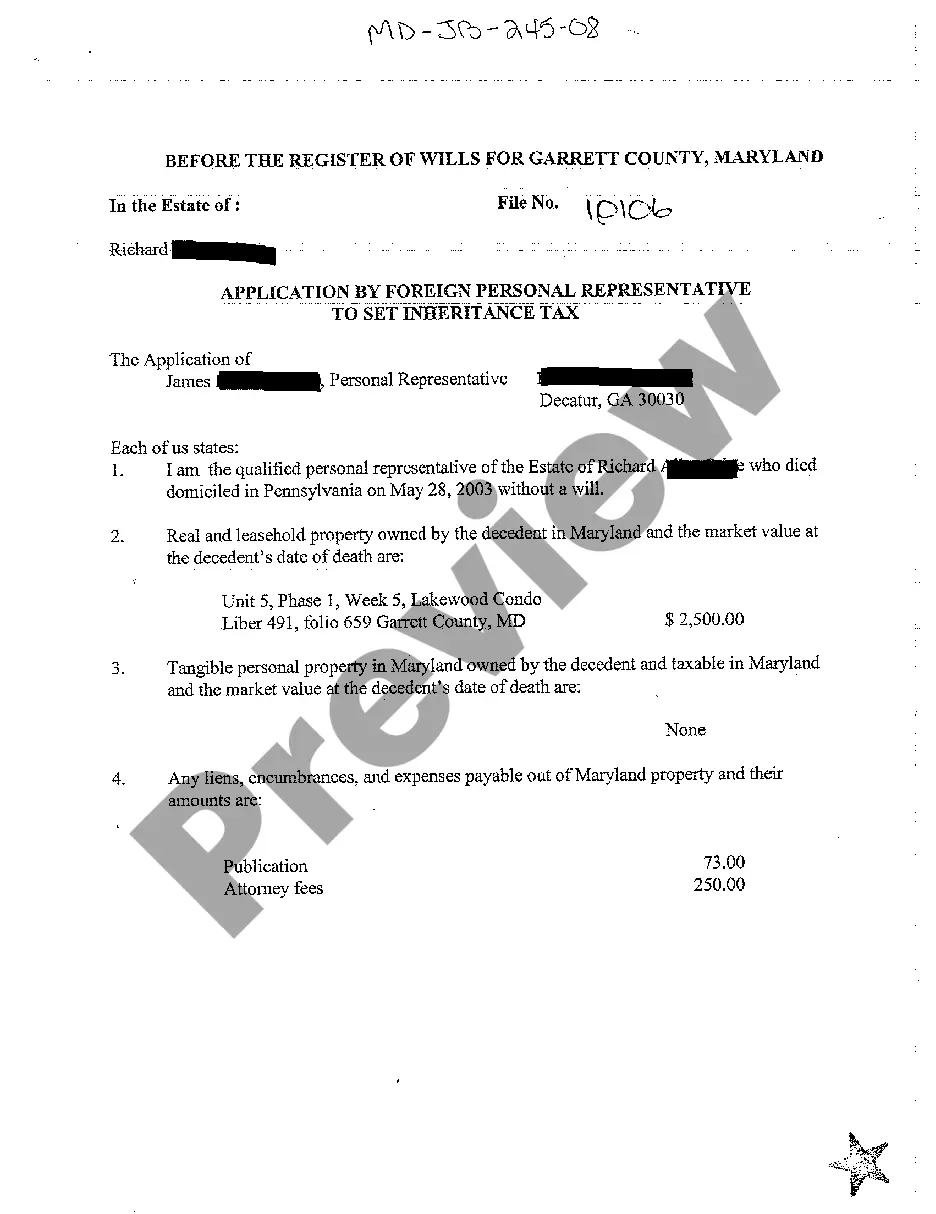

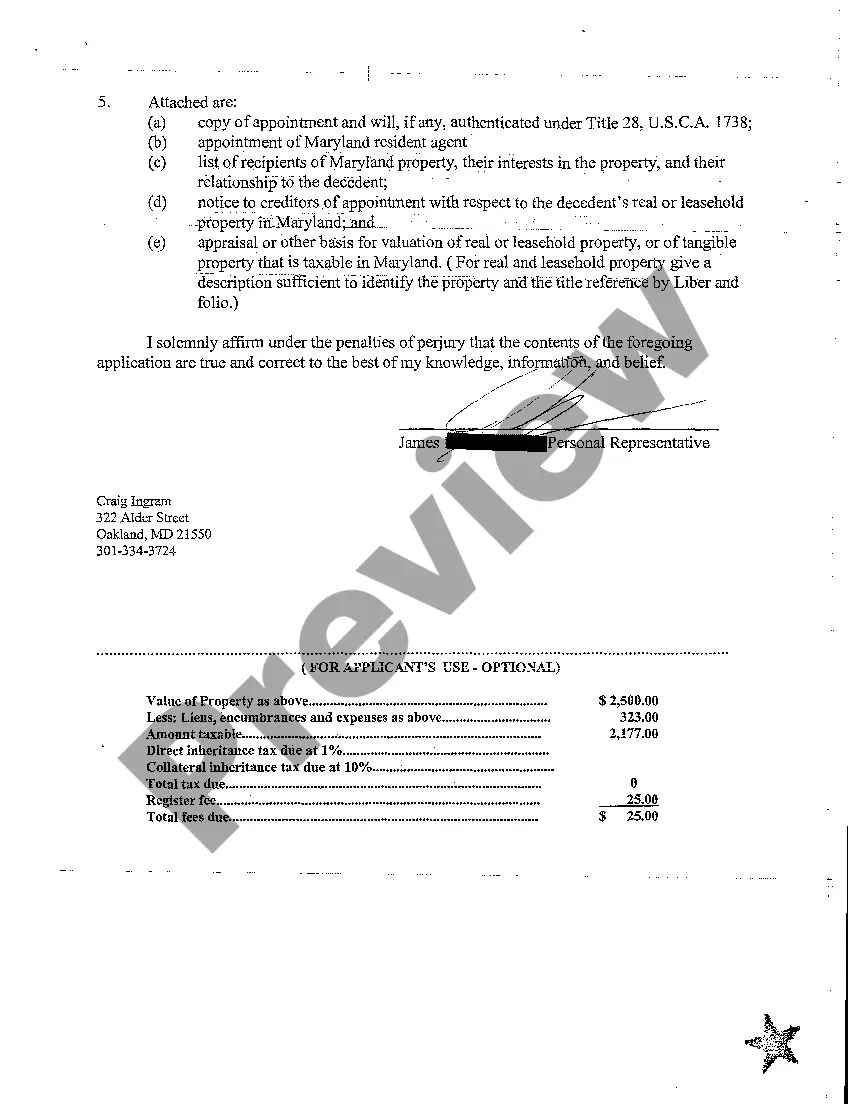

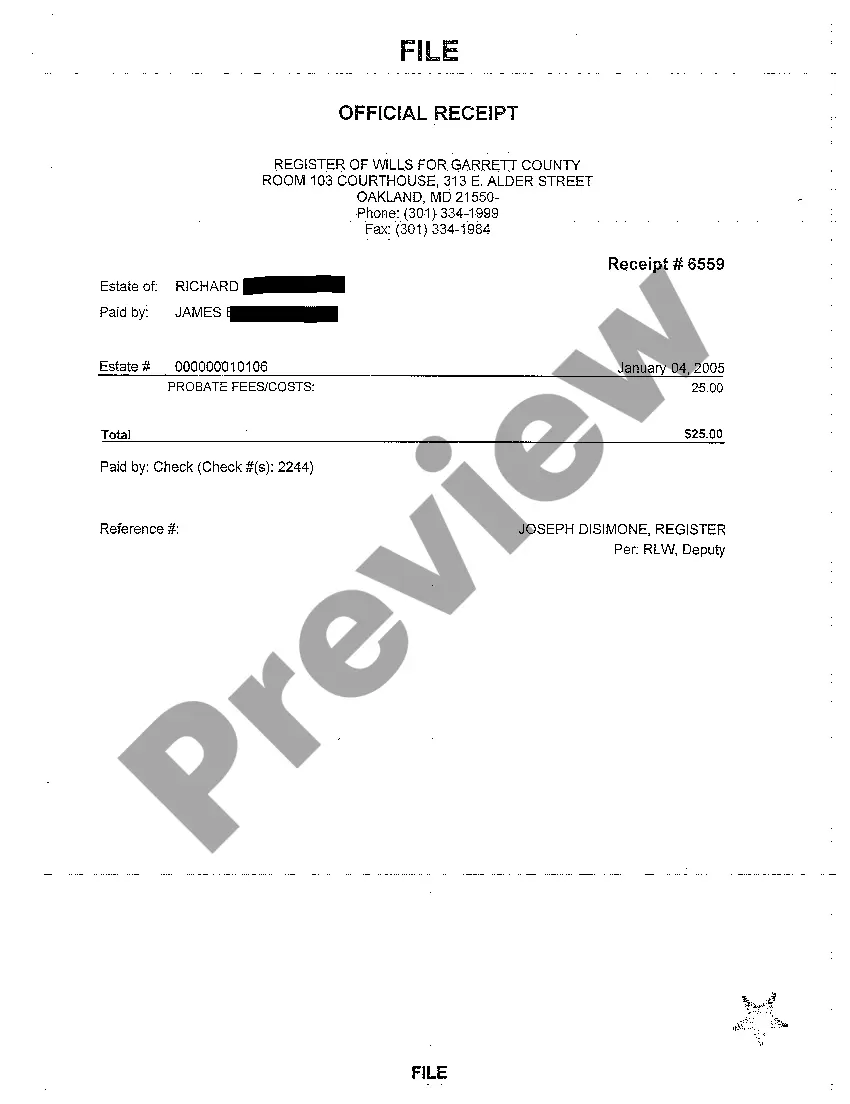

The Montgomery Maryland Application by Foreign Personal Representative to set Inheritance Tax is a legal application process that allows foreign personal representatives to establish and pay the inheritance tax owed on an estate in Montgomery County, Maryland. This comprehensive process ensures that the tax liabilities associated with an inheritance are correctly calculated and paid, allowing for a smooth transfer of assets to the rightful beneficiaries. The application is typically initiated by a foreign personal representative, who is the appointed individual responsible for administering the estate of a deceased person residing outside the United States. The foreign personal representative is required to file the necessary forms and documentation with the Montgomery County Register of Wills, demonstrating their authority to act on behalf of the estate and acknowledging their responsibility to fulfill the inheritance tax obligations. The Montgomery Maryland Application by Foreign Personal Representative to set Inheritance Tax encompasses various stages and requirements. These may include: 1. Estate Inventory: The foreign personal representative should provide a detailed inventory of all assets owned by the deceased in Montgomery County. This includes real estate, bank accounts, investments, personal property, and any other valuable assets subject to inheritance tax. 2. Determination of Taxable Estate: The estate's total value is calculated, taking into account any applicable deductions or exemptions allowed by Maryland state law. The foreign personal representative must carefully evaluate and report the fair market value of all inherited assets within the jurisdiction. 