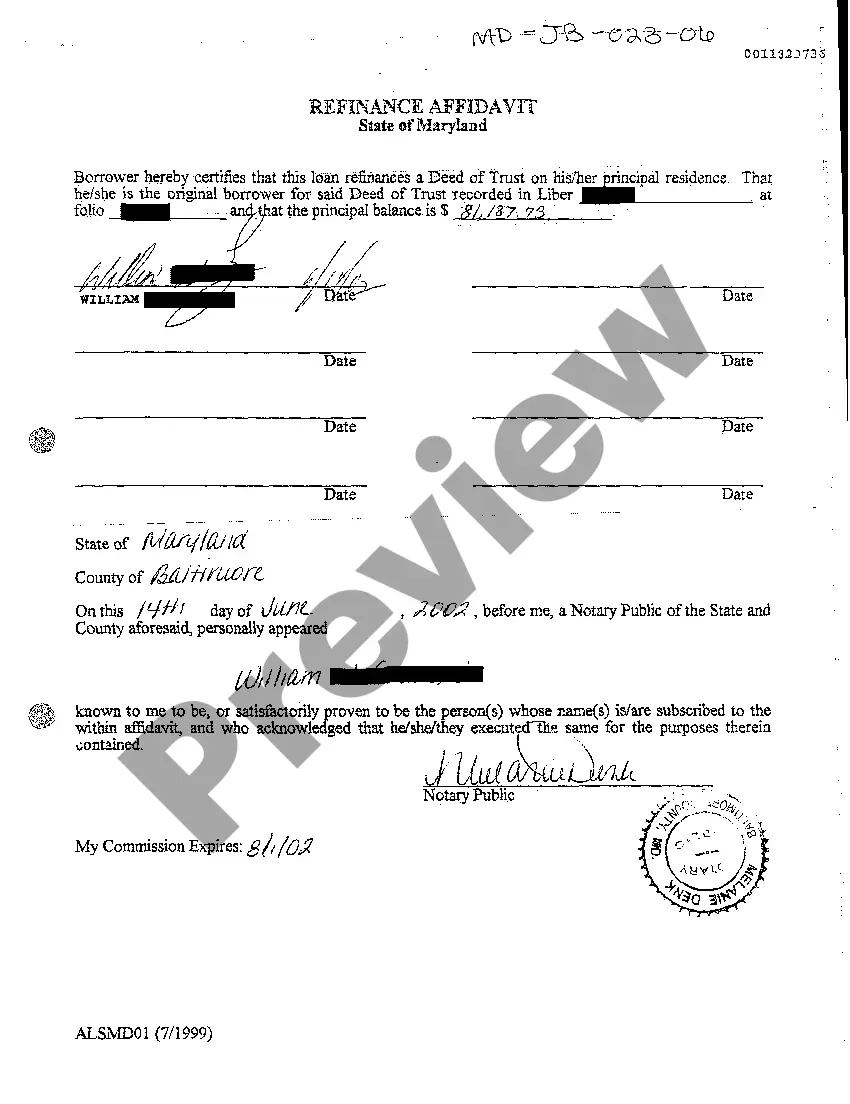

The Montgomery Maryland Refinance Affidavit is a legal document used in the state of Maryland for refinancing purposes. It serves as a sworn statement made by the borrower(s) to confirm certain facts and information about the refinancing transaction. This affidavit is essential for lenders to ensure that all parties involved in the refinancing process are aware of their obligations and responsibilities. Keywords: Montgomery Maryland, refinance, affidavit, legal document, refinancing purposes, borrower(s), sworn statement, facts, information, refinance transaction, lenders, obligations, responsibilities. There are different types of Montgomery Maryland Refinance Affidavits, including: 1. Loan Application Affidavit: This type of affidavit is completed by the borrower(s) at the initiation of the refinancing process. It includes personal information such as income, employment history, and credit history. 2. Property Disclosure Affidavit: This affidavit requires the borrower(s) to disclose any known issues or defects with the property being refinanced. It ensures that all parties are aware of any potential risks associated with the property. 3. Financial Statement Affidavit: This affidavit requires the borrower(s) to provide a comprehensive financial statement, including assets, liabilities, and income. It helps lenders assess the borrower's financial health and determine their eligibility for refinancing. 4. Title Affidavit: This affidavit confirms the borrower(s) have a clear title to the property and there are no outstanding liens or encumbrances. It protects the lender's interest in the property during the refinancing process. 5. Occupancy Affidavit: This affidavit confirms that the borrower(s) will occupy the property being refinanced as their primary residence. It ensures that the refinancing complies with any applicable occupancy requirements and prevents fraud. 6. Power of Attorney Affidavit: If the borrower(s) are unable to personally sign the refinancing documents, this affidavit authorizes a designated individual (the attorney-in-fact) to act on their behalf. It is commonly used when the borrower(s) are unable to attend the closing. In summary, the Montgomery Maryland Refinance Affidavit is a crucial legal document used during the refinancing process. It serves as a sworn statement by the borrower(s) and is required by lenders to ensure compliance with various regulations and protect their interests.

