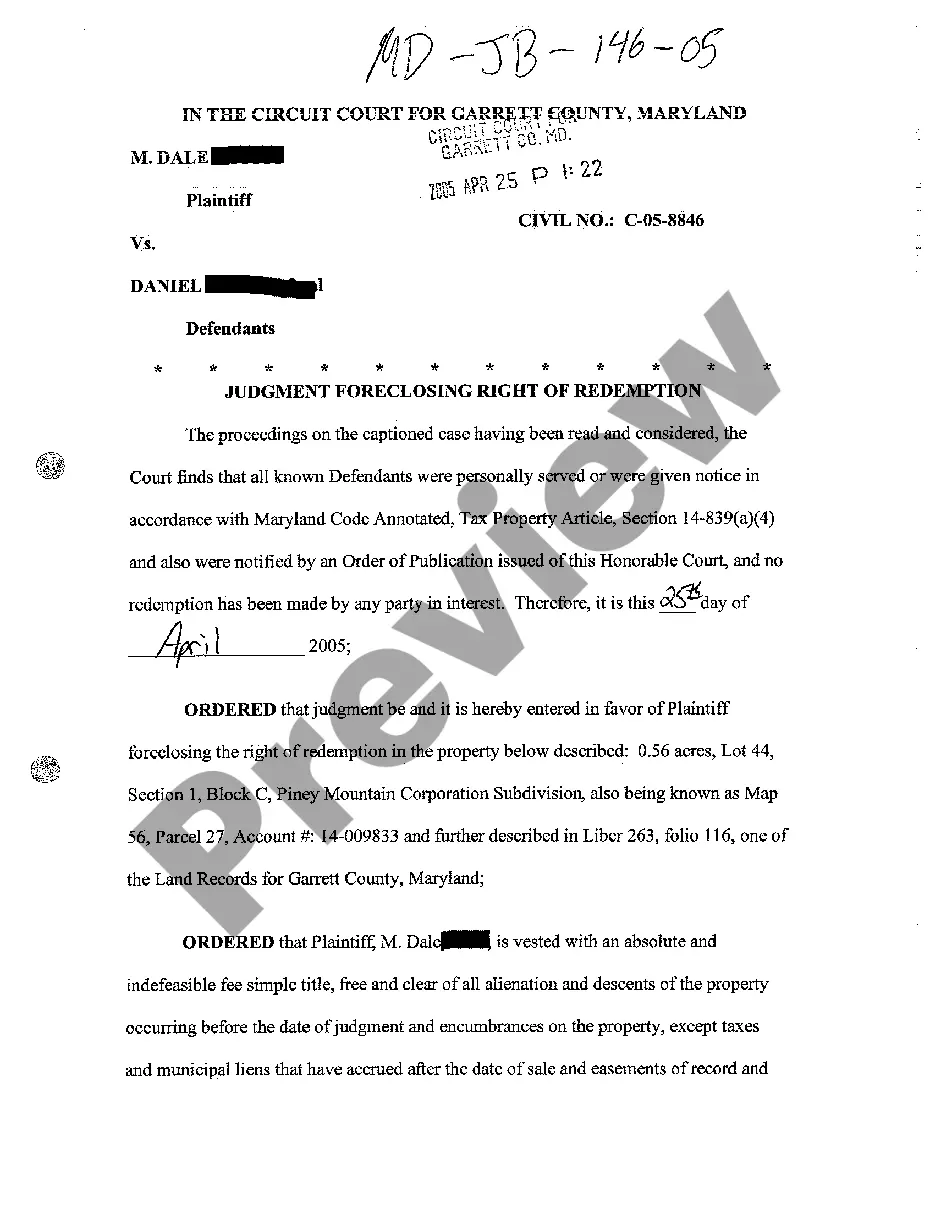

Montgomery Maryland Judgment Foreclosing Right of Redemption is a legal process that grants the lender (mortgagee) the right to take possession of a property and sell it in order to recover the outstanding debt if the borrower (mortgagor) fails to make the agreed upon mortgage payments. This type of judgment is commonly used in Montgomery County, Maryland. In Montgomery County, there are two primary types of judgment foreclosing right of redemption: strict foreclosure and foreclosure by sale. Let's explore each type in detail: 1. Strict Foreclosure: This type of judgment foreclosing right of redemption involves the lender taking ownership of the property without the need for a public sale. In a strict foreclosure, the lender submits a complaint to the court, requesting that the borrower's right of redemption be completely extinguished. If the court approves, the lender becomes the owner of the property, and the borrower loses all rights to redeem the property. 2. Foreclosure by Sale: Unlike strict foreclosure, foreclosure by sale refers to the process of selling the property at a public auction to satisfy the outstanding debt. After the borrower defaults on the mortgage, the lender initiates a foreclosure lawsuit and obtains a judgment authorizing the sale of the property. The auction is usually conducted by a sheriff or a trustee appointed by the court. The proceeds from the sale are used to repay the mortgage debt, and any remaining funds may go to other lien holders or the borrower, depending on the specific case. It's important to note that the right of redemption allows the borrower a limited period to reclaim the property by paying off the debt in full, along with any additional costs incurred during the foreclosure process, such as attorney fees and court costs. Once the right of redemption expires, the borrower loses the opportunity to regain ownership of the property. Montgomery Maryland Judgment Foreclosing Right of Redemption is a crucial legal mechanism that safeguards lenders' interests while providing an opportunity for borrowers to avoid losing their property through timely payment or negotiation with the lender. It is advisable for individuals facing foreclosure in Montgomery County to seek professional legal assistance to navigate the complexities associated with this process.

Montgomery Maryland Judgment Foreclosing Right of Redemption

Description

How to fill out Montgomery Maryland Judgment Foreclosing Right Of Redemption?

Benefit from the US Legal Forms and have instant access to any form sample you require. Our beneficial website with a large number of templates simplifies the way to find and obtain virtually any document sample you need. You are able to export, complete, and sign the Montgomery Maryland Judgment Foreclosing Right of Redemption in a few minutes instead of browsing the web for hours attempting to find an appropriate template.

Utilizing our library is a great strategy to raise the safety of your document filing. Our experienced lawyers on a regular basis review all the documents to make sure that the forms are relevant for a particular state and compliant with new acts and regulations.

How do you get the Montgomery Maryland Judgment Foreclosing Right of Redemption? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Furthermore, you can get all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Find the form you require. Make sure that it is the template you were hoping to find: check its headline and description, and make use of the Preview option if it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the saving procedure. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order with a credit card or PayPal.

- Export the file. Select the format to get the Montgomery Maryland Judgment Foreclosing Right of Redemption and edit and complete, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy form libraries on the web. We are always ready to assist you in virtually any legal case, even if it is just downloading the Montgomery Maryland Judgment Foreclosing Right of Redemption.

Feel free to make the most of our service and make your document experience as convenient as possible!