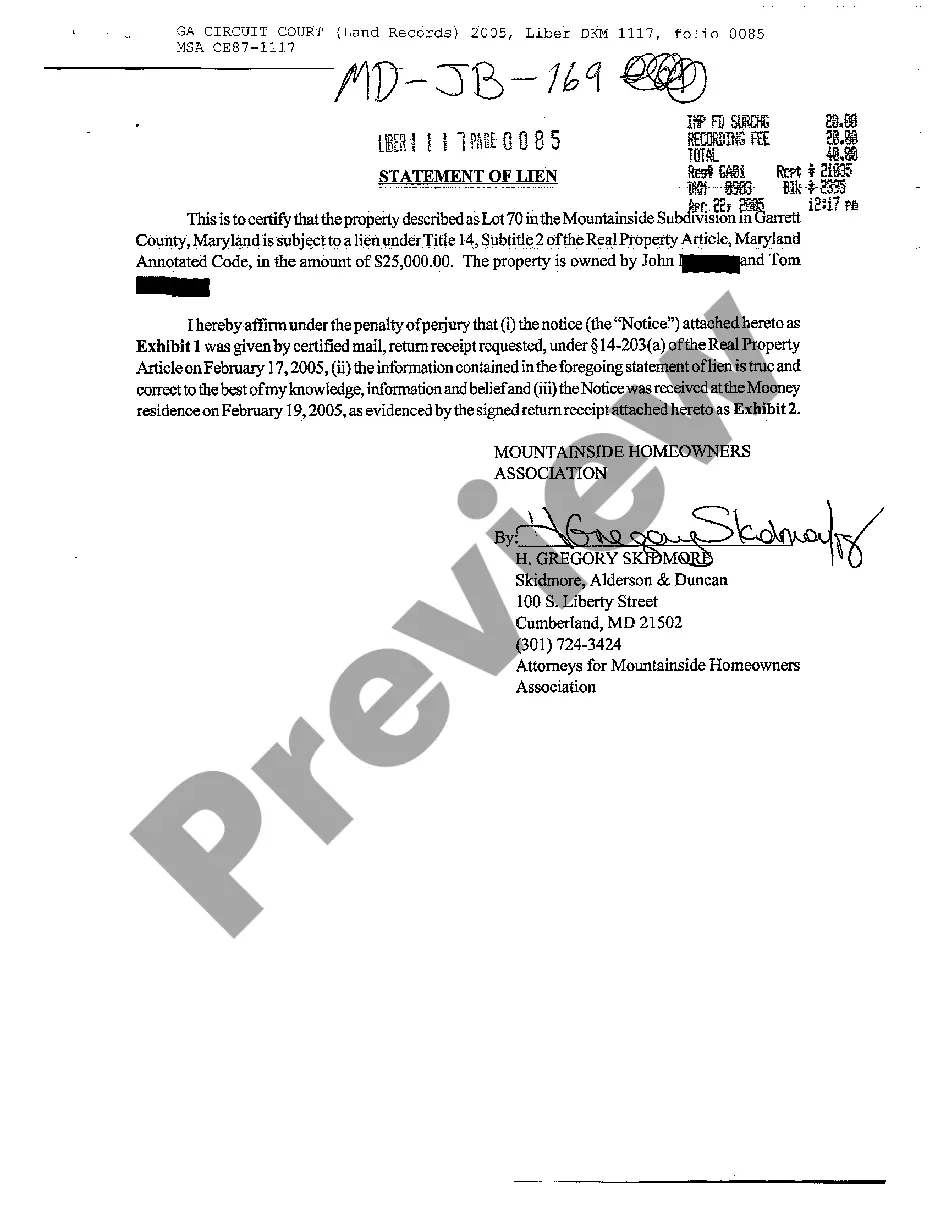

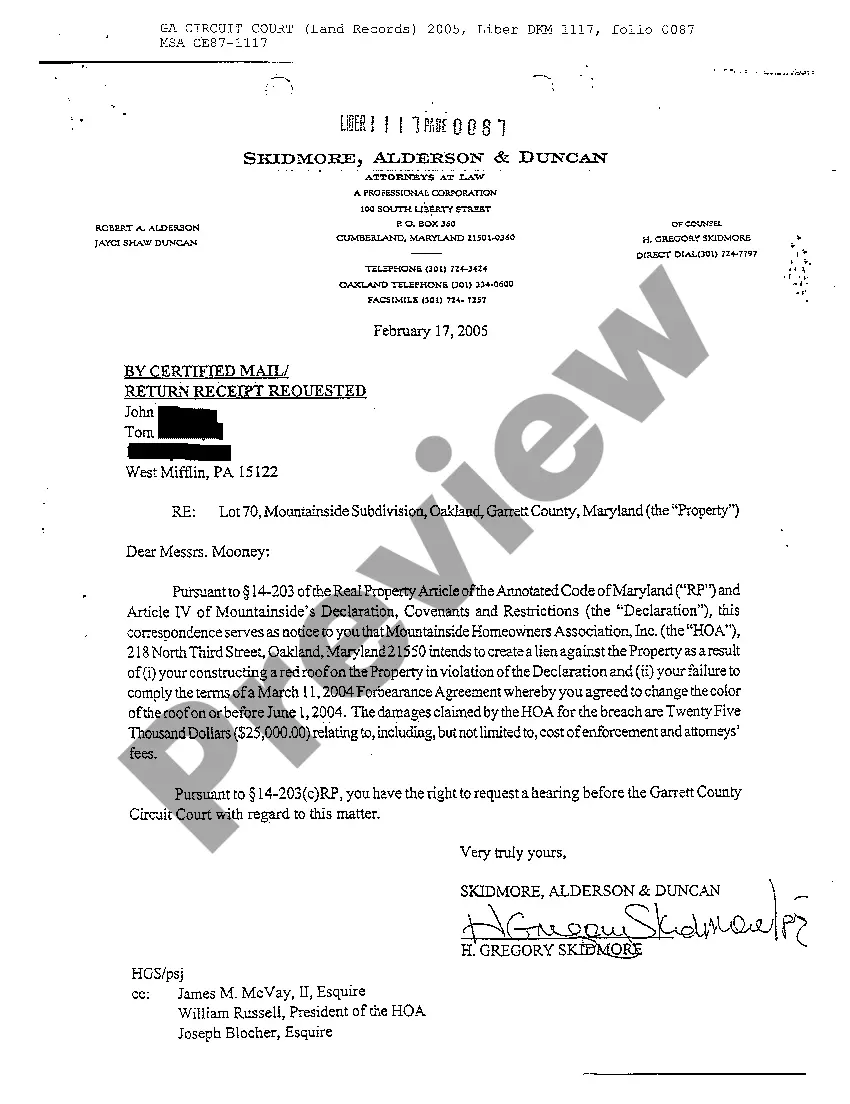

The Montgomery Maryland Statement of Lien is a legal document filed by a creditor to secure a debt or claim against a property located in Montgomery County, Maryland. This statement is typically filed with the County Clerk's Office and serves as a public notice to inform interested parties of the creditor's interest in the property. The Montgomery Maryland Statement of Lien can be used in various scenarios, including but not limited to: 1. Mechanics Lien: This type of lien commonly arises when contractors, subcontractors, or suppliers who have provided labor, materials, or services for a construction project have not been paid. Filing a Mechanics Lien protects their rights and allows them to claim a portion of the property's value to satisfy their outstanding debts. 2. Property Tax Lien: When property owners fail to pay their property taxes, the county government may place a lien on the property. This ensures that the taxes owed will be paid when the property is sold or transferred. 3. Judgment Lien: If someone wins a lawsuit against an individual or business in Montgomery County, they may obtain a judgment lien against the debtor's property. This lien ensures that the creditor has a claim on the property to satisfy the amount owed from the judgment. 4. HOA Lien: Homeowners' Associations (Has) often have the authority to place a lien on a property when homeowners fail to pay their dues or assessments. This lien protects the rights of the association and allows them to enforce the payment of fees. To file a Montgomery Maryland Statement of Lien, the creditor must gather essential information, including the property owner's name, address, a description of the debt or claim, and the amount owed. The completed form must then be filed with the County Clerk's Office, along with any required fees. Once filed, the statement becomes a matter of public record and serves as a legal notice to potential buyers or lenders that the property has a lien against it. Overall, the Montgomery Maryland Statement of Lien serves as a crucial tool for creditors to protect their interests and ensure that they have a legal claim on a property. It provides transparency and allows parties involved in a property transaction to be aware of any existing liens that may affect the property's title and value.

Montgomery Maryland Statement of Lien

Description

How to fill out Montgomery Maryland Statement Of Lien?

Make use of the US Legal Forms and get immediate access to any form you require. Our useful platform with thousands of document templates simplifies the way to find and obtain almost any document sample you require. You are able to export, fill, and certify the Montgomery Maryland Statement of Lien in just a few minutes instead of surfing the Net for hours searching for the right template.

