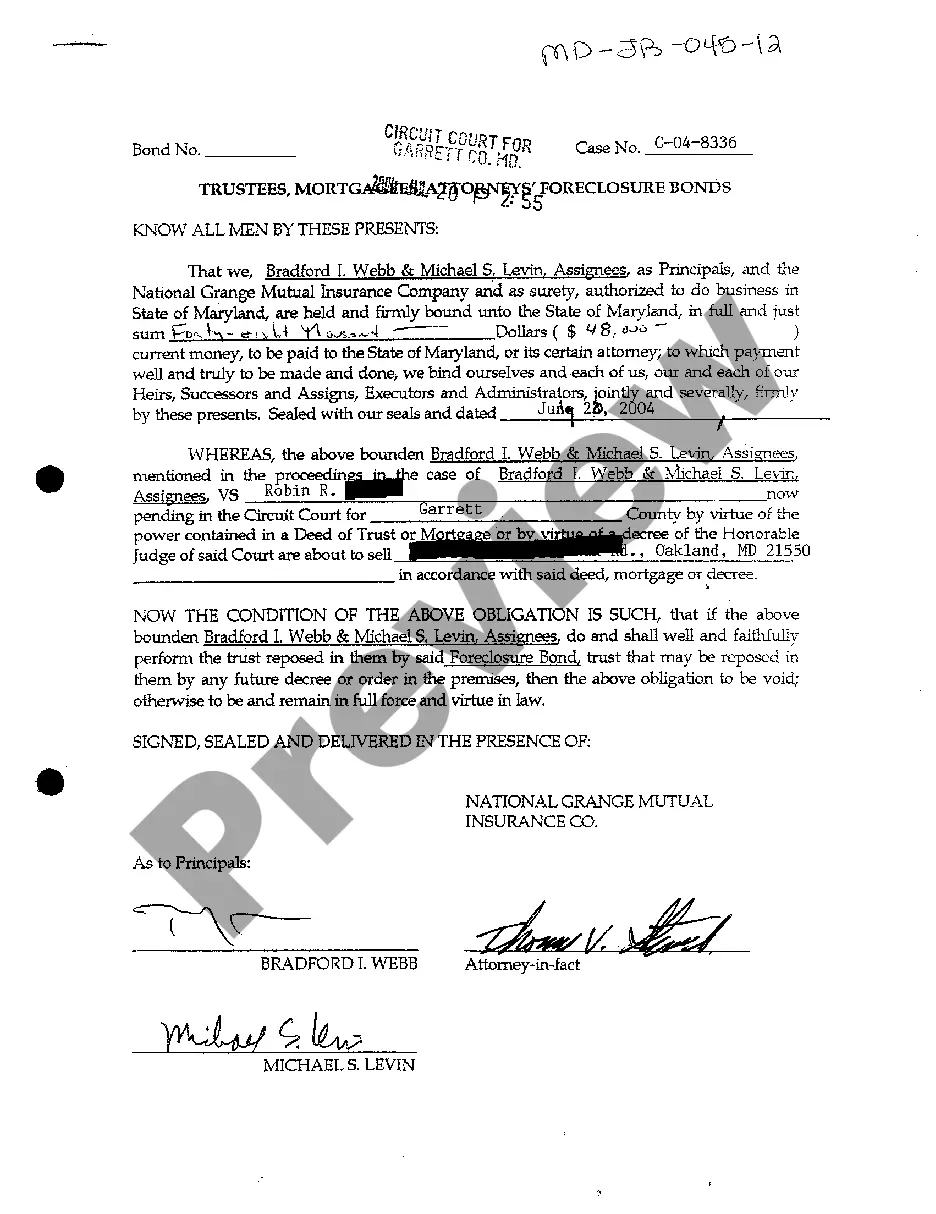

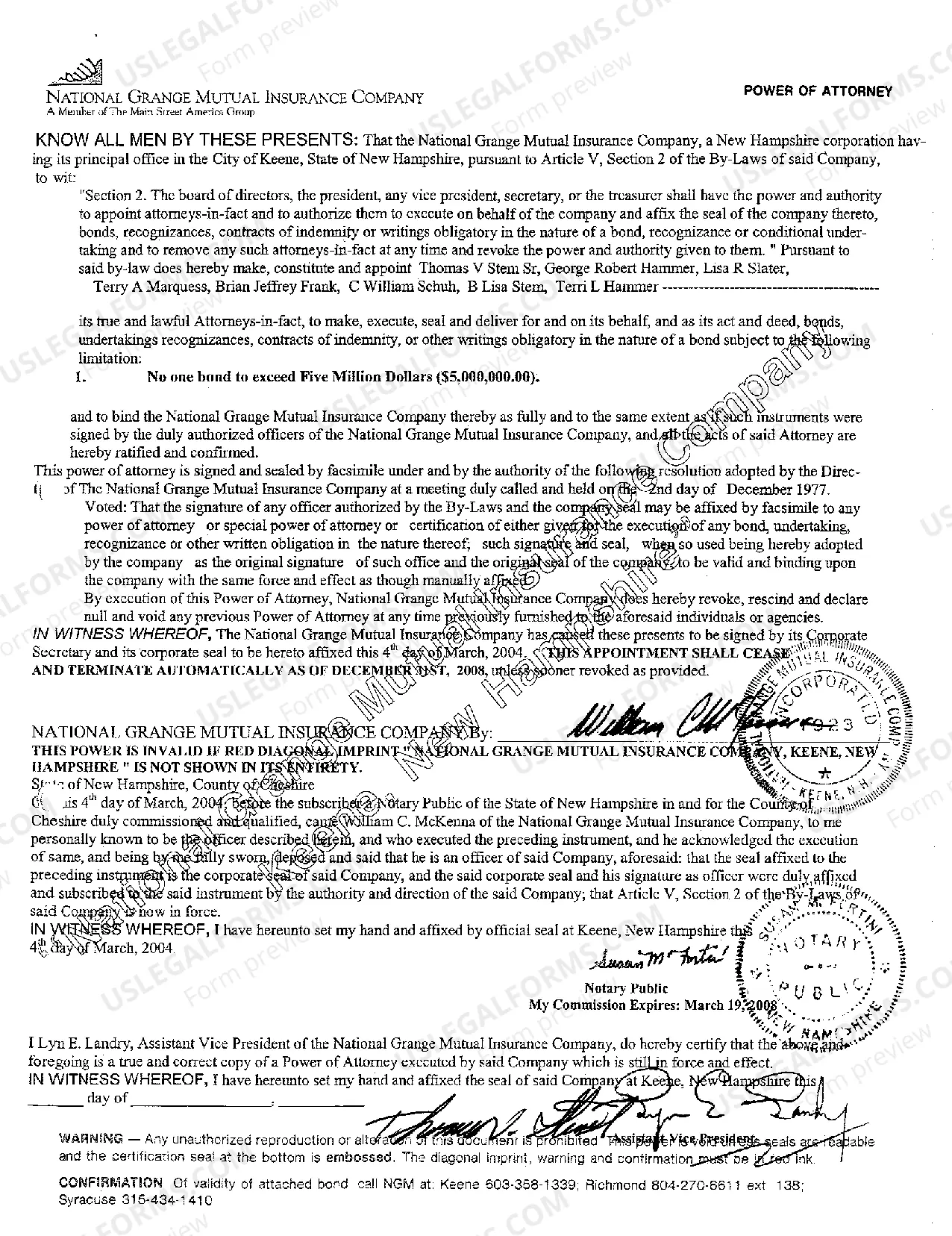

Montgomery Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds: A Comprehensive Insight In Montgomery, Maryland, the realm of real estate transactions and legal processes involves various entities and instruments, including Trustees, Mortgages, Attorney's Foreclosure Bonds. These key components play crucial roles in ensuring a fair and secure process during property transfers, foreclosures, and legal proceedings. Trustees: In Montgomery, Maryland, a Trustee is an individual or entity appointed to oversee and facilitate the transfer of property ownership through a trust. Trusts are legal arrangements where assets, such as real estate, are held by the trustee on behalf of the beneficiaries. There are different types of trustees, such as: 1. Living Trustee: Appointed during an individual's lifetime to manage and distribute their assets according to their wishes. It ensures a smooth transfer of property ownership, even in case of incapacitation or death. 2. Testamentary Trustee: Named in a person's will, this trustee becomes active after the individual's death. Their role is to manage and distribute assets, including real estate, according to the instructions specified in the will. Mortgages: Mortgages are legal agreements between a borrower and a lender, typically a financial institution, where the borrower obtains funds to purchase a property while providing the property as collateral. In Montgomery, Maryland, there are various types of mortgages available, serving different needs: 1. Fixed-Rate Mortgage: This mortgage offers a fixed interest rate for the entire loan term, typically ranging from 15 to 30 years. Borrowers enjoy predictable monthly payments, making it easier to plan their finances. 2. Adjustable-Rate Mortgage (ARM): An ARM features an interest rate that fluctuates after an initial fixed-rate period, often varying based on prevailing market rates. Borrowers should carefully consider the potential risks and rewards associated with ARM's. Attorney's Foreclosure Bonds: In cases of mortgage default, foreclosure may occur where the lender seeks to recover the outstanding debt by selling the property. During this process, an Attorney's Foreclosure Bond is relevant. This bond functions as a financial guarantee that