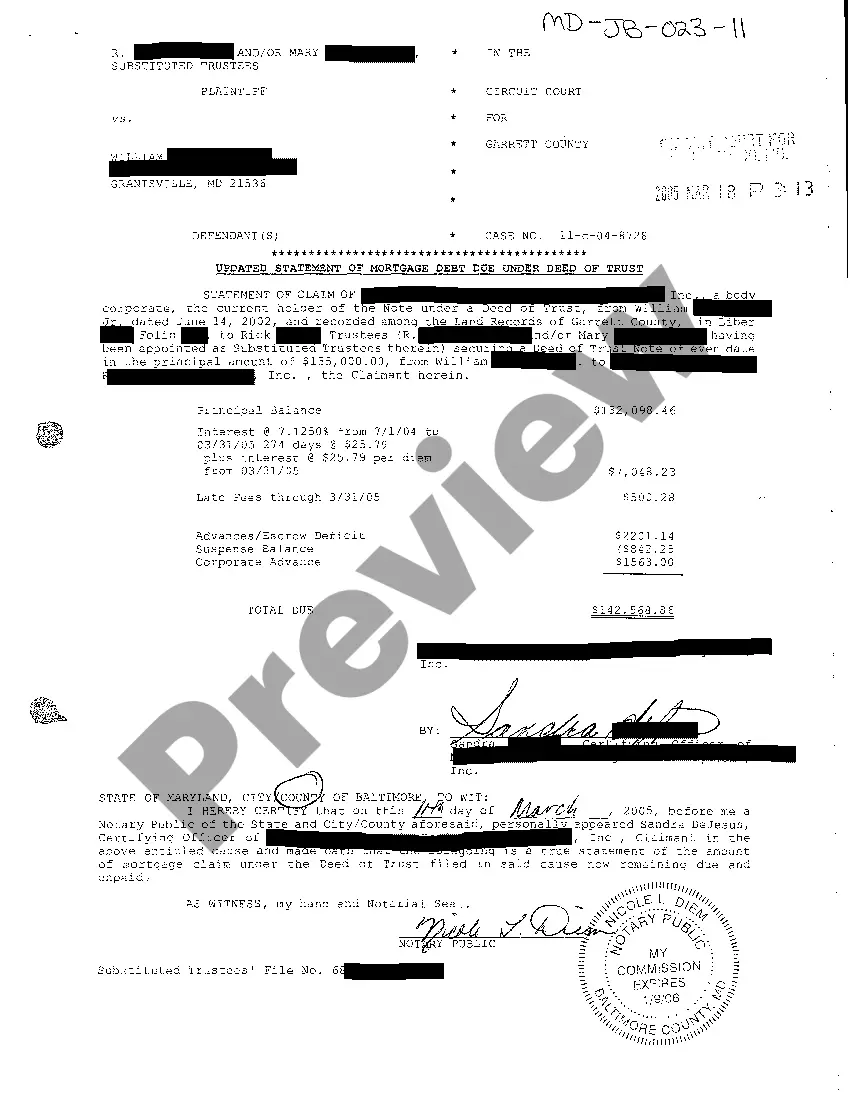

Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust: A Comprehensive Overview The Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust is a legal document that provides a detailed summary of the outstanding mortgage debt owed by a borrower in Montgomery County, Maryland, secured by a property through a deed of trust. This statement serves as an important record for both lenders and borrowers, outlining the various aspects of the mortgage debt and its repayment terms. Key Elements Covered in Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust: 1. Identification Information: The document starts by providing essential details about the borrower, lender, and property. This includes the full names and contact information of the parties involved, as well as the legal description and address of the property securing the mortgage debt. 2. Loan Summary: The statement offers a comprehensive breakdown of the loan amount, including the principal balance, any outstanding interest, and other charges associated with the debt. It may also indicate the interest rate, origination date, and maturity date of the loan. 3. Payment Schedule: This section outlines the repayment terms for the mortgage debt, including the frequency of payments (e.g., monthly, quarterly), the due dates, and the amount due at each payment. Additionally, it may indicate any grace periods, late payment penalties, or prepayment options available to the borrower. 4. Escrow Account Details: If the borrower is required to maintain an escrow account to cover taxes and insurance, the updated statement will include information about the account. This may include the current balance, projected disbursements, and any anticipated adjustments to the monthly payment due to changes in taxes or insurance premiums. 5. Modification or Refinancing Details: If any modifications or refinancing of the original mortgage debt have occurred, the statement will highlight these changes. It might include information about adjusted interest rates, modified payment terms, or any additional debt incurred. Different Types of Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust: 1. Initial Statement of Mortgage Debt: This document is typically provided at the commencement of the loan and outlines the initial terms and conditions agreed upon by the borrower and lender. 2. Updated Statement of Mortgage Debt: Whenever there are noteworthy changes to the original mortgage debt, such as loan modifications, refinancing, or adjustments in payment terms, an updated statement is issued to reflect the updated information accurately. 3. Payoff Statement: This type of statement is requested by borrowers when they intend to pay off the full mortgage debt. It outlines the exact amount required to satisfy the debt and any applicable prepayment penalties. 4. Subordination Agreement Statement: In situations where the original mortgage debt needs to be subordinated to a new debt, such as when refinancing or adding a home equity loan, a subordination agreement statement is issued. It highlights the revised priority of the debts. In conclusion, the Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust serves as a comprehensive record of the outstanding mortgage debt, repayment terms, and related details. It assists both borrowers and lenders in understanding the current status of the loan and aids in maintaining a transparent and accountable financial relationship.

Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust

State:

Maryland

County:

Montgomery

Control #:

MD-JB-023-11

Format:

PDF

Instant download

This form is available by subscription

Description

A12 Updated Statement of Mortgage Debt Due Under Deed of Trust

Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust: A Comprehensive Overview The Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust is a legal document that provides a detailed summary of the outstanding mortgage debt owed by a borrower in Montgomery County, Maryland, secured by a property through a deed of trust. This statement serves as an important record for both lenders and borrowers, outlining the various aspects of the mortgage debt and its repayment terms. Key Elements Covered in Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust: 1. Identification Information: The document starts by providing essential details about the borrower, lender, and property. This includes the full names and contact information of the parties involved, as well as the legal description and address of the property securing the mortgage debt. 2. Loan Summary: The statement offers a comprehensive breakdown of the loan amount, including the principal balance, any outstanding interest, and other charges associated with the debt. It may also indicate the interest rate, origination date, and maturity date of the loan. 3. Payment Schedule: This section outlines the repayment terms for the mortgage debt, including the frequency of payments (e.g., monthly, quarterly), the due dates, and the amount due at each payment. Additionally, it may indicate any grace periods, late payment penalties, or prepayment options available to the borrower. 4. Escrow Account Details: If the borrower is required to maintain an escrow account to cover taxes and insurance, the updated statement will include information about the account. This may include the current balance, projected disbursements, and any anticipated adjustments to the monthly payment due to changes in taxes or insurance premiums. 5. Modification or Refinancing Details: If any modifications or refinancing of the original mortgage debt have occurred, the statement will highlight these changes. It might include information about adjusted interest rates, modified payment terms, or any additional debt incurred. Different Types of Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust: 1. Initial Statement of Mortgage Debt: This document is typically provided at the commencement of the loan and outlines the initial terms and conditions agreed upon by the borrower and lender. 2. Updated Statement of Mortgage Debt: Whenever there are noteworthy changes to the original mortgage debt, such as loan modifications, refinancing, or adjustments in payment terms, an updated statement is issued to reflect the updated information accurately. 3. Payoff Statement: This type of statement is requested by borrowers when they intend to pay off the full mortgage debt. It outlines the exact amount required to satisfy the debt and any applicable prepayment penalties. 4. Subordination Agreement Statement: In situations where the original mortgage debt needs to be subordinated to a new debt, such as when refinancing or adding a home equity loan, a subordination agreement statement is issued. It highlights the revised priority of the debts. In conclusion, the Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust serves as a comprehensive record of the outstanding mortgage debt, repayment terms, and related details. It assists both borrowers and lenders in understanding the current status of the loan and aids in maintaining a transparent and accountable financial relationship.

How to fill out Montgomery Maryland Updated Statement Of Mortgage Debt Due Under Deed Of Trust?

If you’ve already utilized our service before, log in to your account and save the Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Montgomery Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!