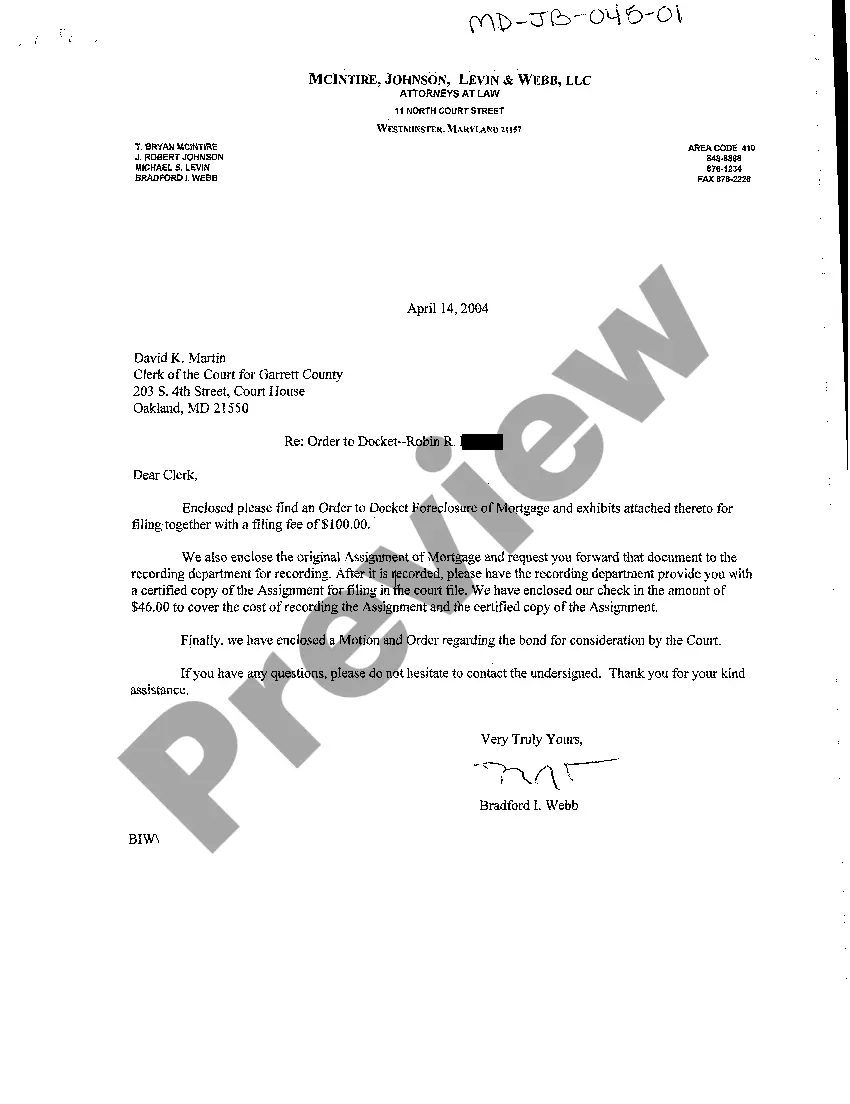

Montgomery, Maryland, located in the United States, follows a specific legal protocol when it comes to notifying individuals about an Order to Docket. This letter serves as an important legal document, informing the recipient of an impending legal action related to a debt or other financial obligation. Understanding its purpose and implications is crucial for individuals involved in such matters. An Order to Docket is typically issued by a court or other authorized entity, requiring a debtor to pay an outstanding debt or face legal consequences. Once served with this order, individuals are provided with a certain period, known as the redemption period, to settle the debt or take appropriate action to prevent further legal action. Failure to comply with the order during this timeframe may lead to eviction, property seizure, or further legal proceedings. Customarily, the Letter Regarding Order to Docket serves as official notification to the debtor. This document includes detailed information such as the debtor's name, relevant case number, the amount owed, contact details of the creditor or their representative, and the designated redemption period. The letter should also provide clear instructions on how to resolve the debt, including acceptable methods of payment or alternative actions to halt the legal process. In Montgomery, Maryland, there may be different types or variations of the Letter Regarding Order to Docket, depending on the specific circumstances of the debt. Some examples include: 1. Mortgage Foreclosure Letter: This type of letter is issued when a debtor fails to meet mortgage payment obligations, resulting in a foreclosure action. It outlines the outstanding amount, outlines any potential options for resolution, and informs the debtor of the current status of their property. 2. Tax Lien Notice: In situations where an individual has unpaid, overdue taxes, a letter regarding an Order to Docket may be sent by the local tax authority. This notice informs the taxpayer of the outstanding amount, penalties, and the possible actions that will be taken if the debt remains unpaid. 3. Unpaid Judgment: If an individual has been ordered to pay a judgment amount by a court but fails to fulfill the obligation, a Letter Regarding Order to Docket could be issued. This letter serves as a final notice to the debtor, emphasizing the need to satisfy the judgment or face potential enforcement actions. In conclusion, the Montgomery, Maryland Letter Regarding Order to Docket is a crucial legal document that informs debtors of actions being taken against them due to non-payment of debts. It serves to provide clear instructions and sets a redemption period for the debtor to resolve the debt before further legal action is taken. Different types of Letters Regarding Order to Docket may exist, catering to various specific situations such as mortgage foreclosure, tax liens, or unpaid judgments. It is imperative for recipients of such letters to carefully review their content, seek legal advice if necessary, and promptly resolve the outstanding debt to avoid potential legal consequences.

Montgomery Maryland Letter Regarding Order to Docket

Description

How to fill out Montgomery Maryland Letter Regarding Order To Docket?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Montgomery Maryland Letter Regarding Order to Docket becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Montgomery Maryland Letter Regarding Order to Docket takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Montgomery Maryland Letter Regarding Order to Docket. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!