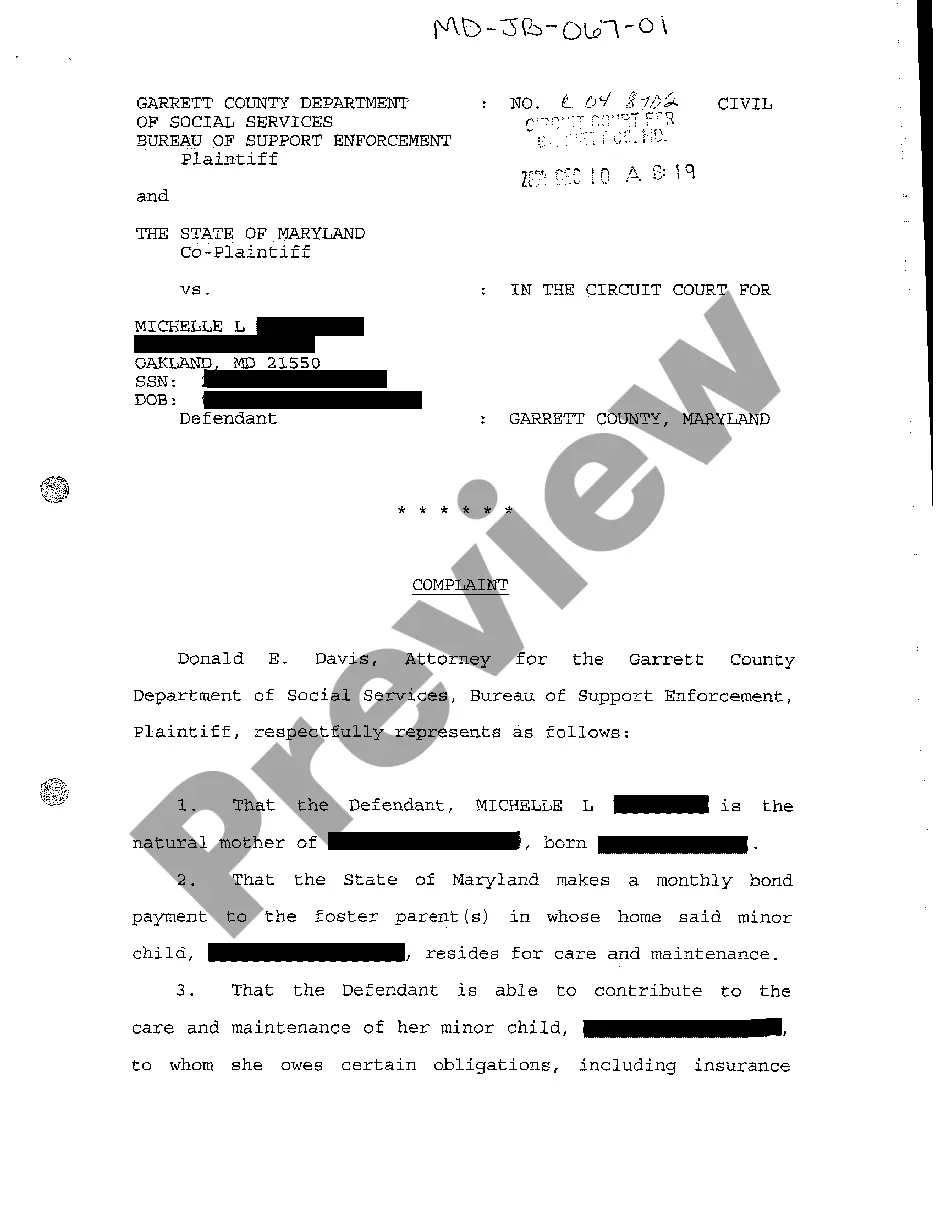

Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support

Description

How to fill out Maryland Complaint Withholding Of Earnings For Purpose Of Child Support?

Regardless of one's social or occupational ranking, completing law-related documents is an unfortunate requirement in today’s working world.

