Montgomery Maryland Order of Default is a legal term referring to a specific process that occurs when a borrower fails to make mortgage payments in a timely manner. In this context, "Montgomery Maryland" indicates that the order applies to properties located within the Montgomery County, Maryland jurisdiction. When a borrower defaults on their mortgage loan, the lender has the right to take legal action to reclaim the property as collateral. This action usually follows a specific sequence of steps, known as the Montgomery Maryland Order of Default. One of the primary objectives of this process is to protect both the rights of the borrower and the lender, ensuring a fair resolution for both parties involved. The Montgomery Maryland Order of Default typically involves the following stages: 1. Missed Payments: A borrower's default usually starts with multiple missed mortgage payments. Failing to make payments on time will trigger the lender to initiate further action. 2. Notice of Default: Once the borrower has missed several payments, the lender will send a formal notice of default. This notice serves as a warning that the borrower is in breach of their loan agreement and provides them with a chance to rectify the situation. 3. Demand Letter: If the borrower does not cure the default within a specified timeframe mentioned in the notice of default, the lender may issue a demand letter. This letter informs the borrower that they are required to repay the full outstanding loan amount. 4. Foreclosure Proceedings: If the borrower still fails to comply with the demand letter, the lender may initiate foreclosure proceedings. This involves filing a lawsuit in the Montgomery Maryland court system, seeking to obtain a court order to sell the property in order to recoup the unpaid debt. 5. Notice of Sale: After the court grants the foreclosure order, the lender will issue a notice of sale. This notification provides details about the impending sale of the property, including the date, time, and location of the foreclosure auction. 6. Foreclosure Auction: The property will be sold to the highest bidder during a public auction held at the designated date and location. The proceeds from the sale are then used to pay off the outstanding mortgage debt. It's important to note that the Montgomery Maryland Order of Default may have slight variations depending on the specific circumstances and local laws. However, the overall process generally remains consistent across most foreclosure proceedings in Montgomery County, Maryland. In conclusion, the Montgomery Maryland Order of Default is a legal process that safeguards the rights of both borrowers and lenders when a mortgage loans recipient fails to make timely payments. This process helps ensure a fair resolution by providing ample notice to the borrower, allowing them opportunities to rectify the default before foreclosure proceedings commence.

Montgomery Maryland Order of Default

Description

How to fill out Montgomery Maryland Order Of Default?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Montgomery Maryland Order of Default gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Montgomery Maryland Order of Default takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