3. Completion of Form FR-19: The primary form used in Montgomery County to establish inheritance tax is Form FR-19, which must be completed by the foreign personal representative. This form requires comprehensive information about the decedent, the representative, the estate assets, and the intended beneficiaries. 4. Submission of Supporting Documents: Along with Form FR-19, the foreign personal representative should submit a range of supporting documents, including a certified copy of the will, death certificate, and any other legal documents necessary to confirm the representative's authority and validate the estate's obligations. Types of Montgomery Maryland Applications by Foreign Personal Representative to set Inheritance Tax: 1. Estate with Real Estate Assets: If the deceased person owned real estate properties in Montgomery County, Maryland, the foreign personal representative must specifically file an application to set inheritance tax on these assets. This ensures accurate taxation and compliance with local laws. 2. Estate with Financial Assets: When the estate primarily comprises financial assets such as bank accounts, investments, or securities located in Montgomery County, a separate application may be required to calculate and pay inheritance tax on these assets. 3. Estate with Multiple Beneficiaries: If the estate involves multiple beneficiaries, each entitled to receive a share of the inheritance, the foreign personal representative must carefully document and specify the distribution plan. This ensures that the inheritance tax owed is accurately calculated and paid based on individual beneficiaries' entitlements. In conclusion, the Montgomery Maryland Application by Foreign Personal Representative to set Inheritance Tax is a meticulous legal process that enables foreign personal representatives to fulfill their tax obligations and facilitate the proper transfer of assets to beneficiaries in Montgomery County. By adhering to the specified steps and providing accurate information and supporting documentation, the foreign personal representative ensures compliance with the local inheritance tax laws and facilitates a smooth estate administration process.

Montgomery Maryland Application by Foreign Personal Representative to set Inheritance Tax

Description

How to fill out Montgomery Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person without any legal education to create such papers from scratch, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform provides a huge collection with over 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Montgomery Maryland Application by Foreign Personal Representative to set Inheritance Tax or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Montgomery Maryland Application by Foreign Personal Representative to set Inheritance Tax in minutes employing our trustworthy platform. In case you are already an existing customer, you can go ahead and log in to your account to download the needed form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps before downloading the Montgomery Maryland Application by Foreign Personal Representative to set Inheritance Tax:

- Be sure the template you have chosen is suitable for your area since the regulations of one state or area do not work for another state or area.

- Review the document and read a brief outline (if available) of scenarios the document can be used for.

- If the one you selected doesn’t meet your needs, you can start again and search for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Montgomery Maryland Application by Foreign Personal Representative to set Inheritance Tax once the payment is completed.

You’re all set! Now you can go ahead and print out the document or fill it out online. Should you have any issues getting your purchased forms, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.