Frequently, it's nearly impossible for an individual without legal training to generate this kind of paperwork from the ground up, primarily due to the intricate terminology and legal subtleties involved.

This is where US Legal Forms can come to the rescue. Our platform provides a vast array of over 85,000 ready-to-use, state-specific forms suitable for nearly any legal matter.

If the one chosen does not meet your requirements, you can restart and look for the correct form.

Click Buy now and choose the subscription plan that best fits your needs. Log In with your account details or create a new account from the beginning. Choose a payment option and proceed to download the Montgomery Maryland Complaint Withholding of Earnings for Child Support once payment is finalized. You’re all set! Now you can either print the form or fill it out online. If you encounter any difficulties in finding your purchased forms, you can conveniently access them in the My documents tab.

- Whether you need the Montgomery Maryland Complaint Withholding of Earnings for Child Support or any other valid document for your state or county, US Legal Forms makes everything readily accessible.

- Here’s how you can swiftly obtain the Montgomery Maryland Complaint Withholding of Earnings for Child Support using our reliable service.

- If you are currently an existing user, feel free to Log In to your account to retrieve the required form.

- However, if you are new to our service, follow these steps before acquiring the Montgomery Maryland Complaint Withholding of Earnings for Child Support.

- Confirm that the form you have selected is appropriate for your area since regulations vary from state to state and county to county.

- Examine the form and read a brief overview (if available) of the situations for which the document can be utilized.

Form popularity

FAQ

Child support payments are not considered taxable income and do not need to be reported to the IRS. However, understanding the nuances of the Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support can help ensure that you manage your finances correctly. If you have any doubts, consulting a tax professional can provide clarity and guidance on your situation.

The income withholding for support form is typically completed by the employer upon receiving the necessary legal documents. However, in the case of Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support, you may also need to ensure that the correct information is provided to facilitate a smooth process. Keeping track of this paperwork can help avoid delays in the receipt of child support payments.

If an employer in Texas fails to withhold child support, it can lead to back payments and possible legal enforcement actions. In cases of Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support, addressing this issue promptly with your employer or the child support agency is crucial. Make sure to keep communication open to resolve any discrepancies and ensure compliance with your obligations.

In Illinois, income withholding for child support typically follows state law guidelines. Generally, they may withhold up to 50% of your disposable income, depending on your situation. Understanding these regulations can help you navigate through the Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support, ensuring that you meet your obligations without jeopardizing your financial stability.

The maximum amount withheld for child support depends on various factors, including state law and your income level. In Maryland, the limits may vary, but they align with federal guidelines to ensure fair support obligations. It's essential to consult resources related to the Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support for specific details and to understand your rights and obligations.

If your employer fails to withhold child support as ordered, it can lead to significant financial and legal repercussions. The Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support provides guidance on how to address this issue. It's advisable to communicate with both your employer and the appropriate child support agency to clarify any misunderstandings and rectify the situation promptly.

When filling out your tax return, child support income does not get specifically queried on most forms. However, it’s important to consider it when calculating overall income for the Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support. Accurate documentation and aware reporting can help ensure compliance with tax regulations while optimizing your financial reporting.

You generally report child support income on your federal tax return. In the context of the Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support, ensure that this information is recorded accurately to avoid any confusion. Additionally, consulting a tax professional can provide you with guidance on how to appropriately report this income, which can be crucial for your financial integrity.

To report child support income, you'll typically list it on your tax return as required. In the case of Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support, understanding how and where to report this information can impact your overall financial situation. It's essential to keep detailed records of the child support received, as this can be helpful not only for tax purposes but also for your future financial planning.

In Maryland, a warrant may be issued for child support when a parent falls behind by at least 120 days. Such a situation often results in the filing of a Montgomery Maryland Complaint Withholding of Earnings for Purpose of Child Support. If you understand the laws and regulations, you can avoid serious legal consequences. Consider utilizing resources from U.S. Legal Forms to help you navigate the complexities of child support issues effectively.