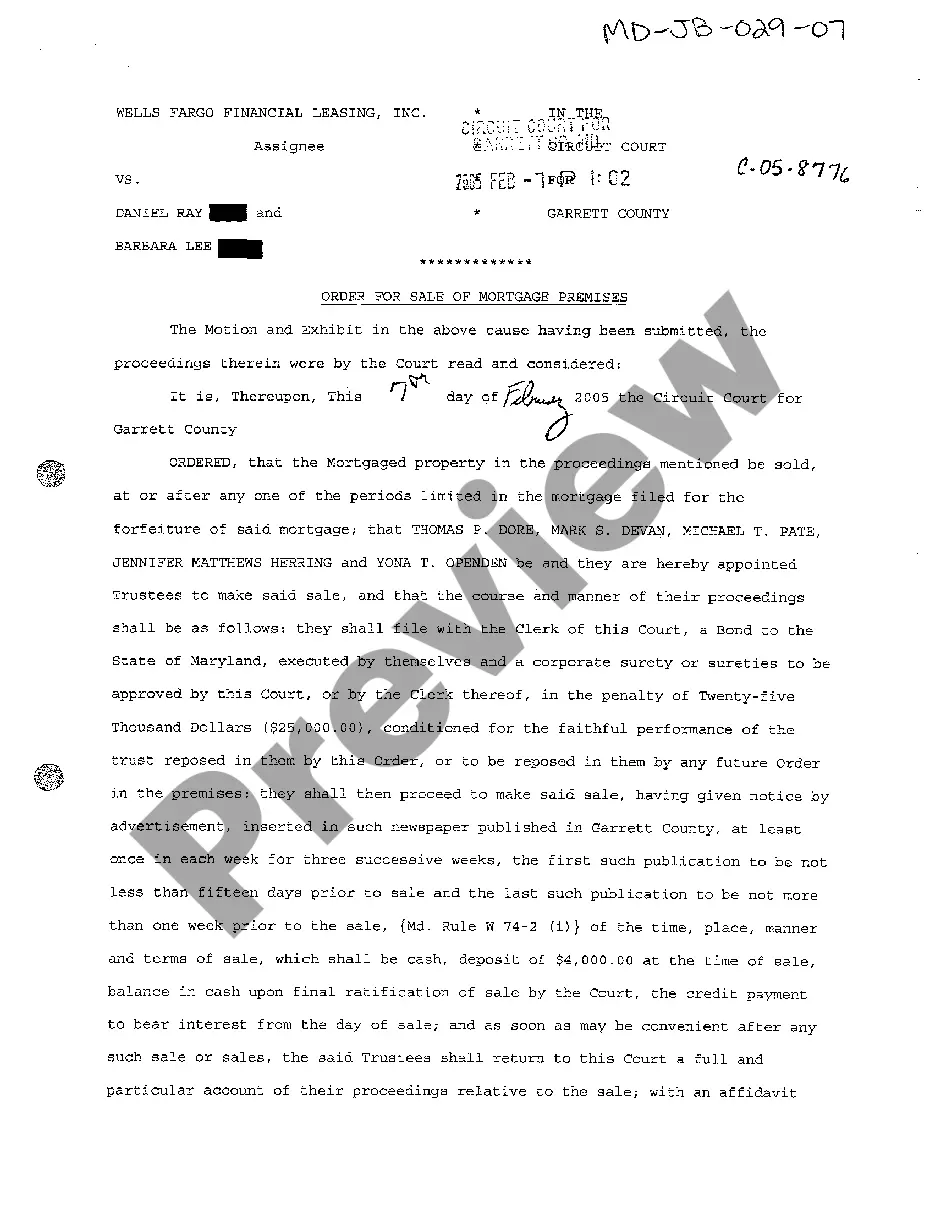

Montgomery Maryland Order for Sale of Mortgage Premises is a legal process that involves the forced sale of a property to settle a mortgage debt. This order is typically issued by a court in Montgomery County, Maryland. In Montgomery County, there are a few different types of orders for the sale of mortgage premises, depending on the specific circumstances: 1. Default Judgment Order for Sale of Mortgage Premises: This type of order is issued when a homeowner fails to make mortgage payments, leading to foreclosure. The lender initiates legal proceedings, and if the court grants a default judgment, an order for sale of mortgage premises is issued to recover the outstanding debt. 2. Consent Order for Sale of Mortgage Premises: In certain cases, the homeowner may agree to a sale of the property to avoid foreclosure. This consent order can be entered into voluntarily by both parties, setting out the terms and conditions of the sale. 3. Final Judgment Order for Sale of Mortgage Premises: After a foreclosure lawsuit is initiated and litigated, the court may issue a final judgment order for the sale of mortgage premises. This order typically includes details about the sale process, such as the method of sale, auction date, and redemption period. 4. Motion Order for Sale of Mortgage Premises: In situations where a homeowner has not responded to foreclosure proceedings, the lender may file a motion for an order of sale. If the court grants the motion, a sale of the mortgaged premises will be scheduled to recover the debt owed. 5. Order Confirming Sale of Mortgage Premises: Following the sale of the property, the court may issue an order confirming the sale. This order validates the sale and outlines the distribution of proceeds among the interested parties, such as the lender and any liens or claims against the property. These different types of orders for the sale of mortgage premises provide a legal framework for resolving disputes related to defaulted mortgages in Montgomery County, Maryland. It is crucial for homeowners to seek legal advice when facing foreclosure to understand their rights and options throughout the process.

Montgomery Maryland Order for Sale of Mortgage Premises

Description

How to fill out Montgomery Maryland Order For Sale Of Mortgage Premises?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Montgomery Maryland Order for Sale of Mortgage Premises becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Montgomery Maryland Order for Sale of Mortgage Premises takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Montgomery Maryland Order for Sale of Mortgage Premises. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

County Transfer Tax is typically computed at 1% of the selling price of a property. Recordation tax is $8.90 per thousand rounded up to the next increment of $500 up to $500,000. (Over $500,000 it is computed at 1.35%).

Deeds can be viewed for free online through mdlandrec.net. You must create an account with the Maryland State Archives to view deeds on mdlandrec.net. Many courthouses also have computer terminals you can use to search or review deeds.

Contact the Maryland State Archives Help Desk at 410-260-6487 for questions regarding mdlandrec.net and .

The Department of Land Records can record any ?instrument? (or legal document) that affects someone's legal interest in real property. Common documents recorded in land records are deeds, mortgages, liens, powers of attorney, and certain leases.

To obtain a copy of a deed, you must contact Land Records for Prince George's County. The help desk phone number is 301-780-2253.

The links below may be used to research land records, liens, and plats on-line. MDLandRec.Net. CASESEARCH. PLATS.NET. (A digital image retrieval system for land record indices in Maryland)

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate (including contracted-for improvements to property) transferred by deed, instrument, long-term lease or other writing. Both grantor and grantee are held jointly and severally liable for payment of the tax.

Anyone can check for liens in Maryland by contacting the Department of Land Records, located in the circuit court clerk's office of the county where the property is located. This department records and maintains land records, including liens on real properties.

You can find all Punjab and Sindh property records online at and sindhzameen.gos.pk respectively. Select your district, tehsil and area from the drop-down list. Enter your CNIC number or property number to check property ownership in Pakistan.

There is a mandatory conveyance/transfer fee of $3 per $1,000 of the actual sale price and $. 50 for each parcel of property that is transferred. Please note: The REAL PROPERTY CONVEYANCE FEE STATEMENT OF VALUE AND RECEIPT form has been updated for 2021.