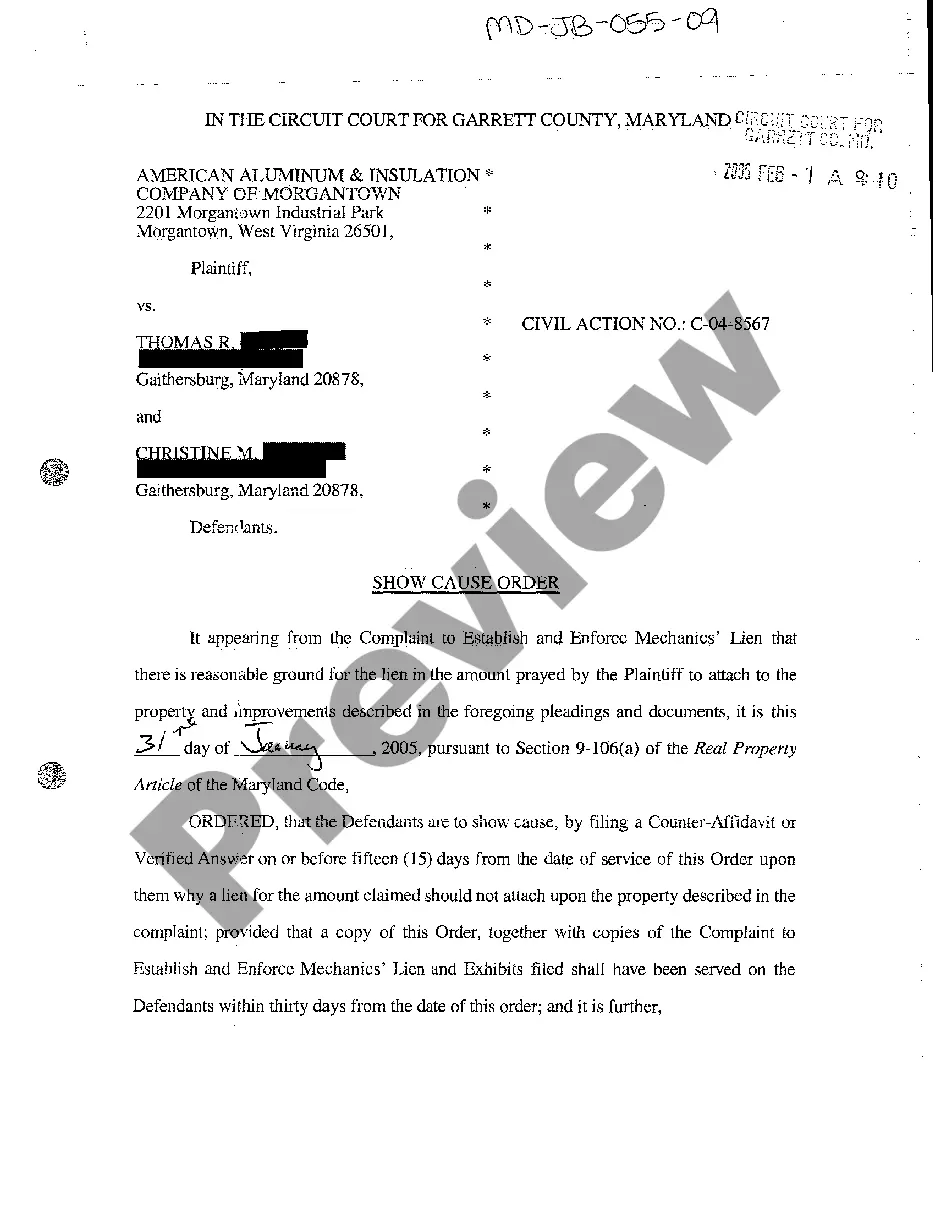

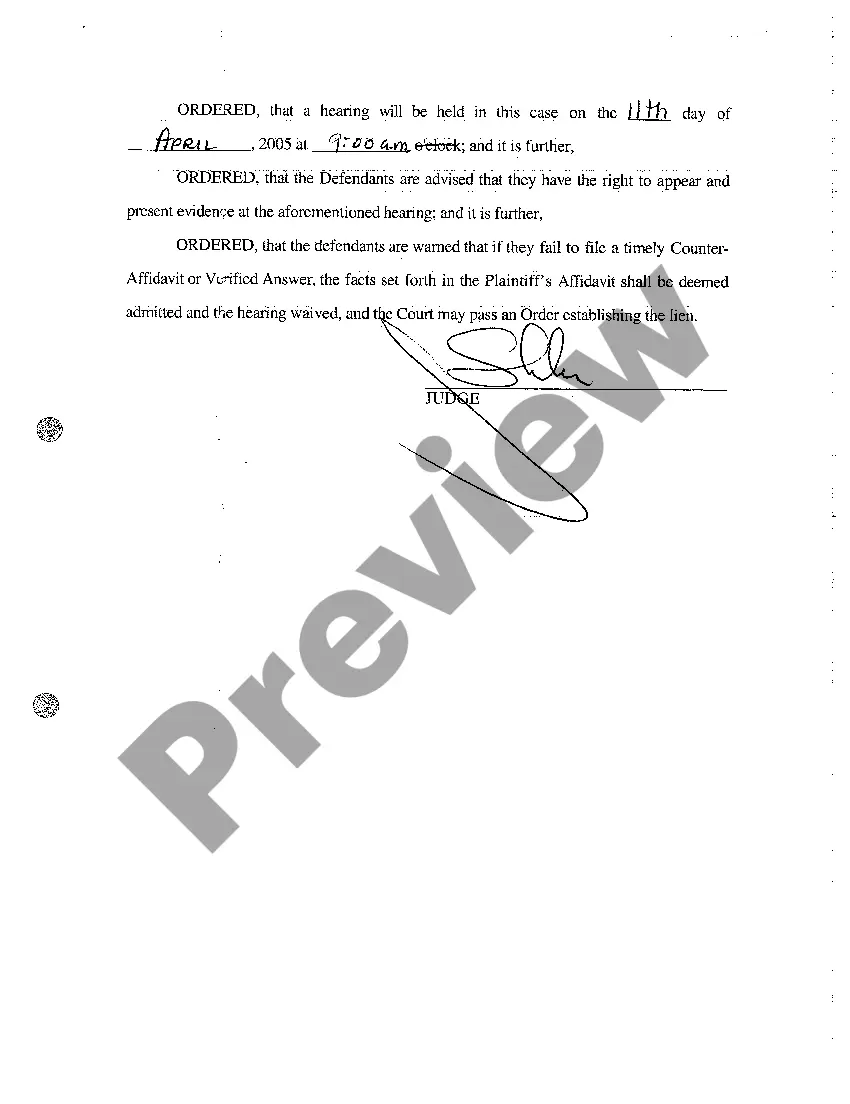

Montgomery County, Maryland is governed by specific laws and procedures when it comes to enforcing liens on properties. In certain situations, a property owner may receive a "Show Cause Order of Why Lien Should Not Attach" from the county. This order outlines the reasons why a lien is being considered and provides the property owner with an opportunity to present their case and prevent the attachment of the lien. There are different types of Show Cause Orders in Montgomery County related to liens that property owners should be aware of. These may include: 1. Show Cause Order — Tax Lien: If a property owner fails to pay their property taxes, the county may issue a Show Cause Order as a preliminary step to enforcing a tax lien on the property. This order requires the property owner to show cause as to why the lien should not attach by presenting evidence or reasons for non-payment. 2. Show Cause Order — Municipal Lien: In Montgomery County, municipalities may also issue Show Cause Orders related to unpaid bills or local assessments such as water or sewer charges, code violations, or street repairs. Property owners receiving such orders must show cause why the lien should not attach by providing explanations or evidence if they believe the charges are incorrect or have been resolved. 3. Show Cause Order — Homeowners Association (HOA) Lien: Homeowners associations in Montgomery County have the authority to issue Show Cause Orders for unpaid fees or assessments. Property owners receiving an order must present valid reasons or evidence at a hearing to argue against the attachment of the HOA lien on their property. When property owners receive a Show Cause Order of Why Lien Should Not Attach, it is crucial to carefully review the document and understand the specific reasons for the proposed lien. It is advisable to consult with a qualified attorney specializing in lien law to ensure legal compliance and proper representation during the hearing process. In conclusion, Montgomery