Utilizing our collection is a superb way to increase the safety of your document filing. Our professional lawyers on a regular basis review all the records to make sure that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you get the Montgomery Maryland Statement of Lien? If you already have a subscription, just log in to the account. The Download option will appear on all the samples you view. In addition, you can find all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, follow the instructions listed below:

- Open the page with the template you require. Ensure that it is the template you were hoping to find: verify its headline and description, and take take advantage of the Preview function when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the saving process. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the document. Pick the format to get the Montgomery Maryland Statement of Lien and modify and fill, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy document libraries on the web. We are always happy to help you in any legal process, even if it is just downloading the Montgomery Maryland Statement of Lien.

Feel free to take full advantage of our service and make your document experience as convenient as possible!

Form popularity

FAQ

Some deeds are stored by HM Land Registry when you register in your name, while others, such as wills and contracts, should be held by you or your solicitor.

Every Maryland County and Baltimore City has a Land Records Department located in that County's Circuit Court. Deeds and other documents stored in land records are open to the public. There are two ways to get a copy of your deed. Either get your deed online or pick up a copy in person at the circuit court.

The links below may be used to research land records, liens, and plats on-line. MDLandRec.Net. CASESEARCH. PLATS.NET. (A digital image retrieval system for land record indices in Maryland)

Obtaining a Copy of your Deed If your property is located in Montgomery County, you can order a copy of your deed by going to the Land Records Department of the Clerk's Office in Montgomery County Circuit Court (50 Maryland Avenue, Room 212, Rockville, Maryland, 20850).

Deeds can be viewed for free online through mdlandrec.net. You must create an account with the Maryland State Archives to view deeds on mdlandrec.net. Many courthouses also have computer terminals you can use to search or review deeds.

Deeds are public information. This means anyone can view and get a copy of a deed. Deeds can be viewed for free online through mdlandrec.net. You must create an account with the Maryland State Archives to view deeds on mdlandrec.net.

How do I find a lien? Liens against property can be recorded at the Department of Land Records alongside deeds. Search for liens online using Maryland Land Records (mdlandrec.net). Some liens come from court judgments.Unpaid taxes on the property may result in a lien.

The public is able to access documents, such as deeds, birth and death certificates, military discharge records, and others through the register of deeds. There may be a fee to access or copy public records through the register of deeds.