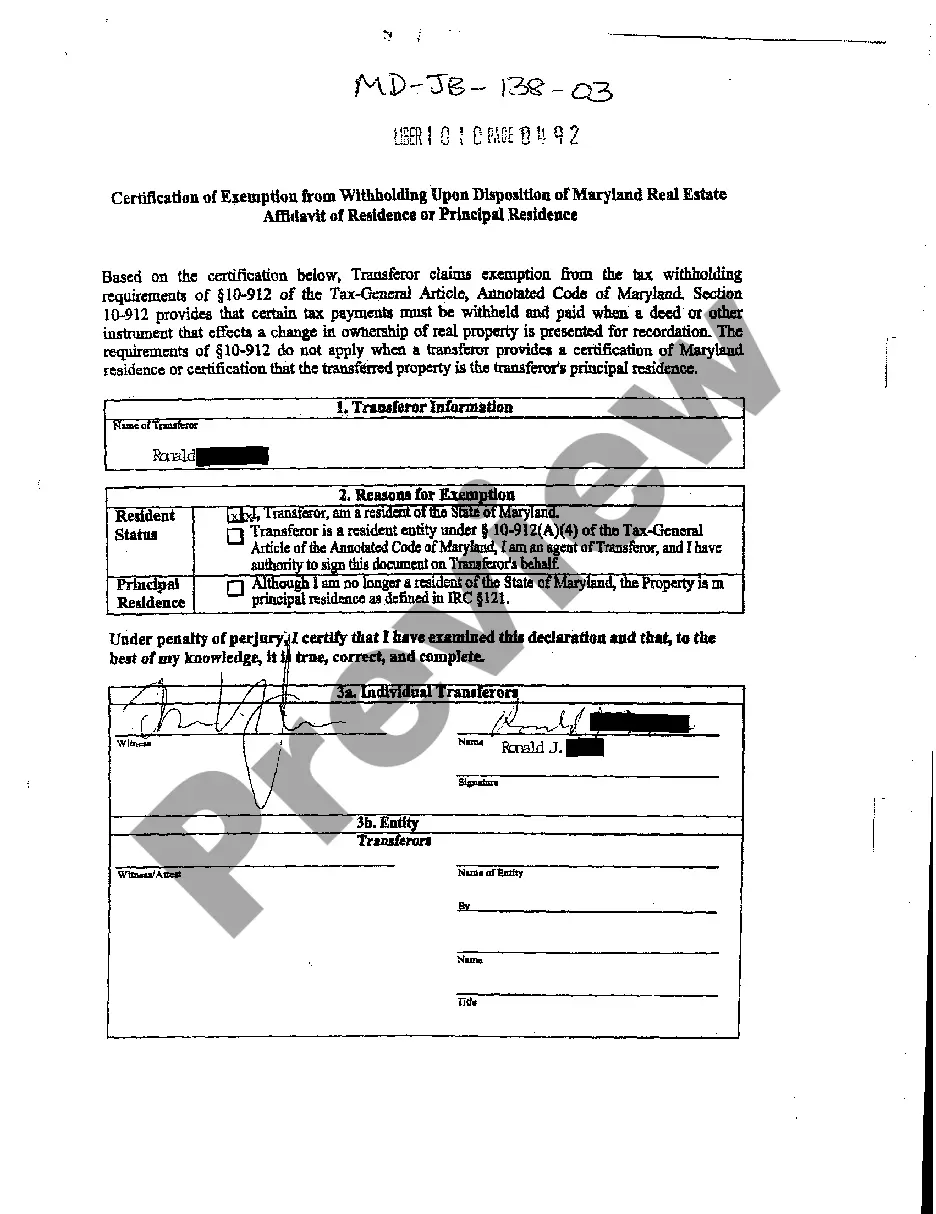

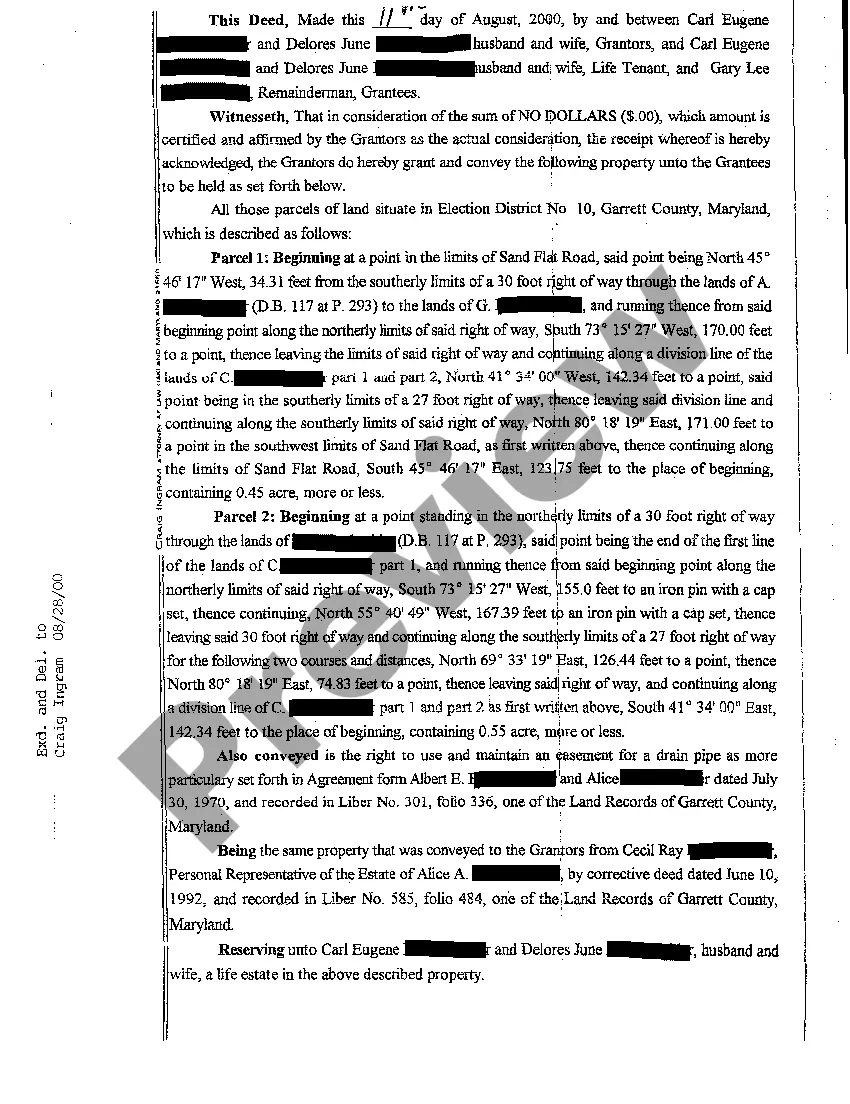

The Montgomery Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence is a legal document required by the Montgomery County, Maryland government when selling or transferring real estate. This affidavit serves as proof that the seller is exempt from withholding taxes on the proceeds from the sale or disposition of their principal residence. The purpose of this affidavit is to provide a mechanism for homeowners to claim an exemption from the usual withholding tax requirements. By submitting this form and meeting the specific criteria outlined, homeowners can avoid having a portion of the sale proceeds withheld by the buyer and remitted to the county government. The Montgomery County government recognizes two types of certifications under this category: 1. Affidavit of Residence: This affidavit is applicable to individuals who own a property in Montgomery County and have used it as their primary residence for at least two out of the five preceding years from the date of disposition. By completing this affidavit, the homeowner confirms their eligibility for exemption from withholding. 2. Affidavit of Principal Residence: This affidavit is relevant when the homeowner is selling a residence that was their principal residence at the time of sale but has not met the full two-year residency requirement. While not meeting the residency duration, the homeowner may still be eligible for exemption based on qualifying circumstances such as job relocation, health issues, or other valid reasons as determined by the county government. To complete the Montgomery Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence, the homeowner must provide detailed information about themselves, the property being sold, and their residency history. Supporting documentation may also be required to establish eligibility for the exemption. It is essential to note that this exemption only applies to the Montgomery County withholding tax requirements. Homeowners should consult with a tax attorney or accountant to understand their federal and state tax obligations regarding the sale or disposition of real estate. By utilizing the Montgomery Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence, eligible homeowners can streamline the process of selling their property and ensure compliance with local tax regulations, potentially saving them from unnecessary withholding expenses.