the attorney handling the foreclosure will act lawfully and ethically while pursuing the legal proceedings. The attorney's foreclosure bond is a type of surety bond, which provides financial protection to homeowners and safeguards against any potential misconduct or negligence by the attorney involved in the foreclosure process. It is crucial to note that while the mentioned components — Trustees, Mortgages, and Attorney's Foreclosure Bonds — are significant in Montgomery, Maryland, seeking professional advice from qualified attorneys, financial advisors, or mortgage brokers is essential. Each situation may present unique circumstances, and professional guidance can help navigate through the complexities of real estate transactions, trusts, mortgages, and foreclosure procedures with confidence.

Montgomery Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds

Description

How to fill out Montgomery Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person with no legal education to create such paperwork cfrom the ground up, mostly because of the convoluted terminology and legal nuances they come with. This is where US Legal Forms can save the day. Our platform provides a huge library with more than 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Montgomery Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Montgomery Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds quickly using our trusted platform. In case you are presently a subscriber, you can proceed to log in to your account to get the needed form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Montgomery Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds:

- Be sure the template you have found is specific to your location since the rules of one state or area do not work for another state or area.

- Review the document and go through a short outline (if provided) of scenarios the document can be used for.

- If the form you picked doesn’t meet your needs, you can start again and search for the suitable document.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Montgomery Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds as soon as the payment is completed.

You’re good to go! Now you can proceed to print the document or complete it online. If you have any problems locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.