Montgomery Maryland Refinance Affidavit

Description

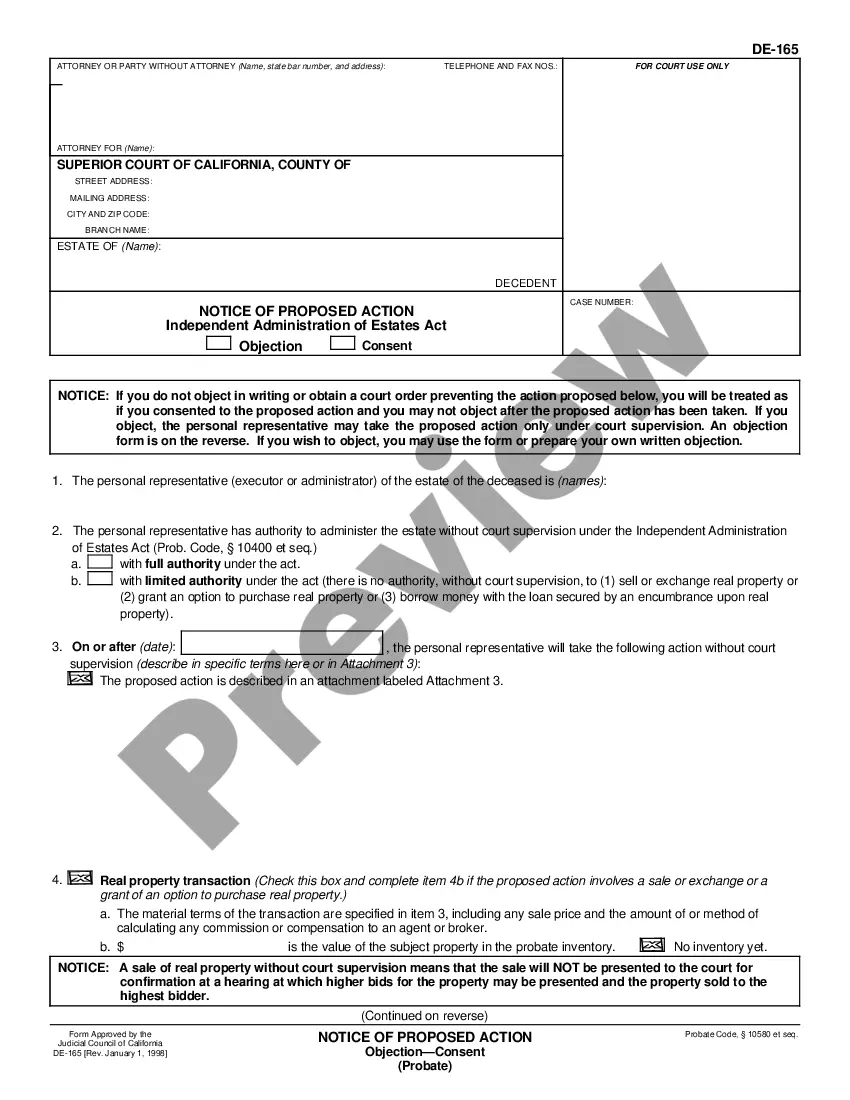

How to fill out Montgomery Maryland Refinance Affidavit?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we apply for attorney solutions that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Montgomery Maryland Refinance Affidavit or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Montgomery Maryland Refinance Affidavit adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Montgomery Maryland Refinance Affidavit is suitable for you, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