County, Maryland issues various types of Show Cause Orders related to different types of liens, including tax liens, municipal liens, and homeowners association liens. Property owners must respond to these orders by presenting valid evidence or explanations to prevent the attachment of a lien on their property. Seeking legal guidance is highly recommended navigating the intricacies of the process effectively.

Montgomery Maryland Show Cause Order of Why Lien Should Not Attach

Description

How to fill out Montgomery Maryland Show Cause Order Of Why Lien Should Not Attach?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any law background to draft this sort of paperwork from scratch, mostly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform offers a massive collection with over 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Montgomery Maryland Show Cause Order of Why Lien Should Not Attach or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Montgomery Maryland Show Cause Order of Why Lien Should Not Attach quickly employing our trusted platform. In case you are presently an existing customer, you can go ahead and log in to your account to download the needed form.

However, if you are a novice to our platform, make sure to follow these steps prior to downloading the Montgomery Maryland Show Cause Order of Why Lien Should Not Attach:

- Ensure the form you have chosen is good for your area considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a brief outline (if available) of cases the document can be used for.

- In case the one you chosen doesn’t meet your needs, you can start over and look for the necessary form.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your login information or register for one from scratch.

- Choose the payment method and proceed to download the Montgomery Maryland Show Cause Order of Why Lien Should Not Attach once the payment is through.

You’re good to go! Now you can go ahead and print out the form or complete it online. If you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.