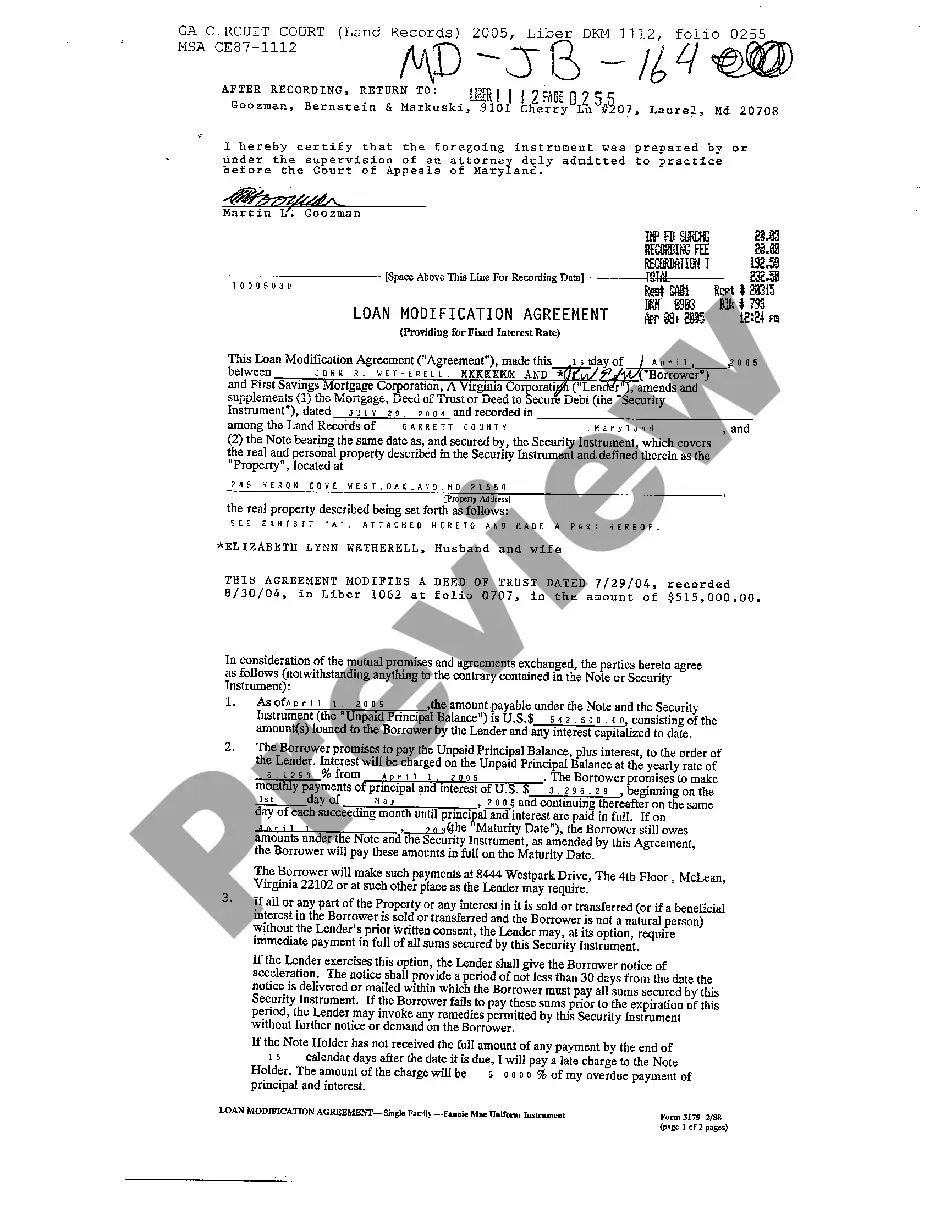

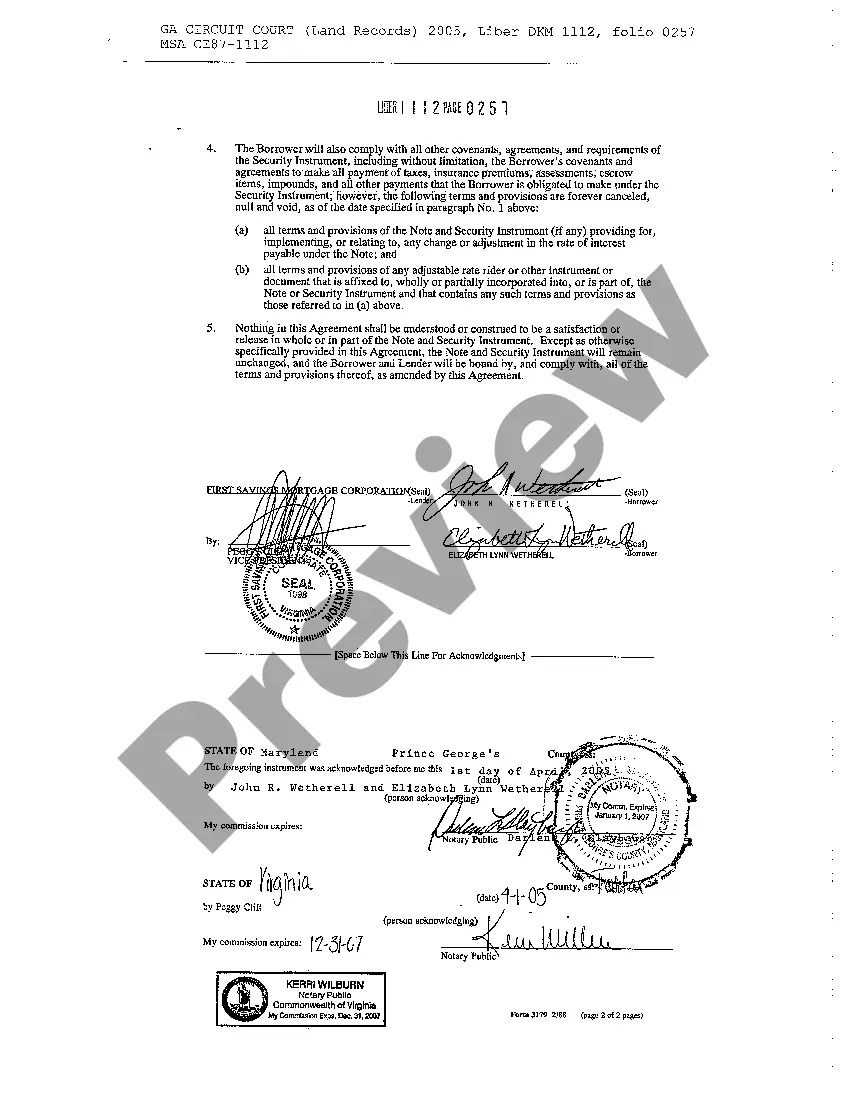

A Montgomery Maryland Loan Modification Agreement Providing for Fixed Interest Rate is a legal contract between a borrower and a lender in Montgomery County, Maryland, that allows for the adjustment of the terms of an existing loan agreement to include a fixed interest rate. This agreement is typically entered into when the borrower is facing financial hardship and is struggling to make regular loan payments. The purpose of a loan modification agreement is to provide the borrower with a more affordable repayment plan, helping them to avoid foreclosure and maintain homeownership. By converting the existing variable interest rate to a fixed rate, the borrower gains stability and predictability in their monthly mortgage payments, as the interest rate remains constant over the life of the modified loan. Different types of Montgomery Maryland Loan Modification Agreements providing for a fixed interest rate may include: 1. Residential Loan Modification Agreement: This type of agreement is specifically designed for homeowners who reside in their properties and are seeking a loan modification to secure a fixed interest rate. It applies to residential properties, such as single-family homes, condominiums, and townhouses. 2. Commercial Loan Modification Agreement: This agreement is suitable for commercial property owners in Montgomery County, Maryland, who require a loan modification with a fixed interest rate for commercial real estate, including office buildings, retail space, warehouses, and other non-residential properties. 3. Government Loan Modification Agreement: This type of loan modification agreement is available to borrowers who have loans insured or guaranteed by government agencies, such as the Federal Housing Administration (FHA), Veterans Administration (VA), or the U.S. Department of Agriculture (USDA). The goal is to help eligible borrowers secure a fixed interest rate on their government-backed mortgages. In the Montgomery Maryland Loan Modification Agreement Providing for Fixed Interest Rate, several key items are typically covered: 1. Loan Identification: This section includes information about the existing loan, such as the lender's name, the loan number, and the original loan terms. 2. Borrower Eligibility: This outlines the criteria that the borrower must meet to be eligible for a loan modification, taking into account factors such as financial hardship and ability to make modified payments. 