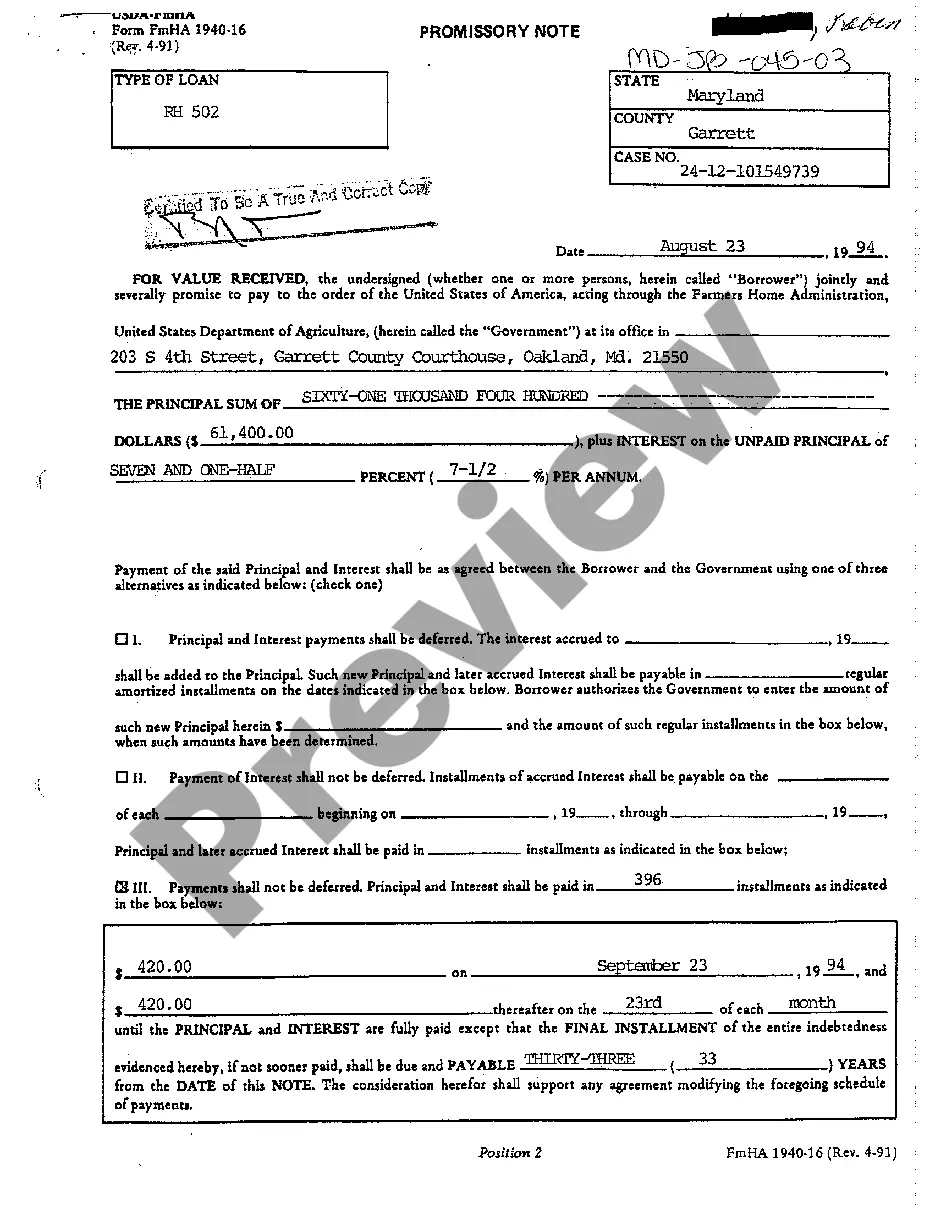

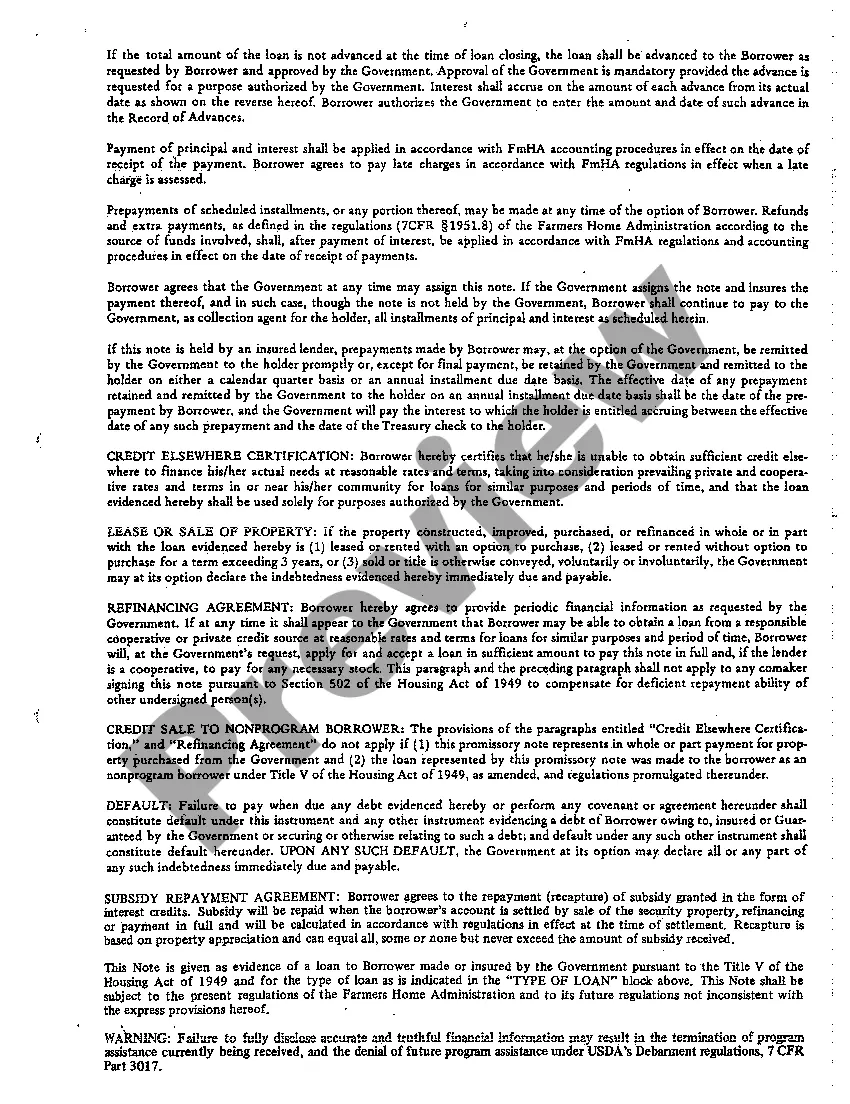

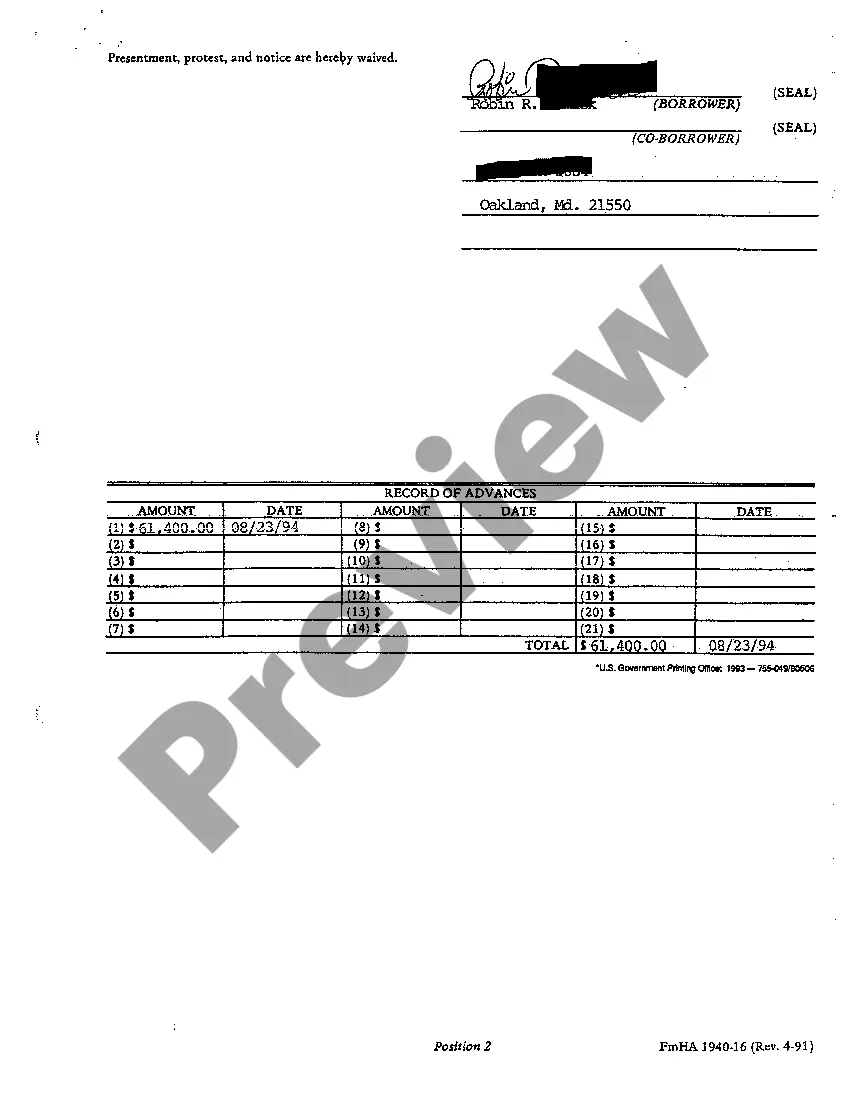

A Montgomery Maryland Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. It provides written evidence of the borrower's promise to repay the borrowed amount within a specified time period, along with any agreed-upon interest rate and other associated terms. In Montgomery County, Maryland, there are various types of promissory notes that individuals, businesses, or organizations may use, based on their specific needs and circumstances. Some key types include: 1. Secured Promissory Note: This type of promissory note is backed by collateral, such as property or assets, which the lender can claim in case of default by the borrower. It offers additional security to the lender while defining the rights and responsibilities of both parties. 2. Unsecured Promissory Note: Unlike the secured promissory note, an unsecured promissory note does not have any collateral attached to it. It relies solely on the borrower's promise to repay. However, as it poses a greater risk to the lender, the interest rates may be higher for this type. 3. Demand Promissory Note: A demand promissory note does not specify a fixed repayment schedule. Instead, it allows the lender to request repayment at any time they see fit. The borrower must repay the outstanding amount within a reasonable period after receiving a demand from the lender. 