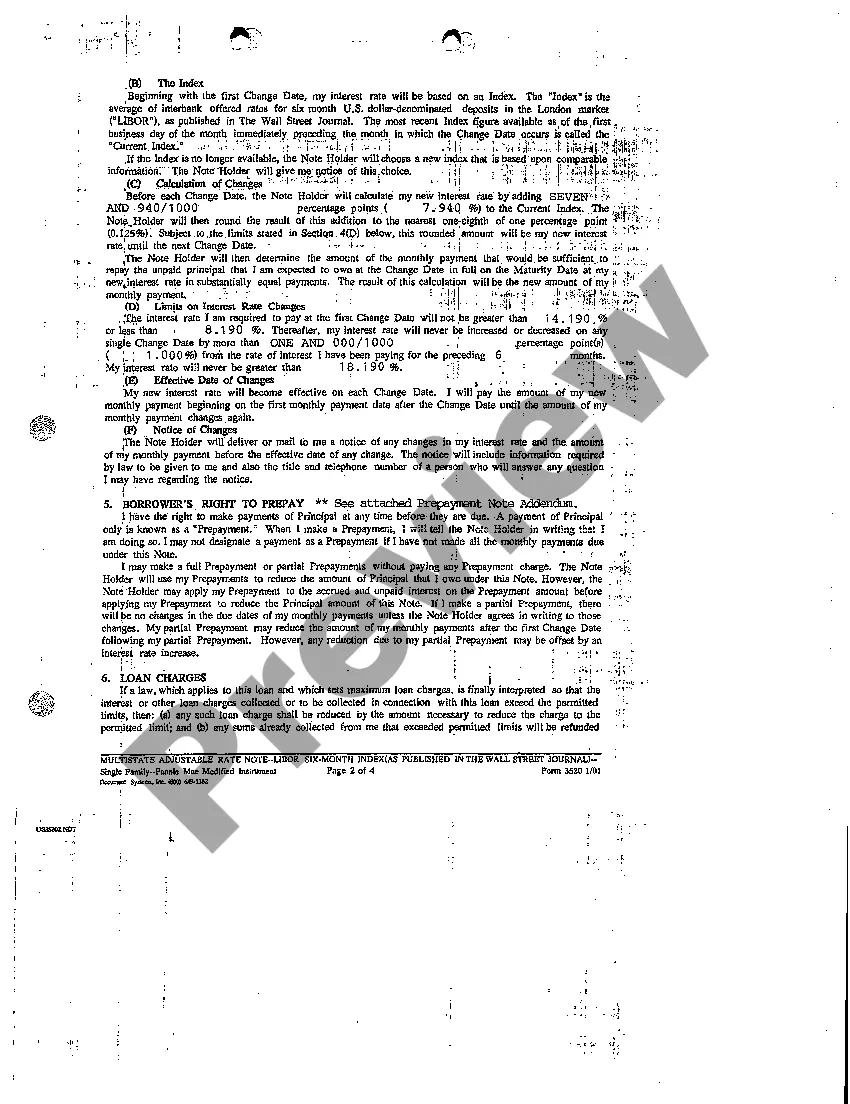

The Montgomery Maryland Adjustable Rate Note (ARM) is a financial instrument commonly used in the real estate industry. It is designed to provide flexibility to borrowers in terms of interest rates and monthly payments over the life of the loan. This type of note is commonly used in Montgomery County, Maryland, in order to accommodate the needs of borrowers in this specific region. The Montgomery Maryland ARM offers borrowers the option to start with a fixed interest rate for an initial period, typically ranging from 3 to 10 years. After this initial fixed rate period, the interest rate on the loan will adjust periodically, usually annually, based on a designated benchmark or index such as the London Inter-bank Offering Rate (LIBOR) or the Constant Maturity Treasury (CMT) index. The adjustable interest rate on the Montgomery Maryland ARM is commonly referred to as the "fully-indexed rate" and is determined by adding a predetermined margin, set by the lender, to the current index rate. The margin remains constant over the life of the loan and determines the additional interest charged on top of the index rate. The Montgomery Maryland ARM also contains various provisions to protect borrowers, such as interest rate caps and periods of rate adjustment. Caps limit the amount by which the interest rate can change during each adjustment period and over the life of the loan. This ensures that borrowers are not exposed to extreme interest rate fluctuations, providing a level of stability and predictability for their mortgage payments. It is important to note that different types of Montgomery Maryland Adjustable Rate Notes may exist, depending on the specific terms and conditions set by the lender. Some common types include: 1. 3/1 ARM: This note offers an initial fixed rate for three years, followed by annual adjustments. 2. 5/1 ARM: This note provides an initial fixed rate for five years, followed by annual adjustments. 3. 7/1 ARM: This note begins with a fixed rate for seven years, followed by annual adjustments. 4. 10/1 ARM: This ARM grants borrowers with a fixed rate for ten years, followed by annual adjustments. These different types of Montgomery Maryland ARM notes cater to borrowers with varying preferences and financial goals. They allow individuals to take advantage of lower initial interest rates and provide a flexible alternative to traditional fixed-rate mortgages. Overall, the Montgomery Maryland Adjustable Rate Note offers borrowers an opportunity to customize their loan terms, with the potential for lower initial payments and flexibility to adapt to changing market conditions. However, borrowers should carefully consider their financial situation and evaluate the risks associated with fluctuating interest rates before opting for an ARM. It is advisable to consult a qualified mortgage professional or financial advisor for guidance on the most suitable options available.

Montgomery Maryland Adjustable Rate Note

Description

How to fill out Montgomery Maryland Adjustable Rate Note?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we apply for legal solutions that, as a rule, are very expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Montgomery Maryland Adjustable Rate Note or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Montgomery Maryland Adjustable Rate Note complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Montgomery Maryland Adjustable Rate Note would work for you, you can pick the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!