3. Modified Loan Terms: This section specifies the new terms of the modified loan, including the fixed interest rate, the duration of the modified loan, and any changes to the monthly payment amount. 4. Repayment Plan: This portion of the agreement details how the borrower will repay any outstanding arrears, such as late payments or accrued interest. 5. Miscellaneous Provisions: This section may include clauses regarding dispute resolution, loan assumption, loan forbearance, or any other specific terms agreed upon by the borrower and the lender. It is important to consult with a qualified attorney specializing in real estate and loan modification agreements to ensure that all legal requirements and provisions are appropriately addressed within the Montgomery Maryland Loan Modification Agreement Providing for Fixed Interest Rate.

Montgomery Maryland Loan Modification Agreement Providing for Fixed Interest Rate

Description

How to fill out Montgomery Maryland Loan Modification Agreement Providing For Fixed Interest Rate?

Take advantage of the US Legal Forms and get immediate access to any form sample you want. Our helpful platform with thousands of document templates makes it simple to find and get almost any document sample you require. You can export, fill, and sign the Montgomery Maryland Loan Modification Agreement Providing for Fixed Interest Rate in just a few minutes instead of surfing the Net for several hours searching for a proper template.

Using our collection is a great strategy to raise the safety of your form filing. Our professional attorneys regularly review all the documents to make sure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How can you get the Montgomery Maryland Loan Modification Agreement Providing for Fixed Interest Rate? If you have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction listed below:

- Find the template you require. Ensure that it is the template you were seeking: examine its title and description, and take take advantage of the Preview option if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving process. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Save the file. Indicate the format to get the Montgomery Maryland Loan Modification Agreement Providing for Fixed Interest Rate and modify and fill, or sign it for your needs.

US Legal Forms is one of the most significant and reliable form libraries on the internet. Our company is always ready to help you in any legal process, even if it is just downloading the Montgomery Maryland Loan Modification Agreement Providing for Fixed Interest Rate.

Feel free to benefit from our form catalog and make your document experience as convenient as possible!