4. Installment Promissory Note: This type of promissory note divides the total loan amount into equal repayments over a specific duration. Each payment includes both principal and interest until the loan is fully paid off. Installment notes provide a structured repayment plan for both parties. 5. Balloon Promissory Note: A balloon promissory note offers a lower initial payment amount during the loan term while requiring a lump-sum "balloon" payment at the end. This type is beneficial for borrowers with limited cash flow during the earlier stages of the loan. It is essential for both parties involved in a Montgomery Maryland promissory note to clearly understand and agree upon all terms mentioned in the document. This includes the loan amount, repayment schedule, interest rate, penalties for late payments or default, and any other specific provisions relevant to the loan agreement. Seeking professional advice or consulting an attorney specializing in loan agreements is recommended to ensure compliance with all applicable laws and regulations in Montgomery County, Maryland. Using a well-drafted promissory note provides legal protection and helps establish a clear understanding between lenders and borrowers.

Montgomery Maryland Promissory Note

Description

How to fill out Montgomery Maryland Promissory Note?

Make use of the US Legal Forms and obtain instant access to any form sample you want. Our useful website with a large number of document templates simplifies the way to find and obtain almost any document sample you require. You are able to save, complete, and certify the Montgomery Maryland Promissory Note in a matter of minutes instead of browsing the web for several hours searching for a proper template.

Utilizing our catalog is a superb strategy to improve the safety of your record filing. Our professional legal professionals on a regular basis review all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and regulations.

How do you get the Montgomery Maryland Promissory Note? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you view. Additionally, you can get all the earlier saved files in the My Forms menu.

If you don’t have an account yet, follow the tips listed below:

- Find the template you require. Ensure that it is the template you were seeking: examine its headline and description, and take take advantage of the Preview function when it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading procedure. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order with a credit card or PayPal.

- Export the document. Select the format to obtain the Montgomery Maryland Promissory Note and change and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and trustworthy template libraries on the web. We are always ready to assist you in virtually any legal case, even if it is just downloading the Montgomery Maryland Promissory Note.

Feel free to make the most of our platform and make your document experience as efficient as possible!