The Montgomery County Statement of Indebtedness is a legal document that outlines the financial obligations of the County government in Montgomery, Maryland. It serves as an official record of all outstanding debts and liabilities incurred by the County. This statement is mandated by state regulations and provides transparency to taxpayers, bondholders, and other stakeholders regarding the County's financial health. It highlights the County's borrowing activities and obligations, including bond issuance, loans, and lease-purchase agreements. Keywords: Montgomery County, Statement of Indebtedness, Maryland, financial obligations, County government, outstanding debts, liabilities, County's financial health, borrowing activities, bond issuance, loans, lease-purchase agreements. There are several types of Montgomery County Statements of Indebtedness, namely: 1. General Obligation Bonds: These are long-term debt instruments issued by the County to finance various capital projects, such as infrastructure development, school construction, and public facilities' improvement. They are backed by the County's taxing authority. 2. Revenue Bonds: Unlike general obligation bonds, revenue bonds are secured by the income generated from specific projects or activities financed by the bond proceeds. These may include toll roads, utilities, or other revenue-generating assets. 3. Certificates of Participation: These are lease-purchase agreements where the County sells an interest in real property or a tangible asset to an investor. The investor receives a certificate representing their equity interest in the lease agreement, while the County secures funds for capital projects. 4. Loans and Lines of Credit: The County may also enter into loan agreements or establish lines of credit with financial institutions to address short-term budgetary needs or finance specific projects. Through the issuance of these various types of indebtedness, the County meets its financial obligations while ensuring the efficient operation of public services, infrastructure development, and overall community improvement. Keywords: general obligation bonds, revenue bonds, certificates of participation, loans, lines of credit, capital projects, infrastructure development, school construction, public facilities, revenue-generating assets, financial obligations.

Montgomery Maryland Statement of Indebtedness

State:

Maryland

County:

Montgomery

Control #:

MD-JB-030-05

Format:

PDF

Instant download

This form is available by subscription

Description

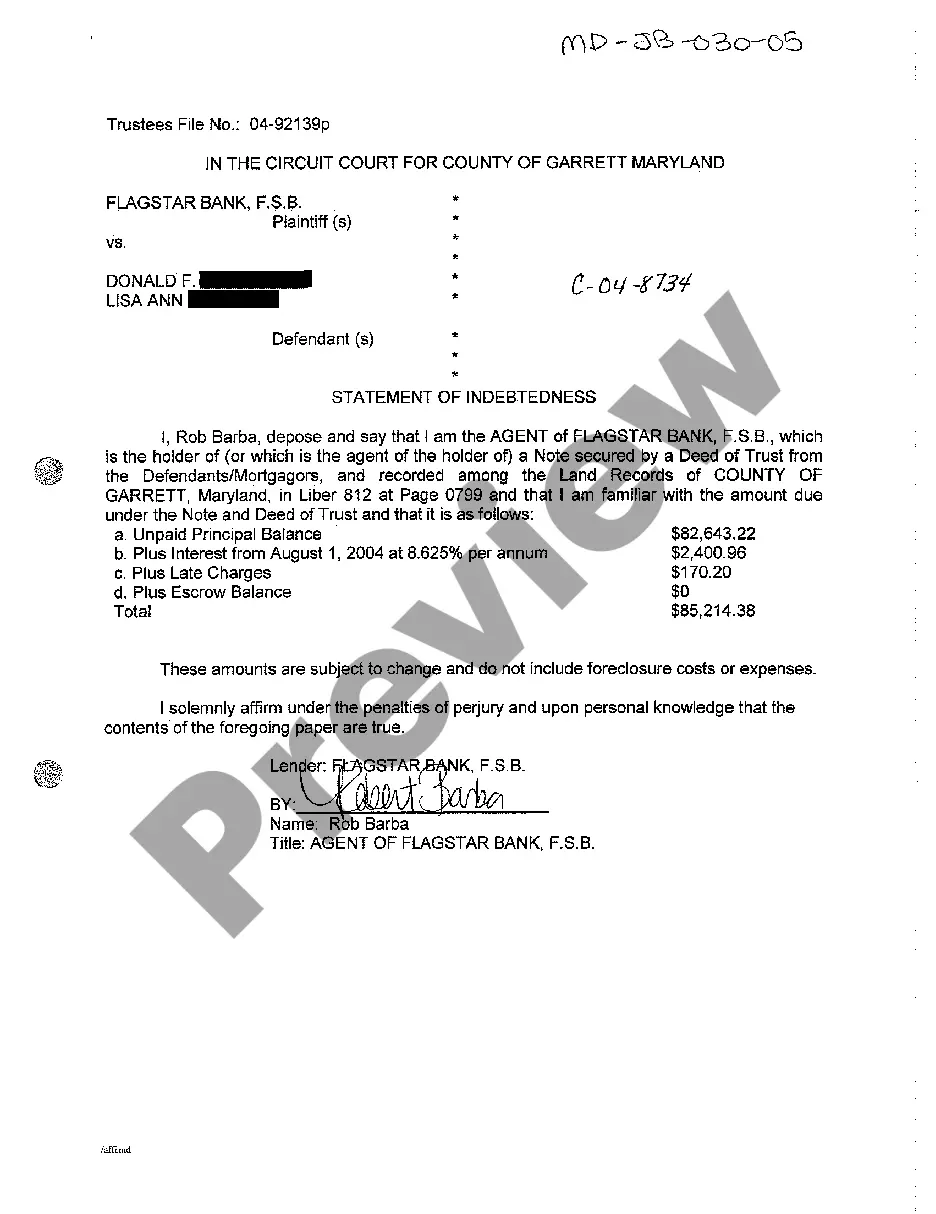

A06 Statement of Indebtedness

The Montgomery County Statement of Indebtedness is a legal document that outlines the financial obligations of the County government in Montgomery, Maryland. It serves as an official record of all outstanding debts and liabilities incurred by the County. This statement is mandated by state regulations and provides transparency to taxpayers, bondholders, and other stakeholders regarding the County's financial health. It highlights the County's borrowing activities and obligations, including bond issuance, loans, and lease-purchase agreements. Keywords: Montgomery County, Statement of Indebtedness, Maryland, financial obligations, County government, outstanding debts, liabilities, County's financial health, borrowing activities, bond issuance, loans, lease-purchase agreements. There are several types of Montgomery County Statements of Indebtedness, namely: 1. General Obligation Bonds: These are long-term debt instruments issued by the County to finance various capital projects, such as infrastructure development, school construction, and public facilities' improvement. They are backed by the County's taxing authority. 2. Revenue Bonds: Unlike general obligation bonds, revenue bonds are secured by the income generated from specific projects or activities financed by the bond proceeds. These may include toll roads, utilities, or other revenue-generating assets. 3. Certificates of Participation: These are lease-purchase agreements where the County sells an interest in real property or a tangible asset to an investor. The investor receives a certificate representing their equity interest in the lease agreement, while the County secures funds for capital projects. 4. Loans and Lines of Credit: The County may also enter into loan agreements or establish lines of credit with financial institutions to address short-term budgetary needs or finance specific projects. Through the issuance of these various types of indebtedness, the County meets its financial obligations while ensuring the efficient operation of public services, infrastructure development, and overall community improvement. Keywords: general obligation bonds, revenue bonds, certificates of participation, loans, lines of credit, capital projects, infrastructure development, school construction, public facilities, revenue-generating assets, financial obligations.

How to fill out Montgomery Maryland Statement Of Indebtedness?

If you’ve already used our service before, log in to your account and download the Montgomery Maryland Statement of Indebtedness on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Montgomery Maryland Statement of Indebtedness. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!