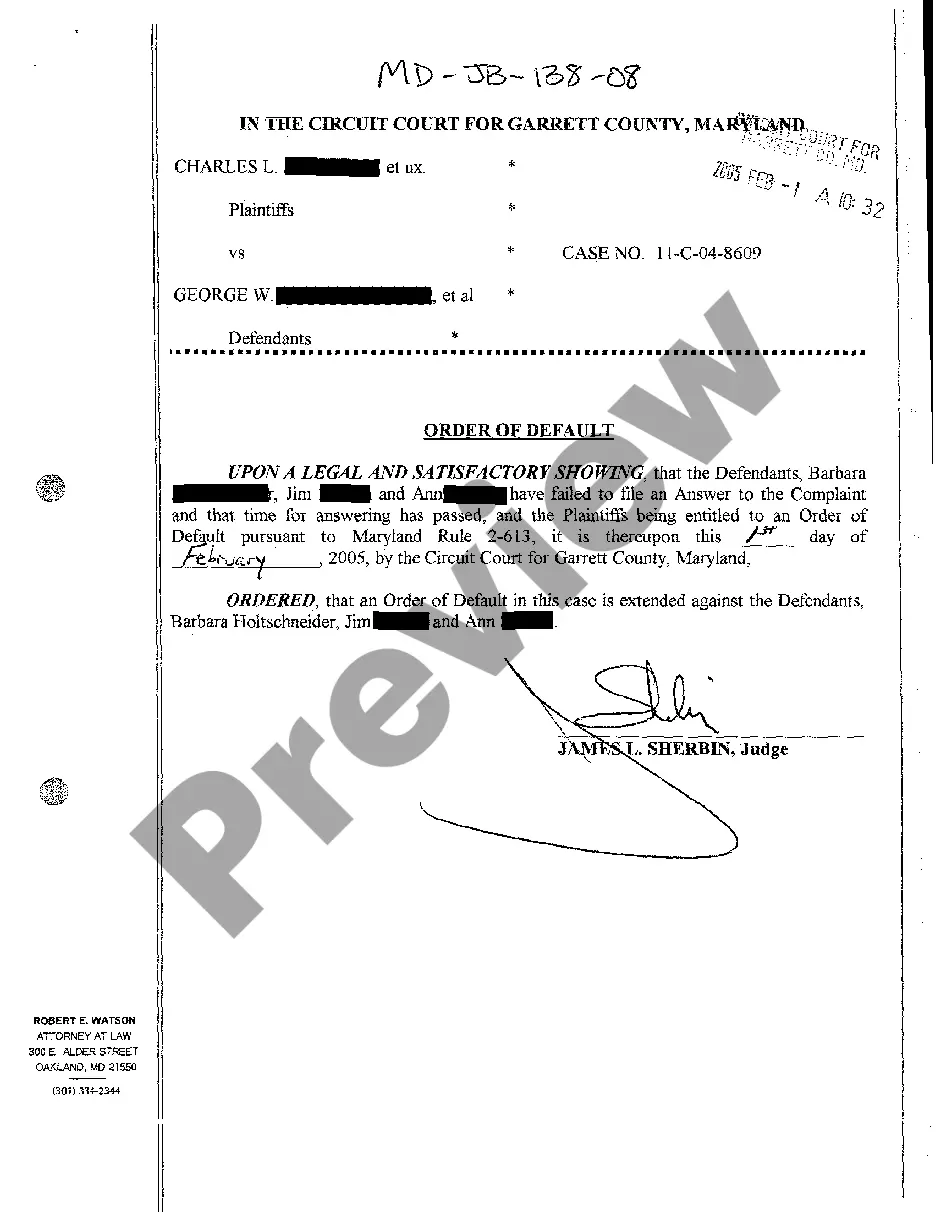

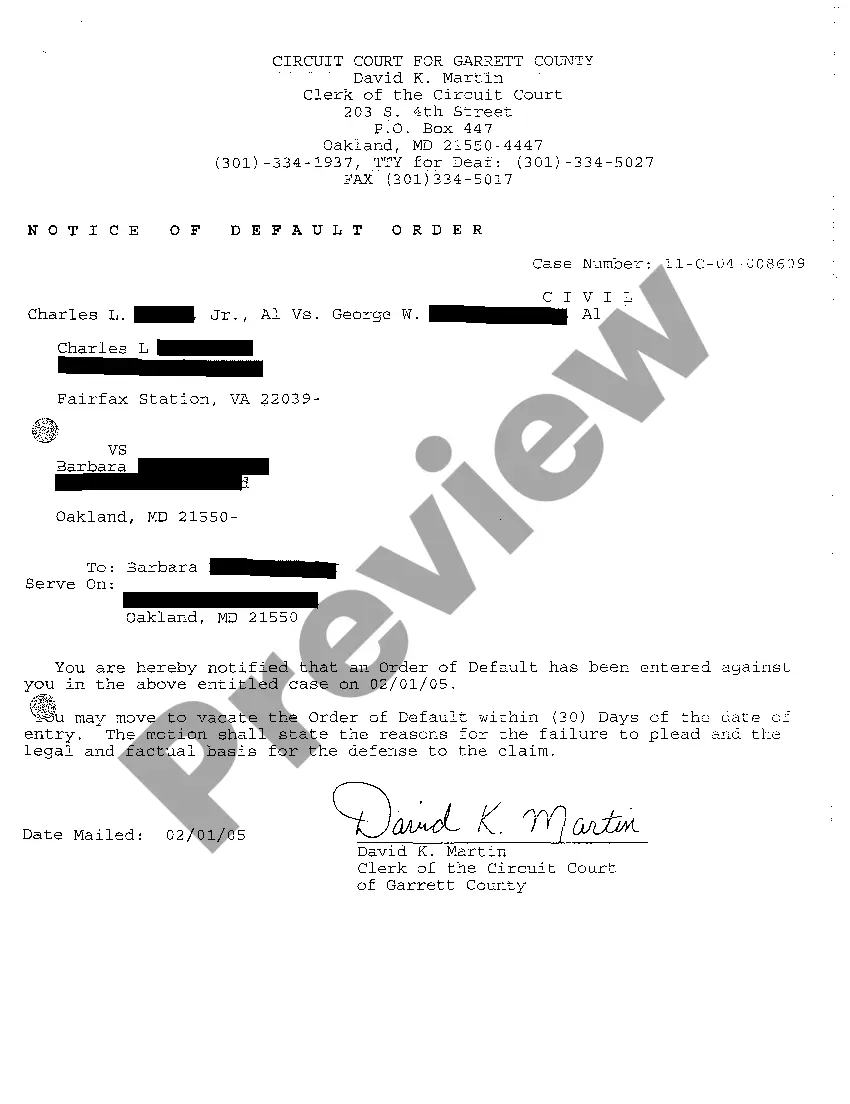

- Look at the Preview mode and form description. Make certain you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Montgomery Maryland Order of Default. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!