The Montgomery Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence is a legal document required by the Montgomery County, Maryland government when selling or transferring real estate. This affidavit serves as proof that the seller is exempt from withholding taxes on the proceeds from the sale or disposition of their principal residence. The purpose of this affidavit is to provide a mechanism for homeowners to claim an exemption from the usual withholding tax requirements. By submitting this form and meeting the specific criteria outlined, homeowners can avoid having a portion of the sale proceeds withheld by the buyer and remitted to the county government. The Montgomery County government recognizes two types of certifications under this category: 1. Affidavit of Residence: This affidavit is applicable to individuals who own a property in Montgomery County and have used it as their primary residence for at least two out of the five preceding years from the date of disposition. By completing this affidavit, the homeowner confirms their eligibility for exemption from withholding. 2. Affidavit of Principal Residence: This affidavit is relevant when the homeowner is selling a residence that was their principal residence at the time of sale but has not met the full two-year residency requirement. While not meeting the residency duration, the homeowner may still be eligible for exemption based on qualifying circumstances such as job relocation, health issues, or other valid reasons as determined by the county government. To complete the Montgomery Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence, the homeowner must provide detailed information about themselves, the property being sold, and their residency history. Supporting documentation may also be required to establish eligibility for the exemption. It is essential to note that this exemption only applies to the Montgomery County withholding tax requirements. Homeowners should consult with a tax attorney or accountant to understand their federal and state tax obligations regarding the sale or disposition of real estate. By utilizing the Montgomery Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence, eligible homeowners can streamline the process of selling their property and ensure compliance with local tax regulations, potentially saving them from unnecessary withholding expenses.