The Montgomery Maryland Statement of Mortgage Debt is an important legal document that serves to provide a comprehensive overview of the debt associated with a specific mortgage in Montgomery County, Maryland. This statement contains relevant information pertaining to the mortgage, such as outstanding balances, interest rates, payment schedules, and any other pertinent details. Montgomery County, Maryland, being a prominent suburban area near Washington, D.C., houses various types of mortgages, and consequently, there are different types of Montgomery Maryland Statements of Mortgage Debt. The most common types include: 1. Fixed-Rate Mortgage Statement of Debt: This type of mortgage carries a fixed interest rate throughout the loan term, and the statement outlines the principal amount owed, the exact interest rate, and the repayment schedule agreed upon by the borrower and the lender. 2. Adjustable-Rate Mortgage Statement of Debt: This variety of mortgage carries an interest rate that is subject to change periodically. The Statement of Mortgage Debt provides detailed information regarding the terms of adjustment, including the initial interest rate, frequency of rate changes, and any caps or limits on interest rate fluctuations. 3. FHA (Federal Housing Administration) Mortgage Statement of Debt: This type of mortgage is insured by the FHA, which offers more relaxed eligibility requirements. The Statement of Mortgage Debt under an FHA loan provides information related to the loan amount, FHA insurance premium, and specific terms and conditions associated with the mortgage. 4. VA (Veterans Affairs) Mortgage Statement of Debt: Designed specifically for eligible military veterans and their families, a VA mortgage is backed by the Department of Veterans Affairs. The Statement of Mortgage Debt for a VA loan provides detailed information about the loan amount, eligibility requirements, funding fee, and other important terms and conditions. Regardless of the type of mortgage, the Montgomery Maryland Statement of Mortgage Debt is crucial for borrowers as it offers transparency and clarity about the financial obligations associated with the mortgage. It enables borrowers to have a comprehensive understanding of their mortgage terms, aids in financial planning, and ensures they are aware of their responsibilities in meeting the payment obligations. Furthermore, this statement can be used as proof of mortgage debt for legal or financial purposes, such as refinancing, selling a property, or applying for additional loans.

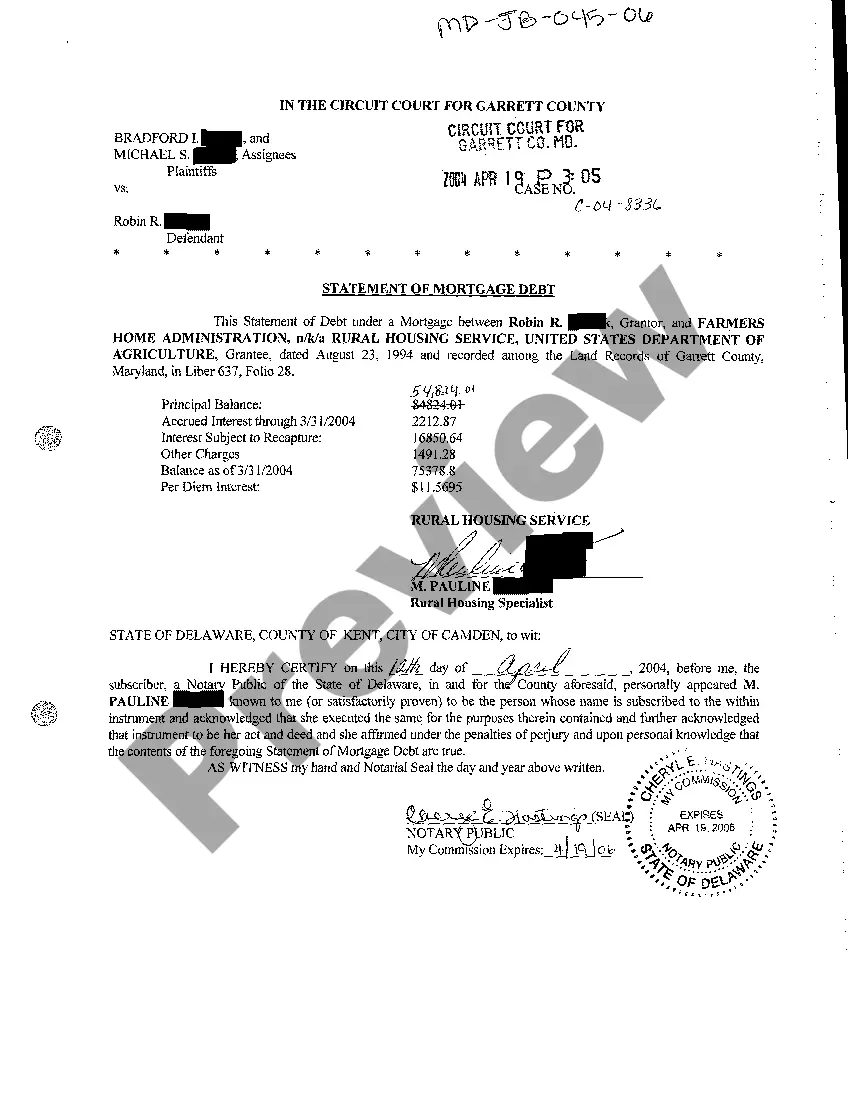

Montgomery Maryland Statement of Mortgage Debt

Description

How to fill out Montgomery Maryland Statement Of Mortgage Debt?

Take advantage of the US Legal Forms and have instant access to any form sample you require. Our useful platform with a huge number of documents makes it simple to find and get virtually any document sample you require. You can save, fill, and sign the Montgomery Maryland Statement of Mortgage Debt in a few minutes instead of surfing the Net for hours searching for the right template.

Utilizing our library is a wonderful strategy to raise the safety of your record submissions. Our experienced attorneys regularly check all the records to make certain that the forms are appropriate for a particular state and compliant with new acts and regulations.

How do you obtain the Montgomery Maryland Statement of Mortgage Debt? If you have a profile, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can find all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions below:

- Find the form you need. Make certain that it is the template you were hoping to find: check its headline and description, and make use of the Preview feature when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading process. Click Buy Now and select the pricing plan you prefer. Then, sign up for an account and process your order using a credit card or PayPal.

- Download the document. Indicate the format to get the Montgomery Maryland Statement of Mortgage Debt and revise and fill, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable template libraries on the internet. Our company is always happy to assist you in any legal case, even if it is just downloading the Montgomery Maryland Statement of Mortgage Debt.

Feel free to take full advantage of our service and make your document experience as convenient as possible!