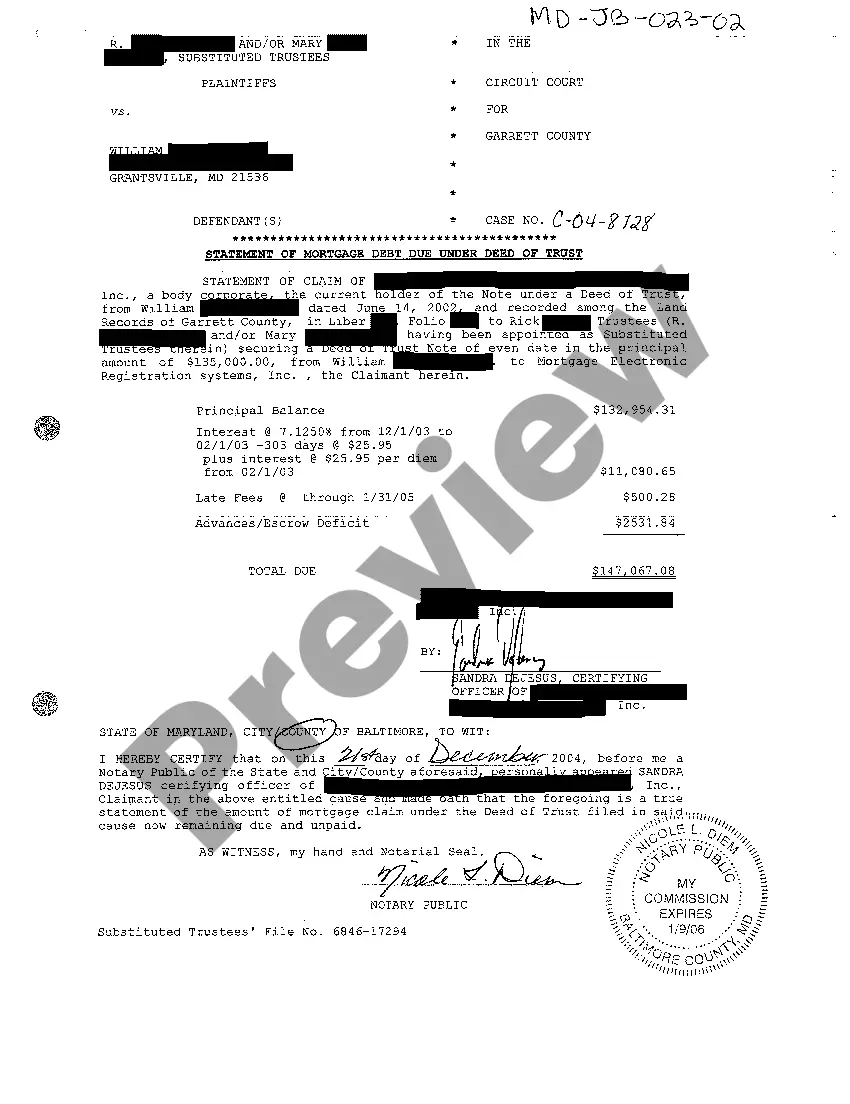

The Montgomery Maryland Statement of Mortgage Debt Due Under Deed of Trust is a legal document that outlines the exact amount owed by a borrower to a lender under a specific deed of trust agreement. This statement serves as a financial record and provides important details related to the mortgage debt. In Montgomery, Maryland, there are two main types of Statements of Mortgage Debt Due Under Deed of Trust: 1. Residential Statement of Mortgage Debt Due Under Deed of Trust: This type of statement is used for residential properties, such as single-family homes, townhouses, and condominiums. It specifies the outstanding principal balance of the mortgage, accrued interest, any unpaid fees or charges, and other relevant information related to the debt. 2. Commercial Statement of Mortgage Debt Due Under Deed of Trust: This statement is designed for commercial properties, such as office buildings, retail spaces, and industrial complexes. It provides a detailed breakdown of the outstanding principal balance, interest, late fees, and any additional charges associated with the commercial mortgage. The Montgomery Maryland Statement of Mortgage Debt Due Under Deed of Trust typically includes the following key information: 1. Borrower Details: The statement identifies the borrower(s) involved in the mortgage agreement, including their names, contact information, and sometimes their social security numbers. 2. Lender Information: It includes the name, address, and contact details of the lender or mortgage holder who is owed the debt. 3. Property Description: This section provides a clear description of the mortgaged property, including the address, legal description, and any other relevant information needed for identification. 4. Principal Balance: The statement specifies the current unpaid principal balance, which is the original loan amount minus any repayments made by the borrower. 5. Accrued Interest: It outlines the amount of interest that has accumulated on the loan since the last payment. The interest is typically calculated based on the loan's interest rate and the time period since the previous payment. 6. Late Fees and Penalties: If the borrower has failed to make timely payments, the statement may include any applicable late fees, penalties, or charges imposed by the lender. 7. Escrow Account: If the borrower has an escrow account for property taxes and insurance, the statement may mention the balance in the account and any adjustments made for upcoming payments. 8. Additional Charges and Fees: This section covers any other charges or fees incurred by the borrower, such as appraisal fees, recording fees, or attorney fees. 9. Total Amount Due: The statement provides a grand total of all the outstanding debt, including the principal balance, accrued interest, late fees, and any additional charges. It's crucial to review the Montgomery Maryland Statement of Mortgage Debt Due Under Deed of Trust carefully to ensure accuracy and address any discrepancies. This document plays a significant role in understanding the borrower's financial obligations towards the lender under the specific deed of trust arrangement.

Montgomery Maryland Statement of Mortgage Debt Due Under Deed of Trust

Description

How to fill out Montgomery Maryland Statement Of Mortgage Debt Due Under Deed Of Trust?

We always strive to reduce or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for legal solutions that, as a rule, are very expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of a lawyer. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Montgomery Maryland Statement of Mortgage Debt Due Under Deed of Trust or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Montgomery Maryland Statement of Mortgage Debt Due Under Deed of Trust complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Montgomery Maryland Statement of Mortgage Debt Due Under Deed of Trust would work for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!