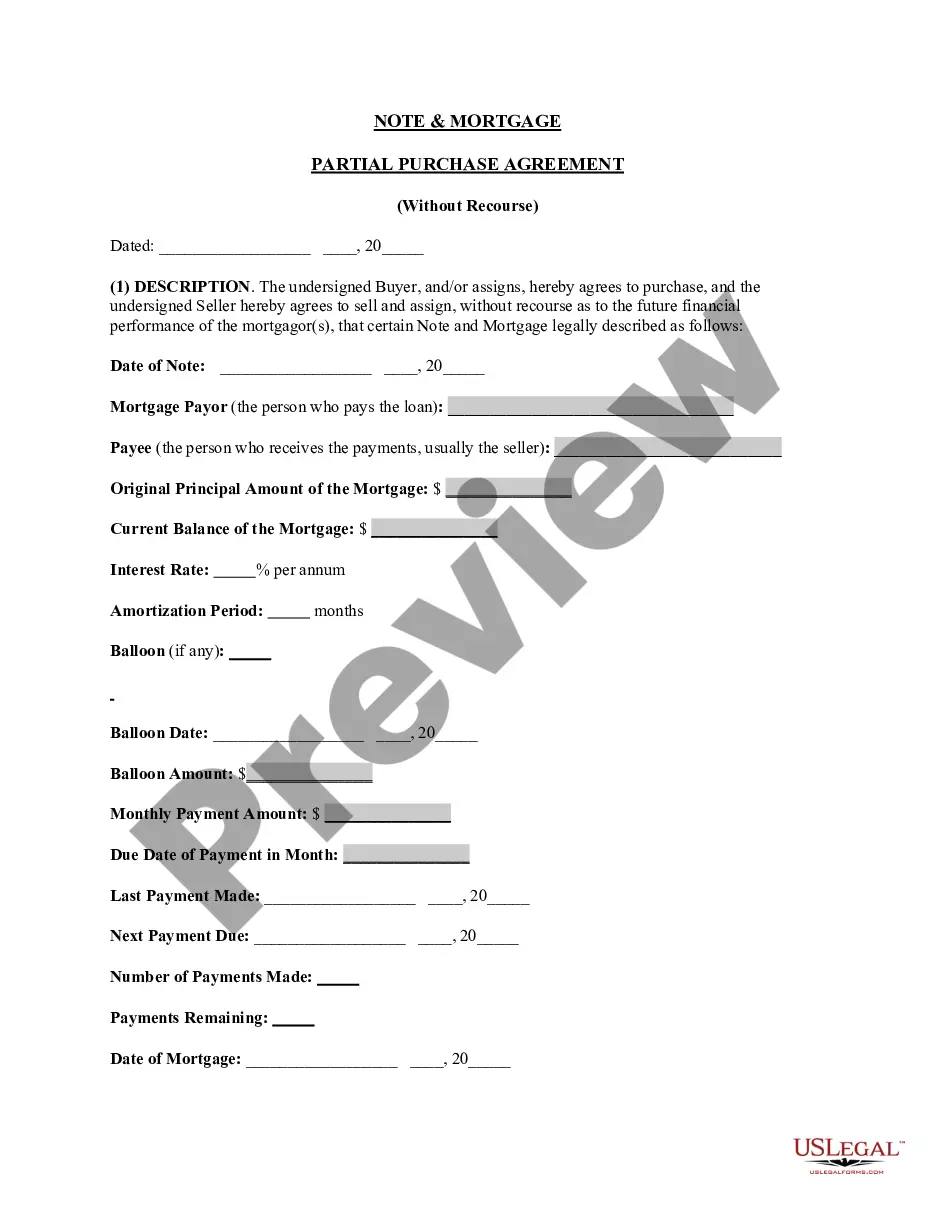

Six Essential Documents You Need to Refinance Your Mortgage Salary statements.W-2s, 1099s, and Tax Returns.Insurance for Homeowners.Statements of Assets.Proof of Expenses.Extra Documentations.

Regarding transfer taxes, most jurisdictions in Maryland do not require you to pay new transfer taxes at the time of your refinance settlement. However, in most jurisdictions, you must pay the State Revenue Stamps (this amount varies by county) on the new money being borrowed.

Transfer Taxes Transfer tax is at the rate of . 5 percent of the actual consideration, unless they are a first-time Maryland home buyer purchasing a principal place of residence, in that case the transfer tax rate is .

County transfer tax This tax is imposed at 1% of the purchase price (or total consideration) and customarily split 50/50 between buyer and seller. Thus, typically, the buyer pays . 5% and the seller pays .

Regarding transfer taxes, most jurisdictions in Maryland do not require you to pay new transfer taxes at the time of your refinance settlement. However, in most jurisdictions, you must pay the State Revenue Stamps (this amount varies by county) on the new money being borrowed.

There is zero transfer / recordation tax for refinances.

Neither Maryland State law nor Montgomery County require that property taxes be paid when refinancing a mortgage.

The Refinance Exemption allows that, in the event the amount secured by a refinance deed of trust is greater than the unpaid principal balance of the loan secured by the existing deed of trust, State Recordation Tax is calculated on the amount of the increase, as opposed to on the entire new principal amount.

Your home equity must be sufficient: Typically, your home's market value must exceed your mortgage balance by anywhere from 3% to 20% You need a decent credit score: The minimum credit score to refinance typically ranges from 580 to 680, depending on your lender and loan program.